概述

RSI趋势反转策略利用RSI指标反转信号,判断潜在趋势反转点,进场做多做空。该策略结合价格反转以及RSI反转,可以有效过滤假反转信号。

策略原理

该策略基于RSI指标的反转信号以及价格的反转信号进行组合判断,主要分为四种情况:

常规多头反转:当RSI形成较高低点(意味着RSI趋势反转由上向下),而价格形成较低低点时(意味着价格趋势反转由下向上),产生常规多头反转信号。

隐藏多头反转:当RSI形成较低低点(意味着RSI趋势继续由上向下),但价格形成较高低点时(意味着价格趋势反转由下向上),产生隐藏多头反转信号。

常规空头反转:当RSI形成较低高点(意味着RSI趋势反转由下向上),而价格形成较高高点时(意味着价格趋势反转由上向下),产生常规空头反转信号。

隐藏空头反转:当RSI形成较高高点(意味着RSI趋势继续由下向上),但价格形成较低高点时(意味着价格趋势反转由上向下),产生隐藏空头反转信号。

这样能够同时结合RSI指标反转和价格反转来发出交易信号,可以有效避免仅凭RSI指标或者仅凭价格反转造成的假信号,增强策略的稳定性。

优势分析

RSI趋势反转策略具有以下优势:

结合RSI指标和价格反转信号,可以有效过滤假反转信号,提高信号质量。RSI指标仅凭自己并不能完全可靠判断反转点,需要和价格行情反转共同验证。

识别隐藏多头和隐藏空头形态,这些隐藏形态往往预示着即将出现更加强劲的价格趋势,能够提前捕捉趋势机会。

RSI参数和回看周期可自定义,可以针对不同市场调整,灵活实用。

可视化绘制指标形态和信号,直观判断市场状态。

策略逻辑简洁清晰,容易理解实现,适合용作量化交易策略。

风险分析

RSI趋势反转策略也存在以下风险:

RSI反转结合价格反转,能够过滤许多假信号,但不排除仍会有误判的可能。指标毕竟是对价格的统计测度,不可完全依赖。

隐藏多头和隐藏空头形态不容易识别,可能会漏掉这些机会,需要一定的经验判断。

回看周期参数设置不当可能导致错过反转时点或判断滞后。不同市场需要调整周期参数。

需要确保止损策略配合使用,避免空头反转后继续下跌造成亏损扩大。

可以通过优化参数,严格止损,适当把握隐藏反转等方法来控制风险。

优化方向

RSI趋势反转策略可以从以下方面进行优化:

调整RSI参数,测试不同市场对RSI周期parameter的敏感性,找到最佳参数。

优化回看周期参数,平衡捕捉反转时点和防止假信号的需求。

增加成交量的统计分析,例如大量减仓导致价格反转的成交量背离识别。

结合其他指标信号进行组合,例如MACD、布林带等,提高判断准确性。

增加止损策略,避免亏损扩大。可以设定价格突破新高/新低之后止损。

根据回测结果修正策略逻辑,提高盈利因子。例如调整开仓条件逻辑关系(与、或、非),寻找最佳交易策略。

总结

RSI趋势反转策略通过组合RSI指标反转和价格反转来识别潜在的趋势转折点。它有效利用了RSI的趋势判断能力,同时结合价格行情过滤假信号。该策略逻辑简单清晰,容易实现。可以通过参数优化、止损策略优化来控制风险,并进一步提升策略表现。总体来说,RSI趋势反转策略是一种可靠、实用的短线交易策略。

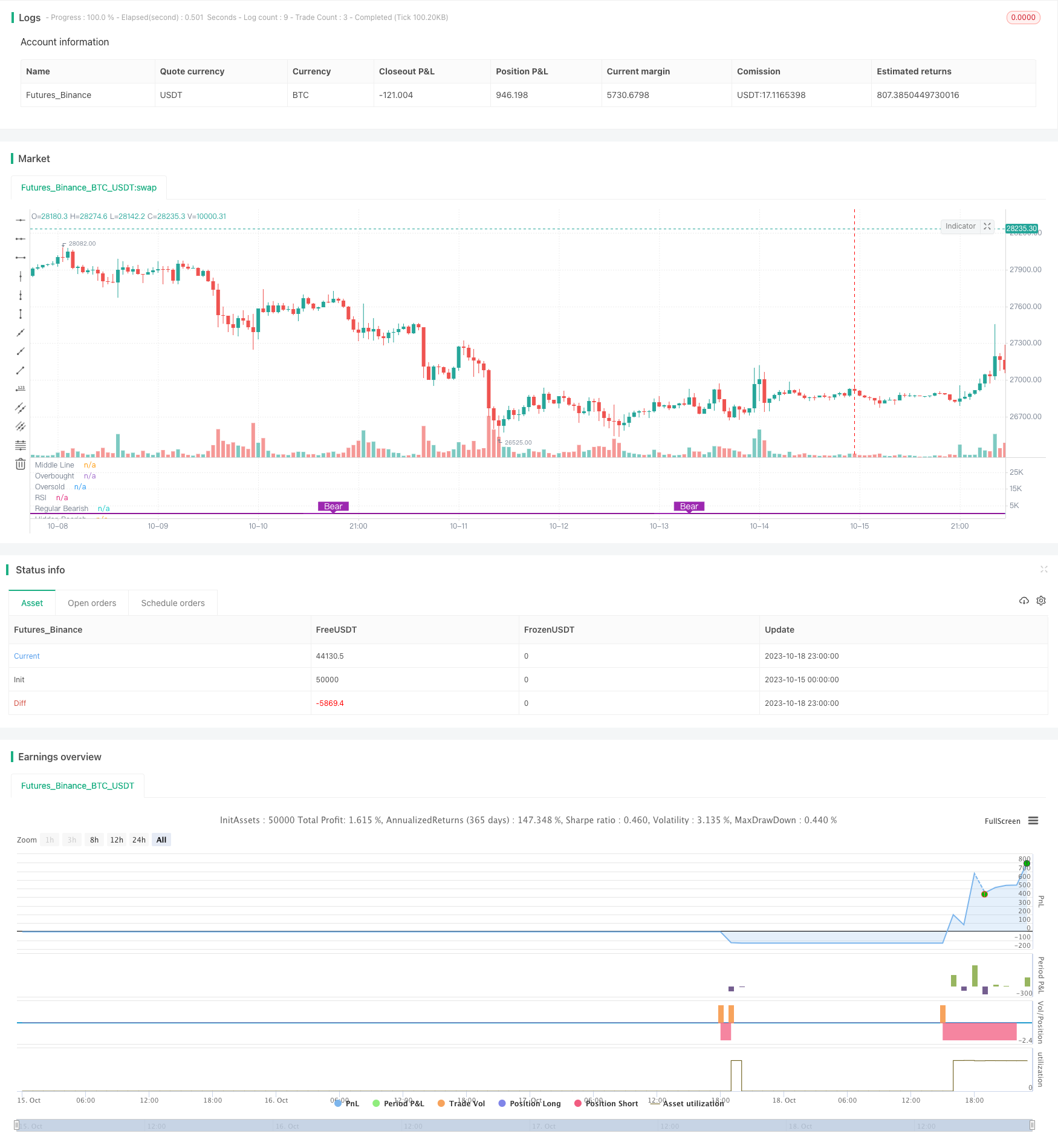

/*backtest

start: 2023-10-15 00:00:00

end: 2023-10-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="Divergence Indicator", format=format.price)

strategy(title="RSI Divergence Indicator", overlay=false,pyramiding=1, default_qty_value=2, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

len = input(title="RSI Period", minval=1, defval=5)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=5)

lbL = input(title="Pivot Lookback Left", defval=5)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

bearColor = color.purple

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = rsi(src, len)

plot(osc, title="RSI", linewidth=2, color=#8D1699)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=#9915FF, transp=90)

plFound = na(pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

longCondition=bullCond or hiddenBullCond

//? osc[lbR] : na

//hiddenBullCond

strategy.entry(id="RSIDivLE", long=true, when=longCondition)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

longCloseCondition=crossover(osc,75) or bearCond

strategy.close(id="RSIDivLE", when=longCloseCondition)