جائزہ

ایک کثیر سطحی متوازن ٹریڈنگ حکمت عملی ایک پیچیدہ تجارتی نظام ہے جس میں متعدد تکنیکی اشارے اور قیمت کی سطح شامل ہیں۔ اس حکمت عملی میں MACD ، RSI ، EMA اور برن بینڈ جیسے اشارے استعمال کیے جاتے ہیں ، جس میں فیبونیکی ریٹرو سطح کے ساتھ مل کر مختلف قیمتوں کے سلسلے میں مختلف تجارتی حکمت عملی اختیار کی جاتی ہے ، تاکہ متوازن تجارت کی متعدد سطحوں کو حاصل کیا جاسکے۔ اس حکمت عملی کا بنیادی خیال یہ ہے کہ تجارت کی درستگی کو متعدد تصدیق کے ذریعہ بڑھایا جائے ، اور اس کے ساتھ ہی اس کیپٹل مینجمنٹ کو بہتر بنایا جائے۔

حکمت عملی کا اصول

اس حکمت عملی کے بنیادی اصولوں میں شامل ہیں:

- مارکیٹ کے رجحانات اور حرکیات کا تعین کرنے کے لئے MACD ، RSI اور EMA اشارے کا استعمال کریں۔

- اہم معاونت اور مزاحمت کی شناخت کے لئے برن بینڈ اور فبونیکی واپسی کی سطح کا استعمال کریں۔

- مختلف قیمتوں کی سطح پر متعدد ٹرانزیکشن انٹری پوائنٹس قائم کریں ، تاکہ پوزیشنوں کو مرحلہ وار بنایا جاسکے۔

- خطرے کا انتظام مختلف رکاوٹوں اور نقصان کی سطحوں کو ترتیب دے کر کریں۔

- ہائکن ایچ آئی ٹی چارٹ کا استعمال کرتے ہوئے اضافی مارکیٹ ڈھانچے کی معلومات فراہم کریں.

حکمت عملی ان عوامل کا مجموعی تجزیہ کرکے مختلف مارکیٹ کے حالات میں اسی طرح کے ٹریڈنگ کے اقدامات کو مستحکم منافع کے حصول کے لئے استعمال کرتی ہے۔

اسٹریٹجک فوائد

- ایک سے زیادہ تصدیق: ایک سے زیادہ تکنیکی اشارے کے ساتھ مل کر ، ٹریڈنگ سگنل کی وشوسنییتا میں اضافہ ہوا۔

- لچکدار فنڈ مینجمنٹ: خطرے کو بہتر طور پر کنٹرول کرنے اور فنڈز کے استعمال کو بہتر بنانے کے لئے ، مرحلہ وار جمع کرنے کا طریقہ اپنائیں۔

- لچکدار: حکمت عملی مختلف مارکیٹ کے حالات کے مطابق ٹریڈنگ کے رویے کو ایڈجسٹ کرتی ہے۔

- جامع خطرے کا انتظام: خطرے کو مؤثر طریقے سے کنٹرول کرنے کے لئے کثیر سطح کے اسٹاپ لاس اور اسٹاپ میکانیزم قائم کیے گئے ہیں۔

- اعلی درجے کی آٹومیشن: حکمت عملی کو مکمل طور پر خود کار طریقے سے عملدرآمد کیا جاسکتا ہے، انسانی مداخلت کو کم کرنا.

اسٹریٹجک رسک

- ضرورت سے زیادہ تجارت: حکمت عملی کے ذریعہ متعدد تجارت کی سطحوں کی وجہ سے ، یہ بار بار تجارت کا سبب بن سکتا ہے ، جس سے تجارت کی لاگت میں اضافہ ہوتا ہے۔

- پیرامیٹرز کی حساسیت: حکمت عملی میں متعدد اشارے اور پیرامیٹرز استعمال کیے جاتے ہیں جن کو مارکیٹ کے مختلف حالات کے مطابق احتیاط سے ایڈجسٹ کرنے کی ضرورت ہوتی ہے۔

- واپسی کا خطرہ: شدید اتار چڑھاؤ والے بازاروں میں ، واپسی کا زیادہ خطرہ ہوسکتا ہے۔

- تکنیکی انحصار: حکمت عملی تکنیکی اشارے پر بہت زیادہ انحصار کرتی ہے اور بعض مارکیٹ کے حالات میں ناکام ہوسکتی ہے۔

- فنڈ مینجمنٹ کا خطرہ: مرحلہ وار ذخیرہ اندوزی کا طریقہ بعض صورتوں میں زیادہ نمائش کا سبب بن سکتا ہے۔

حکمت عملی کی اصلاح کی سمت

- متحرک پیرامیٹرز ایڈجسٹمنٹ: مارکیٹ کی صورتحال کے مطابق حکمت عملی کے پیرامیٹرز کو خود بخود ایڈجسٹ کرنے کے لئے مشین لرننگ الگورتھم متعارف کرایا گیا۔

- مارکیٹ کے جذبات کا تجزیہ: مارکیٹ کے جذبات کے اشارے جیسے وی آئی ایکس انڈیکس کو شامل کرکے حکمت عملی کی موافقت کو بہتر بنائیں۔

- ملٹی ٹائم فریم تجزیہ: ٹریڈنگ سگنل کی وشوسنییتا کو بہتر بنانے کے لئے ملٹی ٹائم فریم تجزیہ متعارف کرایا گیا ہے۔

- اتار چڑھاؤ کی شرح ایڈجسٹمنٹ: مارکیٹ کی اتار چڑھاؤ کی شرح کے مطابق تجارتی حجم اور اسٹاپ نقصان کی سطح کو ایڈجسٹ کریں۔

- ٹرانزیکشن لاگت کی اصلاح: ٹرانزیکشن لاگت کے ماڈل کو متعارف کرانے ، ٹرانزیکشن کی تعدد اور پیمانے کو بہتر بنانے کے لئے۔

خلاصہ کریں۔

ایک کثیر سطحی متوازن ٹریڈنگ حکمت عملی ایک جامع ، مضبوط اور لچکدار ٹریڈنگ سسٹم ہے۔ متعدد تکنیکی اشارے اور قیمت کی سطحوں کے ساتھ مل کر ، یہ حکمت عملی مختلف مارکیٹ کے ماحول میں استحکام برقرار رکھتی ہے۔ اگرچہ کچھ خطرات موجود ہیں ، لیکن مسلسل اصلاح اور موافقت کے ذریعہ ، ان خطرات کو مؤثر طریقے سے کنٹرول کیا جاسکتا ہے۔ مستقبل میں ، اس حکمت عملی کو بہتر کارکردگی کا مظاہرہ کرنے کی امید ہے جیسے مشین لرننگ اور جذباتی تجزیہ جیسے جدید ترین ٹیکنالوجیز کو متعارف کرانا۔

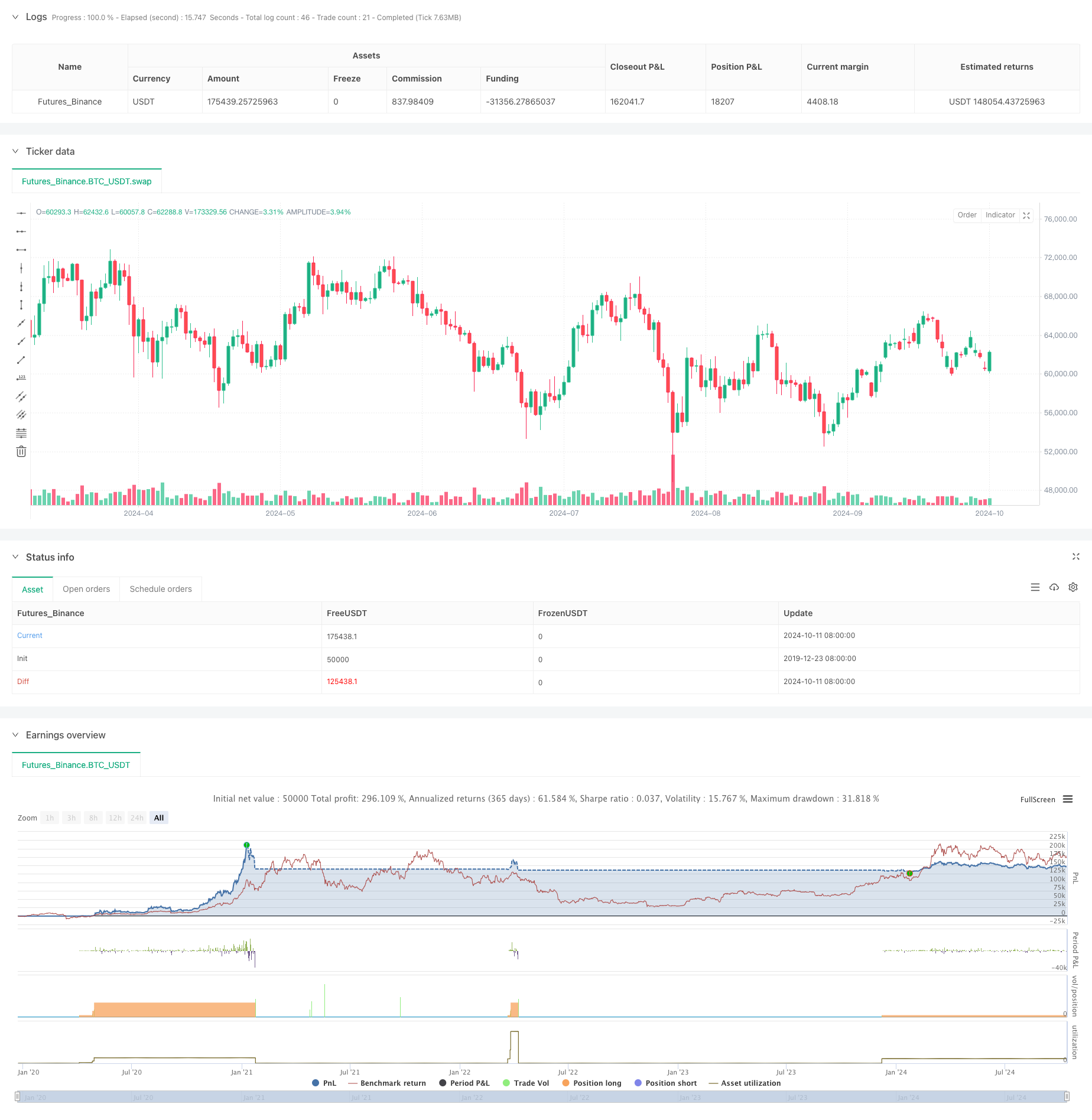

/*backtest

start: 2019-12-23 08:00:00

end: 2024-10-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Incremental Order size +', shorttitle='TradingPost', overlay=true, default_qty_value=1, pyramiding=10)

//Heiken Ashi

isHA = input(false, 'HA Candles')

//MACD

fastLength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

//Bollinger Bands Exponential

src = open

len = 18

e = ta.ema(src, len)

evar = (src - e) * (src - e)

evar2 = math.sum(evar, len) / len

std = math.sqrt(evar2)

Multiplier = input.float(3, minval=0.01, title='# of STDEV\'s')

upband = e + Multiplier * std

dnband = e - Multiplier * std

//EMA

ema3 = ta.ema(close, 3)

//RSIplot

length = 45

overSold = 90

overBought = 10

price = close

vrsi = ta.rsi(price, length)

notna = not na(vrsi)

macdlong = ta.crossover(delta, 0)

macdshort = ta.crossunder(delta, 0)

rsilong = notna and ta.crossover(vrsi, overSold)

rsishort = notna and ta.crossunder(vrsi, overBought)

lentt = input(14, 'Pivot Length')

//The length defines how many periods a high or low must hold to be a "relevant pivot"

h = ta.highest(lentt)

//The highest high over the length

h1 = ta.dev(h, lentt) ? na : h

//h1 is a pivot of h if it holds for the full length

hpivot = fixnan(h1)

//creates a series which is equal to the last pivot

l = ta.lowest(lentt)

l1 = ta.dev(l, lentt) ? na : l

lpivot = fixnan(l1)

//repeated for lows

last_hpivot = 0.0

last_lpivot = 0.0

last_hpivot := h1 ? time : nz(last_hpivot[1])

last_lpivot := l1 ? time : nz(last_lpivot[1])

long_time = last_hpivot > last_lpivot ? 0 : 1

//FIBS

z = input(100, 'Z-Index')

p_offset = 2

transp = 60

a = (ta.lowest(z) + ta.highest(z)) / 2

b = ta.lowest(z)

c = ta.highest(z)

fibonacci = input(0, 'Fibonacci') / 100

//Fib Calls

fib0 = (hpivot - lpivot) * fibonacci + lpivot

fib1 = (hpivot - lpivot) * .21 + lpivot

fib2 = (hpivot - lpivot) * .3 + lpivot

fib3 = (hpivot - lpivot) * .5 + lpivot

fib4 = (hpivot - lpivot) * .62 + lpivot

fib5 = (hpivot - lpivot) * .7 + lpivot

fib6 = (hpivot - lpivot) * 1.00 + lpivot

fib7 = (hpivot - lpivot) * 1.27 + lpivot

fib8 = (hpivot - lpivot) * 2 + lpivot

fib9 = (hpivot - lpivot) * -.27 + lpivot

fib10 = (hpivot - lpivot) * -1 + lpivot

//Heiken Ashi Candles

heikenashi_1 = ticker.heikinashi(syminfo.tickerid)

data2 = isHA ? heikenashi_1 : syminfo.tickerid

res5 = input.timeframe('5', 'Resolution')

//HT Fibs

hfib0 = request.security(data2, res5, fib0[1])

hfib1 = request.security(data2, res5, fib1[1])

hfib2 = request.security(data2, res5, fib2[1])

hfib3 = request.security(data2, res5, fib3[1])

hfib4 = request.security(data2, res5, fib4[1])

hfib5 = request.security(data2, res5, fib5[1])

hfib6 = request.security(data2, res5, fib6[1])

hfib7 = request.security(data2, res5, fib7[1])

hfib8 = request.security(data2, res5, fib8[1])

hfib9 = request.security(data2, res5, fib9[1])

hfib10 = request.security(data2, res5, fib10[1])

vrsiup = vrsi > vrsi[1] and vrsi[1] > vrsi[2]

vrsidown = vrsi < vrsi[1] and vrsi[1] < vrsi[2]

long = ta.cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

short = ta.cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long2 = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short2 = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

reverseOpens = input(false, 'Reverse Orders')

if reverseOpens

tmplong = long

long := short

short := tmplong

short

//Strategy

ts = input(99999, 'TS')

tp = input(30, 'TP')

sl = input(15, 'SL')

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long)

last_short := short ? time : nz(last_short)

in_long = last_long > last_short

in_short = last_short > last_long

long_signal = ta.crossover(last_long, last_short)

short_signal = ta.crossover(last_short, last_long)

last_open_long = 0.0

last_open_short = 0.0

last_open_long := long ? open : nz(last_open_long[1])

last_open_short := short ? open : nz(last_open_short[1])

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_high = 0.0

last_low = 0.0

last_high := not in_long ? na : in_long and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short ? na : in_short and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= last_high - ts and high >= last_open_long_signal

short_ts = not na(last_low) and low >= last_low + ts and low <= last_open_short_signal

long_tp = high >= last_open_long + tp and long[1] == 0

short_tp = low <= last_open_short - tp and short[1] == 0

long_sl = low <= last_open_long - sl and long[1] == 0

short_sl = high >= last_open_short + sl and short[1] == 0

last_hfib_long = 0.0

last_hfib_short = 0.0

last_hfib_long := long_signal ? fib1 : nz(last_hfib_long[1])

last_hfib_short := short_signal ? fib5 : nz(last_hfib_short[1])

last_fib7 = 0.0

last_fib10 = 0.0

last_fib7 := long ? fib7 : nz(last_fib7[1])

last_fib10 := long ? fib10 : nz(last_fib10[1])

last_fib8 = 0.0

last_fib9 = 0.0

last_fib8 := short ? fib8 : nz(last_fib8[1])

last_fib9 := short ? fib9 : nz(last_fib9[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

last_long_tp = 0.0

last_short_tp = 0.0

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

last_long_ts = 0.0

last_short_ts = 0.0

last_long_ts := long_ts ? time : nz(last_long_ts[1])

last_short_ts := short_ts ? time : nz(last_short_ts[1])

long_ts_signal = ta.crossover(last_long_ts, last_long_signal)

short_ts_signal = ta.crossover(last_short_ts, last_short_signal)

last_long_sl = 0.0

last_short_sl = 0.0

last_long_sl := long_sl ? time : nz(last_long_sl[1])

last_short_sl := short_sl ? time : nz(last_short_sl[1])

long_tp_signal = ta.crossover(last_long_tp, last_long)

short_tp_signal = ta.crossover(last_short_tp, last_short)

long_sl_signal = ta.crossover(last_long_sl, last_long)

short_sl_signal = ta.crossover(last_short_sl, last_short)

last_long_tp_signal = 0.0

last_short_tp_signal = 0.0

last_long_tp_signal := long_tp_signal ? time : nz(last_long_tp_signal[1])

last_short_tp_signal := short_tp_signal ? time : nz(last_short_tp_signal[1])

last_long_sl_signal = 0.0

last_short_sl_signal = 0.0

last_long_sl_signal := long_sl_signal ? time : nz(last_long_sl_signal[1])

last_short_sl_signal := short_sl_signal ? time : nz(last_short_sl_signal[1])

last_long_ts_signal = 0.0

last_short_ts_signal = 0.0

last_long_ts_signal := long_ts_signal ? time : nz(last_long_ts_signal[1])

last_short_ts_signal := short_ts_signal ? time : nz(last_short_ts_signal[1])

true_long_signal = long_signal and last_long_sl_signal > last_long_signal[1] or long_signal and last_long_tp_signal > last_long_signal[1] or long_signal and last_long_ts_signal > last_long_signal[1]

true_short_signal = short_signal and last_short_sl_signal > last_short_signal[1] or short_signal and last_short_tp_signal > last_short_signal[1] or short_signal and last_short_ts_signal > last_short_signal[1]

// strategy.entry("BLUE", strategy.long, when=long)

// strategy.entry("RED", strategy.short, when=short)

g = delta > 0 and vrsi < overSold and vrsiup

r = delta < 0 and vrsi > overBought and vrsidown

long1 = ta.cross(close, fib1) and g and last_long_signal[1] > last_short_signal // and last_long_signal > long

short1 = ta.cross(close, fib5) and r and last_short_signal[1] > last_long_signal // and last_short_signal > short

last_long1 = 0.0

last_short1 = 0.0

last_long1 := long1 ? time : nz(last_long1[1])

last_short1 := short1 ? time : nz(last_short1[1])

last_open_long1 = 0.0

last_open_short1 = 0.0

last_open_long1 := long1 ? open : nz(last_open_long1[1])

last_open_short1 := short1 ? open : nz(last_open_short1[1])

long1_signal = ta.crossover(last_long1, last_long_signal)

short1_signal = ta.crossover(last_short1, last_short_signal)

last_long1_signal = 0.0

last_short1_signal = 0.0

last_long1_signal := long1_signal ? time : nz(last_long1_signal[1])

last_short1_signal := short1_signal ? time : nz(last_short1_signal[1])

long2 = ta.cross(close, fib2) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short2 = ta.cross(close, fib4) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long2 = 0.0

last_short2 = 0.0

last_long2 := long2 ? time : nz(last_long2[1])

last_short2 := short2 ? time : nz(last_short2[1])

last_open_short2 = 0.0

last_open_short2 := short2 ? open : nz(last_open_short2[1])

long2_signal = ta.crossover(last_long2, last_long1_signal) and long1_signal == 0

short2_signal = ta.crossover(last_short2, last_short1_signal) and short1_signal == 0

last_long2_signal = 0.0

last_short2_signal = 0.0

last_long2_signal := long2_signal ? time : nz(last_long2_signal[1])

last_short2_signal := short2_signal ? time : nz(last_short2_signal[1])

//Trade 4

long3 = ta.cross(close, fib3) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short3 = ta.cross(close, fib3) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long3 = 0.0

last_short3 = 0.0

last_long3 := long3 ? time : nz(last_long3[1])

last_short3 := short3 ? time : nz(last_short3[1])

last_open_short3 = 0.0

last_open_short3 := short3 ? open : nz(last_open_short3[1])

long3_signal = ta.crossover(last_long3, last_long2_signal) and long2_signal == 0

short3_signal = ta.crossover(last_short3, last_short2_signal) and short2_signal == 0

last_long3_signal = 0.0

last_short3_signal = 0.0

last_long3_signal := long3_signal ? time : nz(last_long3_signal[1])

last_short3_signal := short3_signal ? time : nz(last_short3_signal[1])

//Trade 5

long4 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short4 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long4 = 0.0

last_short4 = 0.0

last_long4 := long4 ? time : nz(last_long4[1])

last_short4 := short4 ? time : nz(last_short4[1])

long4_signal = ta.crossover(last_long4, last_long3_signal) and long2_signal == 0 and long3_signal == 0

short4_signal = ta.crossover(last_short4, last_short3_signal) and short2_signal == 0 and short3_signal == 0

last_long4_signal = 0.0

last_short4_signal = 0.0

last_long4_signal := long4_signal ? time : nz(last_long4_signal[1])

last_short4_signal := short4_signal ? time : nz(last_short4_signal[1])

//Trade 6

long5 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short5 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long5 = 0.0

last_short5 = 0.0

last_long5 := long5 ? time : nz(last_long5[1])

last_short5 := short5 ? time : nz(last_short5[1])

long5_signal = ta.crossover(last_long5, last_long4_signal) and long3_signal == 0 and long4_signal == 0

short5_signal = ta.crossover(last_short5, last_short4_signal) and short3_signal == 0 and short4_signal == 0

last_long5_signal = 0.0

last_short5_signal = 0.0

last_long5_signal := long5_signal ? time : nz(last_long5_signal[1])

last_short5_signal := short5_signal ? time : nz(last_short5_signal[1])

//Trade 7

long6 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short6 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long6 = 0.0

last_short6 = 0.0

last_long6 := long6 ? time : nz(last_long6[1])

last_short6 := short6 ? time : nz(last_short6[1])

long6_signal = ta.crossover(last_long6, last_long5_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0

short6_signal = ta.crossover(last_short6, last_short5_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0

last_long6_signal = 0.0

last_short6_signal = 0.0

last_long6_signal := long6_signal ? time : nz(last_long6_signal[1])

last_short6_signal := short6_signal ? time : nz(last_short6_signal[1])

//Trade 8

long7 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short7 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long7 = 0.0

last_short7 = 0.0

last_long7 := long7 ? time : nz(last_long7[1])

last_short7 := short7 ? time : nz(last_short7[1])

long7_signal = ta.crossover(last_long7, last_long6_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0

short7_signal = ta.crossover(last_short7, last_short6_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0

last_long7_signal = 0.0

last_short7_signal = 0.0

last_long7_signal := long7_signal ? time : nz(last_long7_signal[1])

last_short7_signal := short7_signal ? time : nz(last_short7_signal[1])

//Trade 9

long8 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short8 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long8 = 0.0

last_short8 = 0.0

last_long8 := long8 ? time : nz(last_long8[1])

last_short8 := short8 ? time : nz(last_short8[1])

long8_signal = ta.crossover(last_long8, last_long7_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0

short8_signal = ta.crossover(last_short8, last_short7_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0

last_long8_signal = 0.0

last_short8_signal = 0.0

last_long8_signal := long8_signal ? time : nz(last_long8_signal[1])

last_short8_signal := short8_signal ? time : nz(last_short8_signal[1])

//Trade 10

long9 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short9 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long9 = 0.0

last_short9 = 0.0

last_long9 := long9 ? time : nz(last_long9[1])

last_short9 := short9 ? time : nz(last_short9[1])

long9_signal = ta.crossover(last_long9, last_long8_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0 and long8_signal == 0

short9_signal = ta.crossover(last_short9, last_short8_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0 and short8_signal == 0

last_long9_signal = 0.0

last_short9_signal = 0.0

last_long9_signal := long9_signal ? time : nz(last_long9_signal[1])

last_short9_signal := short9_signal ? time : nz(last_short9_signal[1])

strategy.entry('Long', strategy.long, qty=1, when=long_signal)

strategy.entry('Short', strategy.short, qty=1, when=short_signal)

strategy.entry('Long', strategy.long, qty=2, when=long1_signal)

strategy.entry('Short1', strategy.short, qty=2, when=short1_signal)

strategy.entry('Long', strategy.long, qty=4, when=long2_signal)

strategy.entry('Short2', strategy.short, qty=4, when=short2_signal)

strategy.entry('Long', strategy.long, qty=8, when=long3_signal)

strategy.entry('Short3', strategy.short, qty=8, when=short3_signal)

strategy.entry('Long', strategy.long, qty=5, when=long4_signal)

strategy.entry('Short', strategy.short, qty=5, when=short4_signal)

strategy.entry('Long', strategy.long, qty=6, when=long5_signal)

strategy.entry('Short', strategy.short, qty=6, when=short5_signal)

strategy.entry('Long', strategy.long, qty=7, when=long6_signal)

strategy.entry('Short', strategy.short, qty=7, when=short6_signal)

strategy.entry('Long', strategy.long, qty=8, when=long7_signal)

strategy.entry('Short', strategy.short, qty=8, when=short7_signal)

strategy.entry('Long', strategy.long, qty=9, when=long8_signal)

strategy.entry('Short', strategy.short, qty=9, when=short8_signal)

strategy.entry('Long', strategy.long, qty=10, when=long9_signal)

strategy.entry('Short', strategy.short, qty=10, when=short9_signal)

short1_tp = low <= last_open_short1 - tp and short1[1] == 0

short2_tp = low <= last_open_short2 - tp and short2[1] == 0

short3_tp = low <= last_open_short3 - tp and short3[1] == 0

short1_sl = high >= last_open_short1 + sl and short1[1] == 0

short2_sl = high >= last_open_short2 + sl and short2[1] == 0

short3_sl = high >= last_open_short3 + sl and short3[1] == 0

close_long = ta.cross(close, fib6)

close_short = ta.cross(close, fib0)

// strategy.close("Long", when=close_long)

// strategy.close("Long", when=long_tp)

// strategy.close("Long", when=long_sl)

// strategy.close("Short", when=long_signal)

// strategy.close("Short1", when=long_signal)

// strategy.close("Short2", when=long_signal)

// strategy.close("Short3", when=long_signal)

strategy.close('Short', when=short_tp)

strategy.close('Short1', when=short1_tp)

strategy.close('Short2', when=short2_tp)

strategy.close('Short3', when=short3_tp)

strategy.close('Short', when=short_sl)

strategy.close('Short1', when=short1_sl)

strategy.close('Short2', when=short2_sl)

strategy.close('Short3', when=short3_sl)