Ichimoku Kinko Hyo پر مبنی کلاؤڈ اتار چڑھاؤ کے رجحان کی حکمت عملی

جائزہ

یہ حکمت عملی روایتی برابر لائن ٹریڈنگ حکمت عملی پر مبنی ہے ، جس میں ایک نظر میں توازن کی میز کے اشارے کو استعمال کیا گیا ہے تاکہ فاریکس ٹریڈنگ کے فوائد کا تعین کیا جاسکے۔ اس حکمت عملی میں قیمتوں میں اضافے اور برابر لائن کراسنگ سگنلز کا امتزاج کیا گیا ہے ، تاکہ ممکنہ رجحان کی تبدیلی کی نشاندہی کی جاسکے اور کم خطرہ والے تجارتی مواقع کو پکڑ سکے۔

حکمت عملی کا اصول

ایک نظر میں توازن کی میز میں تبدیلی کی لائن ، بیس لائن ، تاخیر کی لائن اور سرخی لائن شامل ہے۔ جب تبدیلی کی لائن میں بیس لائن کو عبور یا نیچے سے عبور کیا جاتا ہے تو سنہری کانٹا کا نشان پیدا ہوتا ہے۔ قیمت داخل ہونے والے سگنل کے طور پر بادل میں گرنے کے رجحان کو توڑتی ہے ، اور بیس لائن اور سرخی لائن پر مشتمل بادل میں اسٹاپ نقصان کی لائن کے طور پر۔

خاص طور پر ، کثیر سرخی داخلہ سگنل نے بیس لائن کو عبور کیا اور بادل میں اوپر کی لکیروں کو توڑ دیا۔ زیادہ کرنے کے بعد ، اگر قیمت بادل میں نیچے کی لکیروں سے نیچے آجاتی ہے تو اس کا خاتمہ ہوتا ہے۔ خالی سرخی داخلہ اور اسٹاپ نقصان کا اصول اسی طرح کا ہے۔

طاقت کا تجزیہ

روایتی منتقل اوسط حکمت عملی کے مقابلے میں ، اس حکمت عملی کے درج ذیل فوائد ہیں:

- قیمتوں کی نقل و حرکت کے رجحانات کے ساتھ مل کر ایک نظر میں توازن کی میز ، غلط سگنل سے بچنے سے بچنے سے بچنے کے لئے

- کلاؤڈ میں موبائل سٹاپ نقصان ، بروقت سٹاپ نقصان اور کنٹرول کے خطرات

- پیرامیٹرز کے ذریعے ایڈجسٹ، مختلف دورانیہ اور مارکیٹ کے حالات کے مطابق

خطرے کا تجزیہ

اس حکمت عملی میں مندرجہ ذیل خطرات شامل ہیں:

- رجحان کے الٹ جانے کا خطرہ۔ داخل ہونے کے بعد قیمتوں میں دوبارہ دھچکا لگ سکتا ہے ، جس سے منافع نہیں مل سکتا ہے۔

- جعلی سگنلوں کو توڑنے کا خطرہ۔ قیمتوں میں قلیل مدتی ایڈجسٹمنٹ کی واپسی کو توڑنے کے سگنل کے طور پر غلط سمجھا جاسکتا ہے۔

- پیرامیٹرز کو بہتر بنانے کا خطرہ۔ مختلف پیرامیٹرز مختلف سائیکلوں کے لئے لاگو ہوتے ہیں ، جس میں ٹیسٹ ایڈجسٹمنٹ کی ضرورت ہوتی ہے۔

اس کا حل کیا ہے؟

- موبائل سٹاپ نقصان اور جزوی سٹاپ کا استعمال۔

- اعلی تعدد فیصلے کے ساتھ مل کر ، شارٹ لائن شور سے بچیں۔

- کثیر گروپ پیرامیٹر ریٹرننگ ترجیحی مجموعہ پیرامیٹر کی اصلاح

اصلاح کی سمت

اس حکمت عملی کو بہتر بنانے کے لیے:

- جعلی سگنلوں کو توڑنے کے لئے مشین سیکھنے کے امکانات میں اضافہ

- خود کار طریقے سے موزوں موزوں موزوں موزوں موزوں موزوں موزوں موزوں موزوں

- find optimal parameters پیرامیٹرز کو بہتر بنانے کے ل.

خلاصہ کریں۔

یہ حکمت عملی مجموعی طور پر ایک قابل اعتماد ، کم خطرہ والی رجحان سے باخبر رہنے کی حکمت عملی ہے۔ اس کی پہلی نظر میں توازن کی میز کے اشارے کے ساتھ مل کر یہ فیصلہ کیا گیا ہے کہ یہ صرف اوسط لائن کی حکمت عملی کے مقابلے میں کچھ شور سگنل کو فلٹر کرسکتا ہے۔ بادل میں چلنے والے اسٹاپ نقصان کے طور پر اس کی خطرے سے نمٹنے کی صلاحیت کو مضبوط بناتا ہے۔ مزید اصلاح کے ذریعہ ، اس سے زیادہ مستحکم اضافی آمدنی کی توقع کی جاسکتی ہے۔

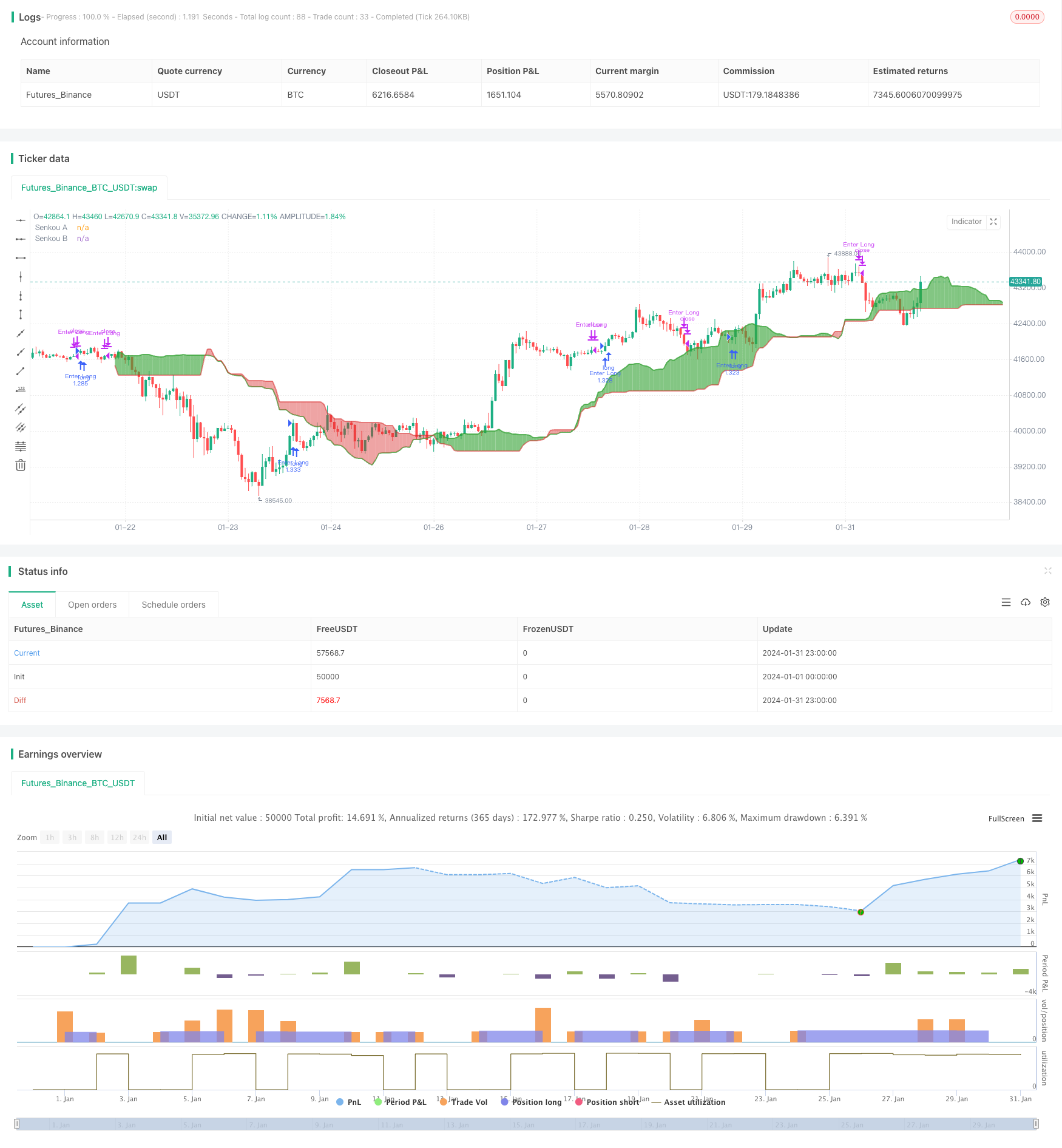

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// -----------------------------------------------------------------------------

// Copyright © 2024 Skyrex, LLC. All rights reserved.

// -----------------------------------------------------------------------------

// Version: v2

// Release: Jan 19, 2024

strategy(title = "Advanced Ichimoku Clouds Strategy Long and Short",

shorttitle = "Ichimoku Strategy Long and Short",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0)

// Trading Period Settings

lookBackPeriodStart = input(title="Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period")

lookBackPeriodStop = input(title="Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period")

// Trading Mode

tradingMode = input.string("Long", "Trading Mode", options = ["Long", "Short"], group = "Position side")

// Long Mode Signal Options

entrySignalOptionsLong = input.string("Bullish All", "Select Entry Signal (Long)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

exitSignalOptionsLong = input.string("Bearish Weak", "Select Exit Signal (Long)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

// Short Mode Signal Options

entrySignalOptionsShort = input.string("None", "Select Entry Signal (Short)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

exitSignalOptionsShort = input.string("None", "Select Exit Signal (Short)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

// Risk Management Settings

takeProfitPct = input.float(7, "Take Profit, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

stopLossPct = input.float(3.5, "Stop Loss, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

// Indicator Settings

tenkanPeriods = input.int(9, "Tenkan", minval=1, group="Indicator Settings")

kijunPeriods = input.int(26, "Kijun", minval=1, group="Indicator Settings")

chikouPeriods = input.int(52, "Chikou", minval=1, group="Indicator Settings")

displacement = input.int(26, "Offset", minval=1, group="Indicator Settings")

// Display Settings

showTenkan = input(false, "Show Tenkan Line", group = "Display Settings")

showKijun = input(false, "Show Kijun Line", group = "Display Settings")

showSenkouA = input(true, "Show Senkou A Line", group = "Display Settings")

showSenkouB = input(true, "Show Senkou B Line", group = "Display Settings")

showChikou = input(false, "Show Chikou Line", group = "Display Settings")

// Function to convert percentage to price points based on entry price

pctToPoints(pct) =>

strategy.position_avg_price * pct / 100

// Colors and Transparency Level

transparencyLevel = 90

colorGreen = color.new(#36a336, 23)

colorRed = color.new(#d82727, 47)

colorTenkanViolet = color.new(#9400D3, 0)

colorKijun = color.new(#fdd8a0, 0)

colorLime = color.new(#006400, 0)

colorMaroon = color.new(#8b0000, 0)

colorGreenTransparent = color.new(colorGreen, transparencyLevel)

colorRedTransparent = color.new(colorRed, transparencyLevel)

// Ichimoku Calculations

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = math.avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement - 1]

displacedSenkouB = senkouB[displacement - 1]

// Plot Ichimoku Lines

plot(showTenkan ? tenkan : na, color=colorTenkanViolet, title = "Tenkan", linewidth=2)

plot(showKijun ? kijun : na, color=colorKijun, title = "Kijun", linewidth=2)

plot(showChikou ? close : na, offset=-displacement, color = colorLime, title = "Chikou", linewidth=1)

p1 = plot(showSenkouA ? senkouA : na, offset=displacement - 1, color=colorGreen, title = "Senkou A", linewidth=2)

p2 = plot(showSenkouB ? senkouB : na, offset=displacement - 1, color=colorRed, title = "Senkou B", linewidth=2)

fill(p1, p2, color=senkouA > senkouB ? colorGreenTransparent : colorRedTransparent)

// Signal Calculations

bullishSignal = ta.crossover(tenkan, kijun)

bearishSignal = ta.crossunder(tenkan, kijun)

bullishSignalValues = bullishSignal ? tenkan : na

bearishSignalValues = bearishSignal ? tenkan : na

strongBullishSignal = bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB

neutralBullishSignal = ((bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB))

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB

neutralBearishSignal = ((bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB))

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

// Functions to determine entry and exit conditions for Long and Short

isEntrySignalLong() =>

entryCondition = false

if entrySignalOptionsLong == "None"

entryCondition := false

else if entrySignalOptionsLong == "Bullish Strong"

entryCondition := strongBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral"

entryCondition := neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Weak"

entryCondition := weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Neutral"

entryCondition := strongBullishSignal or neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral and Weak"

entryCondition := neutralBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Weak"

entryCondition := strongBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish All"

entryCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

entryCondition

isExitSignalLong() =>

exitCondition = false

if exitSignalOptionsLong == "None"

exitCondition := false

else if exitSignalOptionsLong == "Bearish Strong"

exitCondition := strongBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral"

exitCondition := neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Weak"

exitCondition := weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Neutral"

exitCondition := strongBearishSignal or neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral and Weak"

exitCondition := neutralBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Weak"

exitCondition := strongBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish All"

exitCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

exitCondition

isEntrySignalShort() =>

entryCondition = false

if entrySignalOptionsShort == "None"

entryCondition := false

else if entrySignalOptionsShort == "Bearish Strong"

entryCondition := strongBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral"

entryCondition := neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Weak"

entryCondition := weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Neutral"

entryCondition := strongBearishSignal or neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral and Weak"

entryCondition := neutralBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Weak"

entryCondition := strongBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish All"

entryCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

entryCondition

isExitSignalShort() =>

exitCondition = false

if exitSignalOptionsShort == "None"

exitCondition := false

else if exitSignalOptionsShort == "Bullish Strong"

exitCondition := strongBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral"

exitCondition := neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Weak"

exitCondition := weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Neutral"

exitCondition := strongBullishSignal or neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral and Weak"

exitCondition := neutralBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Weak"

exitCondition := strongBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish All"

exitCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

exitCondition

// Strategy logic for entries and exits

if true

if tradingMode == "Long"

takeProfitLevelLong = strategy.position_avg_price * (1 + takeProfitPct / 100)

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPct / 100)

if isEntrySignalLong()

strategy.entry("Enter Long", strategy.long)

if (takeProfitPct > 0 and close >= takeProfitLevelLong) or (stopLossPct > 0 and close <= stopLossLevelLong) or (exitSignalOptionsLong != "None" and isExitSignalLong())

strategy.close("Enter Long", comment="Exit Long")

else if tradingMode == "Short"

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPct / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPct / 100)

if isEntrySignalShort()

strategy.entry("Enter Short", strategy.short)

if (takeProfitPct > 0 and close <= takeProfitLevelShort) or (stopLossPct > 0 and close >= stopLossLevelShort) or (exitSignalOptionsShort != "None" and isExitSignalShort())

strategy.close("Enter Short", comment="Exit Short")