Обзор

Стратегия представляет собой интеллектуальную торговую систему, объединяющую несколько технических показателей, для выявления рыночных возможностей путем комплексного анализа разрыва в справедливой стоимости (FVG), сигналов тренда и ценового поведения. Система использует механизм двойной стратегии в сочетании с отслеживанием тенденций и особенностями торговли в диапазоне, чтобы оптимизировать торговую производительность с помощью динамического управления позициями и многомерного механизма выхода.

Стратегический принцип

Основная логика стратегии основана на следующих измерениях:

- Идентификация пробелов FVG - поиск потенциальных торговых возможностей путем расчета размера пробелов в цене

- Система подтверждения трендов - подтверждение рыночных тенденций в сочетании с 200-дневной средней линией, индикатором SuperTrend и MACD

- Умные подтверждения денег - используют RSI для закупки, перепродажи, аномалии объема сделки и модели ценового поведения в качестве условий для сделок

- Динамическое управление позициями - изменение размера позиции на основе ATR для обеспечения согласованности рисковых выходов

- Многоуровневый механизм выхода - управление выходом из сделки с использованием комбинации стоп-лосса и целевого стоп-стопа

Стратегические преимущества

- Адаптируемость - стратегия может автоматически корректировать параметры и позиции в зависимости от рыночных колебаний

- Управление рисками - управление рисками с помощью нескольких фильтров и строгого управления позициями

- Надежность качества сигналов - повышение точности торговых сигналов с помощью подтверждения многомерных показателей

- Гибкий подход к торговле - возможность одновременно ловить тренды и потрясения

- Наука управления капиталом - применение процентного управления рисками для обеспечения рационального использования капитала

Стратегический риск

- Чувствительность параметров - настройки нескольких параметров могут повлиять на эффективность стратегии, требуя постоянной оптимизации

- Зависимость от рыночных условий - в некоторых рыночных условиях могут возникнуть ложные сигналы прорыва

- Влияние скольжения - на рынках с меньшей ликвидностью может быть больше скольжения

- Комплексность вычислений - вычисление множества показателей может привести к задержке сигнала

- Высокие требования к финансированию - полноценная реализация стратегии требует больших начальных капиталовложений

Направление оптимизации стратегии

- Оптимизация весов индикаторов - можно внедрить методы машинного обучения для динамической настройки весов индикаторов

- Повышение адаптивности рынка - механизм самостоятельной адаптации для повышения волатильности рынка

- Улучшение фильтрации сигналов - введение новых показателей микроструктуры рынка

- Оптимизация механизмов исполнения - увеличение интеллектуальных механизмов разделения заказов и снижение ударных затрат

- Повышение уровня управления рисками - добавление динамической системы управления рисковым бюджетом

Подвести итог

Стратегия создает целостную торговую систему, используя в совокупности несколько технических показателей и торговых технологий. Ее преимущество заключается в том, что она может адаптироваться к изменениям рынка, сохраняя при этом строгий контроль над риском. Хотя существует определенный простор для оптимизации, в целом это грамотно спроектированная количественная торговая стратегия.

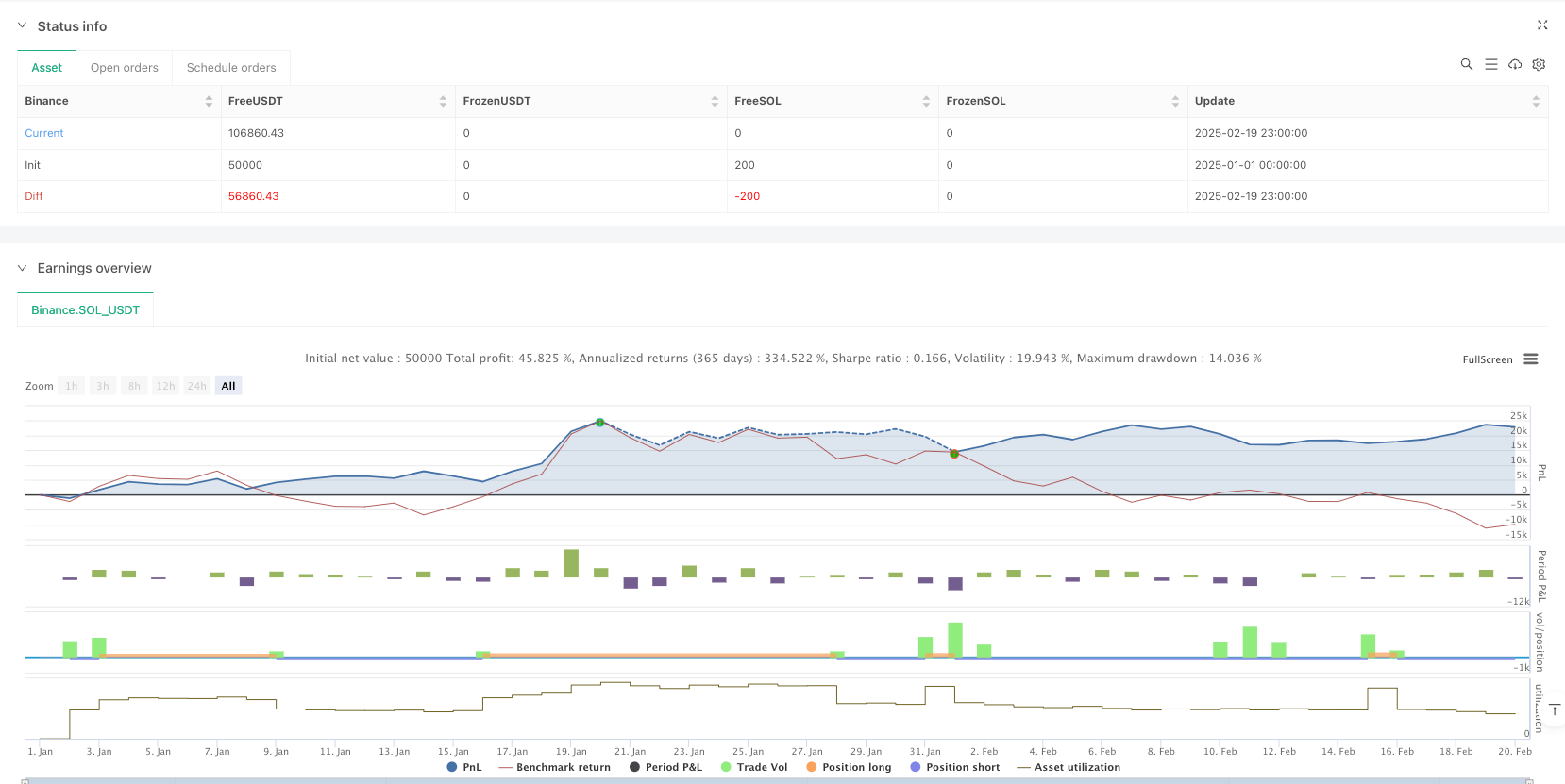

/*backtest

start: 2025-01-01 00:00:00

end: 2025-02-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Adaptive Trend Signals", overlay=true, margin_long=100, margin_short=100, pyramiding=1, initial_capital=50000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.075)

// 1. Enhanced Inputs with Debugging Options

fvgSize = input.float(0.25, "FVG Size (%)", minval=0.1, step=0.05)

atrPeriod = input.int(14, "ATR Period") // Increased for better stability

rsiPeriod = input.int(7, "RSI Period")

useSuperTrend = input.bool(true, "Use SuperTrend Filter")

useTrendFilter = input.bool(false, "Use 200 EMA Trend Filter") // Disabled by default

volatilityThreshold = input.float(1.0, "Volatility Threshold (ATR%)", step=0.1) // Increased threshold

useVolume = input.bool(true, "Use Volume Confirmation")

riskPercentage = input.float(2.0, "Risk %", minval=0.1, maxval=5)

// 2. Advanced Market Filters with Trend Change Detection

var int marketTrend = 0

var bool trendChanged = false

ema200 = ta.ema(close, 200)

prevMarketTrend = marketTrend

marketTrend := close > ema200 ? 1 : close < ema200 ? -1 : 0

trendChanged := marketTrend != prevMarketTrend

// 3. Enhanced FVG Detection with Adjusted Volume Requirements

bullishFVG = (low[1] > high[2] and (low[1] - high[2])/high[2]*100 >= fvgSize) or

(low > high[1] and (low - high[1])/high[1]*100 >= fvgSize)

bearishFVG = (high[1] < low[2] and (low[2] - high[1])/low[2]*100 >= fvgSize) or

(high < low[1] and (low[1] - high)/low[1]*100 >= fvgSize)

// 4. Smart Money Confirmation System with Signal Debugging

rsi = ta.rsi(close, rsiPeriod)

[macdLine, signalLine, _] = ta.macd(close, 5, 13, 5)

[supertrendLine, supertrendDir] = ta.supertrend(3, 10)

// Script 2 Indicators

[macdLine2, signalLine2, _] = ta.macd(close, 4, 11, 3)

[supertrendLine2, supertrendDir2] = ta.supertrend(3, 7)

vWAP = ta.vwap(close)

ema21 = ta.ema(close, 21)

// 5. Price Action Filters from Script 2

breakoutLong = close > ta.highest(high, 5) and (useVolume ? volume > ta.sma(volume, 10)*1.8 : true)

breakdownShort = close < ta.lowest(low, 5) and (useVolume ? volume > ta.sma(volume, 10)*1.8 : true)

bullishRejection = low < vWAP and close > (high + low)/2 and close > open

bearishRejection = high > vWAP and close < (high + low)/2 and close < open

// 6. Combined Entry Conditions

longBaseCond = (bullishFVG and rsi < 35 and macdLine > signalLine) or

(bullishFVG and rsi < 38 and supertrendDir2 == 1) or

(breakoutLong and macdLine2 > signalLine2) or

(bullishRejection and close > ema21)

shortBaseCond = (bearishFVG and rsi > 65 and macdLine < signalLine) or

(bearishFVG and rsi > 62 and supertrendDir2 == -1) or

(breakdownShort and macdLine2 < signalLine2) or

(bearishRejection and close < ema21)

longSignal = longBaseCond and (not useSuperTrend or supertrendDir == 1) and (not useTrendFilter or marketTrend == 1)

shortSignal = shortBaseCond and (not useSuperTrend or supertrendDir == -1) and (not useTrendFilter or marketTrend == -1)

// 7. Position Sizing with Minimum Quantity

var float longEntryPrice = na

var float shortEntryPrice = na

atr = ta.atr(atrPeriod)

positionSizeScript1 = math.max(strategy.equity * riskPercentage / 100 / (atr * 1.5), 1)

positionSizeScript2 = strategy.equity * riskPercentage / 100 / (atr * 2)

// 8. Dynamic Exit System with Dual Strategies

var float trailPrice = na

if longSignal or trendChanged and marketTrend == 1

trailPrice := close

if shortSignal or trendChanged and marketTrend == -1

trailPrice := close

trailOffset = atr * 0.75

// Script 1 Exit Logic

if strategy.position_size > 0

trailPrice := math.max(trailPrice, close)

strategy.exit("Long Exit", "Long", stop=trailPrice - trailOffset, trail_offset=trailOffset)

if strategy.position_size < 0

trailPrice := math.min(trailPrice, close)

strategy.exit("Short Exit", "Short", stop=trailPrice + trailOffset, trail_offset=trailOffset)

// Script 2 Exit Logic

longStop = close - atr * 1.2

shortStop = close + atr * 1.2

strategy.exit("Long Exit 2", "Long", stop=longStop, limit=na(longEntryPrice) ? na : longEntryPrice + (atr * 4), trail_points=not na(longEntryPrice) and close > longEntryPrice + atr ? atr * 3 : na, trail_offset=atr * 0.8)

strategy.exit("Short Exit 2", "Short", stop=shortStop, limit=na(shortEntryPrice) ? na : shortEntryPrice - (atr * 4), trail_points=not na(shortEntryPrice) and close < shortEntryPrice - atr ? atr * 3 : na, trail_offset=atr * 0.8)

// 9. Trend Change Signals and Visuals

// plot(supertrendLine, "SuperTrend", color=color.new(#2962FF, 0))

// plot(supertrendLine2, "SuperTrend 2", color=color.new(#FF00FF, 0))

// plot(ema200, "200 EMA", color=color.new(#FF6D00, 0))

// plot(ema21, "21 EMA", color=color.new(#00FFFF, 0))

bgcolor(marketTrend == 1 ? color.new(color.green, 90) :

marketTrend == -1 ? color.new(color.red, 90) : na)

plotshape(trendChanged and marketTrend == 1, "Bullish Trend", shape.labelup,

location.belowbar, color=color.green, text="▲ Trend Up")

plotshape(trendChanged and marketTrend == -1, "Bearish Trend", shape.labeldown,

location.abovebar, color=color.red, text="▼ Trend Down")

// 10. Signal Visualization for Both Strategies

// plotshape(longSignal, "Long Entry", shape.triangleup, location.belowbar,

// color=color.new(#00FF00, 0), size=size.small)

// plotshape(shortSignal, "Short Entry", shape.triangledown, location.abovebar,

// color=color.new(#FF0000, 0), size=size.small)

// plotshape(breakoutLong, "Breakout Long", shape.flag, location.belowbar,

// color=color.new(#00FF00, 50), size=size.small)

// plotshape(breakdownShort, "Breakdown Short", shape.flag, location.abovebar,

// color=color.new(#FF0000, 50), size=size.small)

// 11. Order Execution with Dual Entry Systems

if trendChanged and marketTrend == 1

strategy.entry("Long Trend", strategy.long, qty=positionSizeScript1)

longEntryPrice := close

if trendChanged and marketTrend == -1

strategy.entry("Short Trend", strategy.short, qty=positionSizeScript1)

shortEntryPrice := close

if longSignal and strategy.position_size == 0

strategy.entry("Long Signal", strategy.long, qty=positionSizeScript2)

longEntryPrice := close

if shortSignal and strategy.position_size == 0

strategy.entry("Short Signal", strategy.short, qty=positionSizeScript2)

shortEntryPrice := close