概述

RSI多空动量策略是一种典型的以Larry Connors RSI指标为基础,使用RSI指标的超买超卖信号来决定买入卖出的动量策略。该策略主要判断价格是否处于超买或超卖状态,并以此作为买入卖出信号。

策略原理

该策略通过计算一段时间内的价格上涨动量和下跌动量,来构建RSI指标。当RSI指标低于超卖线10时视为超卖,当指标高于超买线90时视为超买。策略在RSI指标从低位上穿超卖线时产生买入信号,在RSI指标从高位下穿超买线时产生卖出信号。

策略额外加入了均线判断规则,要求5日均线高于200日均线时才能产生买入信号,5日均线低于200日均线时才能产生卖出信号。这可以过滤掉短期反弹造成的假信号。

另外,策略还增加了止盈机制。当持有多头头寸时,如果RSI指标上穿超买线90,会强制平掉所有多头;当持有空头头寸时,如果RSI指标下穿超卖线10,会强制平掉所有空头。这可以锁定盈利,避免亏损扩大。

策略优势

使用RSI指标判断超买超卖状态,可以捕捉到价格反转的时机。

增加均线过滤,可以减少短期噪音造成的错误交易。

设置止盈机制,可以很好控制风险,避免亏损扩大。

策略规则简单清晰,容易理解实现。

RSI是一种常用且实用的技术指标,许多股票和数字货币都适用。

策略风险

RSI指标存在反转失败的可能。价格超买超卖不一定会发生反转。

均线过滤也可能过滤掉较好的交易机会。

止盈设置不当也会过早止盈,无法持有较长线的趋势。

需要适当调整参数,如计算RSI的周期长度、超买超卖阈值、均线参数等。

可通过优化参数、组合其他指标、适当宽松止盈以减少上述风险。

策略优化方向

可以测试不同周期的RSI指标效果。

可以增加其他指标,如KDJ、MACD等与RSI形成组合。

可以根据市场情况调整超买超卖阈值。

可以根据具体持仓时间调整止盈激活的RSI数值。

可以添加止损策略,在亏损达到一定比例时止损。

可以优化均线系统,改为动态追踪止损。

总结

RSI多空动量策略利用RSI指标判断超买超卖状态作为信号,加入均线和止盈规则进行筛选过滤,可以有效抓住短期反转机会。该策略简单实用,值得进一步测试优化,以适应更广泛的市场情况。总体来说,该策略提供了一个不错的思路,可以作为量化交易策略开发的参考。

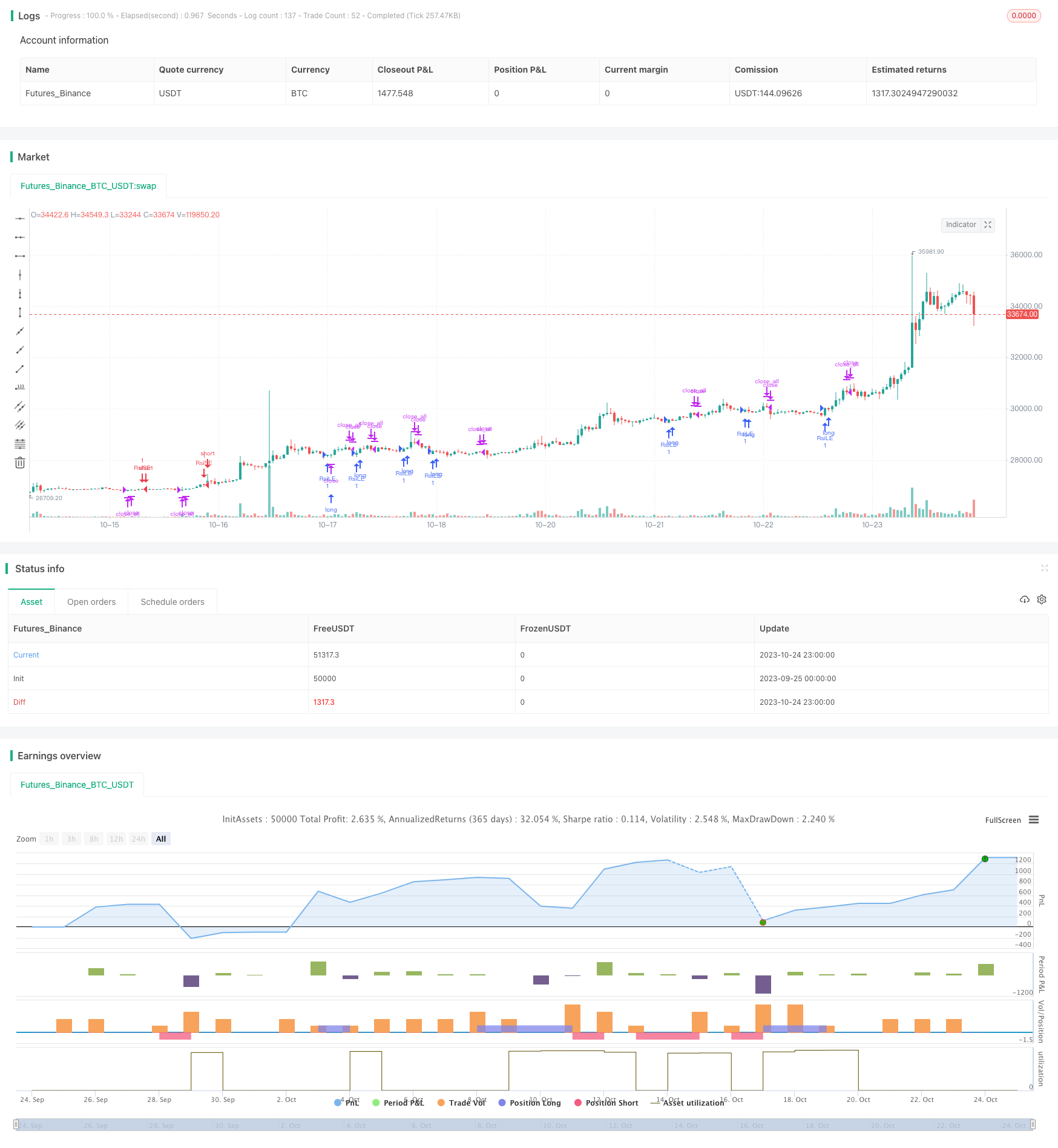

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//authour: SudeepBisht

//@version=3

//Based on Larry Connors RSI-2 Strategy - Lower RSI

strategy("SB_CM_RSI_2_Strategy_Version 2.0", overlay=true)

src = close

entry= input(defval=0,title="Entry area")

entry:=nz(entry[1])

overBought=input(90)

overSold=input(10)

//RSI CODE

up = rma(max(change(src), 0), 2)

down = rma(-min(change(src), 0), 2)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//Criteria for Moving Avg rules

ma5 = sma(close,5)

ma200= sma(close, 200)

//Rule for RSI Color

col = close > ma200 and close < ma5 and rsi < 10 ? lime : close < ma200 and close > ma5 and rsi > 90 ? red : silver

chk= col==red?-1:col==lime?1:0

if (not na(rsi))

if (crossover(rsi, overSold))

if(chk[1]==1)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

entry:=1

if (crossunder(rsi, overBought))

if(chk[1]==-1)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

entry:=-1

if (not na(rsi))

if (crossover(rsi, overSold) and entry==-1)

strategy.close_all()

//strategy.entry("RsiLE", strategy.long, comment="RsiLE")

entry:=0

if (crossunder(rsi, overBought) and entry==1)

strategy.close_all()

//strategy.entry("RsiSE", strategy.short, comment="RsiSE")

entry:=0