概述

该策略主要利用均线交叉原理,结合RSI指标反转信号,以及自定义的双线追踪算法实现均线交叉追踪交易。策略追踪两个不同周期的均线交叉,一个快速均线追踪短期趋势,另一个慢速均线追踪长期趋势。当快速均线向上穿过慢速均线时,表示短期趋势向上,可以买入;当快速均线向下穿过慢速均线时,表示短期趋势结束,应该平仓。

策略原理

计算两组不同参数的VWAP均线,分别代表长期趋势和短期趋势

- 慢速天幕线和基准线计算长期趋势

- 快速天幕线和基准线计算短期趋势

分别取两组天幕线和基准线的平均值作为慢速均线和快速均线

计算布林带指标判断盘整和突破

- 中线为快速均线和慢速均线的平均值

- 布林带上下轨用于判断突破

计算TSV指标判断交易量能量

- TSV大于0表示上涨力量大于下跌力量

- TSV大于其EMA表示力量增强

计算RSI指标判断超买超卖

- RSI低于30时为超卖区间,可以买入

- RSI高于70时为超买区间,应该卖出

入场条件:

- 快速均线上穿慢速均线

- 关闭价上穿布林带上轨

- TSV大于0且大于其EMA

- RSI低于30

出场条件:

- 快速均线下穿慢速均线

- RSI高于70

优势分析

使用双均线系统,可以同时捕捉长短期趋势

RSI指标避免买入超买区域,卖出超卖区域

TSV指标确保有足够的交易量支撑趋势

利用布林带判断关键的突破点

多种指标组合,可以有效过滤假突破

风险分析

均线系统容易产生错误信号,需要辅助指标过滤

RSI指标参数需要优化,否则可能错过买卖点

TSV指标对参数也很敏感,需要仔细测试

突破布林带上轨有可能是假突破,需要验证

多指标组合,参数优化难度大,容易过度优化

训练和测试数据不充分可能导致曲线拟合

优化方向

测试更多周期参数,寻找最佳参数组合

尝试其他指标如MACD、KD替代或结合RSI

参数优化要充分利用walk forward分析

增加止损策略,以控制单笔损失

考虑加入机器学习模型辅助信号判断

针对不同市场调整参数,不要过度依赖单一参数组合

总结

本策略通过双均线系统捕捉长短期趋势,同时使用RSI、TSV、布林带等多种指标过滤信号。策略优势是可以顺势而为,捕捉长期上升浪潮。但也存在一定的假信号风险,需要进一步优化参数并控制止损来降低风险。总体来说,该策略结合趋势跟踪和反转指标,在长线上升市场中效果较好,但需要针对不同市场做getParameter调整。

策略源码

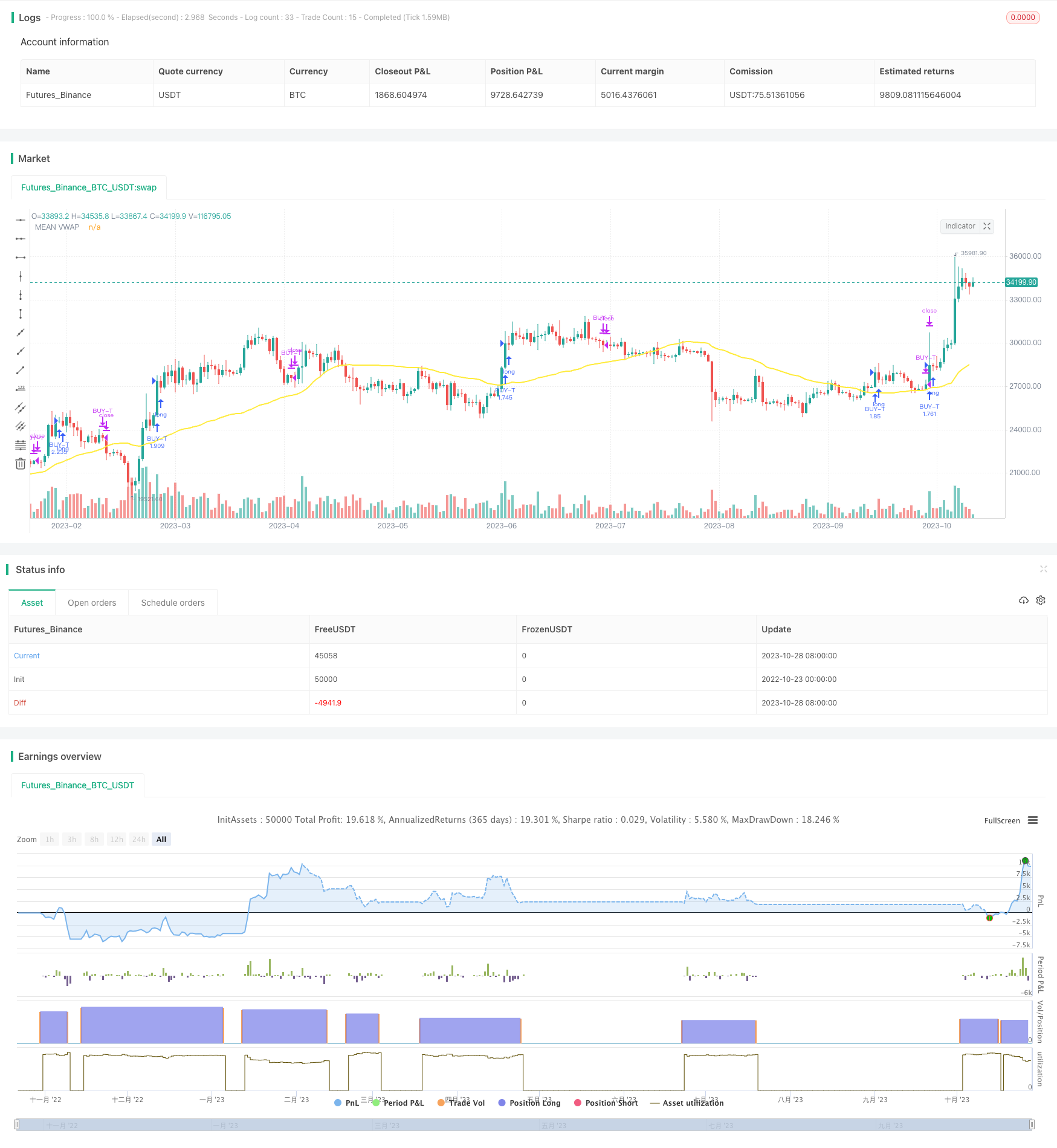

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Credits

// "Vwap with period" code which used in this strategy to calculate the leadLine was written by "neolao" active on https://tr.tradingview.com/u/neolao/

// "TSV" code which used in this strategy was written by "liw0" active on https://www.tradingview.com/u/liw0. The code is corrected by "vitelot" December 2018.

// "Vidya" code which used in this strategy was written by "everget" active on https://tr.tradingview.com/u/everget/

strategy("HYE Combo Market [Strategy] (Vwap Mean Reversion + Trend Hunter)", overlay = true, initial_capital = 1000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_value = 0.025)

//Strategy inputs

source = input(title = "Source", defval = close, group = "Mean Reversion Strategy Inputs")

smallcumulativePeriod = input(title = "Small VWAP", defval = 8, group = "Mean Reversion Strategy Inputs")

bigcumulativePeriod = input(title = "Big VWAP", defval = 10, group = "Mean Reversion Strategy Inputs")

meancumulativePeriod = input(title = "Mean VWAP", defval = 50, group = "Mean Reversion Strategy Inputs")

percentBelowToBuy = input(title = "Percent below to buy %", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiPeriod = input(title = "Rsi Period", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiEmaPeriod = input(title = "Rsi Ema Period", defval = 5, group = "Mean Reversion Strategy Inputs")

rsiLevelforBuy = input(title = "Maximum Rsi Level for Buy", defval = 30, group = "Mean Reversion Strategy Inputs")

slowtenkansenPeriod = input(9, minval=1, title="Slow Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

slowkijunsenPeriod = input(13, minval=1, title="Slow Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fasttenkansenPeriod = input(3, minval=1, title="Fast Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fastkijunsenPeriod = input(7, minval=1, title="Fast Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

BBlength = input(20, minval=1, title= "Bollinger Band Length", group = "Trend Hunter Strategy Inputs")

BBmult = input(2.0, minval=0.001, maxval=50, title="Bollinger Band StdDev", group = "Trend Hunter Strategy Inputs")

tsvlength = input(20, minval=1, title="TSV Length", group = "Trend Hunter Strategy Inputs")

tsvemaperiod = input(7, minval=1, title="TSV Ema Length", group = "Trend Hunter Strategy Inputs")

length = input(title="Vidya Length", type=input.integer, defval=20, group = "Trend Hunter Strategy Inputs")

src = input(title="Vidya Source", type=input.source, defval= hl2 , group = "Trend Hunter Strategy Inputs")

// Vidya Calculation

getCMO(src, length) =>

mom = change(src)

upSum = sum(max(mom, 0), length)

downSum = sum(-min(mom, 0), length)

out = (upSum - downSum) / (upSum + downSum)

out

cmo = abs(getCMO(src, length))

alpha = 2 / (length + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group = "Strategy Date Range")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group = "Strategy Date Range")

startYear = input(title="Start Year", type=input.integer,

defval=2000, minval=1800, maxval=2100, group = "Strategy Date Range")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group = "Strategy Date Range")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group = "Strategy Date Range")

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100, group = "Strategy Date Range")

inDateRange = true

// Mean Reversion Strategy Calculation

typicalPriceS = (high + low + close) / 3

typicalPriceVolumeS = typicalPriceS * volume

cumulativeTypicalPriceVolumeS = sum(typicalPriceVolumeS, smallcumulativePeriod)

cumulativeVolumeS = sum(volume, smallcumulativePeriod)

smallvwapValue = cumulativeTypicalPriceVolumeS / cumulativeVolumeS

typicalPriceB = (high + low + close) / 3

typicalPriceVolumeB = typicalPriceB * volume

cumulativeTypicalPriceVolumeB = sum(typicalPriceVolumeB, bigcumulativePeriod)

cumulativeVolumeB = sum(volume, bigcumulativePeriod)

bigvwapValue = cumulativeTypicalPriceVolumeB / cumulativeVolumeB

typicalPriceM = (high + low + close) / 3

typicalPriceVolumeM = typicalPriceM * volume

cumulativeTypicalPriceVolumeM = sum(typicalPriceVolumeM, meancumulativePeriod)

cumulativeVolumeM = sum(volume, meancumulativePeriod)

meanvwapValue = cumulativeTypicalPriceVolumeM / cumulativeVolumeM

rsiValue = rsi(source, rsiPeriod)

rsiEMA = ema(rsiValue, rsiEmaPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * bigvwapValue[0]

inTrade = strategy.position_size > 0

notInTrade = strategy.position_size <= 0

if(crossunder(smallvwapValue, buyMA) and rsiEMA < rsiLevelforBuy and close < meanvwapValue and inDateRange and notInTrade)

strategy.entry("BUY-M", strategy.long)

if(close > meanvwapValue or not inDateRange)

strategy.close("BUY-M")

// Trend Hunter Strategy Calculation

// Slow Tenkan Sen Calculation

typicalPriceTS = (high + low + close) / 3

typicalPriceVolumeTS = typicalPriceTS * volume

cumulativeTypicalPriceVolumeTS = sum(typicalPriceVolumeTS, slowtenkansenPeriod)

cumulativeVolumeTS = sum(volume, slowtenkansenPeriod)

slowtenkansenvwapValue = cumulativeTypicalPriceVolumeTS / cumulativeVolumeTS

// Slow Kijun Sen Calculation

typicalPriceKS = (high + low + close) / 3

typicalPriceVolumeKS = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKS = sum(typicalPriceVolumeKS, slowkijunsenPeriod)

cumulativeVolumeKS = sum(volume, slowkijunsenPeriod)

slowkijunsenvwapValue = cumulativeTypicalPriceVolumeKS / cumulativeVolumeKS

// Fast Tenkan Sen Calculation

typicalPriceTF = (high + low + close) / 3

typicalPriceVolumeTF = typicalPriceTF * volume

cumulativeTypicalPriceVolumeTF = sum(typicalPriceVolumeTF, fasttenkansenPeriod)

cumulativeVolumeTF = sum(volume, fasttenkansenPeriod)

fasttenkansenvwapValue = cumulativeTypicalPriceVolumeTF / cumulativeVolumeTF

// Fast Kijun Sen Calculation

typicalPriceKF = (high + low + close) / 3

typicalPriceVolumeKF = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKF = sum(typicalPriceVolumeKF, fastkijunsenPeriod)

cumulativeVolumeKF = sum(volume, fastkijunsenPeriod)

fastkijunsenvwapValue = cumulativeTypicalPriceVolumeKF / cumulativeVolumeKF

// Slow LeadLine Calculation

lowesttenkansen_s = lowest(slowtenkansenvwapValue, slowtenkansenPeriod)

highesttenkansen_s = highest(slowtenkansenvwapValue, slowtenkansenPeriod)

lowestkijunsen_s = lowest(slowkijunsenvwapValue, slowkijunsenPeriod)

highestkijunsen_s = highest(slowkijunsenvwapValue, slowkijunsenPeriod)

slowtenkansen = avg(lowesttenkansen_s, highesttenkansen_s)

slowkijunsen = avg(lowestkijunsen_s, highestkijunsen_s)

slowleadLine = avg(slowtenkansen, slowkijunsen)

// Fast LeadLine Calculation

lowesttenkansen_f = lowest(fasttenkansenvwapValue, fasttenkansenPeriod)

highesttenkansen_f = highest(fasttenkansenvwapValue, fasttenkansenPeriod)

lowestkijunsen_f = lowest(fastkijunsenvwapValue, fastkijunsenPeriod)

highestkijunsen_f = highest(fastkijunsenvwapValue, fastkijunsenPeriod)

fasttenkansen = avg(lowesttenkansen_f, highesttenkansen_f)

fastkijunsen = avg(lowestkijunsen_f, highestkijunsen_f)

fastleadLine = avg(fasttenkansen, fastkijunsen)

// BBleadLine Calculation

BBleadLine = avg(fastleadLine, slowleadLine)

// Bollinger Band Calculation

basis = sma(BBleadLine, BBlength)

dev = BBmult * stdev(BBleadLine, BBlength)

upper = basis + dev

lower = basis - dev

// TSV Calculation

tsv = sum(close>close[1]?volume*(close-close[1]):close<close[1]?volume*(close-close[1]):0,tsvlength)

tsvema = ema(tsv, tsvemaperiod)

// Rules for Entry & Exit

if(fastleadLine > fastleadLine[1] and slowleadLine > slowleadLine[1] and tsv > 0 and tsv > tsvema and close > upper and close > vidya and inDateRange and notInTrade)

strategy.entry("BUY-T", strategy.long)

if((fastleadLine < fastleadLine[1] and slowleadLine < slowleadLine[1]) or not inDateRange)

strategy.close("BUY-T")

// Plots

plot(meanvwapValue, title="MEAN VWAP", linewidth=2, color=color.yellow)

//plot(vidya, title="VIDYA", linewidth=2, color=color.green)

//colorsettingS = input(title="Solid Color Slow Leadline", defval=false, type=input.bool)

//plot(slowleadLine, title = "Slow LeadLine", color = colorsettingS ? color.aqua : slowleadLine > slowleadLine[1] ? color.green : color.red, linewidth=3)

//colorsettingF = input(title="Solid Color Fast Leadline", defval=false, type=input.bool)

//plot(fastleadLine, title = "Fast LeadLine", color = colorsettingF ? color.orange : fastleadLine > fastleadLine[1] ? color.green : color.red, linewidth=3)

//p1 = plot(upper, "Upper BB", color=#2962FF)

//p2 = plot(lower, "Lower BB", color=#2962FF)

//fill(p1, p2, title = "Background", color=color.blue)

//plot(smallvwapValue, color=#13C425, linewidth=2)

//plot(bigvwapValue, color=#CA1435, linewidth=2)