概述

本策略基于动量指标RSI和趋势跟踪止损指标SuperTrend,设计了一个中长线的动量交易策略。该策略主要用于识别股票价格中存在的趋势性动量,并配合止损来锁定盈利,降低大幅回撤的概率。

原理

使用RSI识别股票中的趋势性动量

RSI指标可以有效识别股票价格中的趋势,RSI高于60时为超买区,表示当前股票处于强势上涨趋势中;RSI低于40时为超卖区,表示当前股票处于下跌趋势中。

本策略在RSI大于60时产生买入信号,表示识别到股票价格中的上涨动量,可以买入做多。

使用SuperTrend进行趋势跟踪止损

SuperTrend是一个趋势跟踪止损指标,它基于ATR和价格本身计算出一个动态止损线。当价格突破此止损线时,表示趋势发生反转,应当止损了结当前头寸。

本策略使用SuperTrend指标计算出的止损线作为策略的停损位,在价格突破该止损线时立即平仓止损。

优势

识别趋势性动量,profit from momentum

使用RSI指标可以有效识别出股票价格中存在的趋势性动量,这样可以在价格形成趋势的早期就进场,潜在获利空间更大。

止损控制风险,锁定盈利

通过SuperTrend指标的止损线,可以及时止损离场,避免回撤过大。同时也可以随着趋势的推进逐步抬高止损线锁定盈利。

策略逻辑清晰简单

本策略使用了两个指标的组合,每一个指标都具有明确的意义,策略逻辑简单清晰,容易理解和验证。

风险

虚假突破导致的止损被触发

在盘整时期,价格可能出现一些短期的突破又快速回调的虚假突破情况。这可能会导致止损线被触发,产生一些不必要的损失。

表现跟随大盘,具有一定相关性

本策略识别的是股票中的趋势性动量,所以它的表现会一定程度上跟随大盘 market 的走势。在大盘出现调整时,策略可能会产生额外的损失。

无法识别趋势反转

本策略专注于识别并跟踪趋势,无法有效识别趋势反转情况。一旦出现突然的趋势反转,策略可能难以及时止损,导致较大的损失。

优化方向

优化RSI参数,提高识别准确率

可以测试不同的RSI参数,找到最佳的参数组合,以提高RSI对趋势的识别准确率。

优化止损策略,降低止损率

可以尝试不同类型的止损方式,如离场前等待一定周期等,避免被高频的虚假突破止损出局。

增加趋势反转信号

可以考虑加入像MACD等指标,提前识别趋势反转情况,避免强势趋势反转后的大幅损失。

考虑适当的对冲手段

在大盘面临较大调整时,可以考虑加入一定的对冲组合,降低策略的市场相关性。

总结

本策略通过RSI识别趋势性动量以及SuperTrend的趋势跟踪止损这两个关键要素,构建了一个简单实用的中长线动量策略。该策略能够有效跟踪趋势,同时止损控制风险。通过优化参数以及增加反转信号等手段,可以进一步增强策略的表现。总体来说,本策略具有较强的实用性。

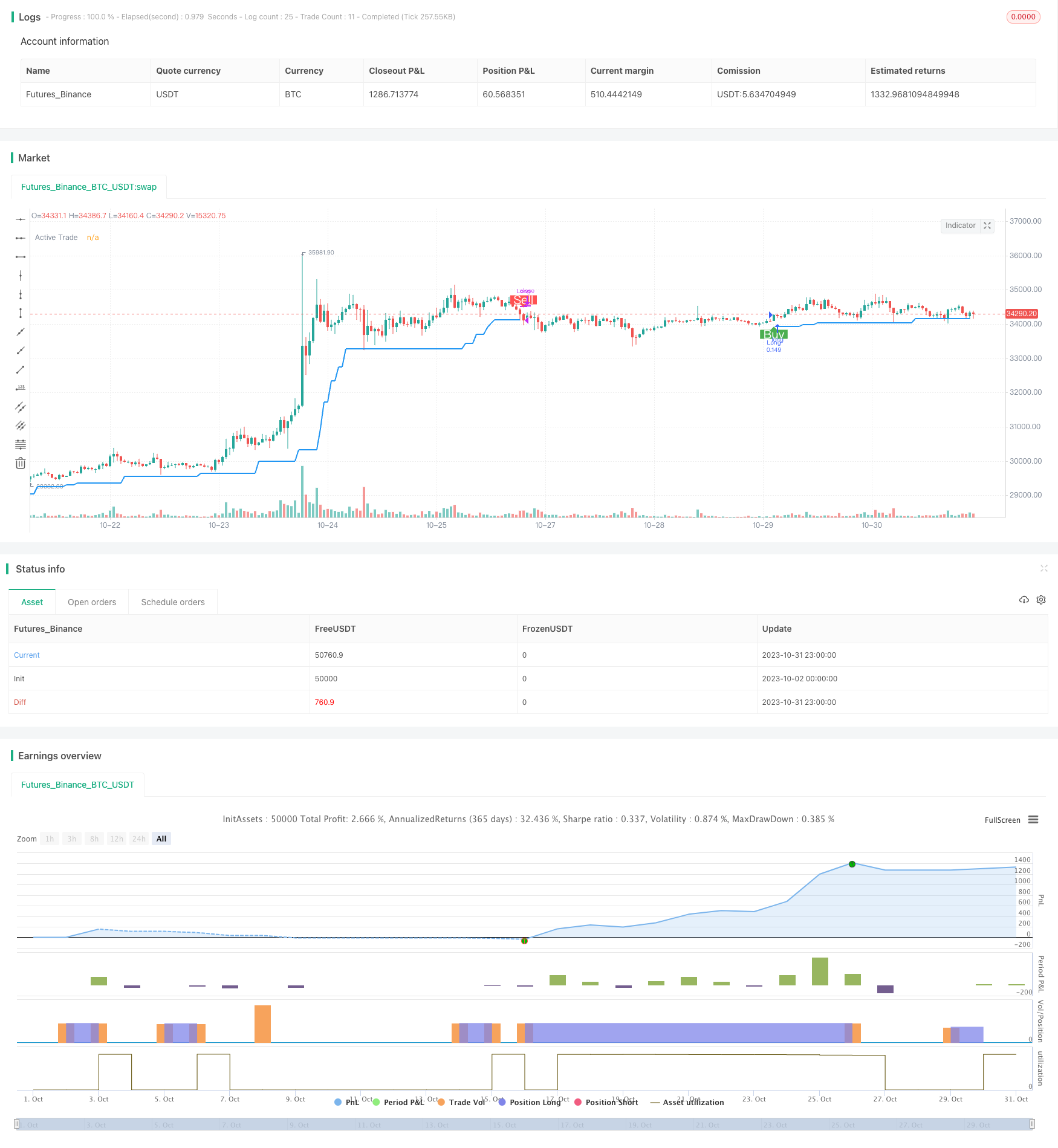

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2021 Amey Tavkar

// Momentum Trading Strategy (Weekly Chart) script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Description

// ===========

// The strategy will open position when there is momentum in the stock

// The strategy will ride up your stop loss based on the super trend.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

strategy("Momentum Trading Strategy (Weekly Chart)", precision = 2, overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

//Entry

[fastSupertrend, fastSupertrendDir] = supertrend(5, 1)

rsi = rsi(close, 14)

entry = close > fastSupertrend and rsi > 60

strategy.entry("Long", strategy.long, when = entry)

plotshape(entry and strategy.opentrades == 0,color=color.green,text="Buy",location=location.belowbar,style=shape.labelup,textcolor=color.white, size = size.normal)

plot(fastSupertrendDir == -1 and strategy.opentrades == 1 ? fastSupertrend : na, title="Active Trade", style=plot.style_linebr, linewidth=2, color=color.blue)

//Exit

exit = close < fastSupertrend

strategy.close("Long", when = exit)

plotshape(exit and strategy.opentrades == 1,color=color.red,text="Sell",style=shape.labeldown,textcolor=color.white, size=size.normal)