Đây là chiến lược giao dịch theo đà toàn diện dựa trên nhiều chỉ báo giao cắt trung bình động và chỉ báo giá khối lượng. Chiến lược này tạo ra các tín hiệu giao dịch dựa trên sự kết hợp giữa đường trung bình động hàm mũ (EMA) nhanh và chậm, giá trung bình theo khối lượng (VWAP) và SuperTrend, đồng thời kết hợp các khung thời gian giao dịch trong ngày và các Điều kiện như phạm vi thay đổi giá được sử dụng để kiểm soát mục nhập. và thoát ra.

Nguyên tắc chiến lược

Chiến lược này sử dụng EMA 5 ngày và 13 ngày làm chỉ báo đánh giá xu hướng chính. Khi EMA nhanh cắt lên trên EMA chậm và giá đóng cửa cao hơn VWAP, tín hiệu mua sẽ được kích hoạt; khi EMA nhanh cắt xuống dưới EMA chậm và giá đóng cửa thấp hơn VWAP, tín hiệu mua được kích hoạt. Khi giá giảm, tín hiệu bán được kích hoạt. Đồng thời, chiến lược này cũng giới thiệu chỉ báo SuperTrend làm cơ sở để xác nhận xu hướng và dừng lỗ. Chiến lược này thiết lập các điều kiện vào lệnh khác nhau cho những ngày giao dịch khác nhau, bao gồm phạm vi thay đổi giá so với giá đóng cửa của ngày giao dịch trước đó, phạm vi dao động của giá cao nhất và thấp nhất trong ngày, v.v.

Lợi thế chiến lược

- Việc sử dụng phối hợp nhiều chỉ báo kỹ thuật giúp cải thiện độ tin cậy của các tín hiệu giao dịch

- Thiết lập các điều kiện nhập cảnh khác nhau cho các ngày giao dịch khác nhau để thích ứng tốt hơn với đặc điểm thị trường

- Áp dụng cơ chế dừng lỗ và dừng lãi động có thể kiểm soát rủi ro hiệu quả

- Kết hợp với các hạn chế của khung thời gian giao dịch trong ngày, rủi ro của các giai đoạn biến động cao sẽ được tránh khỏi

- Bằng cách hạn chế các điểm cao, thấp trước đó và phạm vi biến động giá, rủi ro theo đuổi mức giá cao và bán mức giá thấp sẽ được giảm thiểu.

Rủi ro chiến lược

- Tín hiệu sai có thể xuất hiện trong điều kiện thị trường biến động nhanh

- Có thể có độ trễ trong giai đoạn đầu của sự đảo ngược xu hướng

- Tối ưu hóa tham số có thể có nguy cơ quá khớp

- Chi phí giao dịch có thể ảnh hưởng đến lợi nhuận chiến lược

- Thị trường có thể phải đối mặt với sự sụt giảm lớn trong thời kỳ biến động cao

Hướng tối ưu hóa chiến lược

- Hãy cân nhắc việc giới thiệu các chỉ báo phân tích khối lượng để xác nhận thêm sức mạnh của xu hướng

- Tối ưu hóa cài đặt tham số cho các ngày giao dịch khác nhau để cải thiện khả năng thích ứng của chiến lược

- Thêm nhiều chỉ số tâm lý thị trường hơn để cải thiện độ chính xác của dự đoán

- Cải thiện cơ chế dừng lãi, dừng lỗ để nâng cao hiệu quả sử dụng vốn

- Hãy cân nhắc thêm các chỉ báo biến động để tối ưu hóa việc quản lý vị thế

Tóm tắt

Chiến lược này kết hợp theo dõi xu hướng và giao dịch theo đà thông qua việc sử dụng toàn diện nhiều chỉ báo kỹ thuật. Thiết kế chiến lược xem xét đầy đủ tính đa dạng của thị trường và áp dụng các quy tắc giao dịch khác nhau cho những ngày giao dịch khác nhau. Thông qua kiểm soát rủi ro chặt chẽ và cơ chế dừng lỗ, dừng lãi linh hoạt, chiến lược này chứng tỏ có giá trị ứng dụng thực tế tốt. Trong tương lai, tính ổn định và lợi nhuận của chiến lược có thể được cải thiện bằng cách đưa vào nhiều chỉ số kỹ thuật hơn và tối ưu hóa cài đặt tham số.

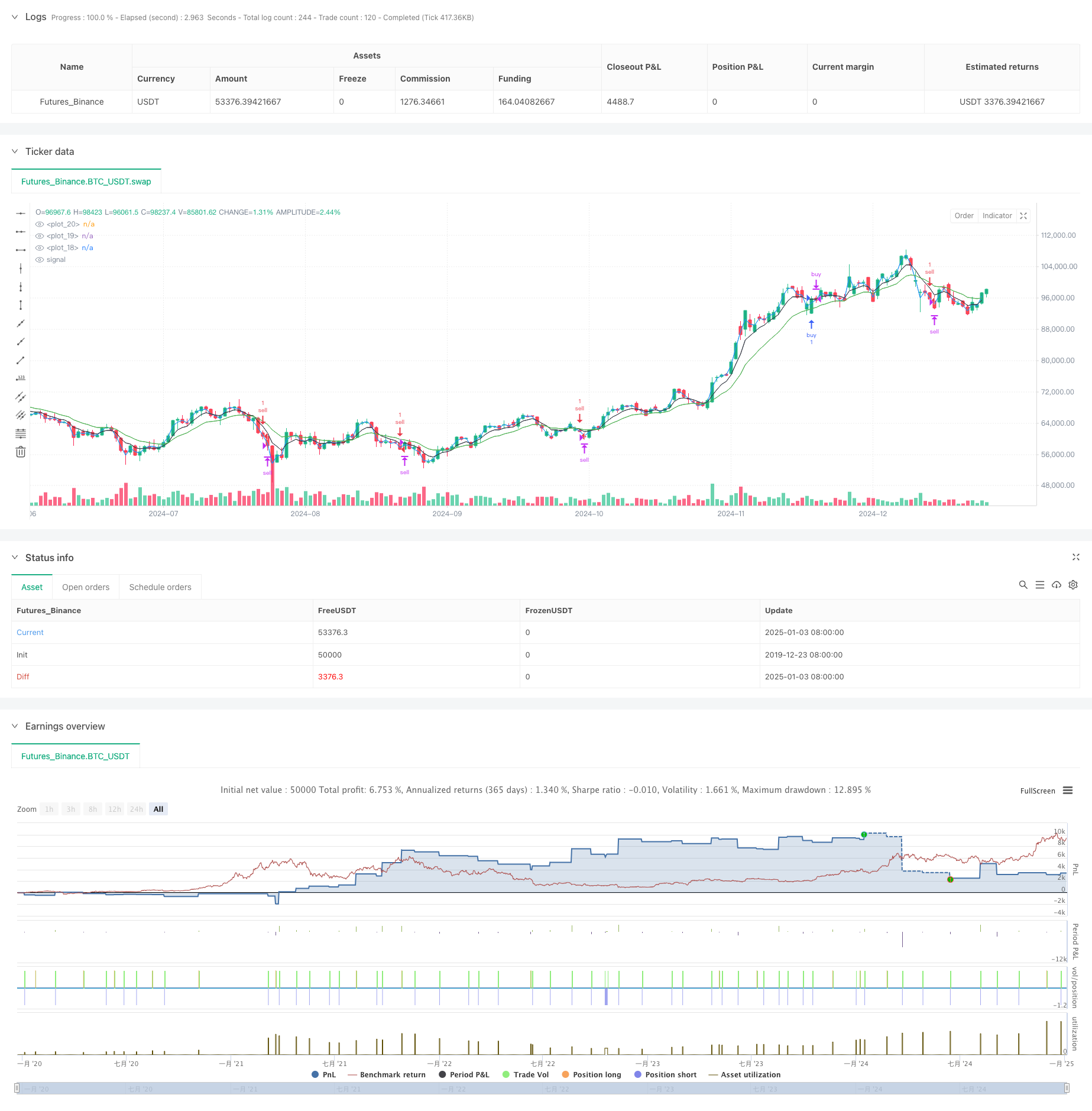

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=6

strategy("S1", overlay=true)

fastEMA = ta.ema(close, 5)

slowEMA = ta.ema(close,13)

ema9 = ta.ema(close, 9)

ema100 = ta.ema(close, 100)

ema5 = ta.ema(close, 5)

ema200 = ta.ema(close, 200)

ma = ta.sma(close, 50)

mult = input.float(defval=3)

len = input.int(defval=11)

[superTrend, dir] = ta.supertrend(mult, len)

vwap1= ta.vwap(hlc3)

plot(slowEMA,color = color.green)

plot(fastEMA,color = color.black)

plot(vwap1, color = color.blue)

var dailyTaskDone = false

var gapdown = false

var gapup = false

var runup = 0.0

var biggapdown = false

var biggapup = false

var prevDayClose = 0.0

var todayLow = 0.0

var todayHigh = 0.0

var noBuyNow = false

var noSellNow = false

var buyPrice = 0.0

var sellPrice = 0.0

var todayBuyDone = false

var todaySellDone = false

var dragonflyDoji = false

var candleCount = 0

var candleCount1 = 0

var lastTrade = 9

var lastFiveCandles = false

var lastSevenCandlesS = false

var fiveEMACC = 0

candleCount := candleCount + 1

candleCount1 := candleCount1 + 1

if fiveEMACC > 0

fiveEMACC := fiveEMACC + 1

if fiveEMACC == 6

fiveEMACC := 0

if strategy.openprofit == 0

candleCount := 0

if hour == 9 and minute ==15

prevDayClose := close[1]

todayLow := low

todayHigh := high

lastTrade := 9

if hour == 9 and minute ==15 and (open - close[1]) > close*0.01

gapup := true

if hour == 9 and minute ==15 and (open - close[1]) < close*0.005*-1

gapdown := true

if hour == 9 and minute ==15 and (close - close[1]) > 200

biggapup := true

if hour == 9 and minute ==15 and (close - close[1]) < 200

biggapdown := true

if low < todayLow

todayLow := low

candleCount1 := 0

if high > todayHigh

todayHigh := high

if close > todayLow + 200

noBuyNow := true

if close < todayHigh - 200//0.01*close

noSellNow := false

lastFiveCandles := (close[4]<open[4] or close[3]<open[3] or close[2] < open[2] or close[1]<open[1])

lastSevenCandlesS := (close[6]>open[6] or close[5]>open[5] or close[4]>open[4] or close[3]>open[3] or close[2] > open[2] or close[1]>open[1])

if hour == 15

dailyTaskDone := false

gapdown := false

gapup := false

biggapup := false

biggapdown := false

noBuyNow := false

noSellNow := false

todayLow := 0.0

todayHigh := 0.0

buyPrice := 0.0

sellPrice := 0.0

todayBuyDone := false

todaySellDone := false

dragonflyDoji := false

lastTrade := 9

// if fastEMA < slowEMA and lastTrade == 1 and strategy.openprofit==0

// lastTrade := 9

if fastEMA > slowEMA and lastTrade == 0 and strategy.openprofit==0

lastTrade := 9

buy = (dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

(dayofweek==dayofweek.friday and ((fastEMA - slowEMA > close*0.001))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

(dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

(dayofweek==dayofweek.friday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

// buy = (dayofweek==dayofweek.thursday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1]) or

// (dayofweek==dayofweek.monday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

// (dayofweek==dayofweek.tuesday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.wednesday and (fastEMA > slowEMA) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.friday and ((fastEMA > slowEMA))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

// sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA > fastEMA)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

// (dayofweek==dayofweek.monday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

// (dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

// (dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

// (dayofweek==dayofweek.friday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

dragonflyDoji:= false

// (slowEMA - fastEMA > close*0.00089 or (slowEMA-fastEMA>close*0.00049 and (high[2]>vwap or high[1]>vwap)))

if sellPrice != 0 and runup < sellPrice - low

runup := sellPrice - low

if buyPrice != 0 and runup < high - buyPrice

//ourlabel = label.new(x=bar_index, y=na, text=tostring(runup), yloc=yloc.belowbar)

runup := high - buyPrice

NoBuySellTime = (hour == 15) or ((hour==14 and minute>=25)) or (hour==9 and minute<=35) or hour >= 14

//(fiveEMACC > 0 and low < fastEMA and close < vwap1)

buyexit = fastEMA<slowEMA or (close<superTrend and close < vwap1 and close[1] < vwap1[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

sellexit = slowEMA<fastEMA or (close > vwap1 and close[1] > vwap1[1] and close>superTrend) //or strategy.openprofit > 400 or strategy.openprofit < -5000

exitPosition = (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > 50) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > 80) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek==dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30)

//code such that 2 fastema is > than 2 slowema

//exitPosition = (sellPrice!=0 and runup >21 and strategy.openprofit < -2000) or (candleCount > 18 and strategy.openprofit > 50 and strategy.openprofit < 1000) or (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.007) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.007) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.002) or (dayofweek!=dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.002)

//(runup >21 and strategy.openprofit < -2000) or

if buy and fastEMA>vwap1 and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

strategy.entry("buy", strategy.long)

//dailyTaskDone := true

if buyPrice == 0.0

fiveEMACC := 1

buyPrice := close

//ourlabel = label.new(x=bar_index, y=na, text=tostring(todayLow + 500), yloc=yloc.belowbar9

todayBuyDone := true

lastTrade := 1

runup := 0.0

if sell and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone // and dayofweek!=dayofweek.friday //and (dayofweek==dayofweek.friday or (prevDayClose-close)<150)//and not biggapdown

strategy.entry("sell", strategy.short)

//dailyTaskDone := true

if sellPrice == 0.0

fiveEMACC := 1

sellPrice := close

todaySellDone := true

lastTrade := 0

runup := 0.0

// if ((fastEMA-slowEMA>18 and close>vwap and close[1]>vwap[1] and (not todayBuyDone or candleCount>12)) or (slowEMA-fastEMA>10 and close < vwap and close[1]<vwap[1] and (not todaySellDone or candleCount > 12))) and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(abs(prevDayClose-close)), yloc=yloc.belowbar)

IntraDay_SquareOff = minute >=15 and hour >= 15

if true and (IntraDay_SquareOff or exitPosition)

strategy.close("buy")

strategy.close("sell")

buyPrice := 0

sellPrice := 0

runup := 0.0

if buyexit

strategy.close("buy")

buyPrice := 0

if sellexit

strategy.close("sell")

sellPrice := 0

buy1 = ((dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and not gapup) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.0085) or

(dayofweek==dayofweek.friday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close - todayLow < close*0.012))

and dayofweek!=dayofweek.friday and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

sell1= ((dayofweek==dayofweek.thursday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.01 and todayHigh-close[1] < close * 0.01) or

(dayofweek==dayofweek.tuesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not gapdown and not dragonflyDoji and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close) or

(dayofweek==dayofweek.friday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close)) and

dayofweek!=dayofweek.friday and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone

// if buy1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(fastEMA - slowEMA), yloc=yloc.belowbar)

// if sell1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(slowEMA - fastEMA), yloc=yloc.belowbar)

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 20)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 10) or ((fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]) and (slowEMA - fastEMA) > 20)

// buy = (fastEMA > slowEMA and fastEMA[1] < slowEMA[1])

// sell= (fastEMA < slowEMA and fastEMA[1] > slowEMA[1] )

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 1)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 5)

// buy = fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]

// sell= fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]

//Daily chart

// buyexit = (close + 40 < slowEMA)//rsi > 65 and fastEMA > ema9 // fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close - 40 > slowEMA)//rsi < 35 // and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend)// and (close < vwap1 and close[1] < vwap1[1] and close < close[1])//and close[2] < vwap1[2]//rsi > 65 and close < fastEMA// fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close > superTrend)// and (close > vwap1 and close[1] > vwap1[1] and close > close[1]) //and close[2] > vwap1[2]//rsi < 35// and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend and close < vwap1 and close[1] < vwap1[1] and close[1] < superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

// sellexit = (close > superTrend and close > vwap1 and close[1] > vwap1[1] and close[1] > superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000