概述

这是一个利用双Stochastics指标与成交量加权移动平均线的组合来识别趋势的策略。该策略运用两个不同周期的Stochastics指标,一个是短周期的,一个是长周期的,再结合成交量加权移动平均线来判断目前的趋势方向。

策略原理

该策略主要通过如下几个部分来实现对趋势的判断:

计算一个短周期的Stochastics指标,周期长度为input(30),平滑参数为2

计算一个长周期的Stochastics指标,周期长度为input(90),平滑参数为2

将短周期和长周期的Stochastics指标相加,得到一个综合的Stochastics曲线ts

对ts曲线计算一个成交量加权移动平均线tsl,周期长度为input(30)

比较tsl当前值与其1周期前的值,当tsl上扬时,认为是上升趋势,当tsl下挫时,认为是下降趋势

再结合Stochastics曲线的位置来判断是否为多头或空头信号

- 当tsl上扬且ts在中间区时为多头信号

- 当tsl下挫且ts在中间区时为空头信号

策略优势分析

该策略结合了趋势判断和超买超卖判断,可以比较可靠地识别趋势方向。具体优势如下:

双Stochastics指标可以同时反映短期和长期的超买超卖情况,避免漏掉某些信号

成交量加权可以过滤掉一些虚假的突破信号

Stochastics曲线的位置再次验证了趋势信号的可靠性

参数可调,可以根据不同市场适当调整周期长度

策略思路清晰简洁,容易理解和修改

风险及改进分析

该策略也存在一些风险需要注意:

Stochastics指标容易发出假信号,需要结合较长周期指标过滤

固定周期参数不适应所有市场情况,可以考虑动态优化参数

仅基于技术指标,可结合基本面因素提高准确率

成交量数据不准确也会影响结果,需要验证成交量数据质量

回测时间不足,需要更长的历史数据验证效果

可优化入场点位,现在是 crosses under最低值直接做多,可设置缓冲区

总结

总体来说,该策略利用双Stochastics指标和成交量加权移动平均线进行趋势判断,在理论上可以比较可靠地识别趋势转折点。但参数设置需要针对具体市场进行优化,且存在一定假信号风险。建议结合其他因素如基本面、长期趋势等来综合判断,以提高策略Profit Factor。该策略思路简单清晰,为量化交易提供了一个模板,可根据需求进行修改优化,具有很强的应用价值。

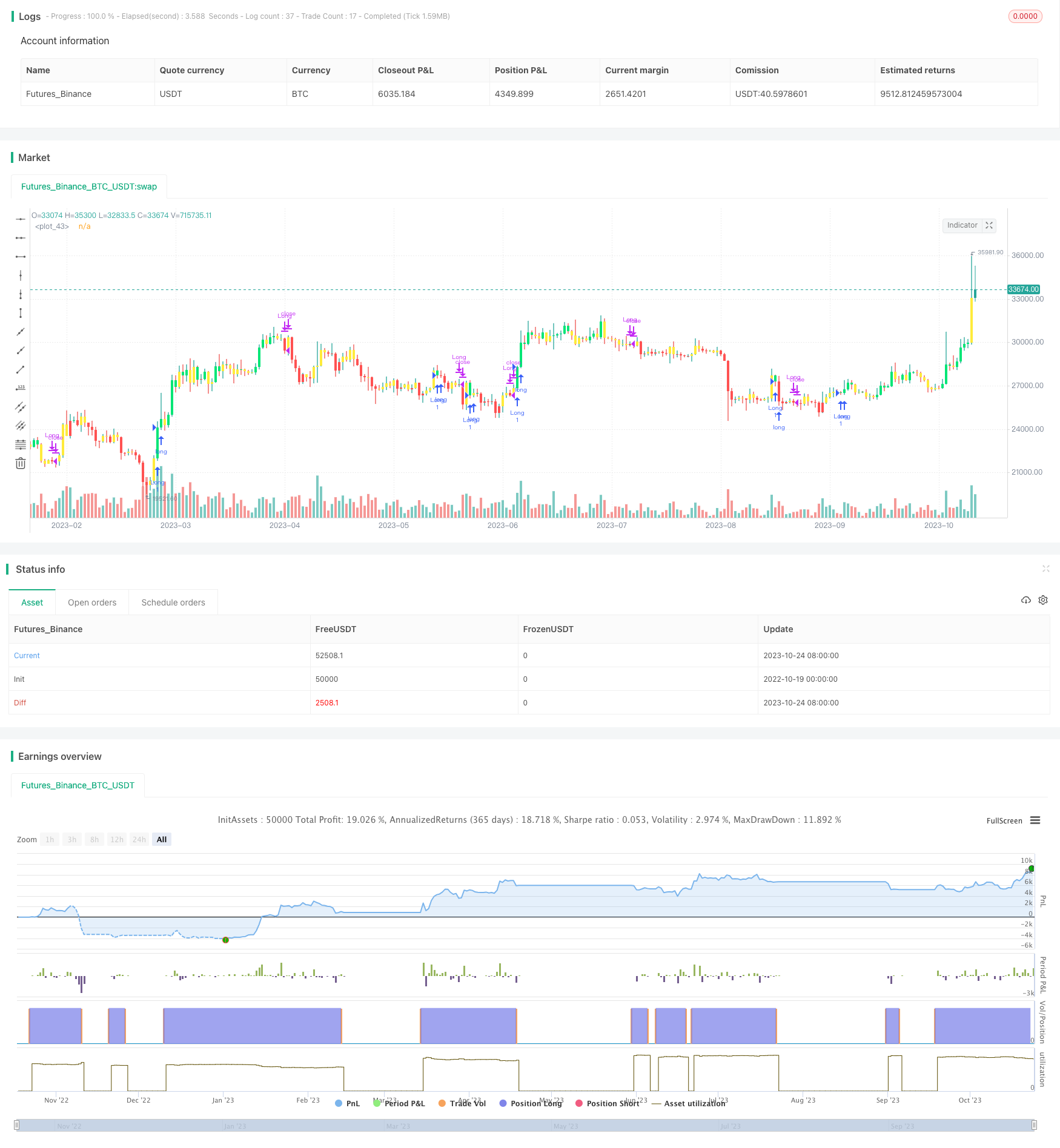

/*backtest

start: 2022-10-19 00:00:00

end: 2023-10-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Trend Finder V2", shorttitle="TFV2", format=format.price, precision=2, overlay = true)

//----------Indicator------------//

periodK = input(30)

periodD = 3

smoothK = 2

periodK_two = input(90)

periodD_two = 3

smoothK_two = 2

k = sma(stoch(close, high, low, periodK), smoothK)

d = sma(k, periodD)

k_two = sma(stoch(close, high, low, periodK_two), smoothK_two)

d_two = sma(k, periodD_two)

ts = k + k_two

tsl = vwma(ts, input(30, title = "VWMA Length"))

//--------Label parameter--------//

up_label = tsl[1] < 100 and tsl > 100 ? 1 : 0

down_label = tsl[1] > 100 and tsl < 100 ? 1 : 0

//----------Color Code-----------//

//tsl_col = tsl > 100 and tsl > tsl[1] ? color.aqua : tsl > 100 and tsl < tsl[1] ? color.green : tsl < 100 and tsl > tsl[1] ? color.maroon : tsl < 100 and tsl < tsl[1] ? color.red : color.silver

//tsl_col = tsl > 100 and ts < 100 and ts > ts[1] ? color.aqua : tsl > 100 and ts > 100 and (ts > ts[1] or ts < ts[1]) ? color.green : tsl < 100 and ts > 100 and ts < ts[1] ? color.red : tsl < 100 and ts < 100 and (ts < ts[1] or ts > ts[1]) ? color.maroon : color.purple

tsl_col = ts > ts[1] and tsl > tsl[1] ? color.lime : ts < ts[1] and tsl < tsl[1] ? color.red : color.yellow

ts_col = (tsl_col == color.lime or tsl_col == color.maroon) and (k>k[1] and k < 30) ? color.lime : (tsl_col == color.green or tsl_col == color.red) and (k < k[1] and k > 70) ? color.red : color.silver

//-------------Plots-------------//

buy = tsl_col[1] == color.yellow and tsl_col == color.lime ? 1 : 0

sell = tsl_col[1] == color.yellow and tsl_col == color.red ? -1 : 0

plotcandle(open,high,low,close, color=tsl_col)

strategy.entry("Long", strategy.long,when=buy==1)

strategy.close("Long", when=sell==-1)