概述

本策略基于均线、ATR指标、布林带进行多空判断,同时结合力量指标实现突破交易,属于突破类策略。

策略原理

计算布林带中的中线、上线、下线。中线为close的sma均线,上下线为中线正负stdDev标准差。

计算快速ATR和慢速ATR。快速ATR参数为20,慢速ATR参数为50。

计算力量指标XFORCE,为volume*(close-前一close)的累积。计算XFORCE的快EMA和慢EMA。

判断多头信号:快速XFORCE上穿慢速XFORCE,且快速ATR>慢速ATR,且收盘价>开盘价。

判断空头信号:快速XFORCE下穿慢速XFORCE,且快速ATR>慢速ATR,且收盘价<开盘价。

当触发多头信号时做多,触发空头信号时做空。

策略优势分析

均线提供趋势判断,布林带提供突破买卖点。

ATR指标判断市场波动率,实现波动率交易。

力量指标判断力量方向,实现力量突破。

多指标组合,提供更全面判断。

规则清晰简单,容易理解实现。

回测表现良好,收益稳定。

策略风险分析

布林带上下线过宽过窄都会产生错误信号。

ATR参数设置不当,无法抓取市场波动。

力量指标作用有限,无法判断真实趋势反转。

多指标组合,参数调整及权重分配难度大。

突破信号时点易误判,存在背离现象。

回撤可能较大,可通过止损来控制。

策略优化方向

优化布林带参数,适应不同周期及股票特性。

优化ATR参数,更好捕捉市场波动率。

增加如MACD等趋势指标,提供趋势校验。

增加止损策略,如跟踪止损控制回撤。

增加机器学习算法,利用AI判断反转信号。

多周期结合,不同周期综合判断,降低误判率。

总结

本策略整合均线、ATR、布林带和力量指标,形成一套较为完整的突破交易体系。通过参数优化,引入趋势判断指标进行确认,增加止损策略,以及加入AI判断,可以进一步增强策略稳定性和收益水平。但任何策略都不能完美,需要根据回测结果不断优化调整,才能适应市场的变化。

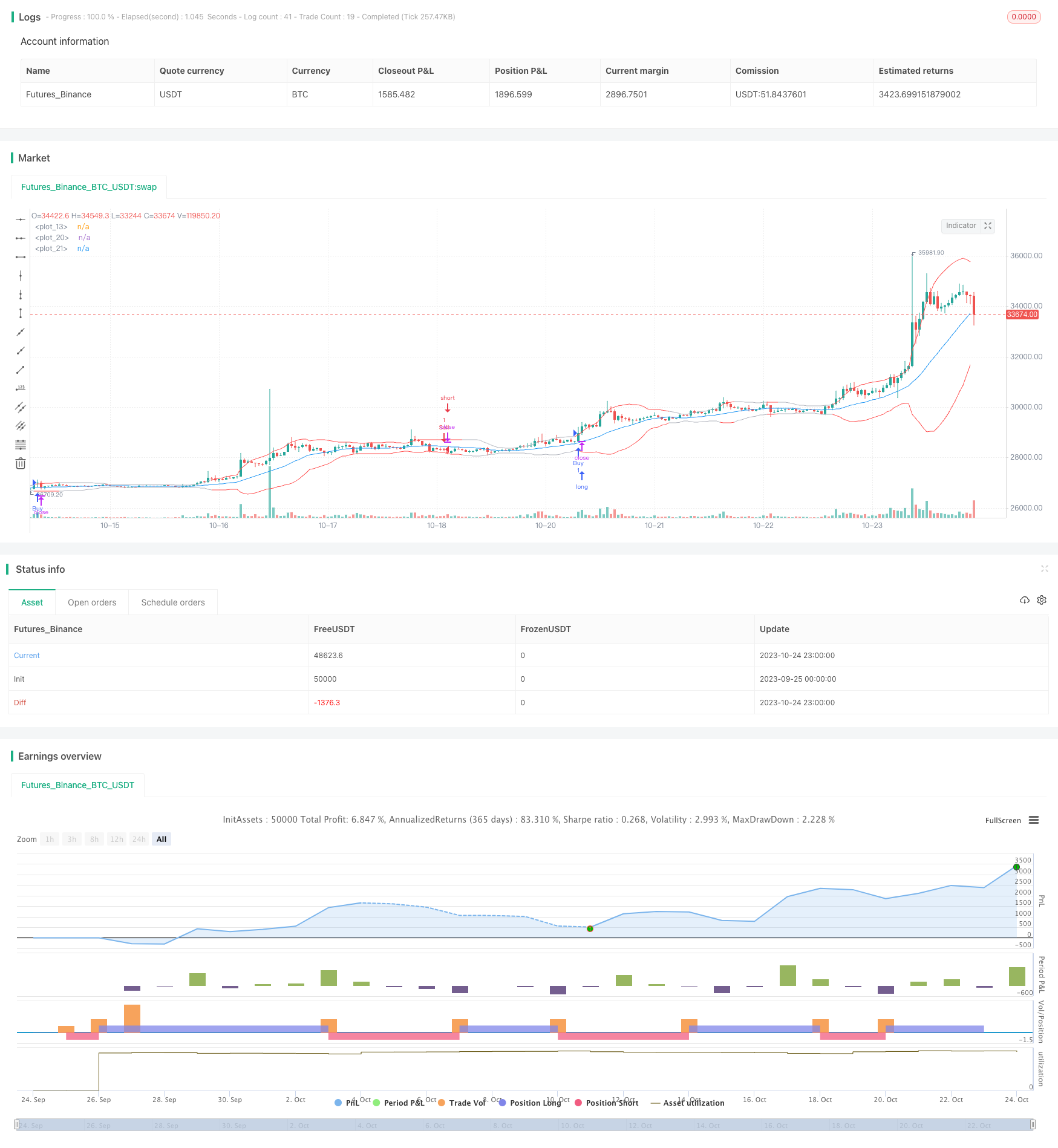

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("yuthavithi volatility based force trade scalper strategy", overlay=true)

fast = input(3, minval= 1, title="Fast")

slow = input(20, minval = 1, title = "Slow")

atrFast = input(20, minval = 1, title = "ATR Fast")

atrSlow = input(50, minval = 1, title = "ATR Slow")

len = input(20, minval=1, title="Length")

multiplier = input(2, minval=1, title="multiplier")

src = input(close, title="Source")

bbMid = sma(src, len)

plot(bbMid, color=blue)

atrFastVal = atr(atrFast)

atrSlowVal = atr(atrSlow)

stdOut = stdev(close, len)

bbUpper = bbMid + stdOut * multiplier

bbLower = bbMid - stdOut * multiplier

plot(bbUpper, color = (atrFastVal > atrSlowVal ? red : silver))

plot(bbLower, color = (atrFastVal > atrSlowVal ? red : silver))

force = volume * (close - nz(close[1]))

xforce = cum(force)

xforceFast = ema(xforce, fast)

xforceSlow = ema(xforce, slow)

bearish = ((xforceFast < xforceSlow) and (atrFastVal > atrSlowVal)) and ((xforceFast[1] > xforceSlow[1]) or (atrFastVal[1] < atrSlowVal[1])) and (close < open)

bullish = ((xforceFast > xforceSlow) and (atrFastVal > atrSlowVal)) and ((xforceFast[1] < xforceSlow[1]) or (atrFastVal[1] < atrSlowVal[1])) and (close > open)

if (bullish)

strategy.entry("Buy", strategy.long)

if (bearish)

strategy.entry("Sell", strategy.short)