概述

本策略结合移动平均线指标和MACD指标,设计了一个相对保守的做多策略。该策略主要根据价格是否站上200日简单移动平均线来判断行情趋势,再结合20日指数移动平均线和MACD指标的金叉来选择买入时机。在行情向上时,仅在MACD金叉时买入,并在MACD死叉时止损;在行情向下时,需要价格站上20日指数移动平均线并且MACD金叉时才买入,在MACD死叉时止损。这种双重确认机制可以有效避免在震荡行情中频繁买卖。

策略原理

首先,该策略使用200日简单移动平均线SMA判断当前价格趋势。如果收盘价高于SMA,则判断行情为上涨趋势;如果收盘价低于SMA,则判断行情为下跌趋势。

其次,在上涨趋势中,策略忽略20日指数移动平均线EMA的条件,仅在MACD的快线向上突破慢线时(即MACD金叉)发出买入信号。此时采用趋势跟踪策略,只要MACD保持金叉,就持有多单。当MACD快线下穿慢线时(即MACD死叉),就执行止损。

在下跌趋势中,策略变得保守,只有当价格收盘价上穿20日EMA并且MACD金叉时才会发出买入信号,也就是需要双重确认。此时仍然在MACD死叉时止损。

通过这种机制,该策略在趋势明确时(价格高于或低于200日SMA时)采用较积极的策略,而当价格处于震荡区间时则采取较为谨慎的策略,可以有效避免虚假信号导致不必要的交易。

策略优势

该策略同时结合趋势判断和双重确认机制,可以有效过滤噪音,避免虚假信号,从而减少不必要的交易。

在趋势明显时,策略及时跟踪趋势;在趋势不明显时,策略采取谨慎态度,可以减少亏损。

策略采用移动平均线指标和MACD指标进行组合,可以使买卖信号更加可靠。

策略操作简单,容易实现,适合不同水平的投资者使用。

策略采用固定的止损条件,可以有效控制单笔亏损。

策略风险

该策略过于依赖技术指标,无法应对突发事件导致的张力行情。

双重确认机制可能导致策略有时错过买入良机。

MACD指标存在滞后性,可能导致买卖点发生延迟。

如果止损点设置不当,可能导致亏损扩大。

200日SMA无法准确判断长期趋势,可能发生判断错误。

移动平均线作为过滤器容易产生幅度过小的交易信号。

策略优化

可以考虑加入其他指标进行组合,如KDJ、布林带等,使买卖信号更加准确。

可以测试其他长期均线,如120日EMA,看是否可以更好判断长期趋势。

可以优化移动平均线的天数,寻找最佳参数组合。

可以加入止盈策略,而不仅仅依赖止损,以锁定更多利润。

可以根据不同市场调整均线参数,使策略更具适应性。

可以考虑加入机器学习算法,利用历史数据训练模型,自动优化参数。

总结

本策略整合移动平均线和MACD指标的优势,在保持相对简单的同时实现了较好的风险控制。通过判断趋势和双重确认,可以有效过滤噪音信号。但策略也存在一定局限性,需要进一步优化和提高应对突发事件的能力。总的来说,该策略为保守型投资者提供了一个稳健的参考方案。

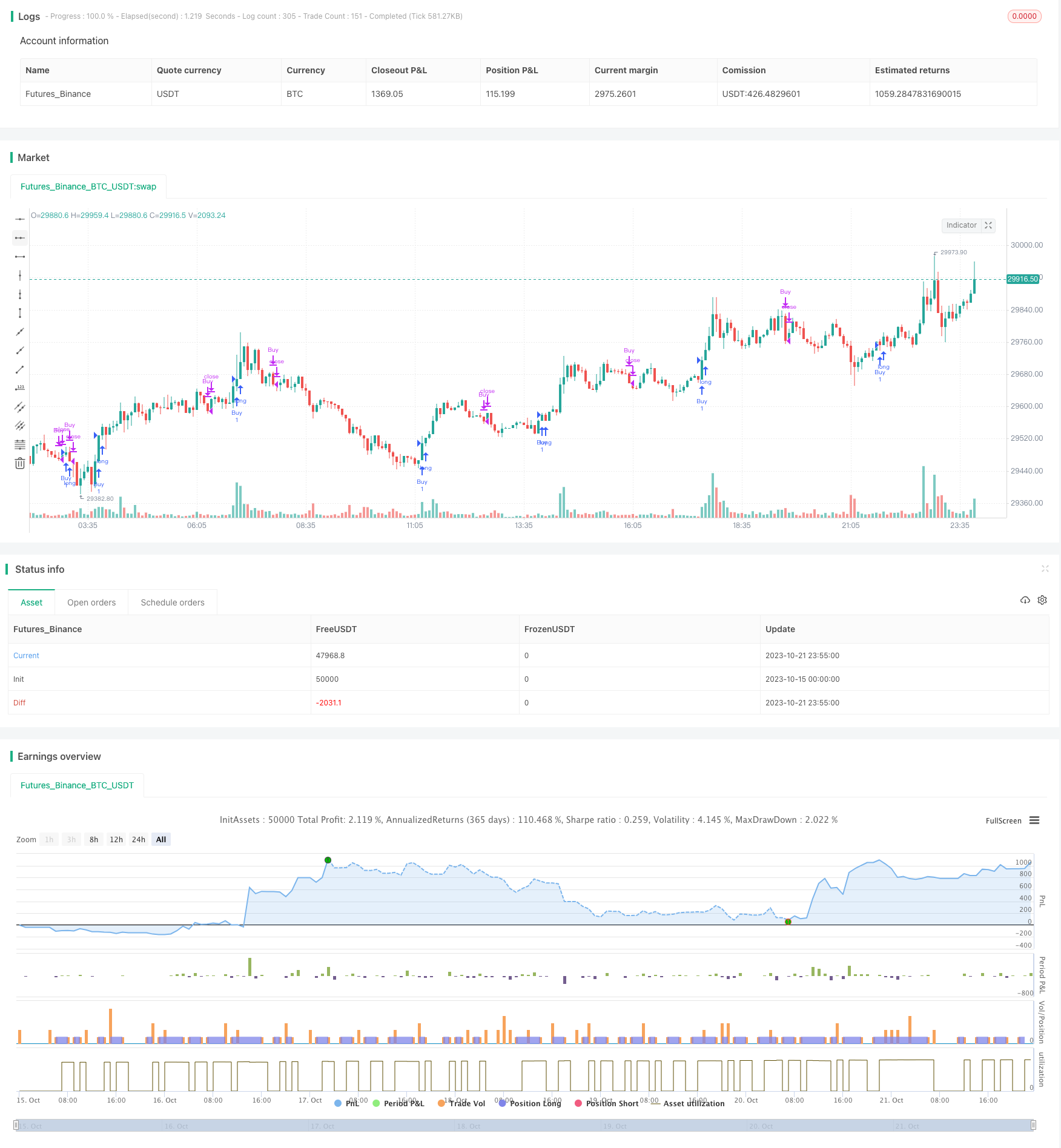

/*backtest

start: 2023-10-15 00:00:00

end: 2023-10-22 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="MACD/EMA Long Strategy",overlay=true,scale=scale.left)

// SMA Indicator - Are we in a Bull or Bear market according to 200 SMA?

SMA = sma(close, input(200))

// EMA Indicator - Are we in a rally or not?

EMA = ema(close, input(20))

//MACD Indicator - Is the MACD bullish or bearish?

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Set Buy/Sell conditions

[main,signal,histo]=macd(close,fastLength,slowlength,MACDLength)

buy_entry= if close>SMA

delta>0

else

delta>0 and close>EMA

strategy.entry("Buy",true , when=buy_entry)

alertcondition(delta, title='Long', message='MACD Bullish')

sell_entry = if close<SMA

delta<0

else

delta<0 and close<EMA

strategy.close("Buy",when= sell_entry)

alertcondition(delta, title='Short', message='MACD Bearish')

//plot(delta, title="Delta", style=cross, color=delta>=0 ? green : red )