Chiến lược giao dịch dựa trên biến động giá trung bình

Tổng quan

Ý tưởng cốt lõi của chiến lược này là tạo ra tín hiệu giao dịch dựa trên sự di chuyển của giá trung bình. Nó kết hợp các chỉ số siêu xu hướng với ba thiết lập tham số khác nhau, và thiết lập nhiều cách dừng như ATR Stop, Stop Fixed, Stop Percentage và Stop Point.

Lợi thế của chiến lược là sử dụng nhiều hệ thống siêu xu hướng để tăng độ chính xác tín hiệu, đồng thời cung cấp các thiết lập dừng lỗ linh hoạt.

Nguyên tắc chiến lược

Tính toán ba nhóm chỉ số siêu xu hướng: Đường siêu xu hướng được tính dựa trên ATR và giá trị trung bình của nó. Nó được sử dụng để báo hiệu tăng giá khi giá vượt quá đường siêu xu hướng và báo hiệu giảm giá khi giá giảm xuống đường siêu xu hướng.

Sử dụng đường dẫn trên và đường dẫn dưới của chỉ số Brin để xác định giá phá vỡ. Brin trên đường dẫn là tín hiệu đi lên, đường dẫn dưới là tín hiệu đi xuống.

Kết hợp các tín hiệu mua và bán của ba nhóm chỉ số siêu xu hướng để xác định xem có phù hợp với điều kiện nhập cảnh của nhiều đầu và đầu trống hay không.

Thiết lập nhiều phương thức dừng lỗ như ATR Stop, Fixed Stop, Percentage Stop và Points Stop để quản lý rủi ro.

Đánh giá có vào sân hay không dựa trên kích thước của giá trị chỉ số ATR. Điều này có thể được sử dụng để lọc các tín hiệu sai trong môi trường có tỷ lệ dao động thấp.

Lợi thế chiến lược

Kết hợp các tham số đa dạng để thiết lập các chỉ số siêu xu hướng khác nhau, có thể cải thiện độ chính xác của tín hiệu.

Sử dụng chỉ số BRI để xác định giá có phá vỡ đường đi lên xuống hay không và tránh phá vỡ giả.

Cung cấp nhiều phương thức dừng lỗ để quản lý rủi ro, tránh tối đa thiệt hại vượt quá mức chịu được.

Sử dụng giá trị chỉ số ATR để kiểm soát xem có vào sân hay không, có thể lọc tín hiệu sai lệch.

Rủi ro chiến lược

Các nhà phân tích đã đưa ra một số đánh giá về sự hợp tác giữa các chỉ số và có thể sẽ bỏ lỡ một số cơ hội tốt hơn.

Thiết lập phương thức dừng lỗ không đúng có thể gây ra tổn thất vượt quá mong đợi.

Thiết lập tham số băng thông Brin không đúng cũng gây ra sự chậm trễ tín hiệu.

Các điều kiện lọc ATR được thiết lập quá nghiêm ngặt cũng sẽ dẫn đến nhiều tín hiệu được lọc.

Hướng tối ưu hóa chiến lược

Điều chỉnh tham số chu kỳ ATR của chỉ số vượt xu hướng, tối ưu hóa độ nhạy của chỉ số.

Thử các loại giá trung bình khác nhau như nguồn đầu vào cho các chỉ số siêu xu hướng, chẳng hạn như trung bình di chuyển có trọng lượng.

Tối ưu hóa các tham số của Binance để đáp ứng nhanh hơn với xu hướng thực tế của giá cả.

Điều chỉnh giới hạn tham số của bộ lọc chỉ số ATR kết hợp với tính năng biến động của thị trường.

Thử nghiệm lợi nhuận trong các điều kiện dừng khác nhau trong phản hồi để tìm điểm dừng tối ưu.

Tóm tắt

Chiến lược này lọc một phần tiếng ồn bằng cách kết hợp nhiều tín hiệu lọc và phán đoán. Đồng thời cung cấp cơ chế dừng lỗ linh hoạt để kiểm soát rủi ro. Hiệu suất chiến lược tốt hơn có thể được đạt được bằng cách điều chỉnh các tham số.

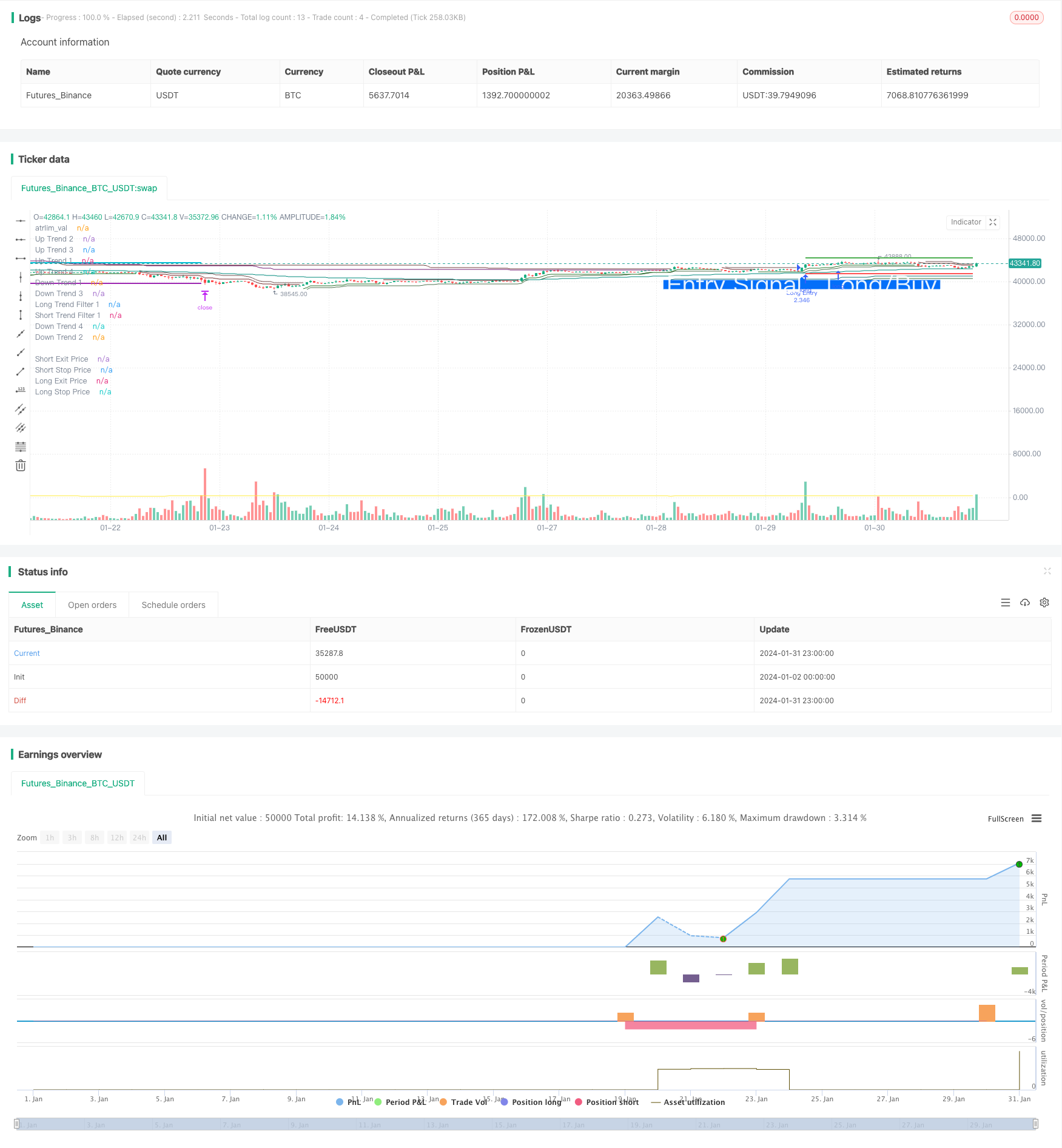

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=5

// @strategy_alert_message {{strategy.order.comment}}

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradeSmart22

strategy( title="ATR GOD Strategy by TradeSmart", overlay=true)

// PLOT SETTINGS

plot_signals = input.bool(true, title="Plot Signals", group="Plot Settings", tooltip="Show Long and Short signals on the signal candle, besides the actual entry points of the strategy.")

plot_sl_tp = input.bool(true, title="Plot SL/TP Lines", group="Plot Settings")

// STRATEGY SETTINGS

// Supertrend 1

plot_st_1 = input.bool(false, title="Plot Supertrend 1", group="Supertrend 1")

can_be_entry_signal_st_1 = input.bool(true, title="Supertrend 1 can be entry signal", group="Supertrend 1", tooltip="This Supertrend will be checked for a potential entry signal. (meaning Buy for a Long entry and Sell for a Short entry) If disabled, the strategy will not enter on any Buy/Sell signals emitted by this particular Supertrend.\n\nNOTE: One of the Supertrends must be enabled to be a potential entry signal in order for the strategy to enter into any trades.")

long_trend_st_1 = input.string("uptrend", options=["uptrend", "downtrend", "unspecified"], title="Long: Supertrend 1 has to be in", group="Supertrend 1", tooltip="When checking for a potential Long entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

short_trend_st_1 = input.string("downtrend", options=["uptrend", "downtrend", "unspecified"], title="Short: Supertrend 1 has to be in", group="Supertrend 1", tooltip="When checking for a potential Short entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

per_st_1 = input.int(20, title="ATR Period 1", group="Supertrend 1")

src_st_1 = input(hl2, title="Source 1", group="Supertrend 1")

mult_st_1 = input.float(2.0, title="ATR Multiplier 1", step=0.1, group="Supertrend 1")

atr_st_1 = ta.atr(per_st_1)

up_st_1 = src_st_1 - (mult_st_1 * atr_st_1)

up1_st_1 = nz(up_st_1[1], up_st_1)

up_st_1 := close[1] > up1_st_1 ? math.max(up_st_1, up1_st_1) : up_st_1

dn_st_1 = src_st_1 + (mult_st_1 * atr_st_1)

dn1_st_1 = nz(dn_st_1[1], dn_st_1)

dn_st_1 := close[1] < dn1_st_1 ? math.min(dn_st_1, dn1_st_1) : dn_st_1

trend_st_1 = 1

trend_st_1 := nz(trend_st_1[1], trend_st_1)

trend_st_1 := trend_st_1 == -1 and close > dn1_st_1 ? 1 : trend_st_1 == 1 and close < up1_st_1 ? -1 : trend_st_1

buySignal_st_1 = trend_st_1 == 1 and trend_st_1[1] == -1

sellSignal_st_1 = trend_st_1 == -1 and trend_st_1[1] == 1

upPlot_st_1 = plot(trend_st_1 == 1 ? up_st_1 : na, title="Up Trend 1", style=plot.style_linebr, linewidth=1, color=color.rgb(20, 100, 20, 10), display=plot_st_1 ? display.all : display.none)

plotshape(buySignal_st_1 and plot_st_1 ? up_st_1 : na, title="Start Up Trend 1", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(20, 100, 20, 10))

plotshape(buySignal_st_1 and plot_st_1 ? up_st_1 : na, title="Buy 1", text="Buy 1", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.rgb(20, 100, 20, 10), textcolor=color.white)

dnPlot_st_1 = plot(trend_st_1 == 1 ? na : dn_st_1, title="Down Trend 1", style=plot.style_linebr, linewidth=1, color=color.rgb(100, 20, 20, 10), display=plot_st_1 ? display.all : display.none)

plotshape(sellSignal_st_1 and plot_st_1 ? dn_st_1 : na, title="Start Down Trend 1", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(100, 20, 20, 10))

plotshape(sellSignal_st_1 and plot_st_1 ? dn_st_1 : na, title="Sell 1", text="Sell 1", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.rgb(100, 20, 20, 10), textcolor=color.white)

// Supertrend 2

plot_st_2 = input.bool(false, title="Plot Supertrend 2", group="Supertrend 2")

can_be_entry_signal_st_2 = input.bool(false, title="Supertrend 2 can be entry signal", group="Supertrend 2", tooltip="This Supertrend will be checked for a potential entry signal. (meaning Buy for a Long entry and Sell for a Short entry) If disabled, the strategy will not enter on any Buy/Sell signals emitted by this particular Supertrend.\n\nNOTE: One of the Supertrends must be enabled to be a potential entry signal in order for the strategy to enter into any trades.")

long_trend_st_2 = input.string("uptrend", options=["uptrend", "downtrend", "unspecified"], title="Long: Supertrend 2 has to be in", group="Supertrend 2", tooltip="When checking for a potential Long entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

short_trend_st_2 = input.string("downtrend", options=["uptrend", "downtrend", "unspecified"], title="Short: Supertrend 2 has to be in", group="Supertrend 2", tooltip="When checking for a potential Short entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

per_st_2 = input.int(5, title="ATR Period 2", group="Supertrend 2")

src_st_2 = input(hlcc4, title="Source 2", group="Supertrend 2")

mult_st_2 = input.float(15, title="ATR Multiplier 2", step=0.1, group="Supertrend 2")

atr_st_2 = ta.atr(per_st_2)

up_st_2 = src_st_2 - (mult_st_2 * atr_st_2)

up1_st_2 = nz(up_st_2[1], up_st_2)

up_st_2 := close[1] > up1_st_2 ? math.max(up_st_2, up1_st_2) : up_st_2

dn_st_2 = src_st_2 + (mult_st_2 * atr_st_2)

dn1_st_2 = nz(dn_st_2[1], dn_st_2)

dn_st_2 := close[1] < dn1_st_2 ? math.min(dn_st_2, dn1_st_2) : dn_st_2

trend_st_2 = 1

trend_st_2 := nz(trend_st_2[1], trend_st_2)

trend_st_2 := trend_st_2 == -1 and close > dn1_st_2 ? 1 : trend_st_2 == 1 and close < up1_st_2 ? -1 : trend_st_2

buySignal_st_2 = trend_st_2 == 1 and trend_st_2[1] == -1

sellSignal_st_2 = trend_st_2 == -1 and trend_st_2[1] == 1

upPlot_st_2 = plot(trend_st_2 == 1 ? up_st_2 : na, title="Up Trend 2", style=plot.style_linebr, linewidth=1, color=color.rgb(40, 100, 40, 10), display=plot_st_2 ? display.all : display.none)

plotshape(buySignal_st_2 and plot_st_2 ? up_st_2 : na, title="Start Up Trend 2", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(40, 100, 40, 10))

plotshape(buySignal_st_2 and plot_st_2 ? up_st_2 : na, title="Buy 2", text="Buy 2", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.rgb(40, 100, 40, 10), textcolor=color.white)

dnPlot_st_2 = plot(trend_st_2 == 1 ? na : dn_st_2, title="Down Trend 2", style=plot.style_linebr, linewidth=1, color=color.rgb(100, 40, 40, 10), display=plot_st_2 ? display.all : display.none)

plotshape(sellSignal_st_2 and plot_st_2 ? dn_st_2 : na, title="Start Down Trend 2", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(100, 40, 40, 10))

plotshape(sellSignal_st_2 and plot_st_2 ? dn_st_2 : na, title="Sell 2", text="Sell 2", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.rgb(100, 40, 40, 10), textcolor=color.white)

// Supertrend 3

plot_st_3 = input.bool(false, title="Plot Supertrend 3", group="Supertrend 3")

can_be_entry_signal_st_3 = input.bool(true, title="Supertrend 3 can be entry signal", group="Supertrend 3", tooltip="This Supertrend will be checked for a potential entry signal. (meaning Buy for a Long entry and Sell for a Short entry) If disabled, the strategy will not enter on any Buy/Sell signals emitted by this particular Supertrend.\n\nNOTE: One of the Supertrends must be enabled to be a potential entry signal in order for the strategy to enter into any trades.")

long_trend_st_3 = input.string("uptrend", options=["uptrend", "downtrend", "unspecified"], title="Long: Supertrend 3 has to be in", group="Supertrend 3", tooltip="When checking for a potential Long entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

short_trend_st_3 = input.string("downtrend", options=["uptrend", "downtrend", "unspecified"], title="Short: Supertrend 3 has to be in", group="Supertrend 3", tooltip="When checking for a potential Short entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

per_st_3 = input.int(10, title="ATR Period 3", group="Supertrend 3")

src_st_3 = input(hl2, title="Source 3", group="Supertrend 3")

mult_st_3 = input.float(3.0, title="ATR Multiplier 3", step=0.1, group="Supertrend 3")

atr_st_3 = ta.atr(per_st_3)

up_st_3 = src_st_3 - (mult_st_3 * atr_st_3)

up1_st_3 = nz(up_st_3[1], up_st_3)

up_st_3 := close[1] > up1_st_3 ? math.max(up_st_3, up1_st_3) : up_st_3

dn_st_3 = src_st_3 + (mult_st_3 * atr_st_3)

dn1_st_3 = nz(dn_st_3[1], dn_st_3)

dn_st_3 := close[1] < dn1_st_3 ? math.min(dn_st_3, dn1_st_3) : dn_st_3

trend_st_3 = 1

trend_st_3 := nz(trend_st_3[1], trend_st_3)

trend_st_3 := trend_st_3 == -1 and close > dn1_st_3 ? 1 : trend_st_3 == 1 and close < up1_st_3 ? -1 : trend_st_3

buySignal_st_3 = trend_st_3 == 1 and trend_st_3[1] == -1

sellSignal_st_3 = trend_st_3 == -1 and trend_st_3[1] == 1

upPlot_st_3 = plot(trend_st_3 == 1 ? up_st_3 : na, title="Up Trend 3", style=plot.style_linebr, linewidth=1, color=color.rgb(60, 100, 60, 10), display=plot_st_3 ? display.all : display.none)

plotshape(buySignal_st_3 and plot_st_3 ? up_st_3 : na, title="Start Up Trend 3", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(60, 100, 60, 10))

plotshape(buySignal_st_3 and plot_st_3 ? up_st_3 : na, title="Buy 3", text="Buy 3", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.rgb(60, 100, 60, 10), textcolor=color.white)

dnPlot_st_3 = plot(trend_st_3 == 1 ? na : dn_st_3, title="Down Trend 3", style=plot.style_linebr, linewidth=1, color=color.rgb(100, 60, 60, 10), display=plot_st_3 ? display.all : display.none)

plotshape(sellSignal_st_3 and plot_st_3 ? dn_st_3 : na, title="Start Down Trend 3", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(100, 60, 60, 10))

plotshape(sellSignal_st_3 and plot_st_3 ? dn_st_3 : na, title="Sell 3", text="Sell 3", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.rgb(100, 60, 60, 10), textcolor=color.white)

// Supertrend 4

plot_st_4 = input.bool(false, title="Plot Supertrend 4", group="Supertrend 4")

can_be_entry_signal_st_4 = input.bool(true, title="Supertrend 4 can be entry signal", group="Supertrend 4", tooltip="This Supertrend will be checked for a potential entry signal. (meaning Buy for a Long entry and Sell for a Short entry) If disabled, the strategy will not enter on any Buy/Sell signals emitted by this particular Supertrend.\n\nNOTE: One of the Supertrends must be enabled to be a potential entry signal in order for the strategy to enter into any trades.")

long_trend_st_4 = input.string("uptrend", options=["uptrend", "downtrend", "unspecified"], title="Long: Supertrend 4 has to be in", group="Supertrend 4", tooltip="When checking for a potential Long entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

short_trend_st_4 = input.string("downtrend", options=["uptrend", "downtrend", "unspecified"], title="Short: Supertrend 4 has to be in", group="Supertrend 4", tooltip="When checking for a potential Short entry signal, this particular Supertrend must be in the set trend or undefined (meaning that it can be in either up/down trends).")

per_st_4 = input.int(20, title="ATR Period 4", group="Supertrend 4")

src_st_4 = input(hl2, title="Source 4", group="Supertrend 4")

mult_st_4 = input.float(10.0, title="ATR Multiplier 4", step=0.1, group="Supertrend 4")

atr_st_4 = ta.atr(per_st_4)

up_st_4 = src_st_4 - (mult_st_4 * atr_st_4)

up1_st_4 = nz(up_st_4[1], up_st_4)

up_st_4 := close[1] > up1_st_4 ? math.max(up_st_4, up1_st_4) : up_st_4

dn_st_4 = src_st_4 + (mult_st_4 * atr_st_4)

dn1_st_4 = nz(dn_st_4[1], dn_st_4)

dn_st_4 := close[1] < dn1_st_4 ? math.min(dn_st_4, dn1_st_4) : dn_st_4

trend_st_4 = 1

trend_st_4 := nz(trend_st_4[1], trend_st_4)

trend_st_4 := trend_st_4 == -1 and close > dn1_st_4 ? 1 : trend_st_4 == 1 and close < up1_st_4 ? -1 : trend_st_4

buySignal_st_4 = trend_st_4 == 1 and trend_st_4[1] == -1

sellSignal_st_4 = trend_st_4 == -1 and trend_st_4[1] == 1

upPlot_st_4 = plot(trend_st_4 == 1 ? up_st_4 : na, title="Up Trend 4", style=plot.style_linebr, linewidth=1, color=color.rgb(0, 100, 100, 10), display=plot_st_4 ? display.all : display.none)

plotshape(buySignal_st_4 and plot_st_4 ? up_st_4 : na, title="Start Up Trend 4", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(0, 100, 100, 10))

plotshape(buySignal_st_4 and plot_st_4 ? up_st_4 : na, title="Buy 4", text="Buy 4", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.rgb(0, 100, 100, 10), textcolor=color.white)

dnPlot_st_4 = plot(trend_st_4 == 1 ? na : dn_st_4, title="Down Trend 4", style=plot.style_linebr, linewidth=1, color=color.rgb(100, 0, 100, 10), display=plot_st_4 ? display.all : display.none)

plotshape(sellSignal_st_4 and plot_st_4 ? dn_st_4 : na, title="Start Down Trend 4", location=location.absolute, style=shape.circle, size=size.tiny, color=color.rgb(100, 0, 100, 10))

plotshape(sellSignal_st_4 and plot_st_4 ? dn_st_4 : na, title="Sell 4", text="Sell 4", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.rgb(100, 0, 100, 10), textcolor=color.white)

// Exit Strategy

function(source, length, smoothing) =>

if smoothing == "RMA/SMMA"

ta.rma(source, length)

else

if smoothing == "SMA"

ta.sma(source, length)

else

if smoothing == "EMA"

ta.ema(source, length)

else

ta.wma(source, length)

formula(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

use_atr_based_sl = input.bool(true, "ATR Based Stop Loss", group="Exit Strategy", tooltip="Please select only one active stop loss. Default value (if nothing or multiple stop losses are selected) is the 'ATR Based Stop Loss'.")

nnatr_length = input.int(100, title = "ATR Length", group="Exit Strategy")

smoothing = input.string("RMA/SMMA", title="ATR Smoothing", options=["RMA/SMMA", "SMA", "EMA", "WMA"], group="Exit Strategy")

use_low_high_based_sl = input.bool(false, "Candle Low/High Based Stop Loss", group="Exit Strategy", tooltip="Use recent lowest or highest point (depending on long/short position) to calculate stop loss value.\n\nSet 'Base Risk Multiplier' to 1 if you would like to use the calculated value as is. Setting it to a different value will count as an additional multiplier.\n\nPlease select only one active stop loss. Default value (if nothing or multiple stop losses are selected) is the 'ATR Based Stop Loss'.")

candle_lookback_sl = input.int(50, title="Candle Lookback", group="Exit Strategy")

use_percentage_based_sl = input.bool(false, "Percentage Based Stop Loss", group="Exit Strategy", tooltip="Set the stop loss to current price - % of current price (long) or price + % of current price (short).\n\nSet 'Base Risk Multiplier' to 1 if you would like to use the calculated value as is. Setting it to a different value will count as an additional multiplier.\n\nPlease select only one active stop loss. Default value (if nothing or multiple stop losses are selected) is the 'ATR Based Stop Loss'.")

percentage_sl = input.float(0.3, title="Percentage", group="Exit Strategy")

use_pip_based_sl = input.bool(false, "Pip Based Stop Loss", group="Exit Strategy", tooltip="Set the stop loss to current price - x pips (long) or price + x pips (short).\n\nSet 'Base Risk Multiplier' to 1 if you would like to use the calculated value as is. Setting it to a different value will count as an additional multiplier.\n\nPlease select only one active stop loss. Default value (if nothing or multiple stop losses are selected) is the 'ATR Based Stop Loss'.")

pip_sl = input.int(10, title = "Pip", group="Exit Strategy")

nnatr_loss = input.float(4.5, title="Base Risk Multiplier", minval = 0.1, step = 0.1, group="Exit Strategy")

rr_ratio = input.float(1.5, title="Risk to Reward Ratio", minval = 0.1, step = 0.1, group="Exit Strategy")

nnatr_profit = nnatr_loss * rr_ratio

nnatr = formula(function(ta.tr(true), nnatr_length, smoothing), 5)

lowest_point_sl = ta.lowest(candle_lookback_sl)

highest_point_sl = ta.highest(candle_lookback_sl)

percentage_val = percentage_sl * 0.01

percentage_long_sl = close - (close * percentage_val * nnatr_loss)

percentage_short_sl = close + (close * percentage_val * nnatr_loss)

pip_long_sl = close - pip_sl * syminfo.mintick

pip_short_sl = close + pip_sl * syminfo.mintick

b_atr_buy = use_atr_based_sl ? close + nnatr * nnatr_profit : use_low_high_based_sl ? close + (close - lowest_point_sl) * nnatr_profit : use_percentage_based_sl ? close + (close - percentage_long_sl) / nnatr_loss * nnatr_profit : use_pip_based_sl ? close + (close - pip_long_sl) * nnatr_profit : close + nnatr * nnatr_profit

b_atr_sell = use_atr_based_sl ? close - nnatr * nnatr_loss : use_low_high_based_sl ? lowest_point_sl * nnatr_loss : use_percentage_based_sl ? percentage_long_sl : use_pip_based_sl ? pip_long_sl : close - nnatr * nnatr_loss

s_atr_buy = use_atr_based_sl ? close - nnatr * nnatr_profit : use_low_high_based_sl ? close - (highest_point_sl - close) * nnatr_profit : use_percentage_based_sl ? close - (percentage_short_sl - close) / nnatr_loss * nnatr_profit : use_pip_based_sl ? close - (pip_short_sl - close) * nnatr_profit : close - nnatr * nnatr_profit

s_atr_sell = use_atr_based_sl ? close + nnatr * nnatr_loss : use_low_high_based_sl ? highest_point_sl * nnatr_loss : use_percentage_based_sl ? percentage_short_sl : use_pip_based_sl ? pip_short_sl : close + nnatr * nnatr_loss

// FORCE EXITING

use_force_exit_exact_time_1 = input.bool(false, title="1 - Force exit on custom session close", group="Force Exiting", inline="force_exit_exact_time_1")

force_exit_exact_time_1 = input("0930-1630:1234567", title="", group="Force Exiting", inline="force_exit_exact_time_1", tooltip="If enabled, trades will close automatically after the set session is closed (on next candle's open). CAUTION: do not set the start and end times of the session to the same value!")

custom_session_1 = time("30S", force_exit_exact_time_1)

use_force_exit_exact_time_2 = input.bool(false, title="2 - Force exit on custom session close", group="Force Exiting", inline="force_exit_exact_time_2")

force_exit_exact_time_2 = input("0930-1630:1234567", title="", group="Force Exiting", inline="force_exit_exact_time_2", tooltip="If enabled, trades will close automatically after the set session is closed (on next candle's open). CAUTION: do not set the start and end times of the session to the same value!")

custom_session_2 = time("30S", force_exit_exact_time_2)

use_force_exit_exact_time_3 = input.bool(false, title="3 - Force exit on custom session close", group="Force Exiting", inline="force_exit_exact_time_3")

force_exit_exact_time_3 = input("0930-1630:1234567", title="", group="Force Exiting", inline="force_exit_exact_time_3", tooltip="If enabled, trades will close automatically after the set session is closed (on next candle's open). CAUTION: do not set the start and end times of the session to the same value!")

custom_session_3 = time("30S", force_exit_exact_time_3)

use_force_exit_exact_time_4 = input.bool(false, title="4 - Force exit on custom session close", group="Force Exiting", inline="force_exit_exact_time_4")

force_exit_exact_time_4 = input("0930-1630:1234567", title="", group="Force Exiting", inline="force_exit_exact_time_4", tooltip="If enabled, trades will close automatically after the set session is closed (on next candle's open). CAUTION: do not set the start and end times of the session to the same value!")

custom_session_4 = time("30S", force_exit_exact_time_4)

// BASE SETUPS

allow_long = input.bool(true, title="Allow Long Entries", group="Base Setups")

allow_short = input.bool(true, title="Allow Short Entries", group="Base Setups")

order_size_value = input.float(100000, title='Order Size', minval=0, inline="ordersize", group="Base Setups")

order_size_type = input.string("Cash", title="", inline="ordersize", options=["Cash", "Contract(s)", "Capital Percentage"], group="Base Setups", tooltip="Adjust how the position size is calculated:\n\nCash: only the set cash ammount will be used for each trade\n\nContract(s): the adjusted number of contracts will be used for each trade\n\nCapital Percentage: a % of the current available capital will be used for each trade")

// ATR Filter

switch_ma(maType, maSrc, maLen) =>

float maOut = switch maType

"SMA" => ta.sma(maSrc, maLen)

"EMA" => ta.ema(maSrc, maLen)

"WMA" => ta.wma(maSrc, maLen)

"VWMA" => ta.vwma(maSrc, maLen)

"RMA/SMMA" => ta.rma(maSrc, maLen)

"SWMA" => ta.swma(maSrc)

"HMA" => ta.hma(maSrc, maLen)

use_atr_limiter = input.bool(true, title="Use ATR Limiter", group="ATR Limiter", tooltip="Only enter into any position (long/short) if ATR value is higher than the Low Boundary and lower than the High Boundary.")

atrlim_len = input(50, title="ATR Limiter Length", group="ATR Limiter")

atrlim_smoothing = input.string("RMA/SMMA", title="ATR Limiter Smoothing", options=["RMA/SMMA", "SMA", "EMA", "WMA"], group="ATR Limiter")

atrlim_boundary_high = input.float(1000, title="High Boundary", group="ATR Limiter")

atrlim_boundary_low = input.float(0.0003, title="Low Boundary", group="ATR Limiter")

atrlim_val = formula(function(ta.tr(true), atrlim_len, atrlim_smoothing), 5)

plot(atrlim_val, title='atrlim_val', color=color.yellow)

atrlim_calc_by_ma = input.string("ATR value under MA", options=["ATR value over MA", "ATR value under MA", "Unspecified"], title="MA based calculation", group="ATR Limiter", tooltip="If not Unspecified, an MA is calculated with the ATR value as source. Only enter into position (long/short) if ATR value is higher/lower than the MA.")

atrlim_ema_type = input.string("RMA/SMMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="MA Type", group="ATR Limiter")

atrlim_ema_len = input.int(400, title="MA Length", minval=1, group="ATR Limiter")

atrlim_ema = switch_ma(atrlim_ema_type, atrlim_val, atrlim_ema_len)

check_atr_lim_long() =>

use_atr_limiter ? atrlim_calc_by_ma == "ATR value over MA" ? atrlim_val > atrlim_ema and atrlim_val < atrlim_boundary_high and atrlim_val > atrlim_boundary_low : atrlim_calc_by_ma == "ATR value under MA" ? atrlim_val < atrlim_ema and atrlim_val < atrlim_boundary_high and atrlim_val > atrlim_boundary_low : atrlim_val < atrlim_boundary_high and atrlim_val > atrlim_boundary_low : true

check_atr_lim_short() =>

use_atr_limiter ? atrlim_calc_by_ma == "ATR value over MA" ? atrlim_val > atrlim_ema and atrlim_val > atrlim_boundary_low and atrlim_val < atrlim_boundary_high : atrlim_calc_by_ma == "ATR value under MA" ? atrlim_val < atrlim_ema and atrlim_val > atrlim_boundary_low and atrlim_val < atrlim_boundary_high : atrlim_val > atrlim_boundary_low and atrlim_val < atrlim_boundary_high : true

// Entry Logic

green_1 = trend_st_1 == 1

green_2 = trend_st_2 == 1

green_3 = trend_st_3 == 1

green_4 = trend_st_4 == 1

red_1 = trend_st_1 != 1

red_2 = trend_st_2 != 1

red_3 = trend_st_3 != 1

red_4 = trend_st_4 != 1

st_uptrend_bool_arr = array.from(green_1, green_2, green_3, green_4)

st_downtrend_bool_arr = array.from(red_1, red_2, red_3, red_4)

st_buy_signal_arr = array.from(buySignal_st_1, buySignal_st_2, buySignal_st_3, buySignal_st_4)

last_st_buy_signal_arr = array.from(buySignal_st_1[1], buySignal_st_2[1], buySignal_st_3[1], buySignal_st_4[1])

st_sell_signal_arr = array.from(sellSignal_st_1, sellSignal_st_2, sellSignal_st_3, sellSignal_st_4)

last_st_sell_signal_arr = array.from(sellSignal_st_1[1], sellSignal_st_2[1], sellSignal_st_3[1], sellSignal_st_4[1])

long_trend_arr = array.from(long_trend_st_1, long_trend_st_2, long_trend_st_3, long_trend_st_4)

short_trend_arr = array.from(short_trend_st_1, short_trend_st_2, short_trend_st_3, short_trend_st_4)

long_trends_ok = true

short_trends_ok = true

for [index, value] in st_uptrend_bool_arr

if value

if array.get(long_trend_arr, index) == "downtrend"

long_trends_ok := false

if array.get(short_trend_arr, index) == "downtrend"

short_trends_ok := false

for [index, value] in st_downtrend_bool_arr

if value

if array.get(long_trend_arr, index) == "uptrend"

long_trends_ok := false

if array.get(short_trend_arr, index) == "uptrend"

short_trends_ok := false

can_be_entry_signal_arr = array.from(can_be_entry_signal_st_1, can_be_entry_signal_st_2, can_be_entry_signal_st_3, can_be_entry_signal_st_4)

long_trigger = false

short_trigger = false

for [index, value] in st_buy_signal_arr

if array.get(st_buy_signal_arr, index) and not array.get(last_st_buy_signal_arr, index) and array.get(can_be_entry_signal_arr, index)

long_trigger := true

if array.get(st_sell_signal_arr, index) and not array.get(last_st_sell_signal_arr, index) and array.get(can_be_entry_signal_arr, index)

short_trigger := true

check_entry_long() => long_trigger and long_trends_ok

check_entry_short() => short_trigger and short_trends_ok

// WADDAH ATTAR FILTER

wafilt_calc_macd(source, fast_length, fast_type, slow_length, slow_type) =>

fast_ma = switch_ma(fast_type, source, fast_length)

slow_ma = switch_ma(slow_type, source, slow_length)

fast_ma - slow_ma

wafilt_calc_BBUpper(ma_type, source, length, mult) =>

basis = switch_ma(ma_type, source, length)

dev = mult * ta.stdev(source, length)

basis + dev

wafilt_calc_BBLower(ma_type, source, length, mult) =>

basis = switch_ma(ma_type, source, length)

dev = mult * ta.stdev(source, length)

basis - dev

wa_entry_logic = input.string("Not specified", options=["Explosion over Deadzone", "Explosion under Deadzone", "Not specified"], title="Explosion/Deadzone relation", group="Waddah Attar Filter", tooltip="Explosion over Deadzone: trades will only happen if the explosion line is over the deadzone line;\n\nExplosion under Deadzone: trades will only happen if the explosion line is under the deadzone line;\n\nNot specified: the opening of trades will not be based on the relation between the explosion and deadzone lines.")

wafilt_only_trade_when_trend = input.string("Not specified", options=["Strong Trends", "Soft Trends", "All Trends", "Not specified"], title="Limit trades based on trends", group="Waddah Attar Filter", tooltip="Strong Trends: only enter long if the WA bar is colored green (there is an uptrend and the current bar is higher then the previous); only enter short if the WA bar is colored red (there is a downtrend and the current bar is higher then the previous);\n\nSoft Trends: only enter long if the WA bar is colored lime (there is an uptrend and the current bar is lower then the previous); only enter short if the WA bar is colored orange (there is a downtrend and the current bar is lower then the previous);\n\nAll Trends: only enter long if the WA bar is colored green or lime (there is an uptrend); only enter short if the WA bar is colored red or orange (there is a downtrend);\n\nNot specified: the color of the WA bar (trend) is not relevant when considering entries.")

wa_over_e_dz = input.string("Not specified", options=["Over Explosion and Deadzone", "Not specified"], title="WA bar value", group="Waddah Attar Filter", tooltip="Over Explosion and Deadzone: only enter trades when the WA bar value is over the Explosion and Deadzone lines;\n\nNot specified: the relation between the explosion/deadzone lines to the value of the WA bar will not be used to filter opening trades.")

wafilt_sensitivity = input(150, title="Sensitivity", group="Waddah Attar Filter")

wafilt_fast_type = input.string("SMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="Fast MA Type", inline="wa_1", group="Waddah Attar Filter")

wafilt_fast_length=input(10, title="Fast MA Length", inline="wa_1", group="Waddah Attar Filter")

wafilt_slow_type = input.string("SMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="Slow MA Type", inline="wa_2", group="Waddah Attar Filter")

wafilt_slow_length=input(20, title="Slow MA Length", inline="wa_2", group="Waddah Attar Filter")

wafilt_channel_type = input.string("EMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="Channel MA Type", group="Waddah Attar Filter")

wafilt_channel_length=input(20, title="BB Channel Length", inline="wa_3", group="Waddah Attar Filter")

wafilt_mult=input(2.0, title="BB Stdev Multiplier", inline="wa_3", group="Waddah Attar Filter")

wafilt_dead_zone = nz(ta.rma(ta.tr(true),100)) * 3.7

wafilt_t1 = (wafilt_calc_macd(close, wafilt_fast_length, wafilt_fast_type, wafilt_slow_length, wafilt_slow_type) - wafilt_calc_macd(close[1], wafilt_fast_length, wafilt_fast_type, wafilt_slow_length, wafilt_slow_type)) * wafilt_sensitivity

wafilt_e1 = (wafilt_calc_BBUpper(wafilt_channel_type, close, wafilt_channel_length, wafilt_mult) - wafilt_calc_BBLower(wafilt_channel_type, close, wafilt_channel_length, wafilt_mult))

wafilt_trend_up = (wafilt_t1 >= 0) ? wafilt_t1 : 0

wafilt_trend_down = (wafilt_t1 < 0) ? (-1 * wafilt_t1) : 0

wafilt_trend_up_color = wafilt_trend_up < wafilt_trend_up[1] ? color.lime : color.green

wafilt_trend_down_color = wafilt_trend_down < wafilt_trend_down[1] ? color.orange : color.red

wafilt_trend_val = wafilt_trend_up != 0 ? wafilt_trend_up : wafilt_trend_down

wafilt_trend_color = wafilt_trend_up != 0 ? wafilt_trend_up_color : wafilt_trend_down_color

check_waddah_attar_long() =>

logic = wa_entry_logic == "Explosion over Deadzone" ? wafilt_e1 > wafilt_dead_zone : wa_entry_logic == "Explosion under Deadzone" ? wafilt_e1 < wafilt_dead_zone : true

trend = wafilt_only_trade_when_trend == "All Trends" ? wafilt_trend_color == color.lime or wafilt_trend_color == color.green : wafilt_only_trade_when_trend == "Strong Trends" ? wafilt_trend_color == color.green : wafilt_only_trade_when_trend == "Soft Trends" ? wafilt_trend_color == color.lime : true

wa_bar_value = wa_over_e_dz == "Over Explosion and Deadzone" ? wafilt_trend_val > wafilt_e1 and wafilt_trend_val > wafilt_dead_zone : true

logic and trend and wa_bar_value

check_waddah_attar_short() =>

logic = wa_entry_logic == "Explosion over Deadzone" ? wafilt_e1 > wafilt_dead_zone : wa_entry_logic == "Explosion under Deadzone" ? wafilt_e1 < wafilt_dead_zone : true

trend = wafilt_only_trade_when_trend == "All Trends" ? wafilt_trend_color == color.red or wafilt_trend_color == color.orange : wafilt_only_trade_when_trend == "Strong Trends" ? wafilt_trend_color == color.red : wafilt_only_trade_when_trend == "Soft Trends" ? wafilt_trend_color == color.orange : true

wa_bar_value = wa_over_e_dz == "Over Explosion and Deadzone" ? wafilt_trend_val > wafilt_e1 and wafilt_trend_val > wafilt_dead_zone : true

logic and trend and wa_bar_value

// TREND FILTER

use_long_trend_filter_1 = input.bool(false, title="Use long trend filter 1", group="Trend Filter", tooltip="Only enter long if price is above Long MA.")

show_long_trend_filter_1 = input.bool(false, title="Show long trend filter 1", group="Trend Filter", tooltip="Plot the selected MA on the chart.")

long_ma_type_1 = input.string("EMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="TF1 - MA Type", inline="lTF1", group="Trend Filter")

long_ma_len_1 = input.int(120, title="TF1 - MA Length", inline="lTF1", group="Trend Filter")

long_ma_source_1 = input(close, title="TF1 - MA Source", inline="lTF1", group="Trend Filter")

float long_ma_tf_1 = switch_ma(long_ma_type_1, long_ma_source_1, long_ma_len_1)

use_short_trend_filter_1 = input.bool(false, title="Use short trend filter 1", group="Trend Filter", tooltip="Only enter short if price is under Short MA.")

show_short_trend_filter_1 = input.bool(false, title="Show short trend filter 1", group="Trend Filter", tooltip="Plot the selected MA on the chart.")

short_ma_type_1 = input.string("EMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="TF2 - MA Type", inline="sTF1", group="Trend Filter")

short_ma_len_1 = input.int(120, title="TF2 - MA Length", inline="sTF1", group="Trend Filter")

short_ma_source_1 = input(close, title="TF2 - MA Source", inline="sTF1", group="Trend Filter")

float short_ma_tf_1 = switch_ma(short_ma_type_1, short_ma_source_1, short_ma_len_1)

plot(long_ma_tf_1, color=color.blue, display=show_long_trend_filter_1 ? display.all : display.none, title="Long Trend Filter 1")

plot(short_ma_tf_1, color=color.teal, display=show_short_trend_filter_1 ? display.all : display.none, title="Short Trend Filter 1")

check_trend_filter_long() =>

long_filter_1 = use_long_trend_filter_1 ? close > long_ma_tf_1 : true

long_filter_1

check_trend_filter_short() =>

short_filter_1 = use_short_trend_filter_1 ? close < short_ma_tf_1 : true

short_filter_1

// VOLUME FILTER

use_volume_filter = input.bool(true, title="Only enter trades where volume is higher then the volume-based MA", group="Volume Filter", tooltip="A set type of MA will be calculated with the volume as source, and set length")

vol_ma_type = input.string("RMA/SMMA", options=["SMA", "EMA", "WMA", "VWMA", "RMA/SMMA", "SWMA", "HMA"], title="Volume-based MA Type", group="Volume Filter")

vol_ma_len = input.int(200, title="Volume-based MA Length", group="Volume Filter")

vol_ma = switch_ma(vol_ma_type, volume, vol_ma_len)

check_volume_filter() =>

use_volume_filter ? volume > vol_ma : true

// DATE RANGE SETTINGS

limit_dates = input.bool(false, title="Limit Between Dates", group="Date Range Limiter")

start_date = input(timestamp("Jan 01 2023 00:00:00"), title="Start Date", group="Date Range Limiter")

end_date = input(timestamp("Jun 24 2023 00:00:00"), title="End Date", group="Date Range Limiter")

// SESSION LIMITER

show_session_plots = input.bool(false, title="Show session plots", group="Session Limiter", tooltip="Show crypto market sessions on chart: Sidney (red), Tokyo (orange), London (yellow), New York (green)")

use_session_limit = input.bool(false, title="Use session limiter", group="Session Limiter", tooltip="If enabled, trades will only happen in the ticked sessions below.")

limit_session1 = input.bool(false, title="Sidney session", group="Session Limiter", tooltip="Session between: 15:00 - 00:00 (EST)")

limit_session2 = input.bool(false, title="Tokyo session", group="Session Limiter", tooltip="Session between: 19:00 - 04:00 (EST)")

limit_session3 = input.bool(false, title="London session", group="Session Limiter", tooltip="Session between: 03:00 - 11:00 (EST)")

limit_session4 = input.bool(false, title="New York session", group="Session Limiter", tooltip="Session between: 08:00 - 17:00 (EST)")

session1 = time(timeframe.period, "1500-0000:1234567", "America/New_York") //Sydney Session

session2 = time(timeframe.period, "1900-0400:1234567", "America/New_York") //Tokyo Session

session3 = time(timeframe.period, "0300-1100:1234567", "America/New_York") //London Session

session4 = time(timeframe.period, "0800-1700:1234567", "America/New_York") //New York Session

bgcolor(session1 and show_session_plots ? color.new(color.red, 60) : na, title="Sydney Session")

bgcolor(session2 and show_session_plots ? color.new(color.orange, 60) : na, title="Tokyo Session")

bgcolor(session3 and show_session_plots ? color.new(color.yellow, 60) : na, title="London Session")

bgcolor(session4 and show_session_plots ? color.new(color.green, 60) : na, title="New York Session")

// TRADING TIME

limit_trading_time = input.bool(true, title="Limit Trading Time", group="Trading Time Limiter", tooltip="Tick this together with the options below to enable limiting based on day and time.")

days_to_trade_on = input.string("123567", title="Valid Trading Days Global", tooltip="If the Limit Trading Time is on, trades will only happen on days that are present in this field. If any of the not global Valid Trading Days is used, this field will be neglected.\n\nValues represent days: \nSunday (1), Monday (2), ..., Friday (6), Saturday(7)\nTo trade on all days use: 123457", group="Trading Time Limiter")

limit_day1 = input.bool(false, title="", group="Trading Time Limiter", inline="day1")

days_to_trade_on1 = input.string("23456", title="(1) Valid Trading Days", inline="day1", tooltip="Values represent days: \nSunday (1), Monday (2), ..., Friday (6), Saturday(7)\n\nScript will trade on days that are present in this field. Please make sure that this field and also (1) Valid Trading Hours Between is checked.", group="Trading Time Limiter")

valid_hours1 = input.bool(false, title="", inline="inline1", group="Trading Time Limiter", tooltip="Hours between which the trades can happen. The time is always in the exchange's timezone.")

hours_to_trade_on1 = input("1800-2000", title="(1) Valid Trading Hours Between", inline="inline1", group="Trading Time Limiter")

limit_day2 = input.bool(false, title="", group="Trading Time Limiter", inline="day2")

days_to_trade_on2 = input.string("1234567", title="(2) Valid Trading Days", inline="day2", tooltip="Values represent days: \nSunday (1), Monday (2), ..., Friday (6), Saturday(7)\n\nScript will trade on days that are present in this field. Please make sure that this field and also (2) Valid Trading Hours Between is checked.", group="Trading Time Limiter")

valid_hours2 = input.bool(false, title="", inline="inline2", group="Trading Time Limiter", tooltip="Hours between which the trades can happen. The time is always in the exchange's timezone.")

hours_to_trade_on2 = input("0930-1600", title="(2) Valid Trading Hours Between", inline="inline2", group="Trading Time Limiter")

limit_day3 = input.bool(false, title="", group="Trading Time Limiter", inline="day3")

days_to_trade_on3 = input.string("1234567", title="(3) Valid Trading Days", inline="day3", tooltip="Values represent days: \nSunday (1), Monday (2), ..., Friday (6), Saturday(7)\n\nScript will trade on days that are present in this field. Please make sure that this field and also (3) Valid Trading Hours Between is checked.", group="Trading Time Limiter")

valid_hours3 = input.bool(false, title="", inline="inline3", group="Trading Time Limiter", tooltip="Hours between which the trades can happen. The time is always in the exchange's timezone.")

hours_to_trade_on3 = input("0930-1600", title="(3) Valid Trading Hours Between", inline="inline3", group="Trading Time Limiter")

// PineConnector Automation

use_pc_automation = input.bool(false, title="Use PineConnector Automation | PLEASE READ TOOLTIP -->", group="PineConnector Automation", tooltip="NOTE! In order for the connection to MetaTrader to work, you will need do perform prerequisite steps, you can follow our full guide at our website, or refer to the official PineConnector Documentation.\n\nTo set up PineConnector Automation on the TradingView side, you will need to do the following:\n\n1. Fill out the License ID field with your PineConnector License ID;\n\n2. Fill out the Risk (trading volume) with the desired volume to be traded in each trade (the meaning of this value depends on the EA settings in Metatrader. Follow the detailed guide for additional information);\n\n3. After filling out the fields, you need to enable the 'Use PineConnector Automation' option (check the box in the strategy settings);\n\n4. Check if the chart has updated and you can see the appropriate order comments on your chart;\n\n5. Create an alert with the strategy selected as Condition, and the Message as {{strategy.order.comment}} (should be there by default);\n\n6. Enable the Webhook URL in the Notifications section, set it as the official PineConnector webhook address and enjoy your connection with MetaTrader.")

pc_licence_id = input.int(60123456789, title="License ID", group="PineConnector Automation")

pc_risk = input.float(1, title="Risk (trading volume)", group="PineConnector Automation")

pc_long_entry_alert = str.tostring(pc_licence_id) + ',buy,' + syminfo.ticker + ',risk='+ str.tostring(pc_risk) + ',comment="ATR GOD Strategy by TradeSmart"'

pc_short_entry_alert = str.tostring(pc_licence_id) + ',sell,' + syminfo.ticker + ',risk='+ str.tostring(pc_risk) + ',comment="ATR GOD Strategy by TradeSmart"'

pc_long_exit_alert = str.tostring(pc_licence_id) + ',closelong,' + syminfo.ticker + ',risk='+ str.tostring(pc_risk) + ',comment="ATR GOD Strategy by TradeSmart"'

pc_short_exit_alert = str.tostring(pc_licence_id) + ',closeshort,' + syminfo.ticker + ',risk='+ str.tostring(pc_risk) + ',comment="ATR GOD Strategy by TradeSmart"'

// LIMITERS

in_date() => true

check_valid_session() =>

s1 = limit_session1 ? session1 : na

s2 = limit_session2 ? session2 : na

s3 = limit_session3 ? session3 : na

s4 = limit_session4 ? session4 : na

use_session_limit ? na(s1) and na(s2) and na(s3) and na(s4) ? false : true : true

check_valid_time() =>

t = (limit_day1 == false and limit_day2 == false and limit_day3 == false) ? time(timeframe.period, '0000-0000:' + days_to_trade_on) : na

t7 = valid_hours1 and limit_day1 == false ? time(timeframe.period, hours_to_trade_on1 + ':' + days_to_trade_on) : na

t8 = valid_hours2 and limit_day2 == false ? time(timeframe.period, hours_to_trade_on2 + ':' + days_to_trade_on) : na

t9 = valid_hours3 and limit_day3 == false ? time(timeframe.period, hours_to_trade_on3 + ':' + days_to_trade_on) : na

t1 = valid_hours1 and limit_day1 ? time(timeframe.period, hours_to_trade_on1 + ':' + days_to_trade_on1) : na

t2 = valid_hours2 and limit_day2 ? time(timeframe.period, hours_to_trade_on2 + ':' + days_to_trade_on2) : na

t3 = valid_hours3 and limit_day3 ? time(timeframe.period, hours_to_trade_on3 + ':' + days_to_trade_on3) : na

na(t) and na(t1) and na(t2) and na(t3) and na(t7) and na(t8) and na(t9) ? false : true

check_filters_long() => check_volume_filter() and check_waddah_attar_long() and check_valid_session() and check_atr_lim_long() and check_trend_filter_long()

check_filters_short() => check_volume_filter() and check_waddah_attar_short() and check_valid_session() and check_atr_lim_short() and check_trend_filter_short()

checkLong() => check_entry_long() and check_filters_long()

checkShort() => check_entry_short() and check_filters_short()

should_long_limit_dates = limit_dates ? (in_date() and checkLong()) : checkLong()

should_short_limit_dates = limit_dates ? (in_date() and checkShort()) : checkShort()

should_long_limit_day_trades = limit_trading_time ? (check_valid_time() and checkLong()): checkLong()

should_short_limit_day_trades = limit_trading_time ? (check_valid_time() and checkShort()): checkShort()

long = should_long_limit_dates and should_long_limit_day_trades and allow_long

short = should_short_limit_dates and should_short_limit_day_trades and allow_short

// CALCULATE EXIT PRICES AND STOP LOSSES

long_exit_price = float(na)

long_stop_price = float(na)

short_exit_price = float(na)

short_stop_price = float(na)

long_exit_price := (long and strategy.position_size <= 0) ? b_atr_buy : long_exit_price[1]

long_stop_price := (long and strategy.position_size <= 0) ? b_atr_sell : long_stop_price[1]

short_exit_price := (short and strategy.position_size >= 0) ? s_atr_buy : short_exit_price[1]

short_stop_price := (short and strategy.position_size >= 0) ? s_atr_sell : short_stop_price[1]

plot(strategy.position_size > 0 and plot_sl_tp ? long_exit_price : na, color=color.green, style=plot.style_linebr, linewidth=2, title="Long Exit Price")

plot(strategy.position_size > 0 and plot_sl_tp ? long_stop_price : na, color=color.red, style=plot.style_linebr, linewidth=2, title="Long Stop Price")

plot(strategy.position_size < 0 and plot_sl_tp ? short_exit_price : na, color=color.purple, style=plot.style_linebr, linewidth=2, title="Short Exit Price")

plot(strategy.position_size < 0 and plot_sl_tp ? short_stop_price : na, color=color.aqua, style=plot.style_linebr, linewidth=2, title="Short Stop Price")

// QUANTITY CALCULATION

ourQty = switch order_size_type

"Capital Percentage" => (strategy.initial_capital + strategy.netprofit) * 0.01 * order_size_value / close

"Cash" => order_size_value / close

"Contract(s)" => order_size_value

=> 0

// TEST

// ENTER/EXIT ORDERS

checkForceExit(usage_trigger, exit_trigger, order_comment) =>

if strategy.position_size != 0 and usage_trigger

if exit_trigger

strategy.cancel_all()

if use_pc_automation

strategy.close_all(comment=strategy.position_size > 0 ? pc_long_exit_alert : pc_short_exit_alert)

else

strategy.close_all(comment=order_comment, immediately=true)

plotshape(plot_signals and strategy.position_size == 0 ? long : na, style=shape.labelup, location=location.belowbar, color=color.new(#046ff9, 0), size=size.large, text='Entry Signal \n Long/Buy', textcolor=color.new(color.white, 10))

plotshape(plot_signals and strategy.position_size == 0 ? short : na, style=shape.labeldown, location=location.abovebar, color=color.new(#046ff9, 0), size=size.large, text='Entry Signal \n Short/Sell', textcolor=color.new(color.white, 10))

valid_values = true

if (na(nnatr) and use_atr_based_sl) or (na(lowest_point_sl) and use_low_high_based_sl) or (na(highest_point_sl) and use_low_high_based_sl)

valid_values := false

if valid_values

if allow_long

if long and strategy.position_size == 0

strategy.order("Long Entry", direction=strategy.long, qty=ourQty, comment=use_pc_automation ? pc_long_entry_alert : na)

if strategy.position_size > 0

strategy.cancel("Long Entry")

strategy.order("Long Exit", direction=strategy.short, qty=strategy.position_size, limit=long_exit_price, oca_name="asd", comment=use_pc_automation ? pc_long_exit_alert : na)

strategy.order("Long Stop", direction=strategy.short, qty=strategy.position_size, stop=long_stop_price, oca_name="asd", comment=use_pc_automation ? pc_long_exit_alert : na)

if allow_short

if short and strategy.position_size == 0

strategy.order("Short Entry", direction=strategy.short, qty=ourQty, comment=use_pc_automation ? pc_short_entry_alert : na)

if strategy.position_size < 0

strategy.cancel("Short Entry")

strategy.order("Short Exit", direction=strategy.long, qty=-1*strategy.position_size, limit=short_exit_price, oca_name="asd", comment=use_pc_automation ? pc_short_exit_alert : na)

strategy.order("Short Stop", direction=strategy.long, qty=-1*strategy.position_size, stop=short_stop_price, oca_name="asd", comment=use_pc_automation ? pc_short_exit_alert : na)

checkForceExit(use_force_exit_exact_time_1, custom_session_1[1] and not custom_session_1, "Custom Session Force Exit 1")

checkForceExit(use_force_exit_exact_time_2, custom_session_2[1] and not custom_session_2, "Custom Session Force Exit 2")

checkForceExit(use_force_exit_exact_time_3, custom_session_3[1] and not custom_session_3, "Custom Session Force Exit 3")

checkForceExit(use_force_exit_exact_time_4, custom_session_4[1] and not custom_session_4, "Custom Session Force Exit 4")