概述

RSI上升的加密趋势策略是一种适用于较长时间周期(如4小时或更长)的加密货币和股票市场趋势策略。

该策略利用RSI指标识别趋势的上升和下降,结合布林带和变化率指标避免交易盘整行情。根据测试,这种策略在加密货币对加密货币的交易中表现较好,而不是与法定货币交易。

策略原理

该策略使用以下指标:

- RSI - 识别趋势的上升和下降

- 布林带 - 识别盘整行情

- 变化率 - 识别趋势的方向

具体的交易规则如下:

开仓规则

多头开仓:RSI值上升且布林带和变化率指标表明不在盘整,做多 空头开仓:RSI值下降且布林带和变化率指标表明不在盘整,做空

平仓规则

收到反向信号时平仓

优势分析

- 利用RSI指标识别趋势方向,能及时捕捉趋势的转折点

- 结合布林带识别盘整,避免错过趋势或被套牢

- 变化率指标辅助确认趋势方向,使交易信号更可靠

- 适合较长周期交易,有利于获利

- 更适合加密货币对加密货币交易,避免法定货币汇率风险

风险分析

- 该策略没有止损规则,存在较大风险

- 布林带和变化率参数设置不当可能导致错过机会或错误信号

- 单纯依赖技术指标,无法应对重大黑天鹅事件

需要注意加大止损幅度,调整布林带和变化率参数组合,并结合基本面分析。

优化方向

该策略可以从以下几个方面进一步优化:

增加止损机制,设置合理的止损幅度,控制单笔损失。

优化布林带和变化率指标的参数,找到最佳参数组合。可以通过回测优化。

添加其他辅助指标,如MACD、KD等,实现多指标组合,提高信号准确率。

开发断流动模型,在异常波动时暂停交易,避免被套。

利用机器学习方法自动优化参数组合和信号权重。

结合链上数据,关注交易所流动性、资金流向等参数,提高策略的适应性。

总结

RSI上升的加密趋势策略利用RSI指标辅以布林带和变化率指标,实现了较长时间周期内捕捉加密货币市场趋势的效果。该策略优势在于及时捕捉趋势转折,避免被套,适合追踪较长线的方向性机会。但该策略也存在无止损、参数过度依赖等问题。未来可通过止损、参数优化、多指标组合、机器学习等方法进行改进,使策略更稳健可靠。

策略源码

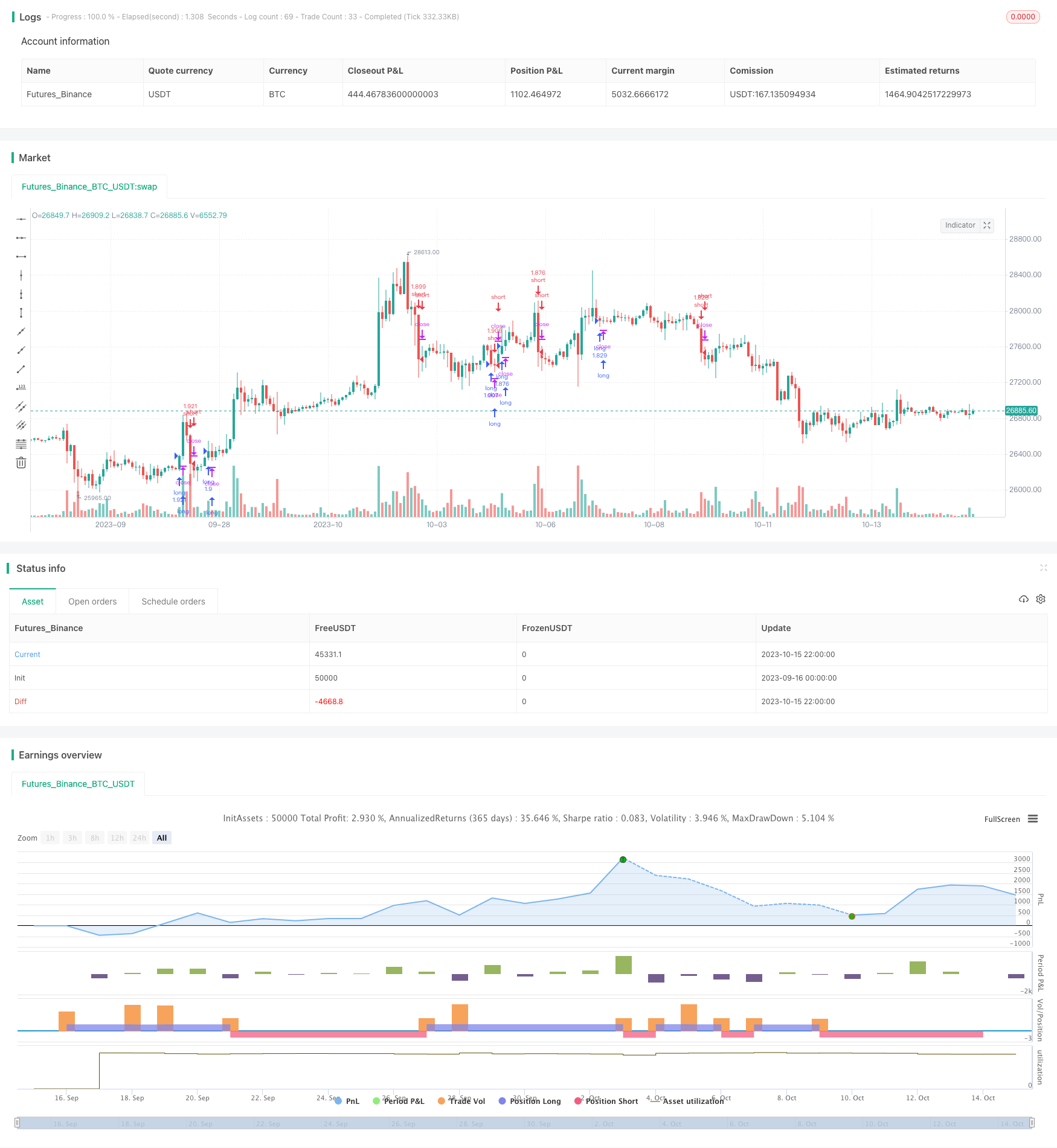

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title = "RSI Rising", overlay = true, initial_capital = 100, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

/////////////////////

source = close

bb_length = 20

bb_mult = 1.0

basis = sma(source, bb_length)

dev = bb_mult * stdev(source, bb_length)

upperx = basis + dev

lowerx = basis - dev

bbr = (source - lowerx)/(upperx - lowerx)

bbr_len = 21

bbr_std = stdev(bbr, bbr_len)

bbr_std_thresh = 0.1

is_sideways = (bbr > 0.0 and bbr < 1.0) and bbr_std <= bbr_std_thresh

////////////////

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2010, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2021, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

sourcex = close

length = 2

pcntChange = 1

roc = 100 * (sourcex - sourcex[length])/sourcex[length]

emaroc = ema(roc, length/2)

isMoving() => emaroc > (pcntChange / 2) or emaroc < (0 - (pcntChange / 2))

periods = input(19)

smooth = input(14, title="RSI Length" )

src = input(low, title="Source" )

rsiClose = rsi(ema(src, periods), smooth)

long=rising(rsiClose,2) and not is_sideways and isMoving()

short=not rising(rsiClose,2) and not is_sideways and isMoving()

if(time_cond)

strategy.entry('long',1,when=long)

strategy.entry('short',0,when=short)