概述

该策略综合运用布林带指标和Aroon指标,通过振荡市场的震荡破坏来获利。策略在震荡趋势型市场中表现较好,能够在震荡突破之后及时入场,并设定止损止盈条件,在合适的时候退出仓位。

策略原理

该策略主要利用两个指标来识别交易机会和退出点。

首先是布林带。布林带由中轨、上轨和下轨组成。中轨是n日收盘价的简单移动平均线,上轨是中轨+k倍标准差,下轨是中轨-k倍标准差。当价格从下轨向上突破中轨时,为买入信号。当价格从上轨向下突破中轨时,为卖出信号。该策略使用布林带判断震荡趋势中的机会点,在中轨附近出现突破时入场。

其次是Aroon指标。Aroon指标反映价格在n日内达到最高值和最低值的相对强弱。Aroon指标可以判断趋势和机会。当Aroon Up主线大于设置的阈值时,认为行情趋势向上;当Aroon Down主线大于设置的阈值时,认为行情趋势向下。该策略使用Aroon指标的Up主线来确认行情处于上升趋势,Down主线来判断是否要止损退出。

综合这两个指标,该策略在布林带发生突破,Aroon Up主线高于阈值时买入。在止损线触发或Aroon Up主线低于设置值时平仓。

策略优势

综合多个指标,提高决策的准确性。单一指标容易受到市场噪音的影响,该策略通过布林带和Aroon指标的组合,可以过滤假信号。

及时捕捉趋势反转点。布林带具有较强的趋势识别能力,可以发现短期内突破中轨的机会点。Aroon指标判断长期趋势,避免在震荡行情中反复开仓。

风险控制到位。止损策略和Aroon指标的Down主线控制了下行风险。同时,部分仓位交易也控制了单笔损失。

适用于震荡行情,不容易产生大额亏损。相比趋势跟踪策略,该策略在震荡行情中表现更佳。

风险分析

布林带存在差错。当市场突发事件造成大幅波动时,布林带会失效。

Aroon参数设置需要优化。不同市场需要调整Aroon参数,以达到最佳效果。

止损过小容易出现再次触发。应适当放宽止损范围,避免止损线被触发后再次被触发。

需避免在强势趋势中使用。策略适用于震荡市场,在强势趋势市场中表现不佳,应注意避免。

优化方向

优化布林带参数,采用自适应布林带。允许布林带参数根据市场变化调整,提高指标的灵活性。

优化Aroon参数的动态设置。不同币种和交易周期需要调整Aroon参数,可以研究动态优化参数。

增加其他指标过滤,如RSI指标来避免超买超卖。可以进一步提高策略决策的准确性。

采用机器学习方法优化止损点。通过算法训练可以得到更优化的止损方式,最大程度减少止损被再次触发的概率。

结合量能指标,避免假突破。如能量指标OBV,可以避免布林带发生的假突破信号。

总结

该策略总体上是一个典型的震荡型交易策略。它结合布林带指标和Aroon指标来识别交易机会,可以有效抓住市场的短期震荡。通过止损和部分仓位管理风险,适合于震荡行情。但需要注意参数优化和风险控制,避免使用于趋势性行情中。如果进一步优化,可以成为一个非常实用的量化策略。

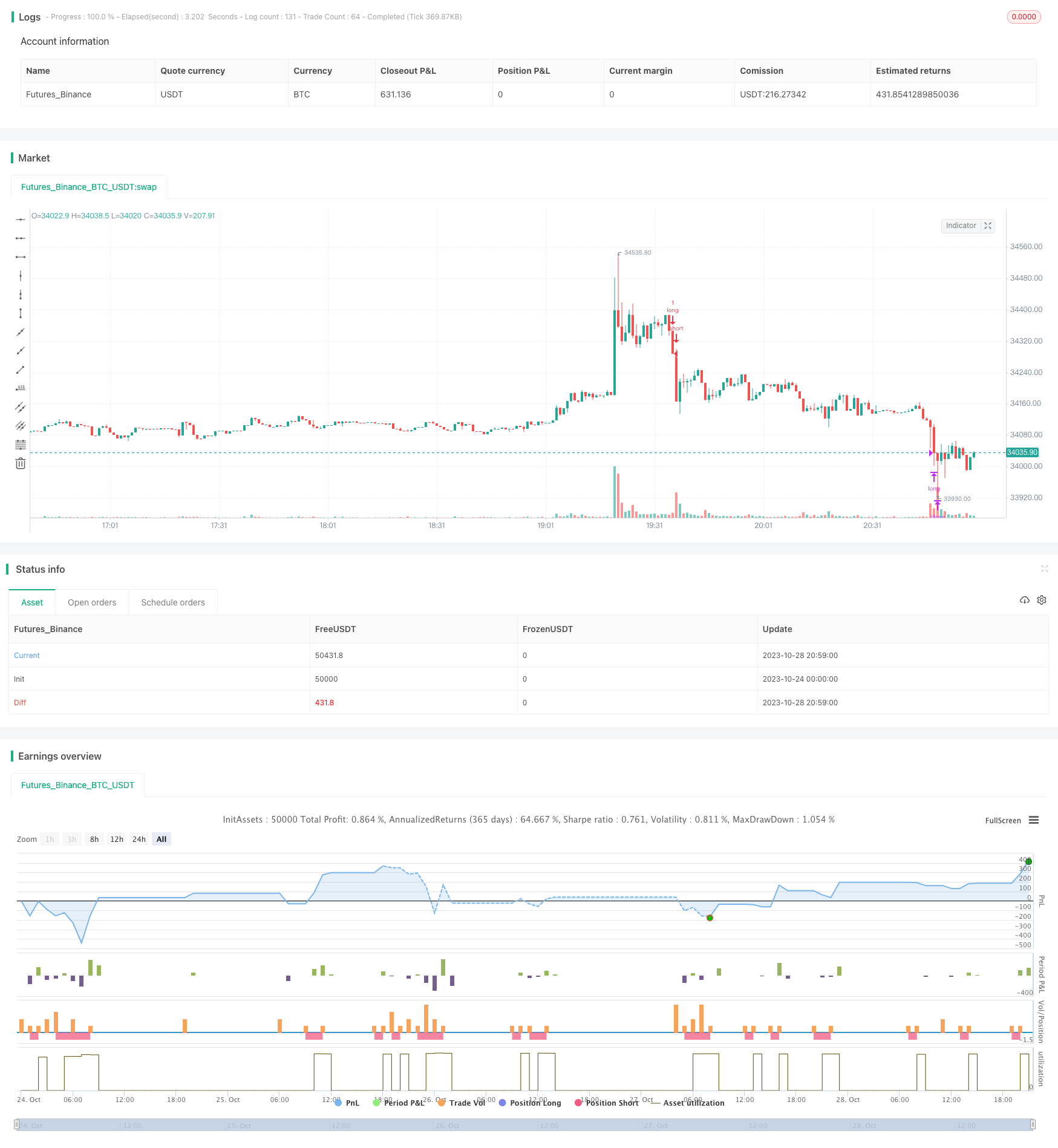

/*backtest

start: 2023-10-24 00:00:00

end: 2023-10-28 21:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © relevantLeader16058

//@version=4

// strategy(shorttitle='Bollinger bands And Aroon Scalping',title='Bollinger bands And Aroon Scalping (by Coinrule)', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 30, commission_type=strategy.commission.percent, commission_value=0.1)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

// BB inputs and calculations

lengthBB = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, lengthBB)

dev = mult * stdev(src, lengthBB)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

lengthAr = input(288, minval=1)

AroonUP = 100 * (highestbars(high, lengthAr+1) + lengthAr)/lengthAr

AroonDown = 100 * (lowestbars(low, lengthAr+1) + lengthAr)/lengthAr

Confirmation = input(90, "Aroon Confirmation")

Stop = input(70, "Aroon Stop")

Bullish = crossunder (close, basis)

Bearish = crossunder (close, upper)

//Entry

strategy.entry(id="long", long = true, when = Bullish and AroonUP > Confirmation and window())

//Exit

strategy.close("long", when = Bearish or AroonUP < Stop and window())