概述

方差反转交易策略通过计算认购看涨期权和认沽看跌期权的比率,也称做看涨期权 和看跌期权比率,当该比率出现反转时产生交易信号。该策略结合简单的资金管理规则来实现盈利。它适用于NDX和SPX的30分钟周期。振荡指标需要调整以反映正确的反转点。通过良好的回测结果可以判断出正确的反转点。

策略原理

该策略的核心指标是看涨看跌期权比率的均线及其标准差。首先计算过去20天的看涨看跌期权比率的均值,然后计算过去30天该比率的标准差。当比率上穿比率均值加1.5倍标准差时,做多;当比率下穿比率均值减1.5倍标准差时,做空。

做多后,如果比率重新回落到均值以上时,平掉做空仓位。止损线设置为开仓价格的1%。止盈线设置为开仓价格的3倍止损距离。

优势分析

该策略最大的优势在于捕捉市场情绪的反转点。当市场过度悲观或过度看多时,看涨看跌期权比率会出现反常态,这时做反向操作就能捕捉到局部反转的机会。另外,资金管理规则设置了止损和止盈距离,可以有效控制单笔交易的风险和收益。

风险分析

该策略的主要风险在于参数设置问题。如果参数设置不当,会导致交易信号过于频繁,从而无法捕捉到较大幅度的反转机会。另外,反转信号可能会被假突破,导致亏损。建议优化参数,使信号更稳定可靠。

优化方向

可以考虑结合其他指标来验证反转信号,防止被假突破误导。例如可以加入成交量指标,只有成交量放大的时候才考虑反转信号。也可以加入一些趋势指标,避免逆势操作。可以测试不同市场不同时间周期下的参数设置。总之,综合更多因素来设定交易策略,会使结果更可靠。

总结

该策略通过计算看涨看跌期权比率并结合简单的资金管理原则,试图捕捉市场反转点。它的优势在于能抓住局部反转的机会,但也存在被假突破误导的风险。通过优化参数设置、加入更多验证指标等方式,可以提高策略的稳定性和盈利能力。总体来说,该策略提供了一种利用市场情绪判断反转点的思路,但需要进一步测试和优化,才能在实盘中应用。

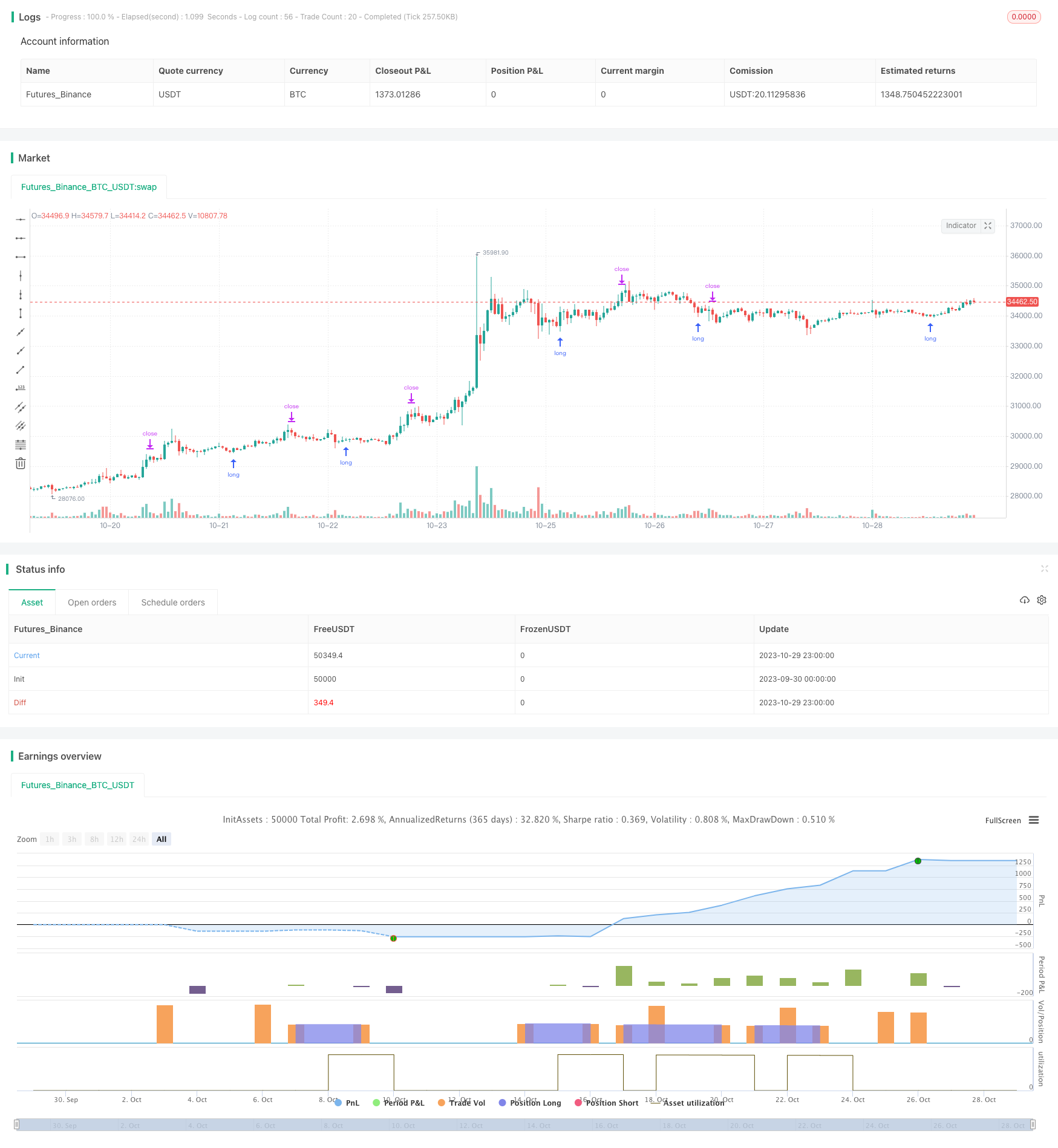

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © I11L

//@version=5

strategy("I11L Long Put/Call Ratio Inversion", overlay=false, pyramiding=1, default_qty_value=10000, initial_capital=10000, default_qty_type=strategy.cash)

SL = input.float(0.01,step=0.01)

CRV = input.float(3)

TP = SL * CRV

len = input.int(30,"Lookback period in Days",step=10)

ratio_sma_lookback_len = input.int(20,step=10)

mult = input.float(1.5,"Standard Deviation Multiple")

ratio_sma = ta.sma(request.security("USI:PCC","D",close),ratio_sma_lookback_len)

median = ta.sma(ratio_sma,len)

standartDeviation = ta.stdev(ratio_sma,len)

upperDeviation = median + mult*standartDeviation

lowerDeviation = median - mult*standartDeviation

isBuy = ta.crossunder(ratio_sma, upperDeviation)// and close < buyZone

isCloseShort = (ratio_sma > median and strategy.position_size < 0)

isSL = (strategy.position_avg_price * (1.0 - SL) > low and strategy.position_size > 0) or (strategy.position_avg_price * (1.0 + SL) < high and strategy.position_size < 0)

isSell = ta.crossover(ratio_sma,lowerDeviation)

isTP = strategy.position_avg_price * (1 + TP) < high

if(isBuy)

strategy.entry("Long", strategy.long)

if(isCloseShort)

strategy.exit("Close Short",limit=close)

if(isSL)

strategy.exit("SL",limit=close)

if(isTP)

strategy.exit("TP",limit=close)

plot(ratio_sma,color=color.white)

plot(median,color=color.gray)

plot(upperDeviation,color=color.rgb(0,255,0,0))

plot(lowerDeviation,color=color.rgb(255,0,0,0))

bgcolor(isBuy?color.rgb(0,255,0,90):na)

bgcolor(isSell?color.rgb(255,0,0,90):na)