概述

该策略基于5分钟开盘价的涨跌幅进行交易决策,使用两阶跨度突破设定不同的触发条件,旨在在震荡趋势中捕捉较大的价格变动。

策略原理

策略基于每天2时整5分钟K线的开盘价计算当下5分钟K线的涨跌幅百分比,当涨跌幅超过设定的第一阶跨度时,做出相应的买入或卖出决策。同时设置止损位和止盈位退出仓位。

如果止损被触发,当涨跌幅继续扩大并超过第二阶跨度的触发条件时,会撤销之前的订单,使用第二阶跨度下新的买入或卖出指令,并继续跟踪止损和止盈。

通过两阶跨度的设定,可以在震荡行情中过滤掉部分噪音,只在较大幅度的价格变动时进行交易。同时第二阶跨度的激活可以减少止损过于频繁被触发的情况。

策略优势

- 使用两阶跨度设定不同的触发条件,可以有效过滤震荡市场中的噪音,只在较大幅度变动时进行交易

- 第二阶跨度的激活可以有效避免止损过于频繁被触发

- 基于开盘价计算当期涨跌幅,可以利用新的交易日开盘后的趋势获利

- 策略逻辑简单清晰,容易理解实现

风险及对策

- 大幅震荡行情中可能频繁打开仓位又止损退出,交易成本增加

- 第二阶跨度设置过大,可能错过较好的交易机会

- 跨度设置过小,可能增加不必要的交易次数

对策:

- 优化跨度参数,找到最佳平衡点

- 增加每日交易次数限制,避免过于频繁交易

- 结合趋势判断,在趋势明显时使用更激进的参数

优化方向

- 优化两阶跨度的数值,找到最佳参数组合

- 研究不同品种、不同时间段的参数区别

- 结合趋势指标,在趋势明显时使用更激进参数

- 增加每日交易次数限制,避免过度交易

- 优化止盈止损点位,实现更好的风险回报比

总结

该策略通过两阶跨度突破来捕捉价格跳动,在震荡行情中有效过滤噪音。策略Concept简单清晰,通过参数优化可以得到较好的效果。下一步可以考虑与趋势判断指标结合,在趋势行情中发挥策略优势。总体来说,策略思路新颖,有效利用突破原理,在优化调整后可获得不错的效果。

策略源码

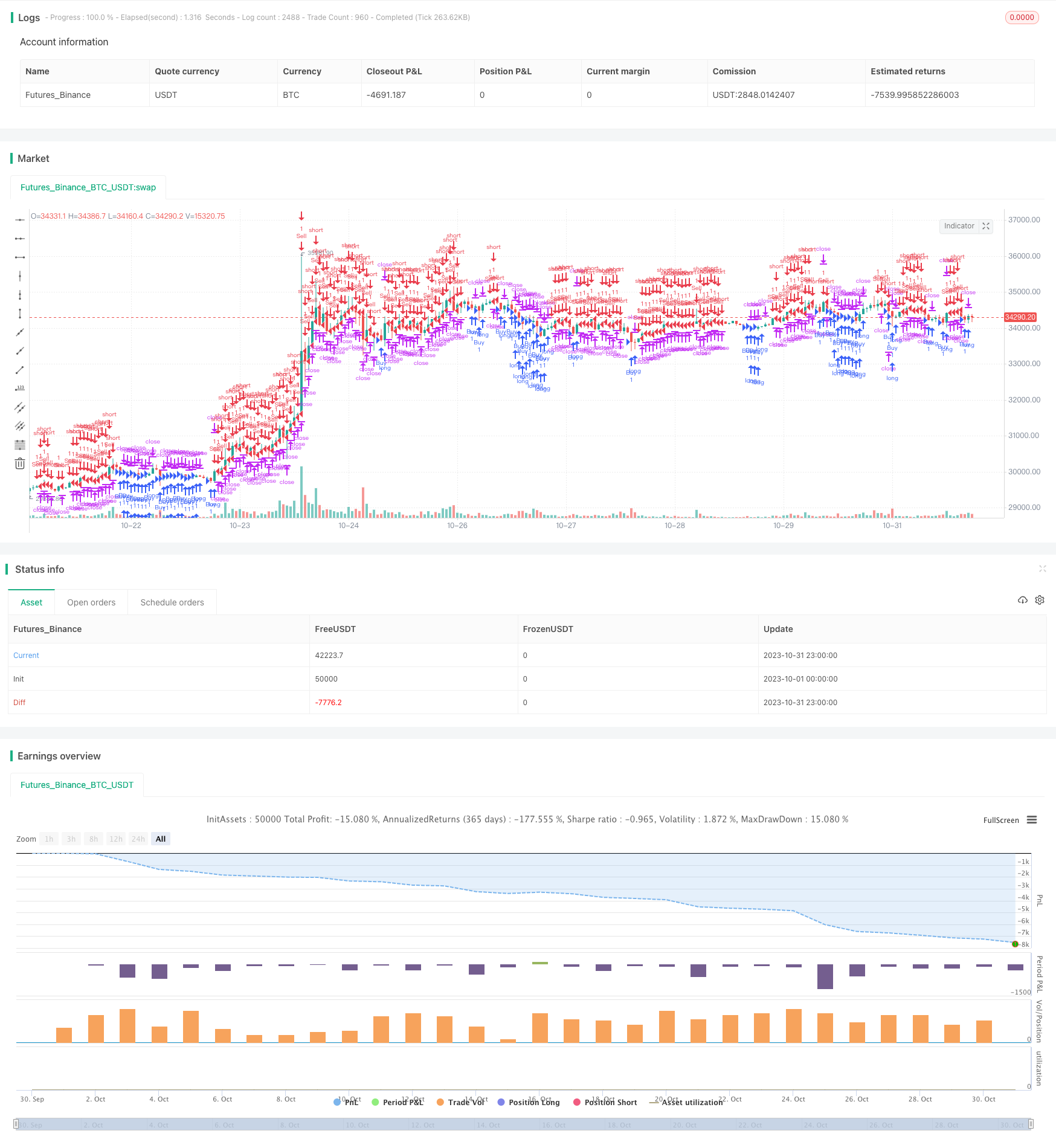

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Auto Entry Bot", overlay=true)

// Define input for the stop loss and take profit levels

stopLossPips = input.int(200, title="Stop Loss Pips", minval=1)

takeProfitPips = input.int(400, title="Take Profit Pips", minval=1)

// Calculate the percentage change from the 5-minute opening candle at 2:00 AM

var float openPrice = na

if (hour == 2 and minute == 0)

openPrice := open

percentageChange = (close - openPrice) / openPrice * 100

// Track the cumulative percentage change

var float cumulativeChange = 0

// Define input for the percentage change trigger

triggerPercentage1 = input.float(0.25, title="Percentage Change Trigger (%)", minval=0.01, step=0.01)

triggerPercentage2 = input.float(0.35, title="Additional Trigger Percentage (%)", minval=0.01, step=0.01)

// Check for price change trigger

if (percentageChange >= triggerPercentage1)

// Sell signal

strategy.entry("Sell", strategy.short)

strategy.exit("ExitSell", loss=stopLossPips, profit=takeProfitPips)

cumulativeChange := 0 // Reset cumulative change after a trade

if (percentageChange <= -triggerPercentage1)

// Buy signal

strategy.entry("Buy", strategy.long)

strategy.exit("ExitBuy", loss=stopLossPips, profit=takeProfitPips)

cumulativeChange := 0 // Reset cumulative change after a trade

// If the price keeps hitting stop loss, activate the second trigger

if (strategy.position_size < 0 and percentageChange <= -triggerPercentage2)

strategy.cancel("Sell") // Cancel previous sell order

strategy.entry("Sell2", strategy.short)

strategy.exit("ExitSell2", loss=stopLossPips, profit=takeProfitPips)

cumulativeChange := 0 // Reset cumulative change after a trade

if (strategy.position_size > 0 and percentageChange >= triggerPercentage2)

strategy.cancel("Buy") // Cancel previous buy order

strategy.entry("Buy2", strategy.long)

strategy.exit("ExitBuy2", loss=stopLossPips, profit=takeProfitPips)

cumulativeChange := 0 // Reset cumulative change after a trade