概述

双EMA跨度突破策略是一种趋势跟踪策略。它使用不同周期的两个EMA均线,并在两条EMA线间形成足够大的跨度时进行交易,以捕捉趋势的方向。这种策略适用于趋势性比较强的市场。

策略原理

该策略使用快速EMA线(小周期EMA线)和慢速EMA线(大周期EMA线)进行交易信号判断。具体逻辑是:

计算快速EMA和慢速EMA。

当快速EMA上穿慢速EMA,并且两条EMA线之间的跨度超过设置阈值时,做多。

当快速EMA下穿慢速EMA,并且两条EMA线之间的跨度超过设置阈值时,做空。

当价格重新跌破快速EMA时,平仓做多头部位。

当价格重新涨破快速EMA时,平仓做空头部位。

这样,它利用EMA的平滑性来识别趋势方向,再结合EMA间距离的突破来确定具体的入场时机。离得越远说明趋势越强,做单的机会越大。

策略优势分析

- 利用EMA的趋势跟踪性进行操作,可以有效跟踪趋势

- EMA间距离的突破来判断入场时机,可以有效过滤震荡情况下的虚假信号

- 采用不同周期EMA组合,可以在一定程度上减少趋势交易中的掉头

- 条件设置合理时,可以在趋势行情中获得较好的回报

策略风险分析

- EMA本身对价格变化响应滞后,可能错过转折点

- 趋势性不强的行情中效果不佳

- 震荡行情中容易止损

- EMA参数设置不当可能带来过多的虚假信号

可以通过调整EMA参数组合、调整跨度阈值以及止损位置来减少风险。

策略优化方向

- 优化快慢EMA的周期参数组合

- 测试不同的EMA间距阈值

- 优化止损策略

- 增加其他过滤信号

- 进行参数调优,找到最佳参数组合

总结

双EMA跨度突破策略整体来说是一个较为简单实用的趋势跟踪策略。它能够有效地在趋势行情中获利,但需要合理的参数设定。通过参数优化和风险管理,可以充分发挥该策略的优势。这是一个值得深入研究和应用的趋势策略。

策略源码

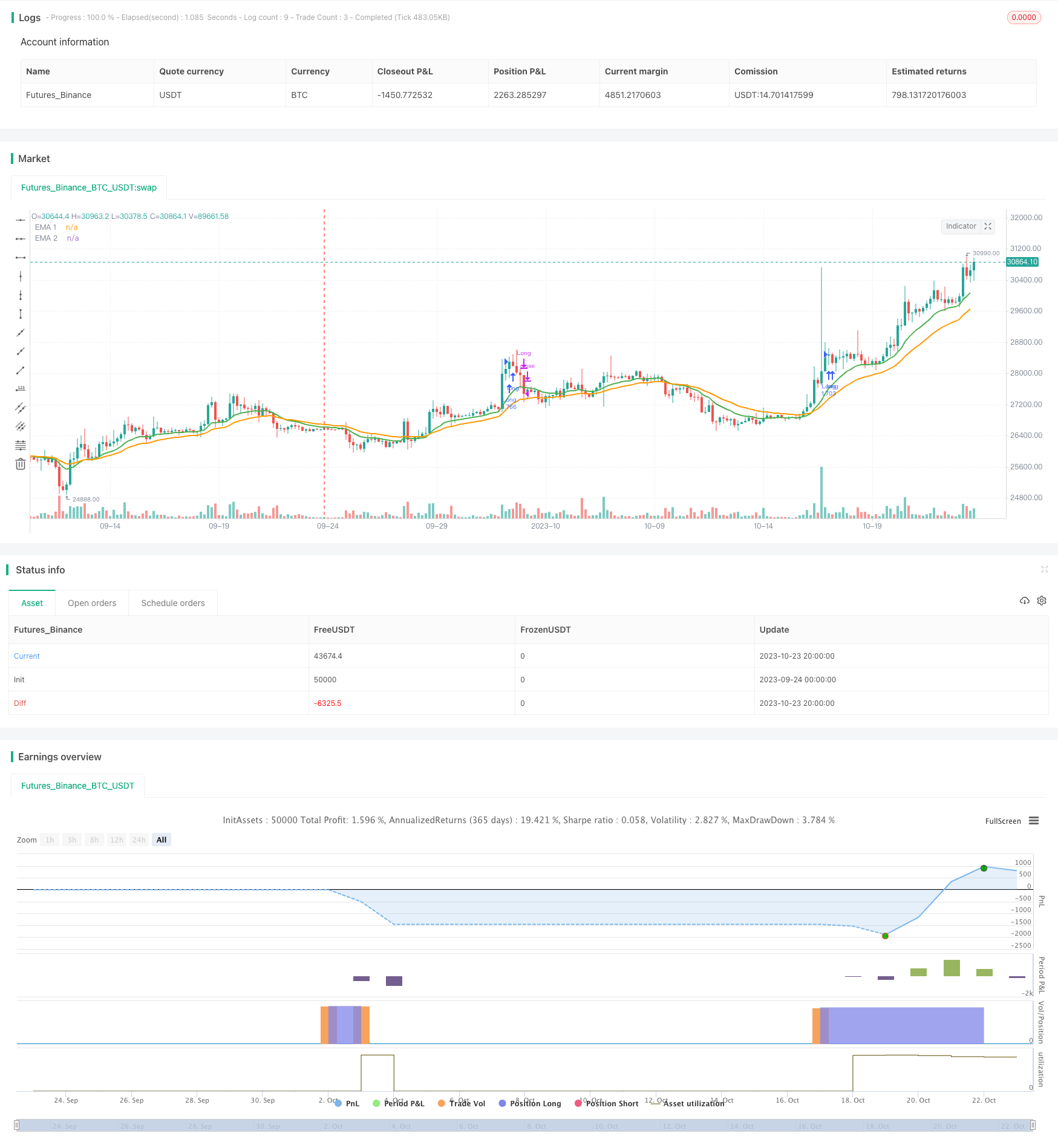

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("2-EMA Strategy", overlay=true, initial_capital=100, currency="USD", default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.075)

diffMinimum = input(0.95, step=0.01)

small_ema = input(13, title="Small EMA")

long_ema = input(26, title="Long EMA")

ema1 = ema(close, small_ema)

ema2 = ema(close, long_ema)

orderCondition = ema1 > ema2?((ema1/ema2)*100)-100 > diffMinimum:((ema2/ema1)*100)-100 > diffMinimum

longCondition = close > ema1 and ema1 > ema2

if (longCondition and orderCondition)

strategy.entry("Long", strategy.long)

shortCondition = close < ema1 and ema1 < ema2

if (shortCondition and orderCondition)

strategy.entry("Short", strategy.short)

strategy.close("Short", when=close > ema1)

strategy.close("Long", when=close < ema1)

plot(ema(close, small_ema), title="EMA 1", color=green, transp=0, linewidth=2)

plot(ema(close, long_ema), title="EMA 2", color=orange, transp=0, linewidth=2)