概述

本策略的核心思想是利用Parabolic SAR这一Momentum Indicators指标在不同时间周期上的交替运用,实现在不同时间周期捕捉市场趋势的转折。该策略同时在多个时间周期监测Parabolic SAR信号,一旦较高时间周期 SAR 信号发出,则进入相应的做多或做空头寸。

策略原理

首先,该策略在不同的时间周期(15分钟,日线,周线,月线)分别计算Parabolic SAR的值。

其次,策略监测周线SAR值,一旦周SAR上穿最近高点,则做多;一旦周SAR下穿最近低点,则做空。

最后,策略采用周线SAR作为止损点。具体来说,如果已做多,则以周线SAR作为该做多头寸的止损点;如果已做空,则以周线SAR作为该做空头寸的止损点。

这样,策略就实现了在较高时间周期发出信号时进场,采取较低时间周期止损的思路。监测周线SAR信号可以更准确判断趋势转折点,减少假突破带来的损失;而采用15分钟SAR作为止损,可以快速止损,避免在反转来临时承担过多损失。

优势分析

这种多时间框架交替使用Parabolic SAR的策略,具有以下优势:

利用不同时间周期 SAR 的优势。周线SAR可准确判断趋势转折,降低假突破带来的亏损风险;15分钟SAR可快速止损,控制单笔损失。

策略灵活度高。可根据不同品种、市场情况调整SAR的参数,优化策略效果。

策略交易频率低。只在较高时间框架SAR发出信号时才入场,避免过度交易。

资金利用效率高。仅在判断到较大概率走势反转时才部署资金,有效避免资金长期闲置。

容易掌控风险。采用固定止损点,可以清晰计算每个头寸的风险敞口。

风险分析

该策略也存在一些风险:

SAR参数设置不当,可能导致止损过于宽松或过于紧密,进而影响策略效果。

标的可能出现剧烈价格跳动,直接突破策略设置的止损线,造成较大亏损。

若仅凭借SAR信号进行交易,可能错过趋势中的其他具有统计优势的交易机会。

多时间框架下,不同周期SAR可能发出冲突信号,需要处理信号优先级问题。

周期选择不当,短周期噪音过大或长周期滞后识别转折点,均可能影响策略效果。

优化方向

该策略可从以下几个方面进行优化:

优化SAR参数设置,降低whipsaw情况发生概率。可以通过回测多次调整参数,找到最优参数组合。

增加止损策略,如移动止损、级差止损等,进一步控制单笔损失。

结合其它指标,如MACD、KDJ等,寻找更多证据确定趋势转折,减少错误交易概率。

增加资金管理策略,如固定资金利用率、固定盈亏比等,控制每个头寸规模,总体控制策略风险。

优化时间周期设置,测试不同周期组合下策略效果,找到最佳周期匹配。

总结

本策略基于Parabolic SAR指标在不同时间周期的交替使用,在较高时间框架判断趋势转折点,较低时间框架进行止损,实现不同时间周期的优势互补。该策略有效降低了whipsaw现象带来的交易频率和假突破带来的风险。通过参数优化、止损策略、资金管理等手段进一步完善,可以获得非常出色的策略效果。

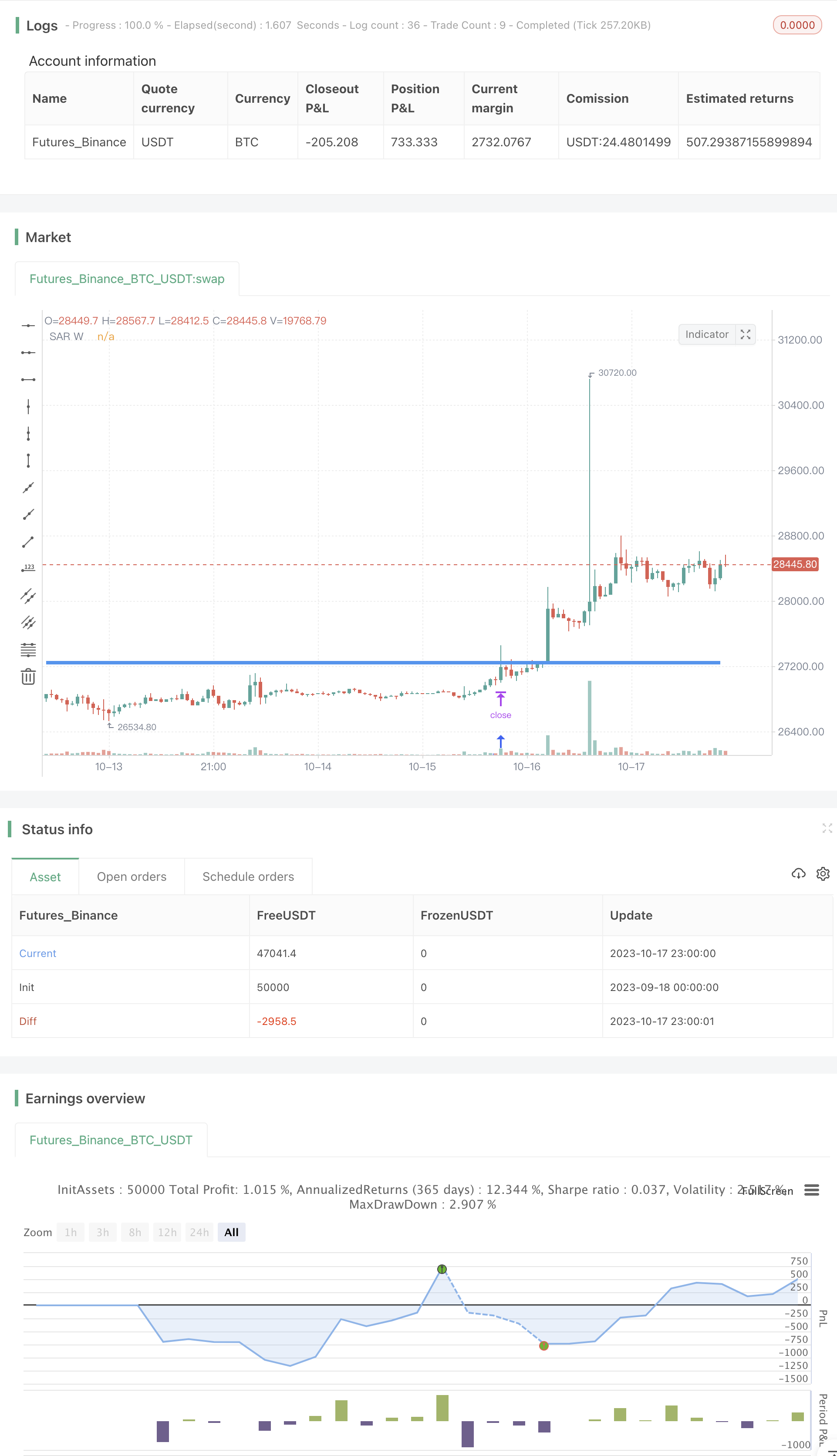

/*backtest

start: 2023-09-18 00:00:00

end: 2023-10-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy ("SAR alternating timeframe", overlay=true)

//resolution

res1=input("15", title="Resolution")

res2=input("D", title="Resolution")

res3=input("W", title="Resolution")

res4=input("M", title="Resolution")

//output functions

out = sar(0.02,0.02,0.2)

// Security

SAR1 = request.security(syminfo.tickerid, res1, out)

SAR2 = request.security(syminfo.tickerid, res2, out)

SAR3 = request.security(syminfo.tickerid, res3, out)

SAR4 = request.security(syminfo.tickerid, res4, out)

//Plots

//plot(SAR1 , title="SAR 15", color = red, linewidth = 2)

//plot(SAR2 , title="SAR D", color = green, linewidth = 3)

plot(SAR3 , title="SAR W", color =blue, linewidth = 4)

//plot(SAR4 , title="SAR W", color =purple, linewidth = 5))

/////////////////////////////////////////////////////////////////////

//trade

if (SAR3 >= high)

strategy.entry("ParLE", strategy.long, stop=SAR3, comment="ParLE")

else

strategy.cancel("ParLE")

if (SAR3 <= low)

strategy.entry("ParSE", strategy.short, stop=SAR3, comment="ParSE")

else

strategy.cancel("ParSE")