概述

黄金VWAP MACD SMO交易策略是一个在12小时时间周期下设计的完整交易策略。它结合了VWAP月线、SMO振荡器和MACD指标来识别黄金市场的交易机会。

策略原理

该策略使用VWAP月线作为主要的趋势指标。VWAP代表价格的平均成交价,月线意味着计算VWAP的时间范围是过去一个月。如果当前收盘价高于VWAP月线,那么表明目前是处于趋势上涨的阶段;如果收盘价低于VWAP月线,则意味着趋势正在下跌。

SMO振荡器则用来判断目前的超买超卖情况。它由一个长周期组分和一个短周期组分构成。当振荡器高于0时表示处于超买状况,而低于0时则代表超卖。

而MACD直方图可以判断动量方向。当柱子向上突破时,代表动量正转强劲,可以做多;当柱子向下突破时,意味着动量转弱,应该考虑做空。

根据这三个指标,可以建立交易策略的具体规则:

多头进入:当收盘价高于VWAP月线,MACD直方柱上涨突破,且SMO振荡器高于0时做多 空头进入:当收盘价低于VWAP月线,MACD直方柱下跌突破,且SMO振荡器低于0时做空

止盈止损根据输入的百分比设置。

优势分析

该策略结合多个时间范围和指标,可以有效判断趋势方向和力度,具有如下优势:

- VWAP月线可以判断主要趋势方向,避免逆势操作

- MACD直方图可以及时捕捉动量变化

- SMO振荡器判断超买超卖情况,有助于在容易形成拐点的区域入场

- 多指标组合可以相互验证,提高信号的可靠性

- 可自定义止盈止损比例,控制风险

风险分析

尽管该策略设计合理,但仍存在一定的风险需要注意:

- VWAP指标对十字异动敏感,可能产生错误信号

- MACD参数设置不当,导致虚假突破的概率增加

- SMO参数不当也可能导致误判超买超卖区域

- 止盈止损设置过于宽松,无法有效控制单笔损失

为控制上述风险,应该合理优化VWAP和MACD的参数,幅度不宜过大。同时,止盈止损比例不宜过大,应控制单笔亏损在3%左右为宜。

优化方向

该策略还可从以下方面进行优化:

- 增加量价确认,例如成交量突破均线

- 结合波动率指标如ATR,根据市场波动率调整仓位

- 在高位添加分批 lighten 机制,防止错失利润

- 测试不同的止盈止损策略,如移动止损、环比止损等

- 增加模型校验模块,过滤异常信号

总结

黄金VWAP MACD SMO策略综合多个指标判断趋势和超买超卖情况,可以有效抓住黄金的中长线机会。虽有一定的风险,但可通过参数优化和风控手段进行控制。该策略具有非常强大的延展性,可根据实际需要进行模块化优化,是一套值得长期跟踪的交易系统。

策略源码

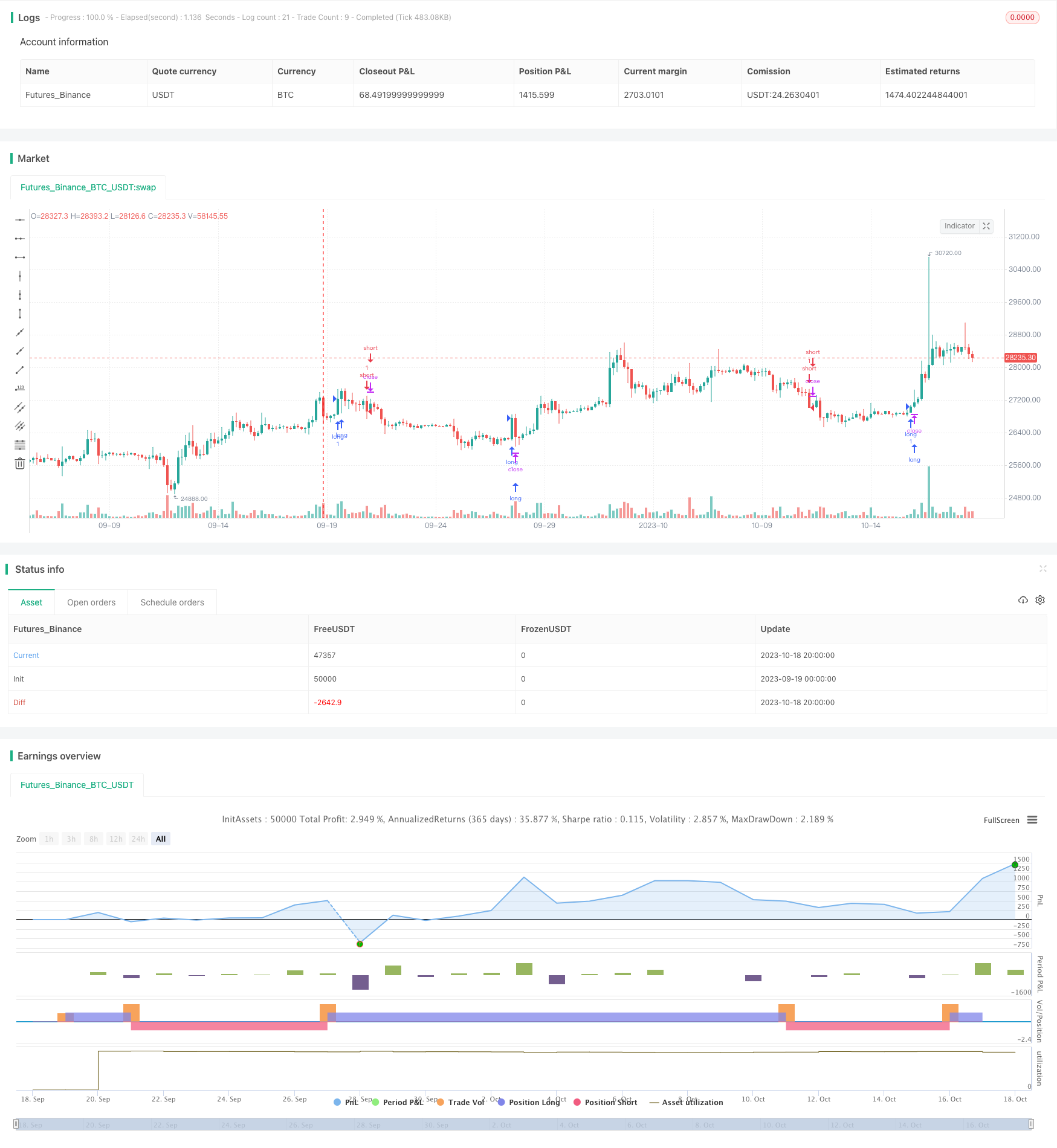

/*backtest

start: 2023-09-19 00:00:00

end: 2023-10-19 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

// strategy("VWAP Gold strategy", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 10000, calc_on_every_tick = true, commission_type = strategy.commission.percent, commission_value = 0.005)

source = input(low)

//vwap monthly

timeframeM = time("M")

beginningM = na(timeframeM[1]) or timeframeM > timeframeM[1]

sumsourceM = source * volume

sumVolM = volume

sumsourceM := beginningM ? sumsourceM : sumsourceM + sumsourceM[1]

sumVolM := beginningM ? sumVolM : sumVolM + sumVolM[1]

vwapMonthly= sumsourceM / sumVolM

//macd

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

fast_ma = ema(src, fast_length)

slow_ma = ema(src, slow_length)

macd = fast_ma - slow_ma

signal = ema(macd, signal_length)

hist = macd - signal

//SMO

longlen = input(22, minval=1, title="Long Length SMO")

shortlen = input(6, minval=1, title="Short Length SMO")

siglen = input(5, minval=1, title="Signal Line Length SMO")

erg = tsi(close, shortlen, longlen)

sig = ema(erg, siglen)

osc = erg - sig

shortCondition = close < vwapMonthly and hist < hist[1] and osc < 0

longCondition = close > vwapMonthly and hist> hist[1] and osc > 0

tplong=input(0.085, step=0.005, title="Take profit % for long")

sllong=input(0.03, step=0.005, title="Stop loss % for long")

tpshort=input(0.05, step=0.005, title="Take profit % for short")

slshort=input(0.025, step=0.005, title="Stop loss % for short")

strategy.entry("long",1,when=longCondition)

strategy.entry("short",0,when=shortCondition)

strategy.exit("short_tp/sl", "long", profit=close * tplong / syminfo.mintick, loss=close * sllong / syminfo.mintick, comment='LONG EXIT', alert_message = 'closeshort')

strategy.exit("short_tp/sl", "short", profit=close * tpshort / syminfo.mintick, loss=close * slshort / syminfo.mintick, comment='SHORT EXIT', alert_message = 'closeshort')