标定值

高点> btc 10000 || MA(10)MA(30)则买入;

Stoploss为8 , 8%止损点.

周期按日线.回测数据还可以;低于日线周期回测数据不好.

本策略是用的趋势指标.

*取10000和6725的理由是根据江恩的思路.

策略源码

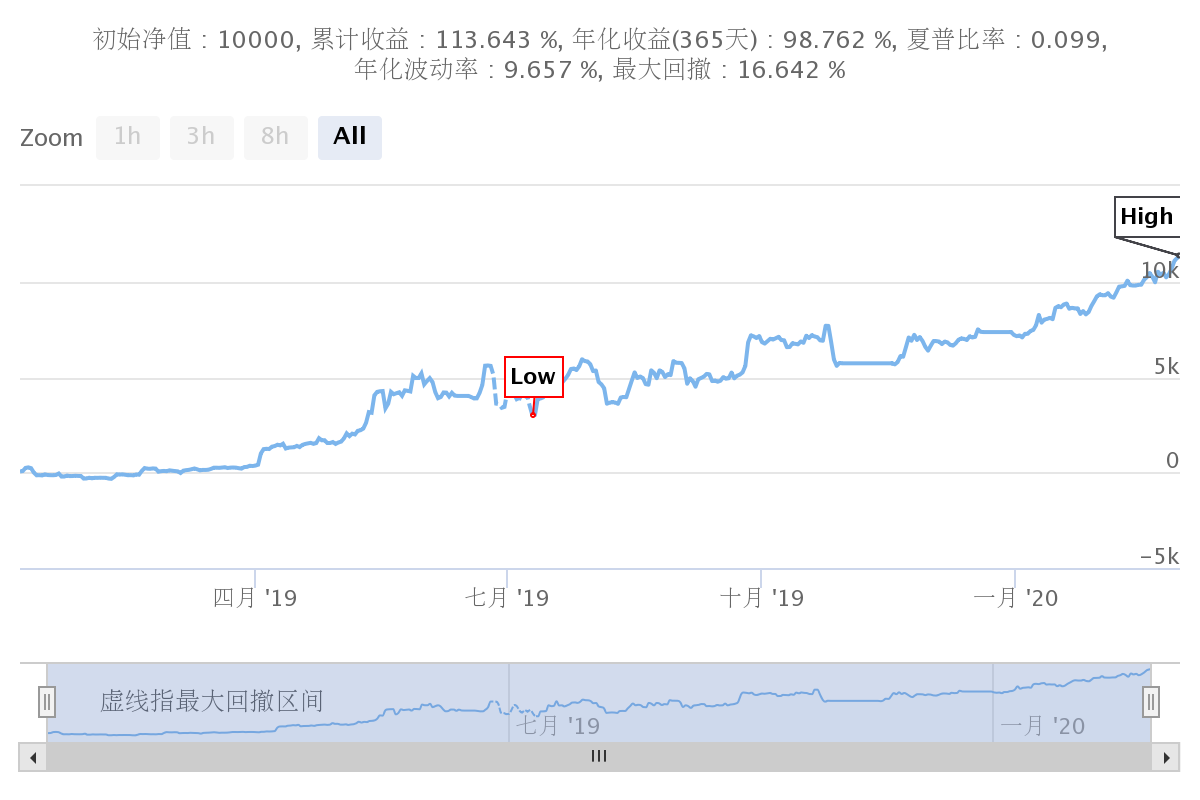

(*backtest

start: 2019-01-05 00:00:00

end: 2020-02-29 00:00:00

period: 1d

exchanges: [{"eid":"Huobi","currency":"BTC_USDT"}]

*)

//

MA10:=MA(C,10);

MA30:=MA(C,30);

买入开仓价:=VALUEWHEN(BARSBK=1,O);

卖出开仓价:=VALUEWHEN(BARSSK=1,O);

//开仓条件

BUYCONDITION:=REF(C,1) < MMD OR CROSSUP(MA10,MA30);

SELLCONDITION:=REF(C,1) > HGH OR CROSSDOWN(MA10,MA30);

BKVOL=0 AND BUYCONDITION,BK;

SKVOL=0 AND SELLCONDITION,SK;

//离场条件

BKVOL>0 AND SELLCONDITION,SP;

SKVOL>0 AND BUYCONDITION,BP;

// 启动止损

SKVOL>0 AND HIGH>=卖出开仓价*(1+STOPLOSS*0.01),BP;

BKVOL>0 AND LOW<=买入开仓价*(1-STOPLOSS*0.01),SP;

AUTOFILTER;

全部留言

cyberking

回测日志 - 进度: 100.0 % - 耗时(秒): 4.339 秒 - 日志总数: 46 - 交易次数: 21 - 已完成 (Tick 683.42 KB) 0.0000

账户信息

名称 定价货币 交易品种 手续费 预估收益

Huobi USDT BTC USDT: 389.673 11364.345 /upload/asset/149338fe3f9011badc20c.png /upload/asset/14947231d56707e5f7e8c.png

2020-03-02 00:09:35