概述

本策略结合了霍尔移动平均线和卡尔曼滤波,以识别并跟踪价格趋势,属于趋势跟踪策略。它使用两个不同周期的霍尔移动平均线构建交易信号,并配合卡尔曼滤波进行平滑处理,旨在提高信号质量和策略稳定性。

策略原理

策略使用24周期的霍尔移动平均线hma和24周期的三重霍尔移动平均线hma3构建交易信号。

当hma上穿hma3时,产生买入信号;当hma下穿hma3时,产生卖出信号。

策略默认关闭卡尔曼滤波,开启卡尔曼滤波后,对hma和hma3进行卡尔曼滤波处理,以过滤掉过多的噪音,提升信号质量。

卡尔曼滤波通过预测和校正步骤消除信号中的随机噪声。每次测量与上次预测之间的差值作为校正项,以更精确预测下一次测量值。通过重复地预测和校正,可逐步减少噪声的影响,使信号变得更平滑。

该策略使用卡尔曼滤波增强移动平均线策略的稳定性,滤除随机波动的影响,跟踪持续趋势。

策略优势

相比单一移动平均线,双移动平均线系统能够更好地识别持续趋势。

霍尔移动平均线通过加权方式计算,对近期价格赋予较大权重,能更敏感地捕捉价格变化。

卡尔曼滤波可有效过滤信号中的随机噪声,减少假 signals,提高信号质量。

策略参数可调整,周期长度和卡尔曼滤波增益可根据市场调整,适应不同行情。

策略采用跨周期技术构建信号,可识别更持久的趋势,避免被过多随机波动愚弄。

可视化界面直观显示信号和趋势状态,便于操作。

策略风险

双移动平均线策略容易在趋势转折点产生错误信号,无法及时捕捉转折。

移动平均线存在滞后性,可能错过价格快速反转的机会。

不适用于剧烈波动的行情,应避免在震荡颠簸阶段使用。

卡尔曼滤波的参数设置会影响策略表现,增益过大可能过滤掉有效信号。

长周期设置则响应不敏锐,短周期设置则容易被噪声影响,需要根据市场调整参数。

多空持仓时间不固定,存在无持仓阶段,降低了资金利用效率。

优化方向

可尝试采用自适应移动平均线动态优化参数,根据波动率调整周期长度。

配合波动率指标判断行情状态,在震荡市避免交易,只在趋势明确时交易。

可设置止损策略,避免亏损扩大,提高风险控制能力。

优化卡尔曼滤波参数,平衡跟踪灵敏度和噪声过滤程度。

结合其他指标确认信号有效性,如量能指标、布林带判断趋势持久性等。

可采用机器学习等手段训练参数,使策略更具鲁棒性和自适应性。

总结

本策略通过双霍尔移动平均线和卡尔曼滤波跟踪趋势,可有效识别持久趋势,提高信号质量。但需注意参数优化,行情适应性调整,风险控制以得到稳定收益。机器学习和量化分析可进一步提升策略表现。通过不断优化,可打造出稳定高效的趋势跟踪交易策略。

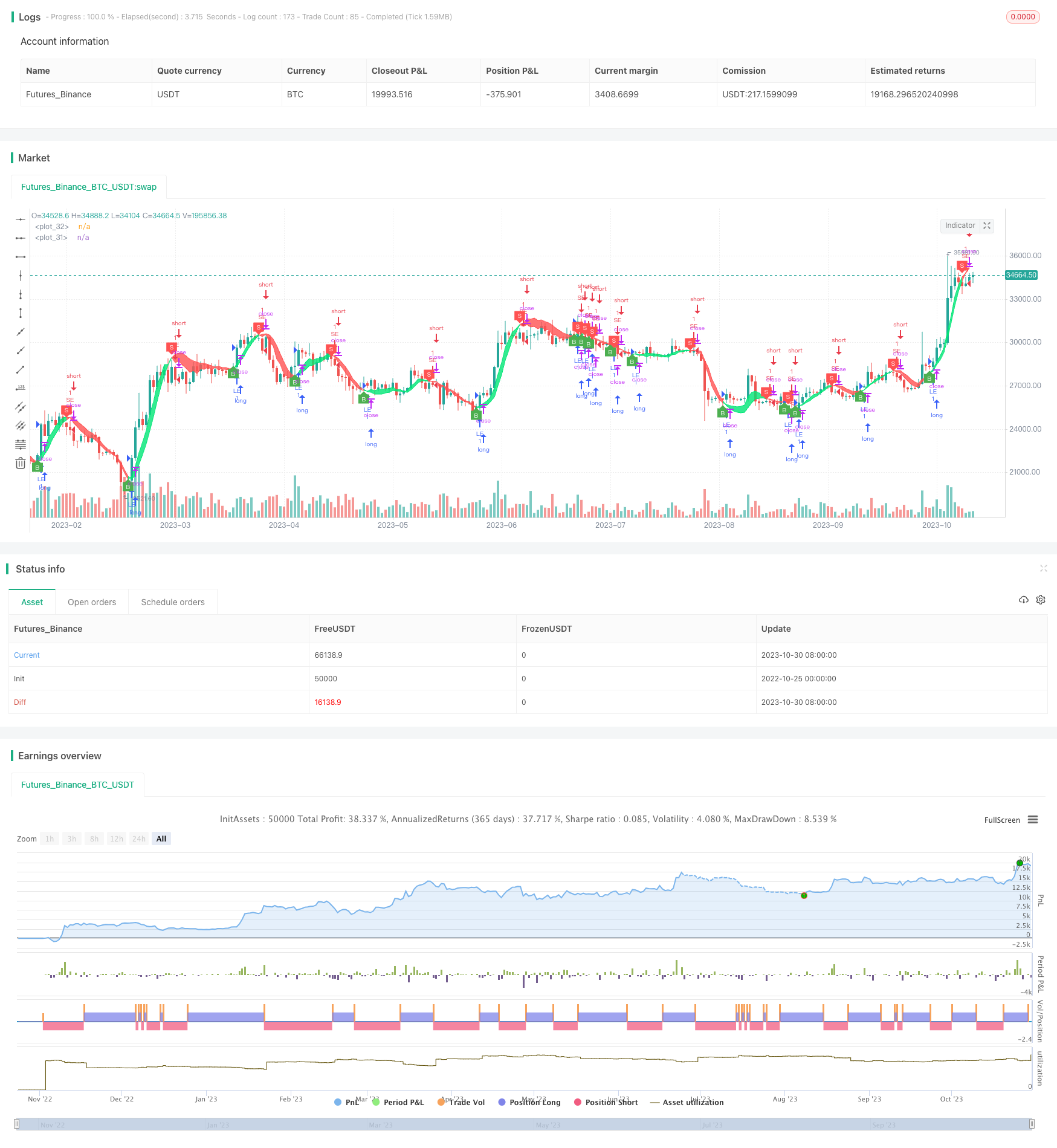

/*backtest

start: 2022-10-25 00:00:00

end: 2023-10-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hull Trend with Kahlman Strategy Backtest", shorttitle="HMA-Kahlman Trend Strat", overlay=true)

src = input(hl2, "Price Data")

length = input(24, "Lookback")

showcross = input(true, "Show cross over/under")

gain = input(10000, "Gain")

k = input(true, "Use Kahlman")

hma(_src, _length) =>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length) =>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

kahlman(x, g) =>

kf = 0.0

dk = x - nz(kf[1], x)

smooth = nz(kf[1],x)+dk*sqrt((g/10000)*2)

velo = 0.0

velo := nz(velo[1],0) + ((g/10000)*dk)

kf := smooth+velo

a = k ? kahlman(hma(src, length), gain) : hma(src, length)

b = k ? kahlman(hma3(src, length), gain) : hma3(src, length)

c = b > a ? color.lime : color.red

crossdn = a > b and a[1] < b[1]

crossup = b > a and b[1] < a[1]

p1 = plot(a,color=c,linewidth=1,transp=75)

p2 = plot(b,color=c,linewidth=1,transp=75)

fill(p1,p2,color=c,transp=55)

plotshape(showcross and crossdn ? a : na, location=location.absolute, style=shape.labeldown, color=color.red, size=size.tiny, text="S", textcolor=color.white, transp=0, offset=-1)

plotshape(showcross and crossup ? a : na, location=location.absolute, style=shape.labelup, color=color.green, size=size.tiny, text="B", textcolor=color.white, transp=0, offset=-1)

longCondition = crossup

if (longCondition)

strategy.entry("LE", strategy.long)

shortCondition = crossdn

if (shortCondition)

strategy.entry("SE", strategy.short)