Chiến lược chỉ báo động lượng RSI/MFI dựa trên lý thuyết Dow

Ngày tạo:

2023-12-12 17:54:58

sửa đổi lần cuối:

2023-12-12 17:54:58

sao chép:

0

Số nhấp chuột:

795

1

tập trung vào

1629

Người theo dõi

Tổng quan

Chiến lược này sử dụng chỉ số tương đối mạnh yếu (RSI) hoặc chỉ số dòng tiền (MFI) để xác định thị trường tăng hoặc giảm, và kết hợp hệ số bò và gấu của lý thuyết Dow để tính toán phân bố xác suất điều chỉnh. Tùy thuộc vào loại thị trường khác nhau, các logic nhập và thoát khác nhau được sử dụng.

Nguyên tắc chiến lược

- Tính toán RSI hoặc MFI để xác định thị trường hiện tại là gì (bull hoặc bear)

- Tính toán hệ số bò và gấu theo thuyết Dow để phản ánh sự liên quan giữa giá hiện tại và khối lượng giao dịch

- Điều chỉnh phân phối xác suất RSI/MFI để xác định phân phối đa không gian chính xác

- Xác định xem có được vào không dựa trên SessionId hiện tại và xác suất

- Khi lợi nhuận bị thu hồi hoặc thị trường bị thu hẹp

Phân tích lợi thế

- Kết hợp với lý thuyết Dao, phân loại thị trường chính xác hơn

- Ghi lại các yếu tố để tránh nhập học mù quáng

- Tỷ lệ lợi nhuận cao, thu hồi thấp

Phân tích rủi ro

- Các tham số không đúng lúc sẽ gây ra nhiều sai lầm.

- Cần có đủ dữ liệu lịch sử

- Logic dừng lỗ đơn giản, không thể tối ưu hóa cho các trường hợp đặc biệt

Hướng tối ưu hóa

- Có thể xem xét kết hợp các chỉ số khác để đánh giá market session

- Thêm logic dừng lỗ nghiêm ngặt hơn dựa trên biến động, dữ liệu lịch sử, v.v.

- Bạn có thể thử học máy để xác định các tham số tốt hơn

Tóm tắt

Chiến lược này nói chung có kết quả tốt và có một số giá trị thực tế. Tuy nhiên, vẫn cần thử nghiệm và điều chỉnh thêm, đặc biệt là logic dừng tổn thất. Sử dụng các chỉ số hỗ trợ phán đoán sẽ hiệu quả hơn, không thể theo dõi mù quáng.

Mã nguồn chiến lược

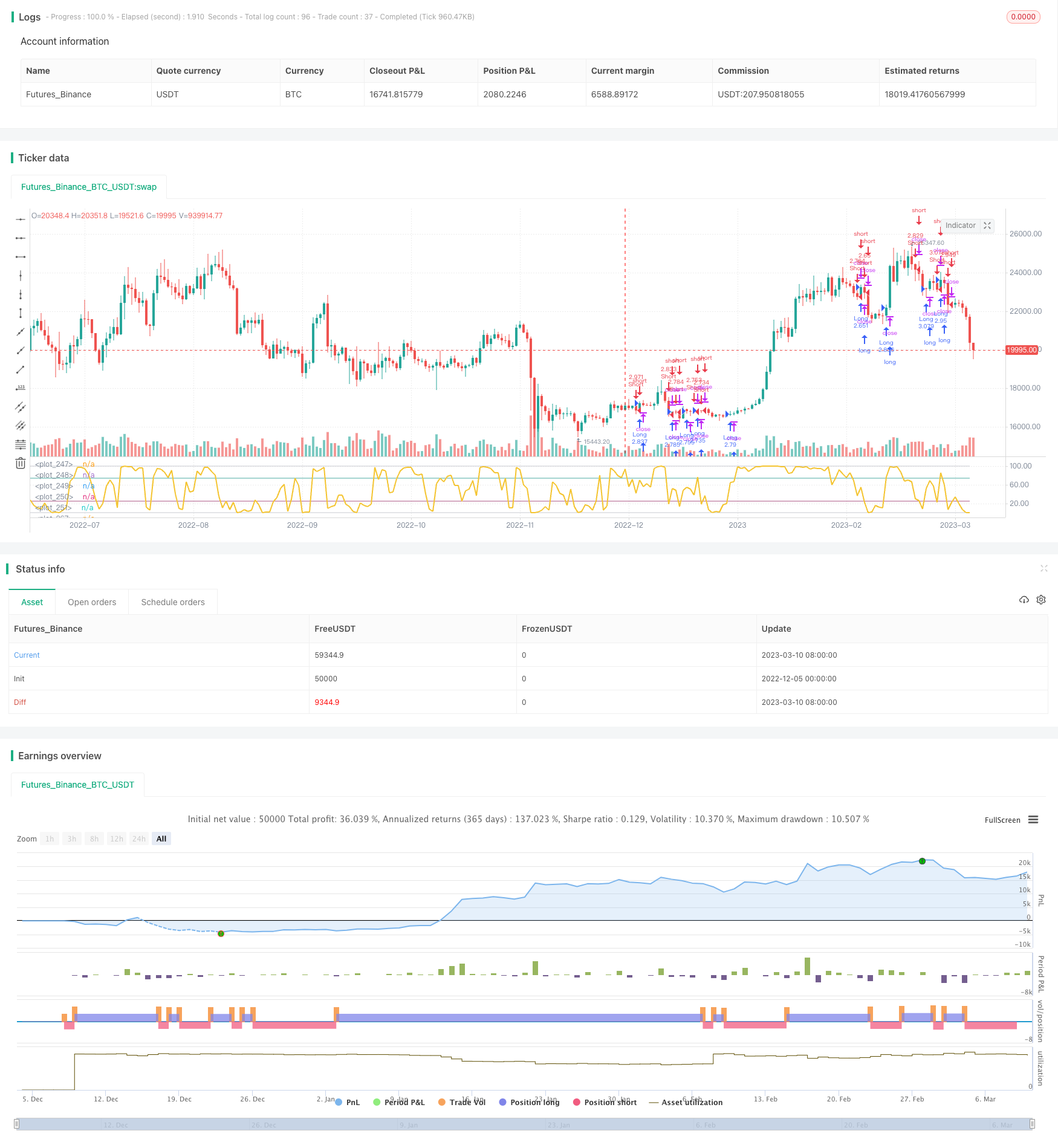

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//MIT License

//Copyright (c) 2019 user-Noldo

//Permission is hereby granted, free of charge, to any person obtaining a copy

//of this software and associated documentation files (the "Software"), to deal

//in the Software without restriction, including without limitation the rights

//to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

//copies of the Software, and to permit persons to whom the Software is

//furnished to do so, subject to the following conditions:

//The above copyright notice and this permission notice shall be included in all

//copies or substantial portions of the Software.

//THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

//IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

//FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

//AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

//LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

//OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

//SOFTWARE.

strategy("Dow Factor RSI/MFI and Dependent Variable Odd Generator Strategy",shorttitle = "Dow_Factor RSI/MFI & DVOG Strategy", overlay = false, default_qty_type=strategy.percent_of_equity,commission_type=strategy.commission.percent, commission_value=0.125, default_qty_value=100 )

src = close

lights = input(title="Barcolor I / 0 ? ", options=["ON", "OFF"], defval="OFF")

method = input(title="METHOD", options=["MFI", "RSI"], defval="RSI")

length = input(5, minval=2,maxval = 14, title = "Strategy Period")

// Essential Functions

// Function Sum

f_sum(_src , _length) =>

_output = 0.00

_length_adjusted = _length < 1 ? 1 : _length

for i = 0 to _length_adjusted-1

_output := _output + _src[i]

f_sma(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

float _sum = 0

for _i = 0 to (_length_adjusted - 1)

_sum := _sum + _src[_i]

_return = _sum / _length_adjusted

// Unlocked Exponential Moving Average Function

f_ema(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

_multiplier = 2 / (_length_adjusted + 1)

_return = 0.00

_return := na(_return[1]) ? _src : ((_src - _return[1]) * _multiplier) + _return[1]

// Function Standard Deviation

f_stdev(_src,_length) =>

float _output = na

_length_adjusted = _length < 2 ? 2 : _length

_avg = f_ema(_src , _length_adjusted)

evar = (_src - _avg) * (_src - _avg)

evar2 = ((f_sum(evar,_length_adjusted))/_length_adjusted)

_output := sqrt(evar2)

// Linear Regression Channels :

f_pearson_corr(_src1, _src2, _length) =>

_length_adjusted = _length < 2 ? 2 : _length

_ema1 = f_ema(_src1, _length_adjusted)

_ema2 = f_ema(_src2, _length_adjusted)

isum = 0.0

for i = 0 to _length_adjusted - 1

isum := isum + (_src1[i] - _ema1) * (_src2[i] - _ema2)

isumsq1 = 0.0

for i = 0 to _length_adjusted - 1

isumsq1 := isumsq1 + pow(_src1[i] - _ema1, 2)

isumsq2 = 0.0

for i = 0 to _length_adjusted - 1

isumsq2 := isumsq2 + pow(_src2[i] - _ema2, 2)

pcc = isum/(sqrt(isumsq1*isumsq2))

pcc

// Dow Theory Cycles

dow_coeff = f_pearson_corr(src,volume,length)

dow_bull_factor = (1 + dow_coeff)

dow_bear_factor = (1 - dow_coeff)

// MONEY FLOW INDEX =====> FOR BULL OR BEAR MARKET (CLOSE)

upper_s = f_sum(volume * (change(src) <= 0 ? 0 : src), length)

lower_s = f_sum(volume * (change(src) >= 0 ? 0 : src), length)

_market_index = rsi(upper_s, lower_s)

// RSI (Close)

// Function RMA

f_rma(_src, _length) =>

_length_adjusted = _length < 1 ? 1 : _length

alpha = _length_adjusted

sum = 0.0

sum := (_src + (alpha - 1) * nz(sum[1])) / alpha

// Function Relative Strength Index (RSI)

f_rsi(_src, _length) =>

_output = 0.00

_length_adjusted = _length < 0 ? 0 : _length

u = _length_adjusted < 1 ? max(_src - _src[_length_adjusted], 0) : max(_src - _src[1] , 0) // upward change

d = _length_adjusted < 1 ? max(_src[_length_adjusted] - _src, 0) : max(_src[1] - _src , 0) // downward change

rs = f_rma(u, _length) / f_rma(d, _length)

res = 100 - 100 / (1 + rs)

res

_rsi = f_rsi(src, length)

// Switchable Method Codes

_method = 0.00

if (method=="MFI")

_method:= _market_index

if (method=="RSI")

_method:= _rsi

// Conditions

_bull_gross = (_method )

_bear_gross = (100 - _method )

_price_stagnant = ((_bull_gross * _bear_gross ) / 100)

_price_bull = (_bull_gross - _price_stagnant)

_price_bear = (_bear_gross - _price_stagnant)

_coeff_price = (_price_stagnant + _price_bull + _price_bear) / 100

_bull = _price_bull / _coeff_price

_bear = _price_bear / _coeff_price

_stagnant = _price_stagnant / _coeff_price

// Market Types with Dow Factor

_temp_bull_gross = _bull * dow_bull_factor

_temp_bear_gross = _bear * dow_bear_factor

// Addition : Odds with Stagnant Market

_coeff_normal = (_temp_bull_gross + _temp_bear_gross) / 100

// ********* OUR RSI / MFI VALUE ***********

_value = _temp_bull_gross / _coeff_normal

// Temporary Pure Odds

_temp_stagnant = ((_temp_bull_gross * _temp_bear_gross) / 100)

_temp_bull = _temp_bull_gross - _temp_stagnant

_temp_bear = _temp_bear_gross - _temp_stagnant

// Now we ll do venn scheme (Probability Cluster)

// Pure Bull + Pure Bear + Pure Stagnant = 100

// Markets will get their share in the Probability Cluster

_coeff = (_temp_stagnant + _temp_bull + _temp_bear) / 100

_odd_bull = _temp_bull / _coeff

_odd_bear = _temp_bear / _coeff

_odd_stagnant = _temp_stagnant / _coeff

_positive_condition = crossover (_value,50)

_negative_condition = crossunder(_value,50)

_stationary_condition = ((_odd_stagnant > _odd_bull ) and (_odd_stagnant > _odd_bear))

// Strategy

closePosition = _stationary_condition

if (_positive_condition)

strategy.entry("Long", strategy.long, comment="Long")

strategy.close(id = "Long", when = closePosition )

if (_negative_condition)

strategy.entry("Short", strategy.short, comment="Short")

strategy.close(id = "Short", when = closePosition )

// Plot Data

// Plotage

oversold = input(25 , type = input.integer , title = "Oversold")

overbought = input(75 , type = input.integer , title = "Overbought")

zero = 0

hundred = 100

limit = 50

// Plot Data

stagline = hline(limit , color=color.new(color.white,0) , linewidth=1, editable=false)

zeroline = hline(zero , color=color.new(color.silver,100), linewidth=0, editable=false)

hundredline = hline(hundred , color=color.new(color.silver,100), linewidth=0, editable=false)

oversoldline = hline(oversold , color=color.new(color.silver,100), linewidth=0, editable=false)

overboughtline = hline(overbought , color=color.new(color.silver,100), linewidth=0, editable=false)

// Filling Borders

fill(zeroline , oversoldline , color=color.maroon , transp=88 , title = "Oversold Area")

fill(oversoldline , stagline , color=color.red , transp=80 , title = "Bear Market")

fill(stagline , overboughtline , color=color.green , transp=80 , title = "Bull Market")

fill(overboughtline , hundredline , color=color.teal , transp=88 , title = "Overbought Market")

// Plot DOW Factor Methods

plot(_value, color = #F4C430 , linewidth = 2 , title = "DOW F-RSI" , transp = 0)

// Plot border lines

plot(oversold ,style = plot.style_line,color = color.new(color.maroon,30),linewidth = 1)

plot(overbought,style = plot.style_line,color = color.new(color.teal,30) ,linewidth = 1)

plot(zero ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

plot(hundred ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

// Switchable Barcolor ( On / Off)

_lights = 0.00

if (lights=="ON")

_lights:= 1.00

if (lights=="OFF")

_lights:= -1.00

bcolor_on = _lights == 1.00

bcolor_off = _lights == -1.00

barcolor((_positive_condition and bcolor_on) ? color.green : (_negative_condition and bcolor_on) ? color.red :

(_stationary_condition and bcolor_on) ? color.yellow : na)

// Alerts

alertcondition(_positive_condition , title='Strong Buy !', message='Strong Buy Signal ')

alertcondition(crossover(_value,overbought) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossover(_value,oversold) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossunder(_value,overbought) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(crossunder(_value,oversold) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(_negative_condition , title='Strong Sell !', message='Strong Sell Signal ')