概述

本策略基于拉里·康诺斯的经典策略思想,利用双均线系统捕捉市场的中短线震荡,在超买超卖区实现落袋为安的操作策略。

策略原理

使用2周期RSI指标判断股价是否处于超卖区域。

使用长周期均线(200周期)判断大趋势方向。只有当价格高于长周期均线时才考虑建仓。

当价格高于长周期均线且RSI指标低于超卖线时,以市价单开仓做多。

当价格上涨突破短周期均线(5周期)时,以市价单全平多单止盈。

此外,策略还提供以下可配置选项:

RSI参数:周期长度、超买超卖线位置。

均线参数:长短均线周期。

RSI均线过滤:添加RSI均线判断,避免RSI指标震荡过激。

止损设置:可选择是否添加止损。

优势分析

使用双均线系统,能够有效跟踪中长线趋势。

RSI指标避免在剧烈震荡中错失最佳入场时机。

可配置灵活,适合不同参数优化。

rundown突破策略,不容易漏单。

风险分析

双均线策略对参数敏感,需要优化参数以达到最佳效果。

无止损设置存在亏损扩大的风险。需要谨慎资金管理,控制单笔仓位规模。

震荡行情中虚假突破可能存在亏损风险。可以考虑优化均线周期或添加其他条件作为过滤器。

回测数据拟合风险。需在多市场多时间段验证策略稳健性。

优化方向

测试优化RSI和均线的参数组合,找到最佳参数。

测试不同的入场过滤条件,如交易量突增等,减少虚假信号。

加入跟踪止损来控制单笔亏损。需要评估止损设置对总体盈利的影响。

评估不同持仓时间对盈利的影响,寻找最佳持仓周期。

在更长的时间周期(如日线级别)测试策略稳健性。

总结

本策略整合了双均线趋势跟踪和RSI指标的超买超卖特性,是一种典型的突破系统。通过参数优化、严格的资金管理和稳健性验证,该策略可以成为量化交易的有力工具。但是交易者需要警惕回测过拟合问题,在实盘中继续调整和完善策略,使之适应多变的市场环境。

策略源码

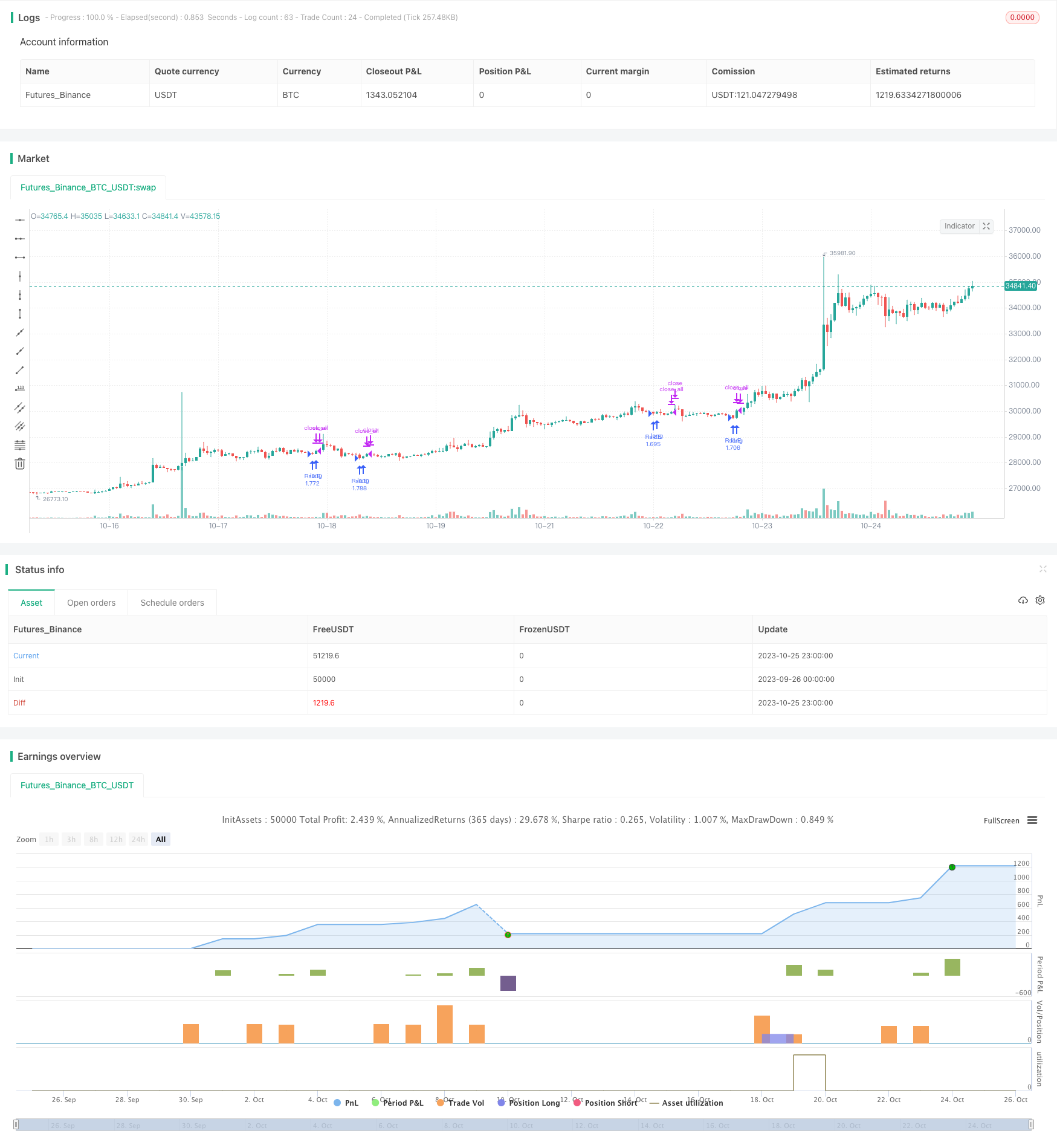

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("RSI Strategy", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//Starter Parameters

length = input(title="RSI Lenght", defval=2)

overBoughtRSI = input(title="OverBought Level for RSI", defval=10)

shortLength = input(title="Short MA Length", defval=5)

longLength = input(title="Long MA Length", defval=200)

RuleMRSI=input(title="RSI Moving Average Filter", defval= true)

lengthmrsi=input(title="RSI Moving Average Length", defval=4)

overBoughtMRSI=input(title="OverBought Level for the Moving Average of the RSI", defval=30)

Rulestop=input(title="Apply Stop Loss", defval=false)

stop_percentual=input(title="% Stop Loss", defval=10)

//RSI

vrsi = rsi(close, length)

//Moving Averages

longma = sma(close,longLength)

shortma = sma(close,shortLength)

mrsi=sma(vrsi,lengthmrsi)

//Stop Loss

stop_level = strategy.position_avg_price*((100-stop_percentual)/100)

//Backtest Period

testStartYear = input(2009, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(2, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2020, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(30, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

//Strategy

if testPeriod() and (not na(vrsi))

if (RuleMRSI==false) and (Rulestop==false)

if (vrsi<overBoughtRSI) and (close>longma)

strategy.entry("RsiLE", strategy.long , comment="Open")

if (close>shortma)

strategy.close_all()

if (RuleMRSI==true) and (Rulestop==false)

if (vrsi<overBoughtRSI) and (close>longma) and (mrsi<overBoughtMRSI)

strategy.entry("RsiLE", strategy.long , comment="Open")

if (close>shortma)

strategy.close_all()

if (RuleMRSI==false) and (Rulestop==true)

if (vrsi<overBoughtRSI) and (close>longma)

strategy.entry("RsiLE", strategy.long , comment="Open")

strategy.exit("RsiLE", stop = stop_level)

if (close>shortma)

strategy.close_all()

if (RuleMRSI==true) and (Rulestop==true)

if (vrsi<overBoughtRSI) and (close>longma) and (mrsi<overBoughtMRSI)

strategy.entry("RsiLE", strategy.long , comment="Open")

strategy.exit("RsiLE", stop = stop_level)

if (close>shortma)

strategy.close_all()