概述

本策略运用双EMA均线的金叉死叉来判断入场和出场时机。具体来说,当快EMA线从下方向上突破慢EMA线时产生金叉信号,做多;当快EMA线从上方向下跌破慢EMA线时产生死叉信号,做空。该策略简单易行,是一种非常常见的交易策略。

策略原理

该策略的核心代码如下:

fast = input(25, title="Fast")

slow = input(75, title="Slow")

matype1=ema(source, fast)

matype2=ema(source, slow)

longCondition = crossover(matype1, matype2)

shortCondition = crossunder(matype1, matype2)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

该策略首先设置快慢两个EMA均线,其中快EMA线周期为25,慢EMA线周期为75。然后计算两条EMA线的值。当快EMA线从下方向上突破慢EMA线时,产生longCondition条件为真;当快EMA从上方向下跌破慢EMA时,产生shortCondition条件为真。满足相应条件时,做多或做空。

该策略利用了EMA均线的平滑特点,可以有效过滤市场Noise,同时又能快速捕捉趋势的变化。两条EMA均线间的金叉死叉交叉为一个较强的交易信号,可以有效控制交易风险。

优势分析

该策略有以下几点优势:

操作思路简单直观,容易理解实现。

利用EMA平滑市场波动,有效过滤False Signal。

金叉死叉是较强的交易信号,可以有效控制风险。

可灵活调整EMA周期,适用于不同市场环境。

容易与其他技术指标组合使用。

可通过优化EMA参数来获得更好的策略效果。

风险分析

该策略也存在一些风险:

在震荡行情中,EMA交叉频繁,会产生大量无效交易信号。

EMA具有滞后性,可能错过短线机会。

仅靠EMA交叉无法确定趋势转折点,存在一定盈利上限。

固定的EMA周期不能适应市场的变化。

需要较强的资金支持,否则衍生风险大。

需要严格的止损约束,否则单笔损失可能很大。

优化方向

该策略可以从以下几个方面进行优化:

优化EMA周期参数,适应不同市场情况。

增加其他指标过滤,如MACD、布林带等,提高信号质量。

增加趋势判断指标,如ATR止损、ADX等,减少无效交易。

结合更多时间周期分析,判断趋势方向。

利用机器学习方法动态优化EMA周期。

优化仓位管理,以控制风险。

优化止损策略,降低单笔损失。

总结

本策略运用双EMA均线的金叉死叉交叉作为交易信号,形成一个较为经典的趋势跟随策略。该策略简单易行,容易与其他技术指标组合,适用于对趋势判断要求不高的投资者。但也存在一定的盈利上限和风险,需要进行适当优化以适应不同市场环境。总体来说,该策略提供了一个非常好的策略开发基础,可供投资者进行深入研究。

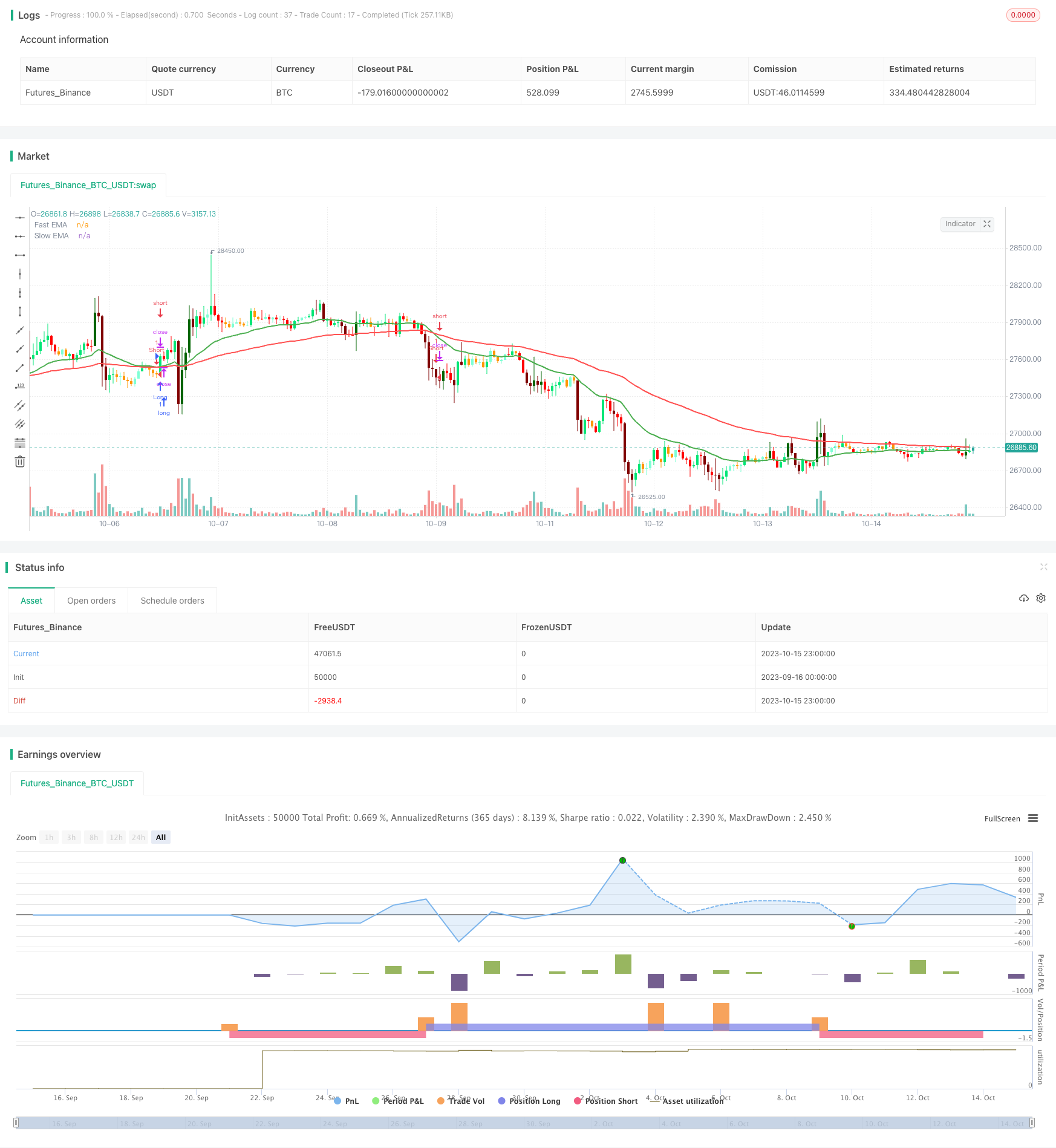

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Double EMA CROSS By © EmreE (Emre Ertürk) Also thx for KivancOzbilgic color based bars

//@version=4

strategy(title="Double EMA CROSS", shorttitle="DEC", overlay=true)

matype = input("ema")

hidema = input(false)

sourcetype = input(close, title="Source Type")

source=close

// STEP 1:

// Configure backtest start date with inputs

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=231)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2020, minval=1800, maxval=2100)

// STEP 2:

// See if this bar's time happened on/after start date

afterStartDate = (time >= timestamp(syminfo.timezone,

startYear, startMonth, startDate, 0, 0))

fast = input(25, title="Fast")

slow = input(75, title="Slow")

matype1=ema(source, fast)

matype2=ema(source, slow)

signalcolor = source > matype2 ? color.blue : color.red

signal = cross(fast, slow)

hizliema=plot(hidema ? na : matype1, color=color.green, linewidth=2,transp=0, title="Fast EMA")

yavasema=plot(hidema ? na : matype2, color=color.red, linewidth=2,transp=0, title="Slow EMA")

//kesisme=plot(signal, style=cross, color=signalcolor, linewidth=5, title="Kesişme")

longCondition = crossover(matype1, matype2)

if (afterStartDate and longCondition)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(matype1, matype2)

if (afterStartDate and shortCondition)

strategy.entry("Short", strategy.short)

//--------------------------------------------------------

//volume based color bars

length=input(21, "length", minval=1)

avrg=sma(volume,length)

vold1 = volume > avrg*1.5 and close<open

vold2 = volume >= avrg*0.5 and volume<=avrg*1.5 and close<open

vold3 = volume < avrg *0.5 and close<open

volu1 = volume > avrg*1.5 and close>open

volu2 = volume >= avrg*0.5 and volume<=avrg*1.5 and close>open

volu3 = volume< avrg*0.5 and close>open

cold1=#800000

cold2=#FF0000

cold3=color.orange

colu1=#006400

colu2=color.lime

colu3=#7FFFD4

ac = vold1 ? cold1 : vold2 ? cold2 : vold3 ? cold3 : volu1 ? colu1 : volu2 ? colu2 : volu3 ? colu3 : na

barcolor(ac)