جائزہ

یہ حکمت عملی ایک اعلی درجے کی ٹریڈنگ سسٹم ہے جس میں کثیر ٹیکنالوجی کی شکل کی شناخت پر مبنی ہے، جس میں گرافک گرافک تجزیہ اور بریک ٹریڈنگ کے اصولوں کو ضم کیا گیا ہے۔ حکمت عملی کئی کلاسیکی گرافک شکلوں کی شناخت اور تجارت کرنے میں کامیاب ہے، بشمول کراس اسٹار شکل ((ڈوجی) ، ہتھوڑا لائن ((ہیمر) ، اور سوئنگ شکل P ((پین بار) ، جبکہ اس میں بائنری انگوٹی کی تصدیق کا نظام شامل ہے جس میں تجارتی سگنل کی وشوسنییتا کو بڑھانے کے لئے.

حکمت عملی کا اصول

اس حکمت عملی کی بنیادی منطق مندرجہ ذیل اہم عناصر پر مبنی ہے:

- شکل کی شناخت کا نظام - تین اہم گرافک شکلوں کی شناخت کے لئے درست ریاضی کے حساب سے: کراس اسٹار ، پنکھے کی لکیر اور سوئی کی شکل۔ ہر شکل میں اس کے منفرد شناخت کے معیار ہیں ، جیسے کہ شبیہہ اور شیڈ لائن کے تناسب کا تناسب۔

- توڑنے کی تصدیق کا طریقہ کار - ڈبل سرنی کی تصدیق کا نظام استعمال کیا جاتا ہے ، جس میں دوسری سرنی کی ضرورت ہوتی ہے کہ وہ پہلے سرنی کے اعلی ((زیادہ کریں) یا کم ((خالی کریں)) کو توڑ دیں ، تاکہ جعلی سگنل کو کم کیا جاسکے۔

- ہدف کی قیمت کا تعین - حکمت عملی کو متحرک طور پر لچکدار بنانے کے لئے ، ہدف کی قیمت کے طور پر حالیہ اونچائی یا نچلے حصے کا تعین کرنے کے لئے ایڈجسٹ ریٹریسمنٹ کی مدت (ڈیفالٹ 20 سائیکل) کا استعمال کریں۔

اسٹریٹجک فوائد

- ایک سے زیادہ شکلوں کی شناخت - ایک ہی وقت میں متعدد تکنیکی شکلوں کی نگرانی کرکے ، ممکنہ تجارت کے مواقع میں نمایاں اضافہ ہوا ہے۔

- سگنل کی تصدیق کا طریقہ کار - دوہری کالم کی تصدیق کے نظام نے جعلی سگنل کے خطرے کو مؤثر طریقے سے کم کیا ہے۔

- ٹریڈنگ زون کو بصری بنائیں - ٹریڈنگ زون کو رنگین خانوں کے ساتھ نشان زد کریں تاکہ ٹریڈنگ کا مقصد زیادہ بدیہی ہو۔

- لچکدار پیرامیٹرز ایڈجسٹمنٹ - مختلف مارکیٹ کے حالات کے مطابق واپسی کی مدت وغیرہ پیرامیٹرز کو ایڈجسٹ کیا جاسکتا ہے۔

اسٹریٹجک رسک

- مارکیٹ میں اتار چڑھاؤ کا خطرہ - اعلی اتار چڑھاؤ کے دوران جعلی بریک سگنل پیدا ہوسکتا ہے۔

- سلائڈ پوائنٹ کا خطرہ - کم لیکویڈیٹی والے بازاروں میں ، اصل سودے کی قیمت سگنل کی قیمت سے زیادہ انحراف کا شکار ہوسکتی ہے۔

- رجحان کے الٹ جانے کا خطرہ - مضبوط رجحان کے بازار میں ، الٹ سگنل سے زیادہ نقصان ہوسکتا ہے۔

اصلاح کی سمت

- ٹرانسمیشن کی تصدیق متعارف کرانے - ٹرانسمیشن تجزیہ کو شکل کی شناخت کے نظام میں شامل کرنے کی تجویز کی گئی ہے تاکہ سگنل کی وشوسنییتا کو بہتر بنایا جاسکے۔

- متحرک اسٹاپ نقصان کا طریقہ کار - متحرک اسٹاپ نقصان کی حد ATR یا اتار چڑھاؤ کی شرح پر مبنی ترتیب دی جاسکتی ہے۔

- مارکیٹ ماحول فلٹر - رجحان کی طاقت کے اشارے شامل کریں ، اور مضبوط رجحان کے دوران الٹ سگنل کو فلٹر کریں۔

- ٹائم فریم کی اصلاح - متعدد ٹائم فریموں پر سگنل کی تصدیق پر غور کریں۔

خلاصہ کریں۔

اس حکمت عملی میں متعدد تکنیکی شکلوں کے تجزیہ اور بریک ٹریڈنگ کے اصولوں کو ملا کر ایک مکمل تجارتی نظام تشکیل دیا گیا ہے۔ اس کا فائدہ سگنل کی کثیر جہتی تصدیق اور لچکدار پیرامیٹرز کی ایڈجسٹمنٹ میں ہے ، لیکن اس کے ساتھ ساتھ مارکیٹ میں اتار چڑھاؤ اور لیکویڈیٹی کے خطرات پر بھی توجہ دینے کی ضرورت ہے۔ تجویز کردہ اصلاحی سمت کے ذریعہ ، حکمت عملی کی استحکام اور وشوسنییتا کو مزید بہتر بنایا جاسکتا ہے۔

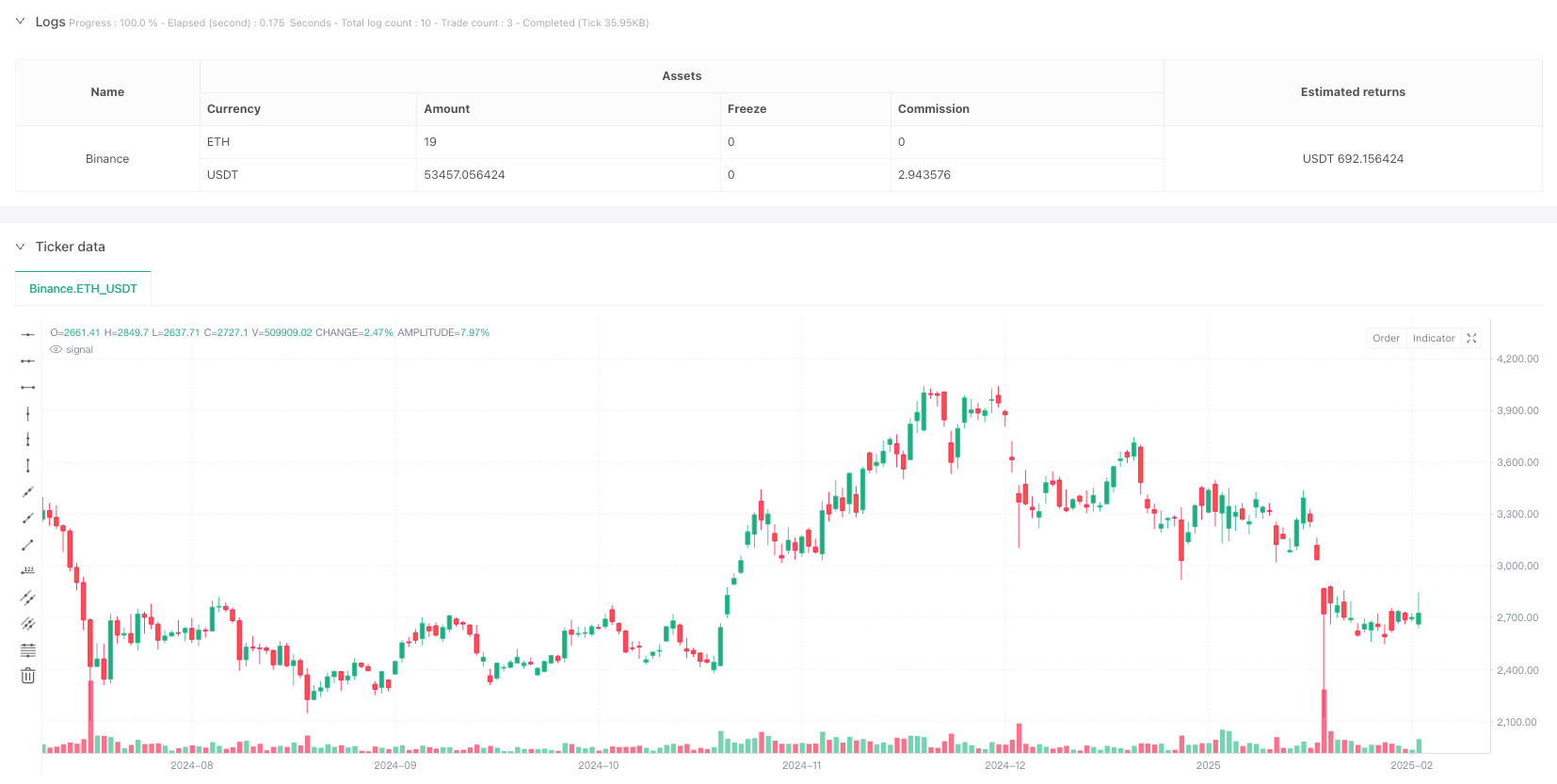

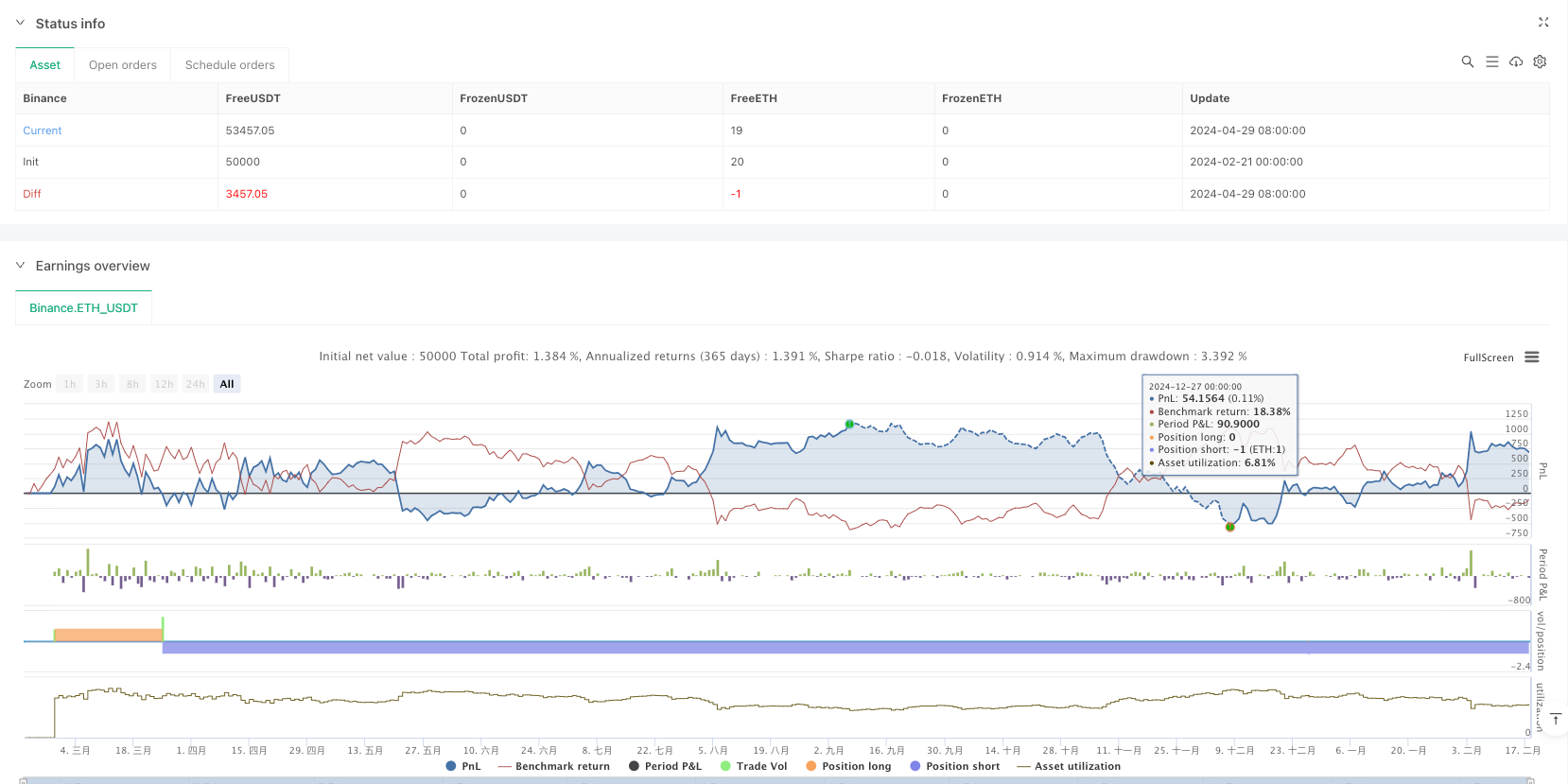

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Target(Made by Karan)", overlay=true)

// Input for lookback period

lookbackPeriod = input.int(20, title="Lookback Period for Recent High/Low", minval=1)

// --- Pattern Identification Functions ---

// Identify Doji pattern

isDoji(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize <= rangeSize * 0.1 // Small body compared to total range

// Identify Hammer pattern

isHammer(open, high, low, close) =>

bodySize = math.abs(close - open)

lowerShadow = open - low

upperShadow = high - close

bodySize <= (high - low) * 0.3 and lowerShadow > 2 * bodySize and upperShadow <= bodySize * 0.3 // Long lower shadow, small upper shadow

// Identify Pin Bar pattern

isPinBar(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

upperShadow = high - math.max(open, close)

lowerShadow = math.min(open, close) - low

(upperShadow > bodySize * 2 and lowerShadow < bodySize) or (lowerShadow > bodySize * 2 and upperShadow < bodySize) // Long shadow on one side

// --- Candle Breakout Logic ---

// Identify the first green candle (Bullish)

is_first_green_candle = close > open

// Identify the breakout above the high of the first green candle

breakout_green_candle = ta.crossover(close, high[1]) and is_first_green_candle[1]

// Identify the second green candle confirming the breakout

second_green_candle = close > open and breakout_green_candle[1]

// Find the recent high (for the target)

recent_high = ta.highest(high, lookbackPeriod) // Use adjustable lookback period

// Plot the green rectangle box if the conditions are met and generate buy signal

var float start_price_green = na

var float end_price_green = na

if second_green_candle

start_price_green := low[1] // Low of the breakout green candle

end_price_green := recent_high // The most recent high in the lookback period

strategy.entry("Buy", strategy.long) // Buy signal

// --- Red Candle Logic ---

// Identify the first red candle (Bearish)

is_first_red_candle = close < open

// Identify the breakdown below the low of the first red candle

breakdown_red_candle = ta.crossunder(close, low[1]) and is_first_red_candle[1]

// Identify the second red candle confirming the breakdown

second_red_candle = close < open and breakdown_red_candle[1]

// Find the recent low (for the target)

recent_low = ta.lowest(low, lookbackPeriod) // Use adjustable lookback period

// Plot the red rectangle box if the conditions are met and generate sell signal

var float start_price_red = na

var float end_price_red = na

if second_red_candle

start_price_red := high[1] // High of the breakout red candle

end_price_red := recent_low // The most recent low in the lookback period

strategy.entry("Sell", strategy.short) // Sell signal

// --- Pattern Breakout Logic for Doji, Hammer, Pin Bar ---

// Detect breakout of Doji, Hammer, or Pin Bar patterns

var float start_price_pattern = na

var float end_price_pattern = na

// Check for Doji breakout

if isDoji(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Doji

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Doji", strategy.long) // Buy signal for Doji breakout

// Check for Hammer breakout

if isHammer(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Hammer

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Hammer", strategy.long) // Buy signal for Hammer breakout

// Check for Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Pin Bar

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Pin Bar", strategy.long) // Buy signal for Pin Bar breakout

// Check for bearish Doji breakout

if isDoji(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Doji

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Doji", strategy.short) // Sell signal for Doji breakdown

// Check for bearish Hammer breakout

if isHammer(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Hammer

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Hammer", strategy.short) // Sell signal for Hammer breakdown

// Check for bearish Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Pin Bar

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Pin Bar", strategy.short) // Sell signal for Pin Bar breakdown

// Optional: Plot shapes for the green sequence of candles

plotshape(series=is_first_green_candle, location=location.belowbar, color=color.green, style=shape.labelup, text="1st Green")

plotshape(series=breakout_green_candle, location=location.belowbar, color=color.blue, style=shape.labelup, text="Breakout")

plotshape(series=second_green_candle, location=location.belowbar, color=color.orange, style=shape.labelup, text="2nd Green")

// Optional: Plot shapes for the red sequence of candles

plotshape(series=is_first_red_candle, location=location.abovebar, color=color.red, style=shape.labeldown, text="1st Red")

plotshape(series=breakdown_red_candle, location=location.abovebar, color=color.blue, style=shape.labeldown, text="Breakdown")

plotshape(series=second_red_candle, location=location.abovebar, color=color.orange, style=shape.labeldown, text="2nd Red")