概述

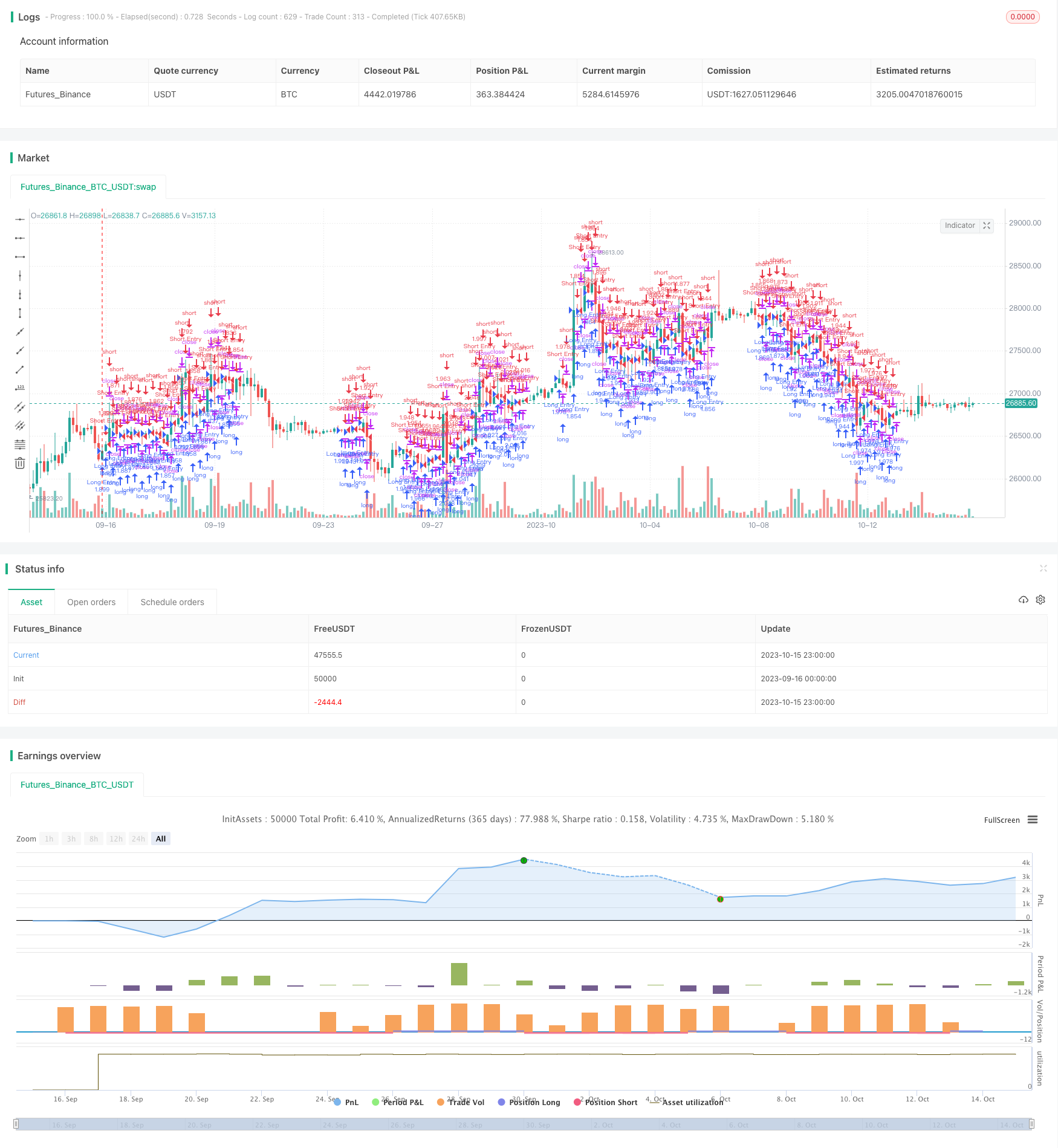

该策略是一个利用MACD指标识别多空方向的趋势跟踪策略。它通过计算快速移动平均线和慢速移动平均线的差值,生成MACD主线。策略使用MACD主线和信号线的黄金交叉来产生买入信号,死叉来产生卖出信号,实现多空平衡跟踪。

策略原理

代码首先设置了回测的起止时间,用于测试策略的历史表现。

然后是MACD指标的计算,包括快速移动平均线、慢速移动平均线和MACD均线的长度设置。快速线反应更敏感,慢速线反应更稳定。它们的差值形成MACD主线,再通过均线形成MACD信号线。当差值上穿零轴时产生多头信号,下穿零轴时产生空头信号。

根据多头和空头信号,记录最后一次产生信号的时间。当快线和慢线发生正交时就确认并记录买入/卖出信号,这时就可以开仓了。

进场后,持续跟踪持仓的最高价和最低价。设定一个止损百分比,当亏损达到该百分比时止损退出。

策略优势

MACD指标能有效识别趋势,属于技术分析的经典指标之一。

快慢平均线的差值设计,可以提早捕捉到价格变化的动量和方向。

利用均线的滤波作用,可以过滤掉部分假信号。

策略加入了止损机制来控制风险。

策略风险

MACD指标容易产生假信号,指标本身可优化空间有限。

止损点设置不当可能过于活跃或保守,需要针对不同品种单独优化。

固定数量头寸容易使杠杆过高,可以考虑根据资金规模设定风险敞口。

回测时间窗口选择合理性需要验证,避免过拟合。

策略优化

优化快慢均线参数组合,找到最佳参数对不同品种进行拟合。

增加其他指标过滤,如K线形态、布林带、RSI等来验证信号。

可以根据回撤、夏普比率等指标评估不同止损点的效果。

优化止损策略,如移动止损、挂单止损等方式。

尝试根据资金变化、波动率等设定动态仓位。

总结

MACD多空平衡策略是一个基于经典技术指标的趋势跟踪策略。它具有对价格变化动量的敏感捕捉能力,可以通过参数优化很好地适应不同品种。结合更多滤波指标、止损方式以及动态仓位管理,可以继续提升策略的稳定性和盈利能力。

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("MACD BF", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.0)

/////////////// Component Code Start ///////////////

testStartYear = input(2017, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay, 0, 0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay, 0, 0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////// MACD Component - Default settings for one day. ///////////////

fastLength = input(12) // 72 for 4hr

slowlength = input(26) // 156 for 4 hr

MACDLength = input(12) // 12 for 4hr

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

long = crossover(delta, 0)

short = crossunder(delta, 0)

last_long = long ? time : nz(last_long[1])

last_short = short ? time : nz(last_short[1])

long_signal = crossover(last_long, last_short)

short_signal = crossover(last_short, last_long)

last_open_long_signal = long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal = short_signal ? open : nz(last_open_short_signal[1])

last_long_signal = long_signal ? time : nz(last_long_signal[1])

last_short_signal = short_signal ? time : nz(last_short_signal[1])

in_long_signal = last_long_signal > last_short_signal

in_short_signal = last_short_signal > last_long_signal

last_high = not in_long_signal ? na : in_long_signal and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low = not in_short_signal ? na : in_short_signal and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

sl_inp = input(5.0, title='Stop Loss %', type=float)/100

/////////////// Strategy Component ///////////////

// Strategy Entry

if testPeriod()

strategy.entry("Long Entry", strategy.long, when=long_signal)

strategy.entry("Short Entry", strategy.short, when=short_signal)

since_longEntry = barssince(last_open_long_signal != last_open_long_signal[1]) // LONG SL

since_shortEntry = barssince(last_open_short_signal != last_open_short_signal[1]) // SHORT SL

slLong = in_long_signal ? strategy.position_avg_price * (1 - sl_inp) : na

slShort = strategy.position_avg_price * (1 + sl_inp)

long_sl = in_long_signal ? slLong : na

short_sl = in_short_signal ? slShort : na

// Strategy SL Exit

if testPeriod()

strategy.exit("Long SL", "Long Entry", stop=long_sl, when=since_longEntry > 1)

strategy.exit("Short SL", "Short Entry", stop=short_sl, when=since_shortEntry > 1)

//plot(strategy.equity, title="equity", color=blue, linewidth=2, style=areabr)