概述

超一策略是基于超一指标进行交易决策的趋势交易策略。该策略采用超一指标的转换线、基准线以及云带的关系来判断目前趋势方向,并结合价格的回调来进行入场。

超一策略主要适用于中长线的趋势交易,可以在较大的趋势中获利。该策略同时具有较强的趋势识别能力。

策略原理

超一策略主要判断以下几个要素来决定交易方向:

转换线和基准线的关系: 当转换线在上时看涨,在下时看跌

云带的颜色: 当云带为绿色时看涨,为红色时看跌

价格回调: 需要价格收回转换线和基准线之外,才可以入场

具体来说,策略的交易信号为:

做多信号:

- 转换线高于基准线

- 价格高于转换线和基准线

- 转换线和基准线高于云带

- 价格收回转换线和基准线以下

做空信号:

- 转换线低于基准线

- 价格低于转换线和基准线

- 转换线和基准线低于云带

- 价格收回转换线和基准线以上

当同时满足做多/空信号时,则根据头寸情况进行开仓操作。

优势分析

超一策略具有以下优势:

使用超一指标组合判断趋势方向,准确率较高

转换线和基准线能清晰判断中短期趋势,云带判断长期趋势

条件要求价格收回转折线,可避免虚假突破带来的亏损

风险控制采用最近期内最高最低价位设定止损,可有效控制单笔损失

盈亏比合理,追求稳定收益

可在不同周期应用,适合中长线趋势交易

策略思路清晰易理解,参数优化空间大

可在多种市场环境中效果良好

风险分析

超一策略也存在以下风险:

在震荡市中,止损可能被频繁触发,影响盈利效果

当趋势快速变化时,不能及时反转头寸,可能带来亏损

设定的盈亏比并不适合所有品种,需要针对不同标的调整参数

当突破云带后拉升空间有限时,可能获利有限

指标参数需要反复测试优化,不适合参数调整频繁的品种

可通过以下方法降低风险:

优化参数,使之更符合不同周期和品种特征

结合其他指标过滤入场信号,避免在震荡市假突破

动态调整止损位置,降低止损被触发概率

测试不同的盈亏比设置

采用图表形态等方法确定趋势信号强弱

优化方向

超一策略可从以下方面进行优化:

优化转换线和基准线参数,使之更符合所交易品种的特性

优化云带参数,使云带对长期趋势判断更准确

优化止损算法,如根据ATR设定止损或带动态止损

结合其它指标进行信号过滤,配置更多过滤条件,降低误入场概率

优化盈亏比设置,适应策略在不同品种和周期上的特点

采用马丁格尔方式管理仓位,适应不同的行情波动频率

采用机器学习方法对参数进行优化,实现更高的稳定性

设置不同的交易时间段,针对夜盘和盘间的行情特点进行调整

总结

超一策略整体来说是一个非常适合中长线趋势交易的策略。它采用超一指标判断趋势方向的优势明显,同时结合价格回调进行入场可以有效避免误入场。通过优化参数设置,可使策略在更多品种和更多周期上达到稳定盈利。该策略既容易理解,又具有很大的优化空间,适合用作策略研究和学习的基础策略之一。

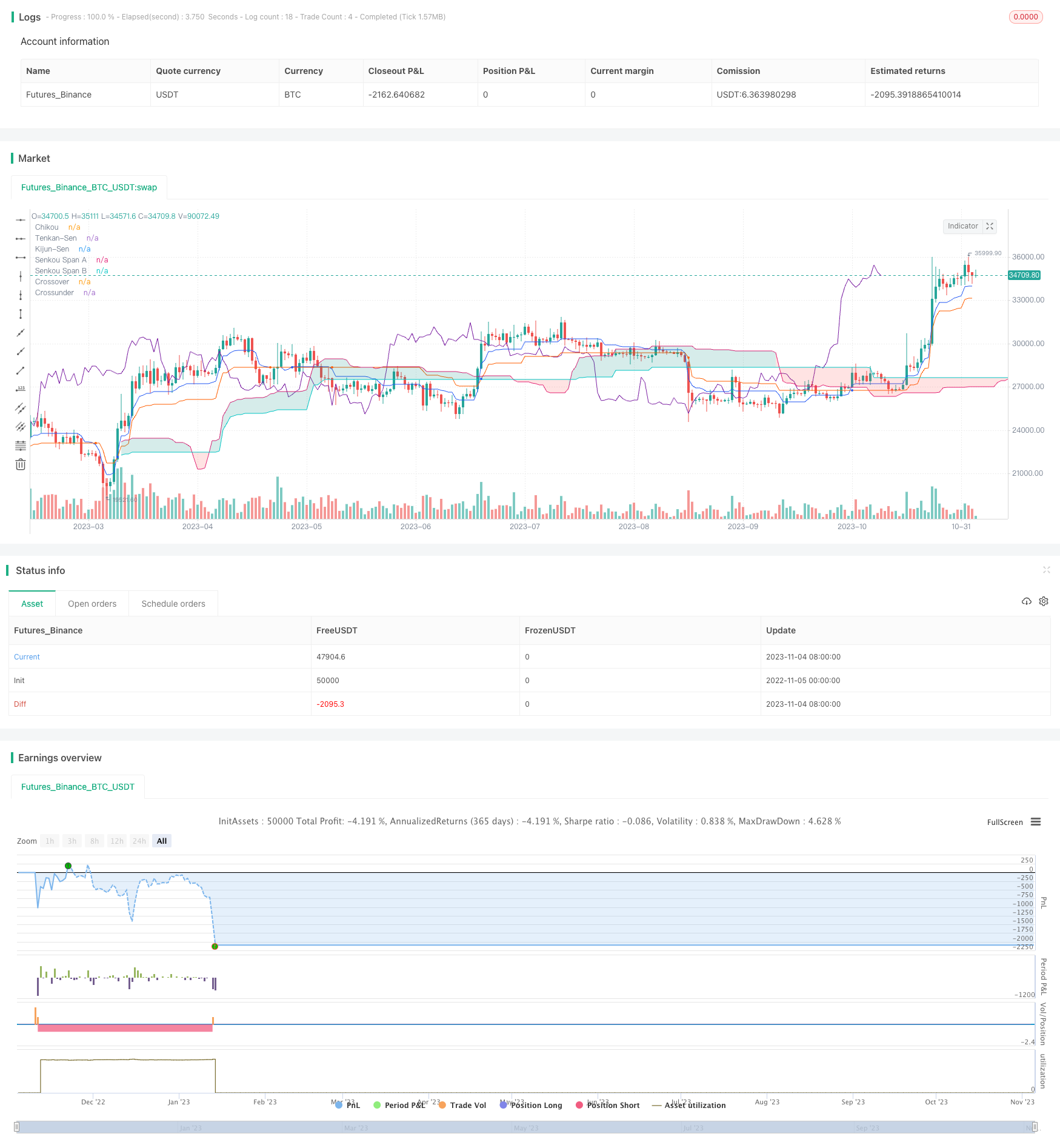

/*backtest

start: 2022-11-05 00:00:00

end: 2023-11-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the the SuperIchi indicator.

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - SuperIchi [LUX]: LuxAlgo (https://www.tradingview.com/script/vDGd9X9y-SuperIchi-LUX/)

//@version=5

strategy("SuperIchi Strategy", overlay=true, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(15, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(2, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

useAtrOverride = input.bool(true, "Use Swing High/Low ATR Override", group='Strategy: Risk Management', tooltip='In some cases price may not have a large enough (if any) swing withing previous X candles. Turn this on to use an ATR value when swing high/low is lower than the given ATR value')

atrMultiplier = input.int(1, "Swing High/Low ATR Override Multiplier", group='Strategy: Risk Management')

atrLength = input.int(14, "Swing High/Low ATR Override Length", group='Strategy: Risk Management')

// -----------------

// Strategy Settings

// -----------------

pullbackLength = input.int(5, "Pullback Lookback Length", group='Strategy: Settings', tooltip='Number of candles to consider for a pullback into the moving averages (prerequisite for trade entry)')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = time >= timestamp(syminfo.timezone, start_year, start_month, start_date, 0, 0) and time < timestamp(syminfo.timezone, end_year, end_month, end_date, 0, 0)

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// SuperIchi [LUX]

// ---------------

tenkan_len = input(9,'Tenkan ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

tenkan_mult = input(2.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

kijun_len = input(26,'Kijun ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

kijun_mult = input(4.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

spanB_len = input(52,'Senkou Span B ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

spanB_mult = input(6.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

offset = input(26,'Displacement', inline='SuperIchi', group='Indicator: SuperIchi Settings')

//------------------------------------------------------------------------------

avg(src,length,mult)=>

atr = ta.atr(length)*mult

up = hl2 + atr

dn = hl2 - atr

upper = 0.,lower = 0.

upper := src[1] < upper[1] ? math.min(up,upper[1]) : up

lower := src[1] > lower[1] ? math.max(dn,lower[1]) : dn

os = 0,max = 0.,min = 0.

os := src > upper ? 1 : src < lower ? 0 : os[1]

spt = os == 1 ? lower : upper

max := ta.cross(src,spt) ? math.max(src,max[1]) : os == 1 ? math.max(src,max[1]) : spt

min := ta.cross(src,spt) ? math.min(src,min[1]) : os == 0 ? math.min(src,min[1]) : spt

math.avg(max,min)

//------------------------------------------------------------------------------

tenkan = avg(close,tenkan_len,tenkan_mult)

kijun = avg(close,kijun_len,kijun_mult)

senkouA = math.avg(kijun,tenkan)

senkouB = avg(close,spanB_len,spanB_mult)

//------------------------------------------------------------------------------

tenkan_css = #2157f3 //blue

kijun_css = #ff5d00 //red

cloud_a = color.new(color.teal,80)

cloud_b = color.new(color.red,80)

chikou_css = #7b1fa2

plot(tenkan,'Tenkan-Sen',tenkan_css)

plot(kijun,'Kijun-Sen',kijun_css)

plot(ta.crossover(tenkan,kijun) ? kijun : na,'Crossover',#2157f3,3,plot.style_circles)

plot(ta.crossunder(tenkan,kijun) ? kijun : na,'Crossunder',#ff5d00,3,plot.style_circles)

A = plot(senkouA,'Senkou Span A',na,offset=offset-1)

B = plot(senkouB,'Senkou Span B',na,offset=offset-1)

fill(A,B,senkouA > senkouB ? cloud_a : cloud_b)

plot(close,'Chikou',chikou_css,offset=-offset+1,display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

plotchar(kijun, "kijun", "", location = location.top)

plotchar(senkouA[offset-1], "senkouA", "", location = location.top)

plotchar(tenkan > kijun, "line above", "", location = location.top)

plotchar(close > tenkan, "price above", "", location = location.top)

plotchar(kijun > senkouA[offset-1], "above cloud", "", location = location.top)

// blue line above red line + price above both lines + both lines above cloud

longSen = tenkan > kijun and close > tenkan and kijun > senkouA[offset-1]

// red line below blue line + price below both lines + both lines below cloud

shortSen = tenkan < kijun and close < tenkan and kijun < senkouA[offset-1]

plotchar(longSen, "longSen", "", location = location.top)

plotchar(shortSen, "shortSen", "", location = location.top)

// Cloud is green

longSenkou = senkouA[offset-1] > senkouB[offset-1]

// Cloud is red

shortSenkou = senkouA[offset-1] < senkouB[offset-1]

// price must have pulled back below sen lines before entry

barsSinceLongPullback = ta.barssince(close < kijun and close < tenkan)

longPullback = barsSinceLongPullback <= pullbackLength

// price must have pulled back above sen lines before entry

barsSinceShortPullback = ta.barssince(close > kijun and close > tenkan)

shortPullback = barsSinceShortPullback <= pullbackLength

// plotchar(lowestClose, "lowestClose", "", location = location.top)

// plotchar(highestClose, "highestClose", "", location = location.top)

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = longSen and longSenkou and longPullback and in_date_range

shortCondition = shortSen and shortSenkou and shortPullback and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = useAtrOverride ? ta.atr(atrLength) * atrMultiplier : 0

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=low)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + "\nQty: " + str.tostring(longQty) + "\nSwing low: " + str.tostring(swingLow) + "\nStop Percent: " + str.tostring(longStopPercent) + "\nTP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=low)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + "\nQty: " + str.tostring(shortQty) + "\nSwing high: " + str.tostring(swingHigh) + "\nStop Percent: " + str.tostring(shortStopPercent) + "\nTP Percent: " + str.tostring(shortTpPercent))