概述

该策略融合了三个不同维度的技术指标,即支撑阻力位、均线系统和超买超卖指标,根据它们的综合信号判断短期趋势方向,以获取较高的胜率。

策略原理

代码中首先计算出价格的支撑阻力位,包括标准振荡轴和费波纳奇支撑阻力位,并绘制在图表上。当价格突破这些关键位时,视为重要的趋势信号。

然后是计算加权移动平均线VWAP和均价,判断它们的黄金交叉和死叉信号。这属于中长期趋势判断。

最后是计算Stochastic RSI指标,判断它的黄金交叉和死叉信号,属于超买超卖指标。

综合这三个维度的指标,如果支撑阻力位、VWAP均线、Stochastic RSI同时发出买入信号,就开多单;如果三者同时发出卖出信号,就开空单。

优势分析

该策略最大的优势在于结合了三个不同维度的指标,使判断更全面准确,胜率较高。首先支撑阻力位判断大趋势;其次VWAP判断中长线趋势;最后Stochastic RSI判断超买超卖情况。三维指标同时发出信号,可以大大过滤假信号,提高入场的成功率。

另外,策略加入了止盈功能,可以锁定一定比例收益,有利于资金管理。

风险分析

该策略主要风险在于多空决策依赖指标同步发出信号,如果部分指标发出错误信号,则可能导致决策错误。例如Stochastic RSI发出超买信号,但VWAP和支撑阻力判断仍为看涨,此时就可能错过买点而不入场。

另外,指标参数设置不当也会导致信号判断错误,需要通过反复回测找出最优参数。

此外,股市短期内常有黑天鹅事件出现,导致指标失效。要防范这种风险,可以加入止损策略,避免单笔损失过大。

优化方向

该策略可以从以下几个方面继续优化:

加入更多指标信号,如成交量指标,判断趋势强弱,提高决策准确率。

增加机器学习模型,对多维指标进行训练,自动寻找最优交易策略。

根据不同品种参数进行优化,设置自适应参数。

增加止损策略,以及根据回撤控制仓位大小,更好控制风险。

进行组合优化,找到相关性低的品种进行组合,降低组合回撤。

总结

该策略整体来说非常适合短期趋势交易。它利用多维指标进行决策,可以过滤掉大量噪音,胜率较高。但仍需注意指标发出错误信号的风险,通过继续优化,该策略有望成为高效稳定的短线策略。

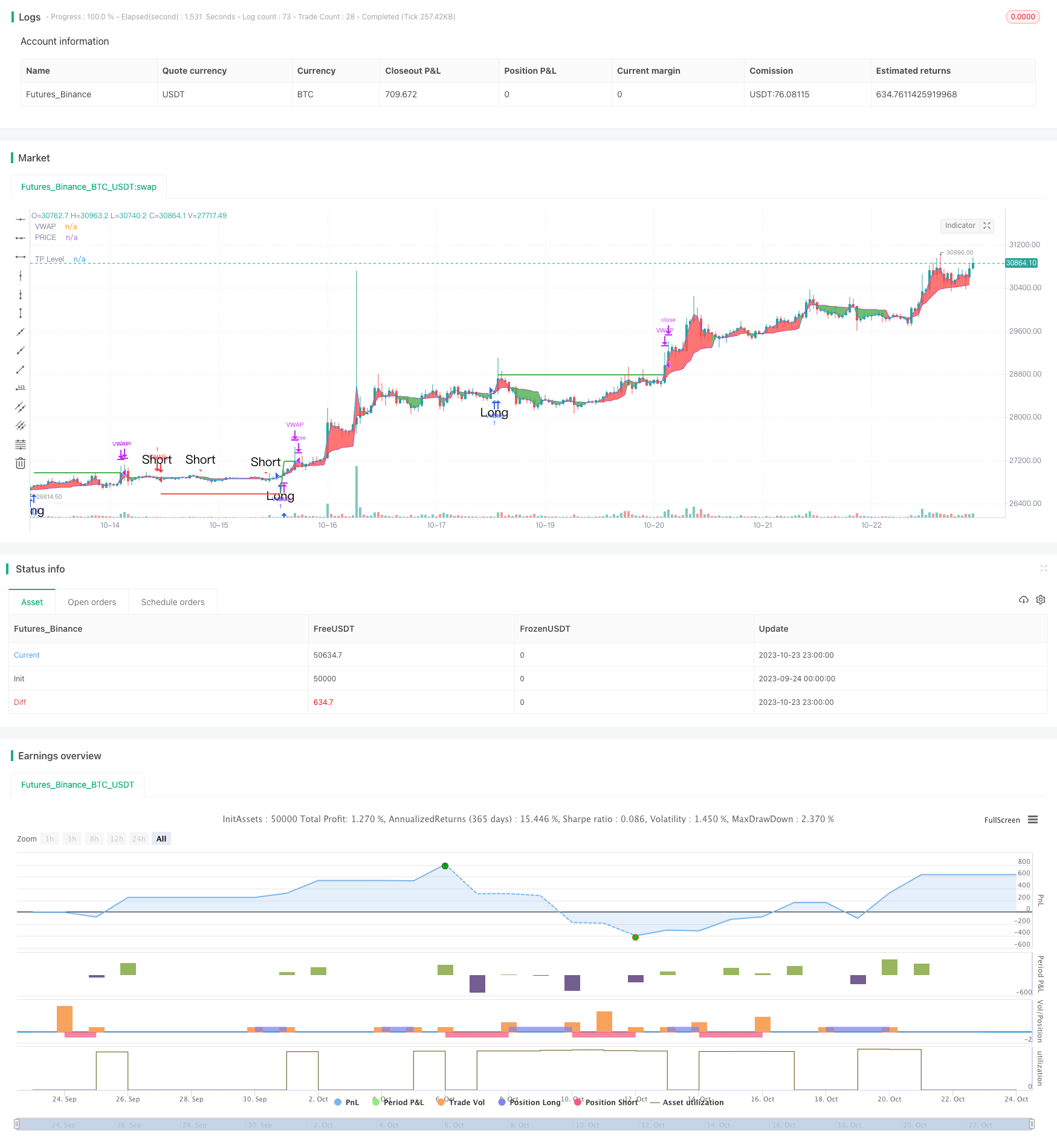

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// EmperorBTC's VWAP Indicator & Strategy

// v2.1

//

// coded by Bogdan Vaida

// This indicator was created after EmperorBTC's conditions on Twitter.

// Good timeframes for it: 30', 15', 5'

// To convert from strategy to study switch the commented lines in the beginning

// and at the end of the script and vice versa.

// What this indicator does is to check if:

// o Pivot Point was crossed

// o Stoch-RSI and VWAP were crossed in current or previous candle

// o Candle (or previous candle) close is in the trend direction

// If all these are true then it will go long or short based on direction.

// FUTURE IDEAS:

// - Volume Expansion

// - Candle Stick patterns

//@version=4

// 🔥Uncomment the line below for the indicator and comment the strategy lines

// study(title="EmperorBTC's VWAP Indicator", shorttitle="EMP-VWAP", overlay=true)

// 🔥 Uncomment the line below for the strategy and comment the above line

strategy(title="EmperorBTC's VWAP Strategy", shorttitle="EMP-VWAP", overlay=true, pyramiding=1)

plotAveragePriceCrossedPivotPoint = input(false, title="Plot Close Price Crossing Pivot Points?", group="Pivot Points")

plotPivotPoints = input(false, title="Plot Pivot Points?", group="Pivot Points")

pivotPointsType = input(title="Pivot Points type", defval="Fibonacci", options=["Fibonacci", "Traditional"], group="Pivot Points")

pivotPointCircleWidth = input(2, title="Width of Pivot Point circles", minval=1, group="Pivot Points")

plotVWAP = input(true, title="Plot VWAP?", group="VWAP")

plotAvgPrice = input(true, title="Plot Average Price?", group="VWAP")

plotVWAPCrossPrice = input(false, title="Plot Price Crossing VWAP?", group="VWAP")

reso = input(title="Period", type=input.resolution, defval="D", group="VWAP")

cumulativePeriod = input(14, "VWAP Cumulative Period", group="VWAP")

plotStochRSICross = input(false, title="Plot StochRSI Cross?", group="StochRSI")

smoothK = input(3, "K", minval=1, group="StochRSI", inline="K&D")

smoothD = input(3, "D", minval=1, group="StochRSI", inline="K&D")

lengthRSI = input(14, "RSI Length", minval=1, group="Stochastic-RSI", inline="length")

lengthStoch = input(14, "Stochastic Length", minval=1, group="Stochastic-RSI", inline="length")

rsiSrc = input(close, title="RSI Source", group="Stochastic-RSI")

plotLong = input(true, title="Plot Long Opportunity?", group="Strategy only")

plotShort = input(true, title="Plot Short Opportunity?", group="Strategy only")

tradingDirection = input(title="Strategy trading Direction: ", defval="L&S", options=["L&S", "L", "S"], group="Strategy only")

takeProfit = input(1.0, title='Take Profit %', group="Strategy only") / 100

plotTP = input(true, title="Plot Take Profit?", group="Strategy only")

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="Backtesting range", inline="Start Date")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="Backtesting range", inline="Start Date")

startYear = input(title="Start Year", type=input.integer,

defval=2017, minval=1800, maxval=2100, group="Backtesting range", inline="Start Date")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group="Backtesting range", inline="End Date")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="Backtesting range", inline="End Date")

endYear = input(title="End Year", type=input.integer,

defval=2050, minval=1800, maxval=2100, group="Backtesting range", inline="End Date")

// PivotPoint code (PVTvX by DGT has some nice code on PP)

candleHigh = security(syminfo.tickerid,"D", high[1], lookahead=barmerge.lookahead_on)

candleLow = security(syminfo.tickerid,"D", low[1], lookahead=barmerge.lookahead_on)

candleClose = security(syminfo.tickerid,"D", close[1], lookahead=barmerge.lookahead_on)

pivotPoint = (candleHigh+candleLow+candleClose) / 3

float resistance1 = na

float resistance2 = na

float resistance3 = na

float support1 = na

float support2 = na

float support3 = na

if pivotPointsType == "Fibonacci"

resistance1 := pivotPoint + 0.382 * (candleHigh - candleLow)

resistance2 := pivotPoint + 0.618 * (candleHigh - candleLow)

resistance3 := pivotPoint + (candleHigh - candleLow)

support1 := pivotPoint - 0.382 * (candleHigh - candleLow)

support2 := pivotPoint - 0.618 * (candleHigh - candleLow)

support3 := pivotPoint - (candleHigh - candleLow)

else if pivotPointsType == "Traditional"

resistance1 := 2 * pivotPoint - candleLow

resistance2 := pivotPoint + (candleHigh - candleLow)

resistance3 := candleHigh + 2 * (pivotPoint - candleLow)

support1 := 2 * pivotPoint - candleHigh

support2 := pivotPoint - (candleHigh - candleLow)

support3 := candleLow - 2 * (candleHigh - pivotPoint)

plot(series = plotPivotPoints ? support1 : na, color=#ff0000, title="S1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support2 : na, color=#800000, title="S2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support3 : na, color=#330000, title="S3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? pivotPoint : na, color=#FFA500, title="PP", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance1 : na, color=#00FF00, title="R1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance2 : na, color=#008000, title="R2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance3 : na, color=#003300, title="R3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

pivotPointCrossedUp = ((low < support3) and (close > support3)) or ((low < support2) and (close > support2)) or ((low < support1) and (close > support1)) or ((low < pivotPoint) and (close > pivotPoint))

pivotPointCrossedDown = ((high > support3) and (close < support3)) or ((high > support2) and (close < support2)) or ((high > support1) and (close < support1)) or ((high > pivotPoint) and (close < pivotPoint))

plotPPColor = pivotPointCrossedUp ? color.green :

pivotPointCrossedDown ? color.red :

na

plotshape(series = plotAveragePriceCrossedPivotPoint ? (pivotPointCrossedUp or pivotPointCrossedDown) : na, title="PP Cross", style = shape.triangleup, location=location.belowbar, color=plotPPColor, text="PP", size=size.small)

// VWAP (taken from the TV code)

// There are five steps in calculating VWAP:

//

// 1. Calculate the Typical Price for the period. [(High + Low + Close)/3)]

// 2. Multiply the Typical Price by the period Volume (Typical Price x Volume)

// 3. Create a Cumulative Total of Typical Price. Cumulative(Typical Price x Volume)

// 4. Create a Cumulative Total of Volume. Cumulative(Volume)

// 5. Divide the Cumulative Totals.

//

// VWAP = Cumulative(Typical Price x Volume) / Cumulative(Volume)

// Emperor's Edition

t = time(reso)

debut = na(t[1]) or t > t[1]

addsource = ohlc4 * volume

addvol = volume

addsource := debut ? addsource : addsource + addsource[1]

addvol := debut ? addvol : addvol + addvol[1]

vwapValue = addsource / addvol

pVWAP = plot(series = plotVWAP ? vwapValue : na, color=color.purple, title="VWAP")

pAvgPrice = plot(series = plotAvgPrice ? ohlc4 : na, color=color.blue, title="PRICE")

fill(pVWAP, pAvgPrice, color = ohlc4 > vwapValue ? color.red : color.green, title="VWAP PRICE FILL")

vwapCrossUp = (low < vwapValue) and (vwapValue < high) and (close > open) // added green candle check

vwapCrossDown = (high > vwapValue) and (vwapValue > low) and (close < open) // added red candle check

plotVWAPColor = vwapCrossUp ? color.green :

vwapCrossDown ? color.red :

na

plotshape(series = plotVWAPCrossPrice ? (vwapCrossUp or vwapCrossDown) : na, title="VWAP Cross Price", style=shape.triangleup, location=location.belowbar, color=plotVWAPColor, text="VWAP", size=size.small)

// Stochastic RSI

rsi1 = rsi(rsiSrc, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

sRsiCrossUp = k[1] < d[1] and k > d

sRsiCrossDown = k[1] > d[1] and k < d

plotColor = sRsiCrossUp ? color.green :

sRsiCrossDown ? color.red :

na

plotshape(series = plotStochRSICross ? (sRsiCrossUp or sRsiCrossDown) : na, title="StochRSI Cross Up", style=shape.triangleup, location=location.belowbar, color=plotColor, text="StochRSI", size=size.small)

// Long Trades

sRsiCrossedUp = sRsiCrossUp or sRsiCrossUp[1]

vwapCrossedUp = vwapCrossUp or vwapCrossUp[1]

// longCond1 = (sRsiCross and vwapCross) or (sRsiCross[1] and vwapCross) or (sRsiCross and vwapCross[1])

longCond1 = (sRsiCrossedUp[1] and vwapCrossedUp[1])

longCond2 = pivotPointCrossedUp[1]

longCond3 = (close[1] > open[1]) and (close > open) // check this

longCond = longCond1 and longCond2 and longCond3

plotshape(series = plotLong ? longCond : na, title="Long", style=shape.triangleup, location=location.belowbar, color=color.green, text="Long", size=size.normal)

// Short Trades

sRsiCrossedDown = sRsiCrossDown or sRsiCrossDown[1]

vwapCrossedDown = vwapCrossDown or vwapCrossDown[1]

shortCond1 = (sRsiCrossedDown[1] and vwapCrossedDown[1])

shortCond2 = pivotPointCrossedDown[1]

shortCond3 = (close[1] < open[1]) and (close < open)

shortCond = shortCond1 and shortCond2 and shortCond3

plotshape(series = plotShort ? shortCond : na, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, text="Short", size=size.normal)

// alertcondition(condition=longCond, title="Long", message="Going long")

// alertcondition(condition=shortCond, title="Short", message="Going short")

// 🔥 Uncomment the lines below for the strategy and revert for the study

takeProfitLong = strategy.position_avg_price * (1 + takeProfit)

takeProfitShort = strategy.position_avg_price * (1 - takeProfit)

exitTp = ((strategy.position_size > 0) and (close > takeProfitLong)) or ((strategy.position_size < 0) and (close < takeProfitShort))

strategy.risk.allow_entry_in(tradingDirection == "L" ? strategy.direction.long : tradingDirection == "S" ? strategy.direction.short : strategy.direction.all)

plot(series = (plotTP and strategy.position_size > 0) ? takeProfitLong : na, title="TP Level",color=color.green, style=plot.style_linebr, linewidth=2)

plot(series = (plotTP and strategy.position_size < 0) ? takeProfitShort : na, title="TP Level",color=color.red, style=plot.style_linebr, linewidth=2)

inDateRange = (time >= timestamp(syminfo.timezone, startYear,

startMonth, startDate, 0, 0)) and (time < timestamp(syminfo.timezone, endYear, endMonth, endDate, 0, 0))

strategy.entry("VWAP", strategy.long, comment="Long", when=longCond and inDateRange)

strategy.entry("VWAP", strategy.short, comment="Short", when=shortCond and inDateRange)

strategy.close(id="VWAP", when=exitTp)

if (not inDateRange)

strategy.close_all()