概述

本策略通过结合均线指标、超买超卖指标以及波动率指标,在超跌反弹的情况下进行逢低买入,在超买回落的情况下进行逢高卖出,实现趋势跟踪。

策略原理

当RSI和Stoch指标同时处于超卖区域,而AO震荡器出现反转信号时建立仓位。具体来说,当RSI和Stoch均处于低位(低于30和20),而AO从负转正时做多;当RSI和Stoch均处于高位(高于70和80),而AO从正转负时做空。止损和止盈根据ATR指标的数值设定,使其能够根据市场波动调整止损止盈位置。

本策略主要使用了四个指标:

- AO震荡器:反映价格变动的动量,可用于判断趋势反转。

- RSI相对强弱指标:反映超买超卖情况。低于30为超卖区域。

- StochStochastic:反映超买超卖区域。低于20为超卖区域。

- ATR平均真实波幅:反映近期价格波动幅度。

当AO出现反转信号,并且RSI和Stoch同时处于超卖区域时,说明价格可能出现反转,这时可以介入建立仓位。ATR指标则用于设定止损止盈价格,根据市场波动性调整止损止盈幅度,避免被套。

策略优势

- 使用多个指标确认信号,避免因单一指标造成的错误交易。

- 根据市场波动性设定止损止盈幅度,可以有效控制单笔损失。

- 策略交易逻辑简单清晰,容易理解实现。

- 利用超买超卖情况介入,可以及时捕捉反转机会。

风险及解决

- AO指标容易产生假信号,需要与RSI和Stoch指标组合使用,避免错误交易。

- 固定的参数设置可能无法适应市场的变化,需要优化参数。

- 停损点过于接近,可能会被频繁止损。可以适当放宽止损范围,或使用离场策略。

- 固定的止盈点,可能会过早离场或inlineCallbacks。可以使用移动止盈或分批离场。

为减小这些风险,可以从以下几个方面进行优化:

- 优化参数,使其更能适应不同周期及品种的市场。

- 改进止损机制,例如移动止损、离场分批等。

- 优化入场条件,避免因为单指标造成错误信号。

- 优化止盈方式,例如移动止盈或根据趋势分段止盈。

策略优化方向

本策略可以从以下几个方面进行优化:

优化参数设置。可以通过遍历寻优等方法找到更优参数组合。

增加过滤条件。可以在入场时增加额外指标的确认,避免假信号。

优化止损机制。可以使用移动止损、离场分批等方式,控制风险。

优化止盈方式。可以使用移动止盈、根据趋势分段止盈等方式,锁定更多利润。

增加自动止盈。例如接近重要整数关口时止盈,避免冲高回落。

优化资金管理。例如根据风险变化调整仓位大小,控制最大损失。

针对特定品种/周期进行测试优化。参数及止损止盈方式应针对不同品种及周期进行优化。

增加对突发事件的处理。例如important news时避开交易,或快速止损。

总结

本策略综合运用了均线系统、超买超卖系统及波动率系统,在价值低估时逢低买入,价值高估时逢高卖出,具有较强的趋势跟踪能力。但也存在一些参数设置固定、止损机制不完善等问题。我们可以从优化参数设置、完善止损机制、增加滤波条件等方面进行多角度的优化,使策略更稳健可靠。在实盘运用时,也需要结合回测结果针对具体品种和周期进行测试优化,才能发挥策略最大效用,获得稳定收益。

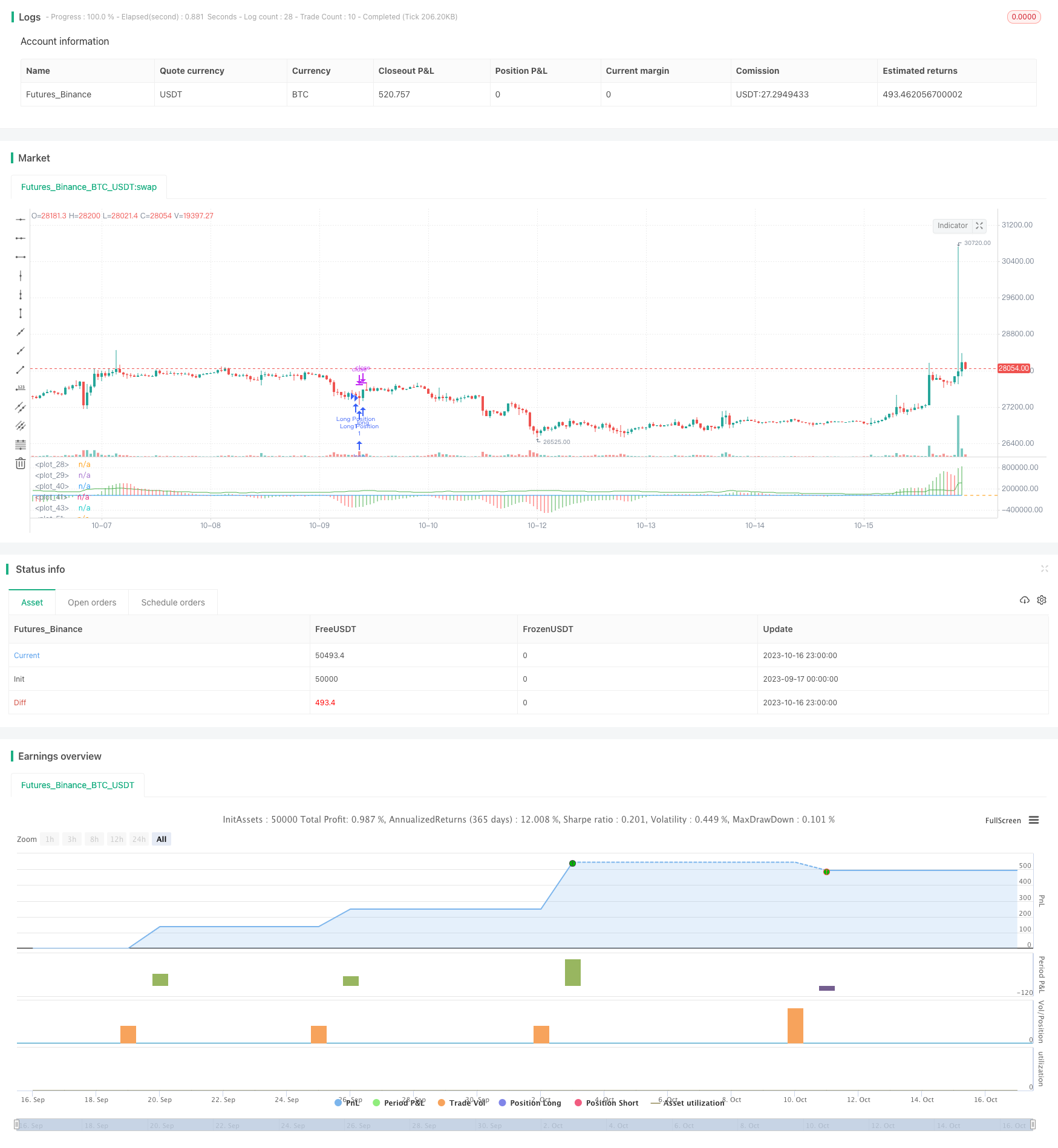

/*backtest

start: 2023-09-17 00:00:00

end: 2023-10-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Buy&Sell Strategy depends on AO+Stoch+RSI+ATR by SerdarYILMAZ", shorttitle="Buy&Sell Strategy")

// Created by Serdar YILMAZ

// This strategy is just for training, its purpose is just learning code in pine script.

// Don't make buy or sell decision with this strategy.

// Bu strateji sadece pine script'te kodlamanın nasıl yapildigini ogrenmek icindir.

// Bu stratejiye dayanarak, kesinlikle al-sat islemleri yapmayin.

//AO

fast=input(title="Fast Length",type=input.integer,defval=5)

slow=input(title="Slow length",type=input.integer,defval=34)

awesome=(sma(hl2,fast)-sma(hl2,slow))*1000

plot(awesome, style=plot.style_histogram, color=(awesome>awesome[1]?color.green:color.red))

//Stoch

K=input(title="K",type=input.integer,defval=14)

D=input(title="D",type=input.integer,defval=3)

smooth=input(title="smooth",type=input.integer,defval=3)

k=sma(stoch(close,high,low,K),D)

d=sma(k,smooth)

hline(80)

hline(20)

plot(k,color=color.blue)

//RSI

rsisource=input(title="rsi source",type=input.source,defval=close)

rsilength=input(title="rsi length",type=input.integer,defval=10)

rsi=rsi(rsisource,rsilength)

hline(70,color=color.orange)

hline(30,color=color.orange)

plot(rsi,color=color.orange)

//ATR

atrlen=input(title="ATR Length", type=input.integer,defval=14)

atrvalue=rma(tr,atrlen)

plot(atrvalue*1000,color=color.green)

LongCondition=k<20 and rsi<30 and awesome>awesome[1]

ShortCondition=k>80 and rsi>70 and awesome<awesome[1]

if (LongCondition)

stoploss=low-atrvalue

takeprofit=close+atrvalue

strategy.entry("Long Position", strategy.long)

strategy.exit("TP/SL",stop=stoploss,limit=takeprofit)

if (ShortCondition)

stoploss=high+atrvalue

takeprofit=close-atrvalue

strategy.entry("Short Position",strategy.short)

strategy.exit("TP/SL",stop=stoploss,limit=takeprofit)