概述

该策略运用双指数移动平均线(EMA)和移动平均线叉点(MACD)的组合指标,发掘短期价值高估股票并进行短线做空,以在股价下跌过程中获利。策略充分利用EMA快速反应价格变化的特点,结合MACD监控动量风向的优势,在牛熊转换点捕捉短期获利机会。

策略原理

计算8日EMA和26日EMA,当8日EMA上穿26日EMA时,视为买入信号。

计算12日EMA、26日EMA和差值DEA的9日EMA构成MACD,当MACD上穿DEA时,视为买入信号。

买入条件:8日EMA>26日EMA 且 MACD上穿DEA,满足时做多。

出场条件:设定浮盈止损为入场价的3%,追踪止损为入场价的1%,满足任一条件时平仓。

该策略同时利用EMA快速响应价格和MACD判断动量方向的特点,在牛转熊的关键点判断操作方向。快速EMA反映较慢EMA对短期内在价值的修正,MACD反映交易力度变化对均线方向的预判,双重指标提高确定交易时点的准确性。

优势分析

EMA和MACD组合提高买卖点确定准确率。EMA捕捉价格变动趋势,MACD判断动量变化方向,两者结合识别短期 extremum,避免假突破带来亏损。

追踪止损控制风险,及时止损出场。入场后设置1%的追踪止损,避免亏损扩大。

回测数据充分。策略在2022年整个熊市中回测,模拟了实际交易环境。

灵活参数调整。止损比例、仓位比例都可自定义,可匹配个人风险偏好。

风险分析

交易频繁,需密切跟踪。使用5分钟周期,出入场频繁,需要足够时间跟进交易。

追踪止损可能过于密集出场。追踪止损幅度设置过小,可能过早止损出场。

市场处于震荡趋势时效果不佳。EMA和MACD更适合用于较明显的趋势市场。

需考虑交易成本。每次交易对应手续费,频繁交易会导致成本增大。

优化方向

调整EMA周期参数,优化买卖时机。可测试缩短快EMA周期,扩大EMA间差异,找出最佳参数组合。

优化止损比例,降低止损过早风险。适当放宽追踪止损幅度,避免追踪止损过于激进。

测试不同持仓时间,选取最优持仓周期。评估不同持仓时间下策略收益,找出最佳持仓周期。

评估增加其他技术指标过滤信号。可测试加入波动率指标等,提高交易决策效果。

总结

该双EMA均线和MACD指标交易策略,旨在捕捉股价短期回落机会进行短线做空获利。它充分利用EMA快速响应和MACD判断力度变化的优势,在双重验证下提高交易时点准确性。策略优化空间在于调整参数、滑点控制、持仓时间等方面,谨慎参数优化后可获得较好收益。

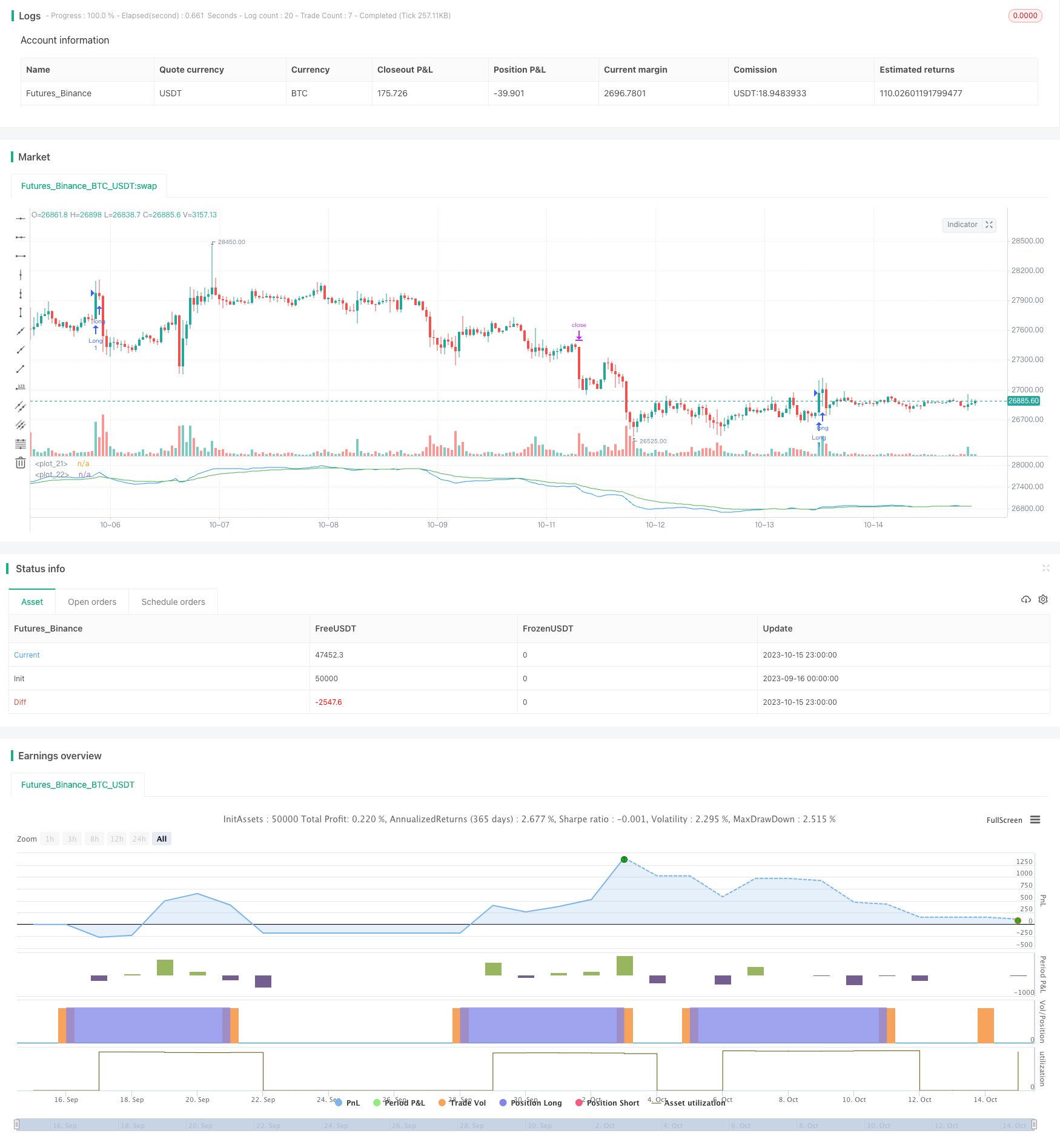

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=5

// strategy('Fast EMA above Slow EMA with MACD (by Coinrule)',

// overlay=true,

// initial_capital=1000,

// process_orders_on_close=true,

// default_qty_type=strategy.percent_of_equity,

// default_qty_value=30,

// commission_type=strategy.commission.percent,

// commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 1, 1, 0, 0)

notInTrade = strategy.position_size <= 0

// EMAs

fastEMA = ta.ema(close, 8)

slowEMA = ta.ema(close, 26)

plot(fastEMA, color = color.blue)

plot(slowEMA, color = color.green)

//buyCondition1 = ta.crossover(fastEMA, slowEMA)

buyCondition1 = fastEMA > slowEMA

// DMI and MACD inputs and calculations

[macd, macd_signal, macd_histogram] = ta.macd(close, 12, 26, 9)

buyCondition2 = ta.crossover(macd, macd_signal)

// Configure trail stop level with input options

longTrailPerc = input.float(title='Trail Long Loss (%)', minval=0.0, step=0.1, defval=3) * 0.01

shortTrailPerc = input.float(title='Trail Short Loss (%)', minval=0.0, step=0.1, defval=1) * 0.01

// Determine trail stop loss prices

longStopPrice = 0.0

shortStopPrice = 0.0

longStopPrice := if strategy.position_size > 0

stopValue = close * (1 - longTrailPerc)

math.max(stopValue, longStopPrice[1])

else

0

shortStopPrice := if strategy.position_size < 0

stopValue = close * (1 + shortTrailPerc)

math.min(stopValue, shortStopPrice[1])

else

999999

if (buyCondition1 and buyCondition2 and notInTrade and timePeriod)

strategy.entry(id="Long", direction = strategy.long)

strategy.exit(id="Exit", stop = longStopPrice, limit = shortStopPrice)

//if (sellCondition1 and sellCondition2 and notInTrade and timePeriod)

//strategy.close(id="Close", when = sellCondition1 or sellCondition2)