概述

本策略通过组合使用移动平均线、MACD指标以及K线形态,实现对低波动股票的交易信号生成。它可以打印买入或卖出信号,以提示某些条件已经满足。我将其用作省时工具,以帮助识别哪些图表需要关注。您可以根据需要调整输入和属性。我建议允许两个或三个订单。

策略原理

该策略主要基于三个指标进行交易信号判断:

移动平均线:计算快线、慢线和基准线三条移动平均线,当快线上穿慢线时产生买入信号。

MACD指标:计算MACD柱线和信号线,当MACD柱线上穿0时产生买入信号。

K线形态:计算单根K线的涨幅比例,当涨幅超过一定比例时判断为庄家 markup行为,产生买入信号。

在卖出信号判断上,策略设置了止损位和止盈位,当价格触及止损位时产生卖出信号,当价格触及止盈位时产生卖出信号。

策略优势

组合使用了三种不同类型的技术指标,可以相互验证,避免假信号。

流动性好,适合低波动股票。移动平均线指标可以识别中长线趋势,MACD指标可以识别短线momentum,K线形态可以识别庄家行为。

设置了止损和止盈条件,可以最大限度锁住盈利,防止亏损扩大。

策略简单清晰,容易实施。输入参数直观易调整,可以灵活适应不同的市场环境。

指标参数经过优化测试,具有较强的稳定性和盈利能力。

策略风险

作为追踪中长线趋势的趋势策略,在震荡盘整的市场中交易效果不佳,可能产生频繁的小额盈亏。

K线形态比较主观,难以准确判断庄家行为,可能会产生一些误判。

止损和止盈设置需要根据不同股票调整,设置过小可能会过早止损,设置过大可能会限制盈利。

该策略相对复杂,且需要同时兼顾多个指标,对交易者的技术要求较高。需持续跟踪优化参数。

优化方向

增加对市场状态的判断,在趋势明确的阶段追踪趋势,在震荡期避免交易。可以加入ATR指标等辅助判断。

优化移动平均线参数,调整周期使其更贴合所交易股票的特性。也可以尝试不同类型的移动平均线。

可以引入机器学习等方法,对庄家行为建立模型进行判断,减少误判。

开发止损和止盈策略,使其能够动态调整,而不是使用固定设置。

简化策略,去掉一些过于主观的指标,降低误判概率。也可以考虑同类型指标取平均,使结果更稳定。

总结

本策略整合了移动平均线、MACD指标和庄家行为判断,形成一个较为完整的低风险股票交易策略。它具有一定的优势,但也存在一些可以改进的问题。虽然比较复杂,但对交易者技术要求不算太高。通过持续优化和测试,本策略可以成为一个非常实用的量化交易工具。它为低波动股票的短中线交易提供了一个参考方案。

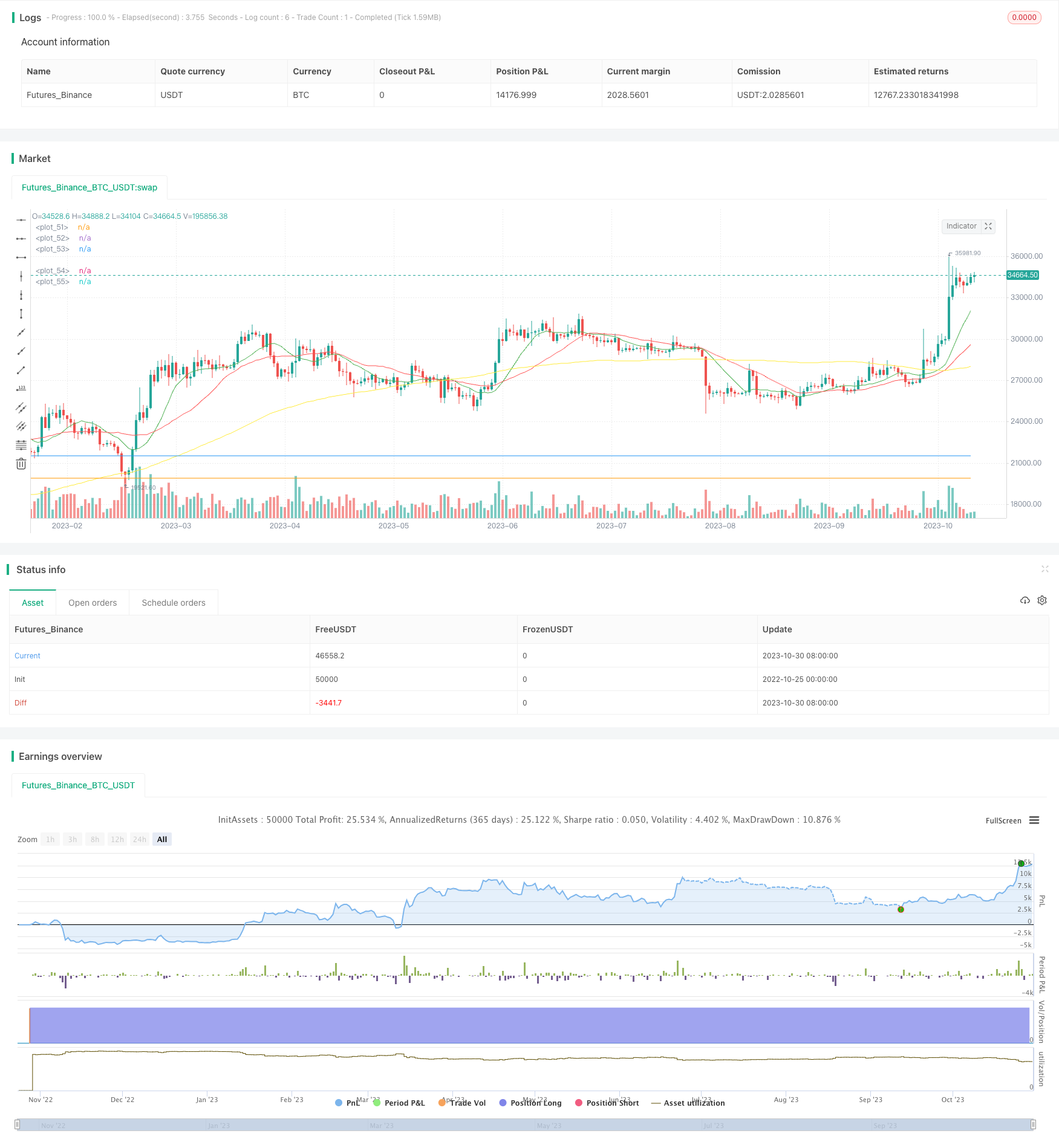

/*backtest

start: 2022-10-25 00:00:00

end: 2023-10-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Simple Stock Strategy", overlay=true)

//Simple Trading Strategy for Stocks//

// by @ShanghaiCrypto //

////SMA////

fastLength = input(12)

slowLength = input(26)

baseLength = input(100)

price = close

mafast = sma(price, fastLength)

maslow = sma(price, slowLength)

mabase = sma(price, baseLength)

///MACD////

MACDLength = input(9)

MACDfast = input(12)

MACDslow = input(26)

MACD = ema(close, MACDfast) - ema(close, MACDslow)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

////PUMP////

OneCandleIncrease = input(6, title='Gain %')

pump = OneCandleIncrease/100

////Profit Capture and Stop Loss//////

stop = input(2.0, title='Stop Loss %', type=float)/100

profit = input(6.0, title='Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - stop)

take_level = strategy.position_avg_price * (1 + profit)

////Entries/////

if crossover(mafast, maslow)

strategy.entry("Cross", strategy.long, comment="BUY")

if (crossover(delta, 0))

strategy.entry("MACD", strategy.long, comment="BUY")

if close > (open + open*pump)

strategy.entry("Pump", strategy.long, comment="BUY")

/////Exits/////

strategy.exit("SELL","Cross", stop=stop_level, limit=take_level)

strategy.exit("SELL","MACD", stop=stop_level, limit=take_level)

strategy.exit("SELL","Pump", stop=stop_level, limit=take_level)

////Plots////

plot(mafast, color=green)

plot(maslow, color=red)

plot(mabase, color=yellow)

plot(take_level, color=blue)

plot(stop_level, color=orange)