概述

超级动量策略综合运用了多种动量指标,在多个动量指标同时看多或看空时,进行买入或卖出操作。该策略通过组合多个动量指标,可以更准确地捕捉价格趋势,避免单一指标造成的错误信号。

策略原理

该策略同时使用了4个Everget的RMI指标和1个Chande动量摆动指标。RMI指标基于价格动量计算得出,可以判断价格上涨和下跌力度。Chande MO则通过计算价格变化,来判断市场的超买超卖情况。

当RMI5上穿其买入线,RMI4下穿其买入线,RMI3下穿其买入线,RMI2下穿其买入线,RMI1下穿其买入线,且Chande MO上穿其买入线时,进行买入操作。

当RMI5下穿其卖出线,RMI4上穿其卖出线,RMI3上穿其卖出线,RMI2上穿其卖出线,RMI1上穿其卖出线,且Chande MO下穿其卖出线时,进行卖出操作。

RMI5设置为与其他RMI指标相反的方向,这可以更好地识别趋势,进行金字塔操作。

优势分析

综合多个指标,可以更准确判断趋势,避免单一指标错误信号

包含多时间周期指标,能识别更大级别的趋势

反向RMI指标可以辅助进行趋势识别和金字塔操作

Chande MO有助于避免超买超卖情况下的错误交易

风险分析

过多指标组合,参数设置复杂,需要仔细测试优化

多指标同时变化时,可能会产生错误信号

综合多个指标,交易频率可能会比较低

需要关注指标参数是否适合不同品种和市场环境

优化方向

测试指标参数设置,优化参数以提高策略稳定性

尝试增加或减少一些指标,评估对信号质量的影响

可以引入一些过滤条件,避免在特定市场情况下的错误信号

调整指标的买卖线位置,找到最优参数组合

考虑加入止损机制来控制风险

总结

本策略通过综合运用多种动量指标,提高了对市场趋势的判断能力。但参数设置较复杂,需要仔细测试优化,不断改进和调整。如果使用得当,有望获取较优的交易信号,在追踪市场趋势方面具有一定优势。但交易者仍需关注风险,寻找最佳参数组合,并加入风险控制机制,以进行稳定交易。

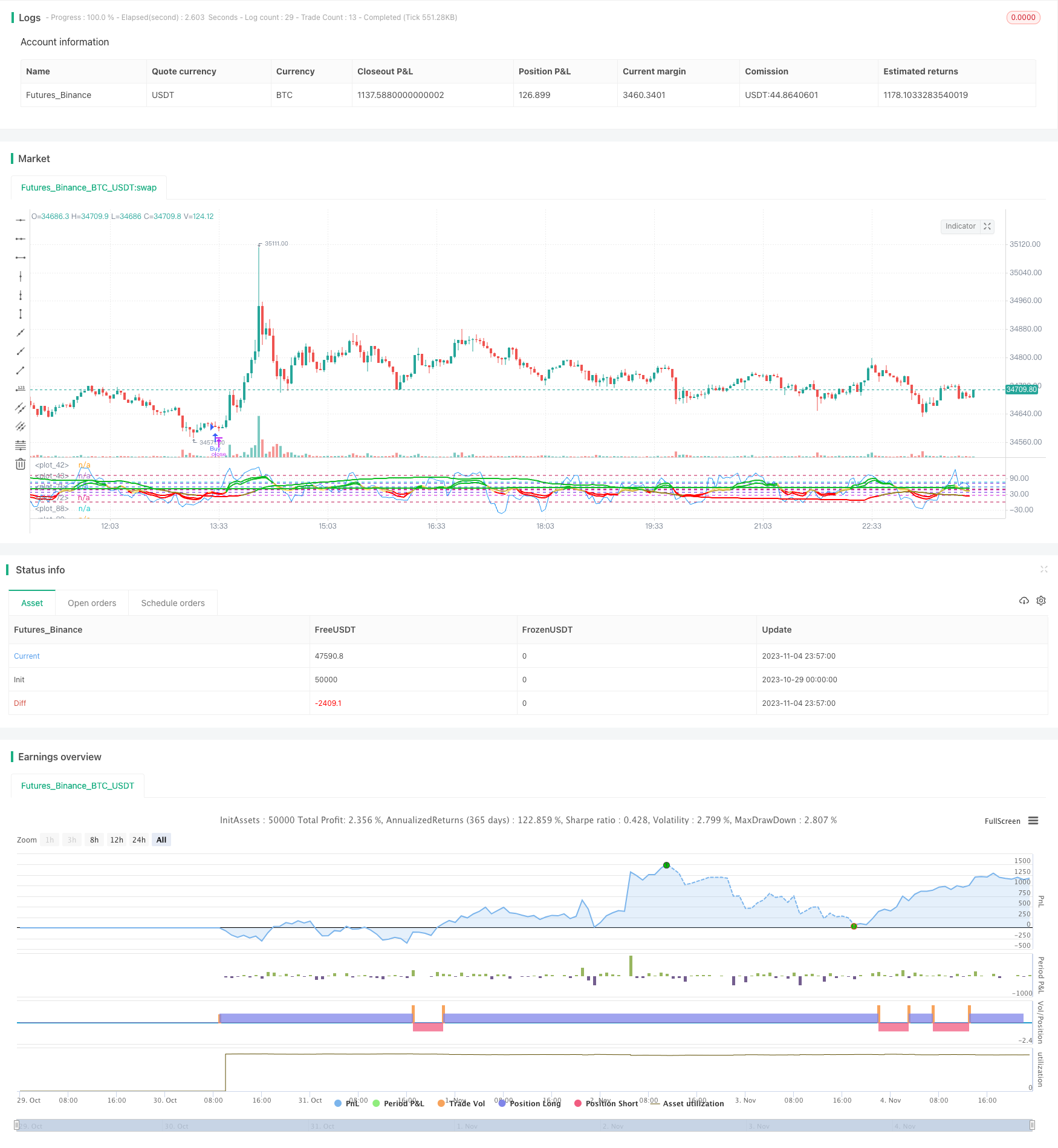

/*backtest

start: 2023-10-29 00:00:00

end: 2023-11-05 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Super Momentum Strat", shorttitle="SMS", format=format.price, precision=2)

//* Backtesting Period Selector | Component *//

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(2021, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(999999, "Backtest Stop Year")

testStopMonth = input(9, "Backtest Stop Month")

testStopDay = input(26, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////// END - Backtesting Period Selector | Component ///////////////

src = input(close, "Price", type = input.source)

highlightBreakouts = input(title="Highlight Overbought/Oversold Breakouts ?", type=input.bool, defval=true)

CMOlength = input(9, minval=1, title="Alpha Chande Momentum Length")

//CMO

momm = change(src)

f1(m) => m >= 0.0 ? m : 0.0

f2(m) => m >= 0.0 ? 0.0 : -m

m1 = f1(momm)

m2 = f2(momm)

sm1 = sum(m1, CMOlength)

sm2 = sum(m2, CMOlength)

percent(nom, div) => 100 * nom / div

chandeMO = percent(sm1-sm2, sm1+sm2)+50

plot(chandeMO, "Chande MO", color=color.blue)

obLevel = input(75, title="Chande Sellline")

osLevel = input(25, title="Chande Buyline")

hline(obLevel, color=#0bc4d9)

hline(osLevel, color=#0bc4d9)

///

///RMIS

//

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Relative Momentum Index script may be freely distributed under the MIT license.

//

///

///

//RMI1

length1 = input(title="RMI1 Length", type=input.integer, minval=1, defval=8)

momentumLength1 = input(title="RMI1 Momentum ", type=input.integer, minval=1, defval=3)

up1 = rma(max(change(src, momentumLength1), 0), length1)

down1 = rma(-min(change(src, momentumLength1), 0), length1)

rmi1 = down1 == 0 ? 100 : up1 == 0 ? 0 : 100 - (100 / (1 + up1 / down1))

obLevel1 = input(57, title="RMI1 Sellline")

osLevel1 = input(37, title="RMI1 Buyline")

rmiColor1 = rmi1 > obLevel1 ? #0ebb23 : rmi1 < osLevel1 ? #ff0000 : #ffe173

plot(rmi1, title="RMI 1", linewidth=2, color=rmiColor1, transp=0)

hline(obLevel1, color=#0b57d9)

hline(osLevel1, color=#0b57d9)

//RMI2

length2 = input(title="RMI2 Length", type=input.integer, minval=1, defval=12)

momentumLength2 = input(title="RMI2 Momentum ", type=input.integer, minval=1, defval=3)

up2 = rma(max(change(src, momentumLength1), 0), length2)

down2 = rma(-min(change(src, momentumLength1), 0), length2)

rmi2 = down2 == 0 ? 100 : up1 == 0 ? 0 : 100 - (100 / (1 + up2 / down2))

obLevel2 = input(72, title="RMI2 Sellline")

osLevel2 = input(37, title="RMI2 Buyline")

rmiColor2 = rmi1 > obLevel1 ? #0ebb23 : rmi2 < osLevel2 ? #ff0000 : #c9ad47

plot(rmi2, title="RMI 2", linewidth=2, color=rmiColor2, transp=0)

hline(obLevel2, color=#5a0bd9)

hline(osLevel2, color=#5a0bd9)

//RMI3

length3 = input(title="RMI3 Length", type=input.integer, minval=1, defval=30)

momentumLength3 = input(title="RMI3 Momentum ", type=input.integer, minval=1, defval=53)

up3 = rma(max(change(src, momentumLength3), 0), length3)

down3 = rma(-min(change(src, momentumLength3), 0), length3)

rmi3 = down3 == 0 ? 100 : up3 == 0 ? 0 : 100 - (100 / (1 + up3 / down3))

obLevel3 = input(46, title="RMI3 Sellline")

osLevel3 = input(24, title="RMI3 Buyline")

rmiColor3 = rmi3 > obLevel3 ? #0ebb23 : rmi3 < osLevel3 ? #ff0000 : #967d20

plot(rmi3, title="RMI 3", linewidth=2, color=rmiColor3, transp=0)

hline(obLevel3, color=#cf0bd9)

hline(osLevel3, color=#cf0bd9)

//RMI4

length4 = input(title="RMI4 Length", type=input.integer, minval=1, defval=520)

momentumLength4 = input(title="RMI4 Momentum ", type=input.integer, minval=1, defval=137)

up4 = rma(max(change(src, momentumLength4), 0), length4)

down4 = rma(-min(change(src, momentumLength4), 0), length4)

rmi4 = down4 == 0 ? 100 : up4 == 0 ? 0 : 100 - (100 / (1 + up4 / down4))

obLevel4 = input(0, title="RMI4 Sellline")

osLevel4 = input(100, title="RMI4 Buyline")

rmiColor4 = rmi4 > obLevel4 ? #0ebb23 : rmi4 < osLevel4 ? #ff0000 : #7a630b

plot(rmi4, title="RMI 4", linewidth=2, color=rmiColor4, transp=0)

hline(obLevel4, color=#bd1150)

hline(osLevel4, color=#bd1150)

//RMI5

length5 = input(title="RMI5 Length", type=input.integer, minval=1, defval=520)

momentumLength5 = input(title="RMI5 Momentum ", type=input.integer, minval=1, defval=137)

up5 = rma(max(change(src, momentumLength5), 0), length5)

down5 = rma(-min(change(src, momentumLength5), 0), length5)

rmi5 = down5 == 0 ? 100 : up4 == 0 ? 0 : 100 - (100 / (1 + up5 / down5))

buy5 = input(0, title="RMI5 Buy Above")

sell5 = input(47, title="RMI5 Sell Below")

rmiColor5 = rmi5 > buy5 ? #0ebb23 : rmi5 < sell5 ? #ff0000 : #7a630b

plot(rmi5, title="RMI 5", linewidth=2, color=rmiColor5, transp=0)

hline(buy5, color=#bd1150)

hline(sell5, color=#bd1150)

///

///END RMIS

//

//

// Relative Momentum Index script may be freely distributed under the MIT license.

//

///

///

hline(50, color=#C0C0C0, linestyle=hline.style_dashed, title="Zero Line")

//alerts

longcondition1 = crossover(chandeMO, osLevel)

shortcondition1 = crossunder(chandeMO, obLevel)

longcondition2 = rmi5>buy5 and rmi4<osLevel4 and rmi3<osLevel3 and rmi2<osLevel2 and rmi1<osLevel1 and longcondition1

shortcondition2 = rmi5<sell5 and rmi4>obLevel4 and rmi3>obLevel3 and rmi2>obLevel2 and rmi1>obLevel1 and shortcondition1

if testPeriod()

if longcondition2

strategy.entry("Buy", strategy.long)

if shortcondition2

strategy.entry("Sell", strategy.short)