概述

超趋势V策略是一种基于移动平均线和标准差的短线交易策略。它利用Super Trend指标判断价格的趋势方向,结合移动平均线形成的支撑和阻力进行入场。同时,它利用标准差通道预测价格潜在的支撑和阻力区域,设定止损止盈的价格区间,实现趋势跟随和高效退出的短线交易策略。

策略原理

该策略首先计算Super Trend指标,Super Trend指标利用ATR和价格的关系判断趋势的方向。当价格高于上升趋势时为看涨,当价格低于下跌趋势时为看跌。

然后计算出价格的移动平均线EMA和开盘价的移动平均线EMA,当价格上穿移动平均线且高于开盘价均线时为买入信号,当价格下穿移动平均线且低于开盘价均线时为卖出信号。

接着利用标准差计算出价格通道的上下轨,并作平滑处理,价格突破标准差上轨时为止损信号,价格突破标准差下轨时为止盈信号。

最后,结合不同时间周期的移动平均线来判断趋势方向,与Super Trend指标结合,形成稳定的趋势判断。

策略优势

- 利用Super Trend指标判断价格趋势方向,避免趋势反转造成损失

- 移动平均线结合开盘价辅助判断入场时机,避免假突破

- 标准差通道预测价格潜在支撑和阻力区域,设置止损止盈价格

- 多时间周期结合判断趋势方向,提高稳定性

策略风险

- Super Trend指标存在滞后,可能漏掉趋势转换点

- 移动平均线产生交叉信号存在滞后,入场时机不准

- 标准差通道范围过于固定,不能实时反映市场波动

- 多个时间周期判断可能产生互相冲突

风险解决方法:

- 适当缩短Super Trend参数,提高敏感性

- 优化移动平均线周期,或加入其他指标判断入场

- 动态调整标准差通道参数,使范围能配合市场

- 确定清楚多周期判断逻辑,处理可能的冲突

策略优化方向

- 优化Super Trend参数,寻找最佳参数组合

- 尝试其他指标结合移动平均线判断入场时机

- 尝试动态调整标准差通道参数

- 测试不同的多周期组合,找到最匹配的周期

- 优化止损止盈策略,以提高策略获利空间

总结

超趋势V策略整合趋势、均线、标准差通道等指标优点,实现了稳定判断趋势方向,选择合适入场时机,并设置价格区域止损止盈的短线交易策略。通过参数优化、指标优化、止损止盈优化等方面进行改进,能够提高策略稳定性和盈利能力。其扎实的逻辑和严谨的思路值得学习和研究。

策略源码

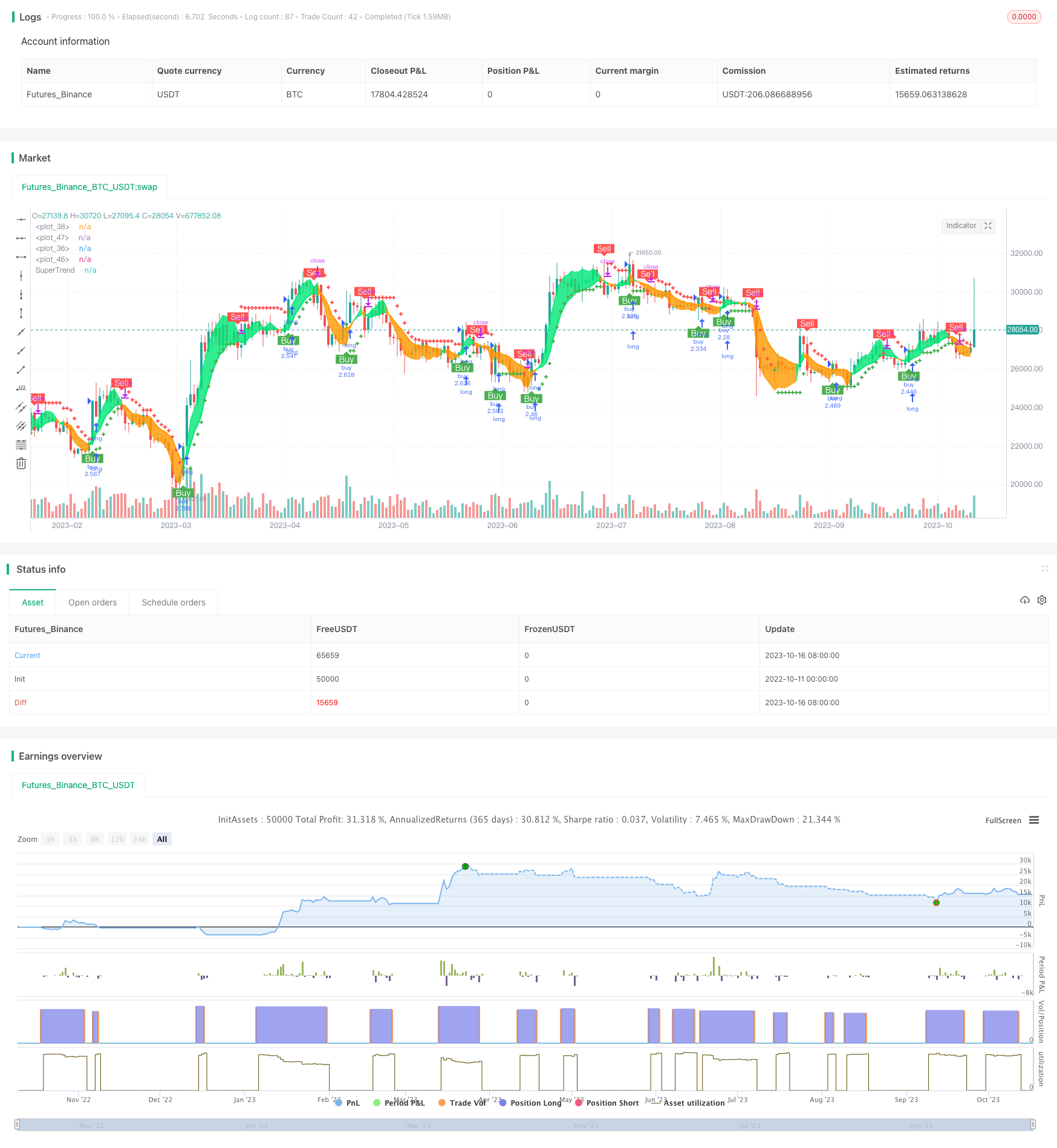

/*backtest

start: 2022-10-11 00:00:00

end: 2023-10-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © theCrypster 2020

//@version=4

strategy(title = "Super trend V Strategy version", overlay = true, pyramiding=1,initial_capital = 1000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.075)

strat_dir_input = input(title="Strategy Direction", defval="long", options=["long", "short", "all"])

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

hilow = ((high - low)*100)

openclose = ((close - open)*100)

vol = (volume / hilow)

spreadvol = (openclose * vol)

VPT = spreadvol + cum(spreadvol)

window_len = 28

v_len = 14

price_spread = stdev(high-low, window_len)

v = spreadvol + cum(spreadvol)

smooth = sma(v, v_len)

v_spread = stdev(v - smooth, window_len)

shadow = (v - smooth) / v_spread * price_spread

out = shadow > 0 ? high + shadow : low + shadow

//

src = out

src1=open

src2=low

src3=high

tf =input(720)

len = timeframe.isintraday and timeframe.multiplier >= 1 ?

tf / timeframe.multiplier * 7 :

timeframe.isintraday and timeframe.multiplier < 60 ?

60 / timeframe.multiplier * 24 * 7 : 7

c = ema(src, len)

plot(c,color=color.red)

o = ema(src1,len)

plot(o,color=color.blue)

//h = ema(src3,len)

//l=ema(src2,len)

//

col=c > o? color.lime : color.orange

vis = true

vl = c

ll = o

m1 = plot(vl, color=col, linewidth=1, transp=60)

m2 = plot(vis ? ll : na, color=col, linewidth=2, transp=80)

fill(m1, m2, color=col, transp=70)

//

vpt=ema(out,len)

// INPUTS //

st_mult = input(1, title = 'SuperTrend Multiplier', minval = 0, maxval = 100, step = 0.01)

st_period = input(10, title = 'SuperTrend Period', minval = 1)

// CALCULATIONS //

up_lev = vpt - (st_mult * atr(st_period))

dn_lev = vpt + (st_mult * atr(st_period))

up_trend = 0.0

up_trend := close[1] > up_trend[1] ? max(up_lev, up_trend[1]) : up_lev

down_trend = 0.0

down_trend := close[1] < down_trend[1] ? min(dn_lev, down_trend[1]) : dn_lev

// Calculate trend var

trend = 0

trend := close > down_trend[1] ? 1: close < up_trend[1] ? -1 : nz(trend[1], 1)

// Calculate SuperTrend Line

st_line = trend ==1 ? up_trend : down_trend

// Plotting

plot(st_line[1], color = trend == 1 ? color.green : color.red , style = plot.style_cross, linewidth = 2, title = "SuperTrend")

buy=crossover( close, st_line) and close>o

sell=crossunder(close, st_line) and close<o

//plotshape(crossover( close, st_line), location = location.belowbar, color = color.green,size=size.tiny)

//plotshape(crossunder(close, st_line), location = location.abovebar, color = color.red,size=size.tiny)

plotshape(buy, title="buy", text="Buy", color=color.green, style=shape.labelup, location=location.belowbar, size=size.small, textcolor=color.white, transp=0) //plot for buy icon

plotshape(sell, title="sell", text="Sell", color=color.red, style=shape.labeldown, location=location.abovebar, size=size.small, textcolor=color.white, transp=0) //plot for sell icon

//

multiplier = input(title="TP VWAP Deviation", type=input.float, defval=2, minval=1)

src5 = vwap

len5 = input(title="TP length", defval=150, minval=1)

offset = 0

calcSlope(src5, len5) =>

sumX = 0.0

sumY = 0.0

sumXSqr = 0.0

sumXY = 0.0

for i = 1 to len5

val = src5[len5-i]

per = i + 1.0

sumX := sumX + per

sumY := sumY + val

sumXSqr := sumXSqr + per * per

sumXY := sumXY + val * per

slope = (len5 * sumXY - sumX * sumY) / (len5 * sumXSqr - sumX * sumX)

average = sumY / len5

intercept = average - slope * sumX / len5 + slope

[slope, average, intercept]

var float tmp = na

[s, a, i] = calcSlope(src5, len5)

vwap1=(i + s * (len5 - offset))

sdev = stdev(vwap, len5)

dev = multiplier * sdev

top=vwap1+dev

bott=vwap1-dev

//

z1 = vwap1 + dev

x1 = vwap1 - dev

low1 = crossover(close, x1)

high1 = crossunder(close, z1)

plotshape(low1, title="low", text="TP", color=color.red, style=shape.labelup, location=location.belowbar, size=size.small, textcolor=color.white, transp=0) //plot for buy icon

plotshape(high1, title="high", text="TP", color=color.green, style=shape.labeldown, location=location.abovebar, size=size.small, textcolor=color.white, transp=0) //plot for sell icon

//

// Testing Start dates

testStartYear = input(2016, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//Stop date if you want to use a specific range of dates

testStopYear = input(2030, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(30, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

l = buy

s1 = sell

if l and testPeriod()

strategy.entry("buy", strategy.long)

if s1 and testPeriod()

strategy.entry("sell", strategy.short)