概述

这个策略使用2个指标来产生交易信号:2/20指数移动均线和平均真实波动范围反转指标。它结合了趋势跟随和短期反转两大策略思想,旨在发现反转机会。

原理

该策略由2部分组成:

2/20指数移动均线。它计算最近20天的指数移动均线,当价格从上穿下或从下穿上移动均线时,产生交易信号。

平均真实波动范围反转指标。它基于价格的平均真实波动范围计算停损位,当价格突破该停损位时,产生信号。这里使用的是3.5倍ATR作为止损位。

这个策略整合了两者信号。当2/20EMA产生多头信号而ATR反转产生空头信号的时候,做空;当2/20EMA产生空头信号而ATR反转产生多头信号的时候,做多。

优势分析

这个策略结合了趋势跟随和反转两大思路,旨在发现价格反转的机会。具体优势有:

2/20EMA能识别中期趋势,避免被市场噪音误导。

ATR反转指标能捕捉短期价格反转,把握反转机会。

结合两者信号,能在中期趋势发生转折的时候提前捕捉,从而提高获利概率。

ATR止损位设置比较合理,有一定的风险控制效果。

可自定义ATR倍数,适应不同品种特性。

可选择正向或反向交易,适用于不同行情环境。

风险分析

该策略也存在以下风险:

2/20EMA parameter较慢,可能错过短线机会。

ATR止损容易被突破打出,应适当宽松止损位。

单一指标易产生错误信号,应结合更多因素过滤。

需留意交易次数,防止过于频繁交易。

需进行参数优化和回测,确认适合该品种。

需严格遵守资金管理,控制单笔风险。

优化方向

该策略可从以下方面进行优化:

调整EMA参数,寻找最佳参数组合

优化ATR倍数大小,平衡止损幅度

增加过滤条件,结合换手率、波动率等指标

增加资金管理模块,动态调整仓位

增加止损策略,如Chandelier Exit

测试不同品种参数效果,找到最佳组合

加入机器学习模型,利用大数据提升表现

组合多个子策略,发掘更多Alpha

总结

该策略整合两大思路,具有一定的捕捉价格反转的能力。但也存在parameter选取不当带来的风险。可以从优化止损策略、增加过滤条件等方面进一步提升策略稳定性和盈利能力。

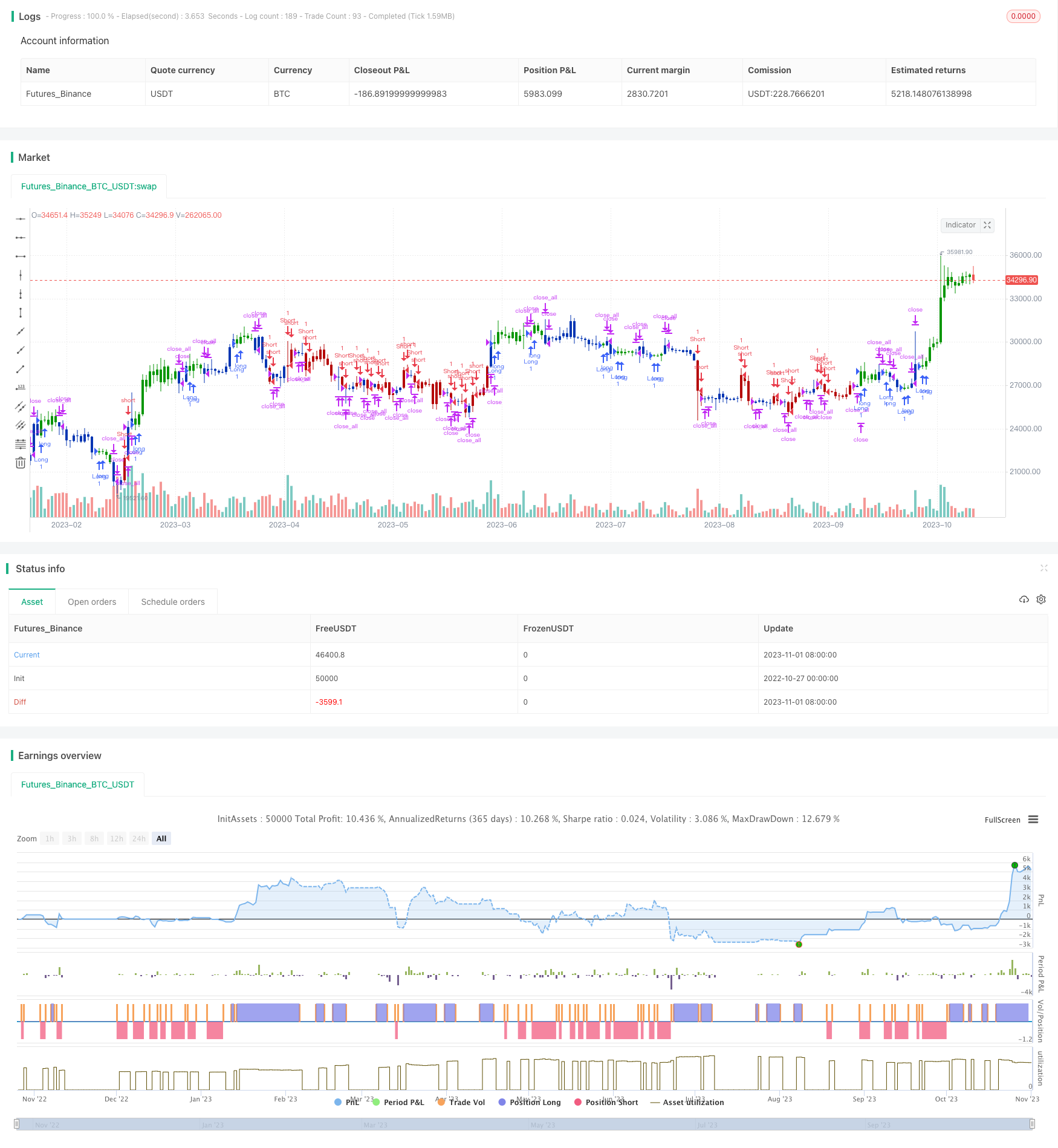

/*backtest

start: 2022-10-27 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 05/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// Average True Range Trailing Stops Strategy, by Sylvain Vervoort

// The related article is copyrighted material from Stocks & Commodities Jun 2009

// Please, use it only for learning or paper trading. Do not for real trading.

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

ATRR(nATRPeriod,nATRMultip) =>

pos = 0.0

xATR = ta.atr(nATRPeriod)

nLoss = nATRMultip * xATR

xATRTrailingStop = 0.0

xATRTrailingStop := close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), close - nLoss) :

close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), close + nLoss) :

close > nz(xATRTrailingStop[1], 0) ? close - nLoss : close + nLoss

pos:= close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0) ? 1 :

close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Average True Range Reversed', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Average True Range Reversed ═════●'

nATRPeriod = input.int(5, group=I2)

nATRMultip = input.float(3.5, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosATRR = ATRR(nATRPeriod,nATRMultip)

iff_1 = posEMA20 == -1 and prePosATRR == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosATRR == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)