概述

该策略是一个组合策略,结合使用了反转策略和复活振荡指标策略,目的是获取更可靠的交易信号。

策略原理

该策略由两部分组成:

反转策略

反转策略来自Ulf Jensen的《我如何在期货市场上将资金增加两倍》一书第183页。该策略属于反转类型,具体逻辑是:

当收盘价比前一日收盘价高,连续两日时,并且9日慢速Stoch指标低于50时,做多入场。

当收盘价比前一日收盘价低,连续两日时,并且9日快速Stoch指标高于50时,做空入场。

复活振荡指标策略

复活振荡指标通过计算市场中最细微波动的差值,其值一般在-1到1之间波动。指标数值越高,表示趋势性越强,无论是涨趋势还是跌趋势。

当指标达到较高值时,做多;当指标达到较低值时,做空。该指标适合用于日内交易。

最后,当两种策略信号同向时,即进行相关方向的交易。

优势分析

结合反转策略和趋势策略,可以过滤掉一些假信号,提高交易信号的可靠性。

反转策略可以捕捉到短期反转机会;复活振荡指标策略可以捕捉中长线趋势。

Stoch指标参数优化较好,可以有效过滤震荡市场的假信号。

复活振荡指标对细微市场波动较为敏感,可以提前捕捉到趋势转折。

风险及解决方案

反转策略容易被巨大趋势反转吞噬,可适当调整参数,或与趋势策略组合使用。

指标策略容易产生过多交易信号,可适当调整参数,或与其他过滤指标组合使用。

两种策略信号可能不一致产生冲突,可根据历史回测数据调整参数,优化两者配合。

可引入止损策略,以控制单笔损失。

优化方向

测试不同的反转参数组合,找到最佳参数。

测试不同的复活振荡指标参数,找到最优参数。

尝试不同的指标参数优化方法,如遗传算法、随机森林等。

增加其他辅助指标,进一步过滤信号。

增加机器学习模型,提高信号准确率。

引入风险管理机制,如止损、仓位管理等。

总结

该策略通过组合反转策略和复活振荡指标策略,综合利用两种不同类型策略的优势,能够提高交易信号质量,在回测中表现出较好的效果。通过参数优化、增加其他指标、风险管理等进一步优化,该策略有望取得更好的实盘效果。总体来说,这是一个非常有创新思路的策略,值得进一步研究和应用。

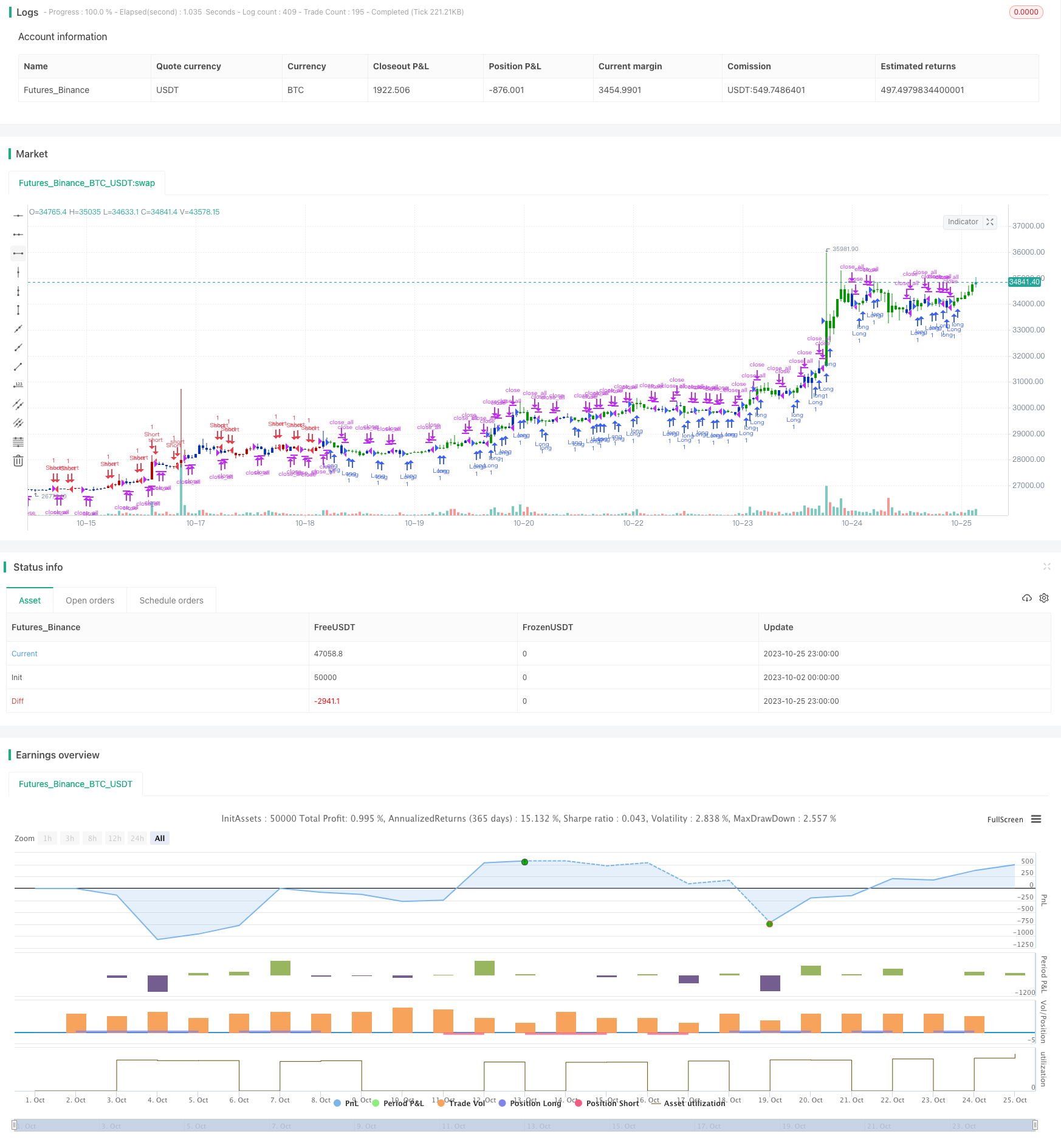

/*backtest

start: 2023-10-02 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/10/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The value of Fractal Chaos Oscillator is calculated as the difference between

// the most subtle movements of the market. In general, its value moves between

// -1.000 and 1.000. The higher the value of the Fractal Chaos Oscillator, the

// more one can say that it follows a certain trend – an increase in prices trend,

// or a decrease in prices trend.

//

// Being an indicator expressed in a numeric value, traders say that this is an

// indicator that puts a value on the trendiness of the markets. When the FCO reaches

// a high value, they initiate the “buy” operation, contrarily when the FCO reaches a

// low value, they signal the “sell” action. This is an excellent indicator to use in

// intra-day trading.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCO(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

xRes = iff(xUpper != xUpper[1], 1,

iff(xLower != xLower[1], -1, 0))

pos := iff(xRes == 1, 1,

iff(xRes == -1, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Oscillator", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCO = FCO(Pattern)

pos = iff(posReversal123 == 1 and posFCO == 1 , 1,

iff(posReversal123 == -1 and posFCO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )