概述

突破交易策略旨在捕捉由市场波动性增加引起的突破价格。该策略利用平均真实波动范围(ATR)指标来测量资产在特定周期内的波动性。当价格突破上下两条由ATR决定的突破线时,产生做多和做空信号。

策略原理

该策略首先计算指定周期内的ATR。然后根据ATR计算上轨和下轨。当收盘价突破上轨时,产生做多信号;当收盘价跌破下轨时,产生做空信号。为了进一步确认信号,需要当前K线形态实体部分关闭。

收盘价突破上轨和下轨时,在突破方向填充突破间隙颜色。该特征有助于快速识别当前趋势方向。

当做多信号产生且当前无持仓时,策略开仓做多。当做空信号产生且当前无持仓时,策略开仓做空。

Length参数决定测量波动性的周期长度。更高的Length值意味着关注更长的价格波动。例如,Length为20时,每次交易跨越大约100根K线,包含多个波动。

减小Length值可以关注更短期的价格波动,增大交易频率。Length值与平均交易长度之间没有严格对应关系,需要通过试错来找到最佳Length值。

优势分析

该策略利用突破原理,能抓住市场波动带来的较大行情。ATR指标动态计算突破位,避免使用固定参数。

使用实体K线确认信号,可过滤假突破。填充突破间隙颜色直观显示趋势方向。

Length参数提供调整策略的灵活性,可根据具体市场调整来优化参数。

风险分析

突破交易存在被套利的风险。可以设置止损来控制单笔损失。

突破信号可能出现误报导致超短线交易。可以适当调整Length参数来滤除误报。

参数优化需要积累足够的交易数据支持。初期参数选择可能不当导致交易表现不佳。

优化方向

可以在ATR周期内引入布林带,作为新的突破位计算方式。布林带突破可减少误报率。

可以在突破后继续追踪趋势,而不立即止损。例如加入趋势随行止损。

可以考虑在震荡市场使用不同的参数或完全不交易,避免被套。

总结

突破交易策略利用市场波动性,在价格产生较大突破时进入趋势。ATR指标动态确定突破位,实体K线过滤假突破。Length参数提供调整策略周期的灵活性。该策略适合追踪中长线趋势,但需要注意突破交易的风险,并进行参数优化。

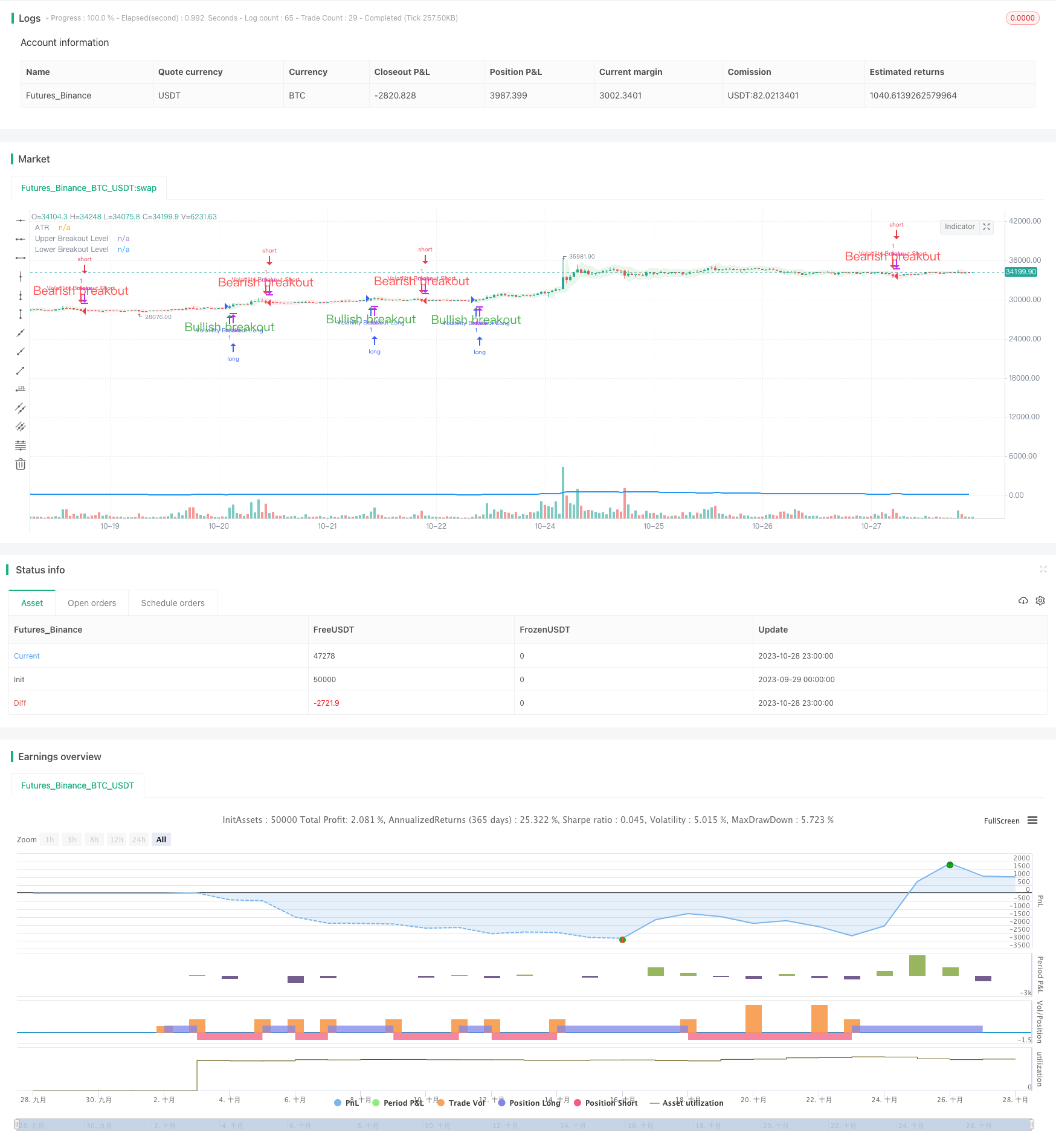

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy("Volatility Breakout Strategy [Angel Algo]", overlay = true)

// Inputs

length = input(title="Length", defval=20)

// Calculate the average true range (ATR)

atr = ta.atr(length)

// Plot the ATR on the chart

plot(atr, color=color.blue, linewidth=2, title="ATR")

// Calculate the upper and lower breakouts

upper_breakout = high + atr

lower_breakout = low - atr

// Plot the upper and lower breakouts on the chart

ul = plot(upper_breakout[1], color = color.new(color.green, 100), linewidth=2, title="Upper Breakout Level")

ll = plot(lower_breakout[1], color = color.new(color.red, 100), linewidth=2, title="Lower Breakout Level")

// Create the signals

long_entry = ta.crossover(close, upper_breakout[1]) and barstate.isconfirmed

short_entry = ta.crossunder(close, lower_breakout[1]) and barstate.isconfirmed

active_signal_color =ta.barssince(long_entry) < ta.barssince(short_entry) ?

color.new(color.green,85) : color.new(color.red,85)

// Plot the signals on the chart

plotshape(long_entry and ta.barssince(long_entry[1]) > ta.barssince(short_entry[1]), location=location.belowbar, style=shape.triangleup,

color=color.green, size=size.normal, text = "Bullish breakout", textcolor = color.green)

plotshape(short_entry and ta.barssince(long_entry[1]) < ta.barssince(short_entry[1]), location=location.abovebar, style=shape.triangledown,

color=color.red, size=size.normal,text = "Bearish breakout", textcolor = color.red)

// Fill the space between the upper and lower levels with the color that indicates the latest signal direction

fill(ul,ll, color=active_signal_color)

long_condition = long_entry and strategy.position_size <= 0 and barstate.isconfirmed

short_condition = short_entry and strategy.position_size >= 0 and barstate.isconfirmed

if long_condition

strategy.entry("Volatility Breakout Long", strategy.long)

if short_condition

strategy.entry("Volatility Breakout Short", strategy.short)