概述

双重随机策略通过计算当前K线及多倍时间周期K线的随机指数,判断多空区域,实现低买高卖的目的。该策略同时计算当前周期及3倍周期的随机指标,利用不同周期随机指标的金叉死叉信号,实现趋势跟踪。

策略原理

该策略同时计算两组随机指标,第一组为当前K线周期的随机指标,即K值和D值,第二组为3倍当前周期的随机指标,即MTFK和MTFD。

当MTFK上穿50线且当前K值大于D值时产生买入信号,表示进入多头区域,做多;当MTFD下穿50线且当前K值小于D值时产生卖出信号,表示进入空头区域,做空。

因此,该策略利用双重随机指标判断多空区域,实现价格的趋势跟踪。进入多头区域做多,进入空头区域做空,达到低买高卖的效果。

具体来说,该策略的买入信号logical为:

longCondition = crossover(mtfK, 50) and k>50 and k>d and mtfK>mtfD

卖出信号logical为:

shortCondition = crossunder(mtfD, 50) and k<50 and k<d and mtfK<mtfD

其中,mtfK为3倍周期的K值,mtfD为3倍周期的D值。当mtfK上穿50线且k>d时产生买入信号;当mtfD下穿50线且k时产生卖出信号。

此外,策略还设置了止损逻辑。当多头仓位时,如果mtfD下穿上轨,产生平仓信号;当空头仓位时,如果mtfK上穿下轨,产生平仓信号。

优势分析

该策略具有以下优势:

使用双重随机指标,判断多空区域更准确。当前周期指标判断短期趋势,大周期指标判断长期趋势,结合双重指标可以更好地把握趋势。

采用不同周期指标的金叉死叉交易策略,可以有效跟踪价格趋势,实现低买高卖。

设置止损逻辑,可以一定程度上控制风险,防止亏损扩大。

策略逻辑简单清晰,容易理解实现,适合用于实盘。

风险分析

该策略也存在一定风险:

双重随机指标可能产生错误信号,导致不必要的交易。例如突发事件导致短期与长期趋势背离。

止损逻辑设置不恰当可能导致亏损扩大。应合理设置止损距离,防止被套。

交易费用频繁买卖会影响策略收益。应适当调整参数,减少不必要交易。

策略仅基于技术指标,没有结合基本面因素。应该适当关注重大 fundamentals 因素。

对应解决方法:

适当调整双随机指标参数,降低错误信号率。

优化止损逻辑,并设置合理的止损距离。

调整参数,降低交易频率。可以适当放宽金叉死叉判定标准。

关注重大基本面消息,避免主观交易。

优化方向

该策略可以从以下几个方面进行优化:

优化双随机指标参数,降低错误信号率。可以测试不同的K值、D值参数对效果的影响。

结合其他指标过滤信号。例如MACD、移动平均线等指标的辅助判断,避免错误信号。

优化止损策略,设置止损距离和比例。测试不同的止损点是否能够有效控制风险。

结合交易量指标。例如放量突破等策略,避免在价格震荡期无效交易。

测试不同持仓时间。持仓时间过短,交易费用影响收益;持仓时间过长,无法及时止损。

结合基本面因素,在重要事件前后关闭策略,避免被事件冲击。

总结

双重随机策略通过当前周期和多倍周期随机指标判断多空区域,实现低买高卖。该策略具有趋势跟踪能力较强、逻辑简单、易于实盘等优势。但也存在一定风险,需要对参数及止损策略进行优化,并辅以其他技术指标或基本面判断来改进。如果经过全面优化和严格的回测验证,该策略可以成为一个非常实用的趋势跟踪策略。

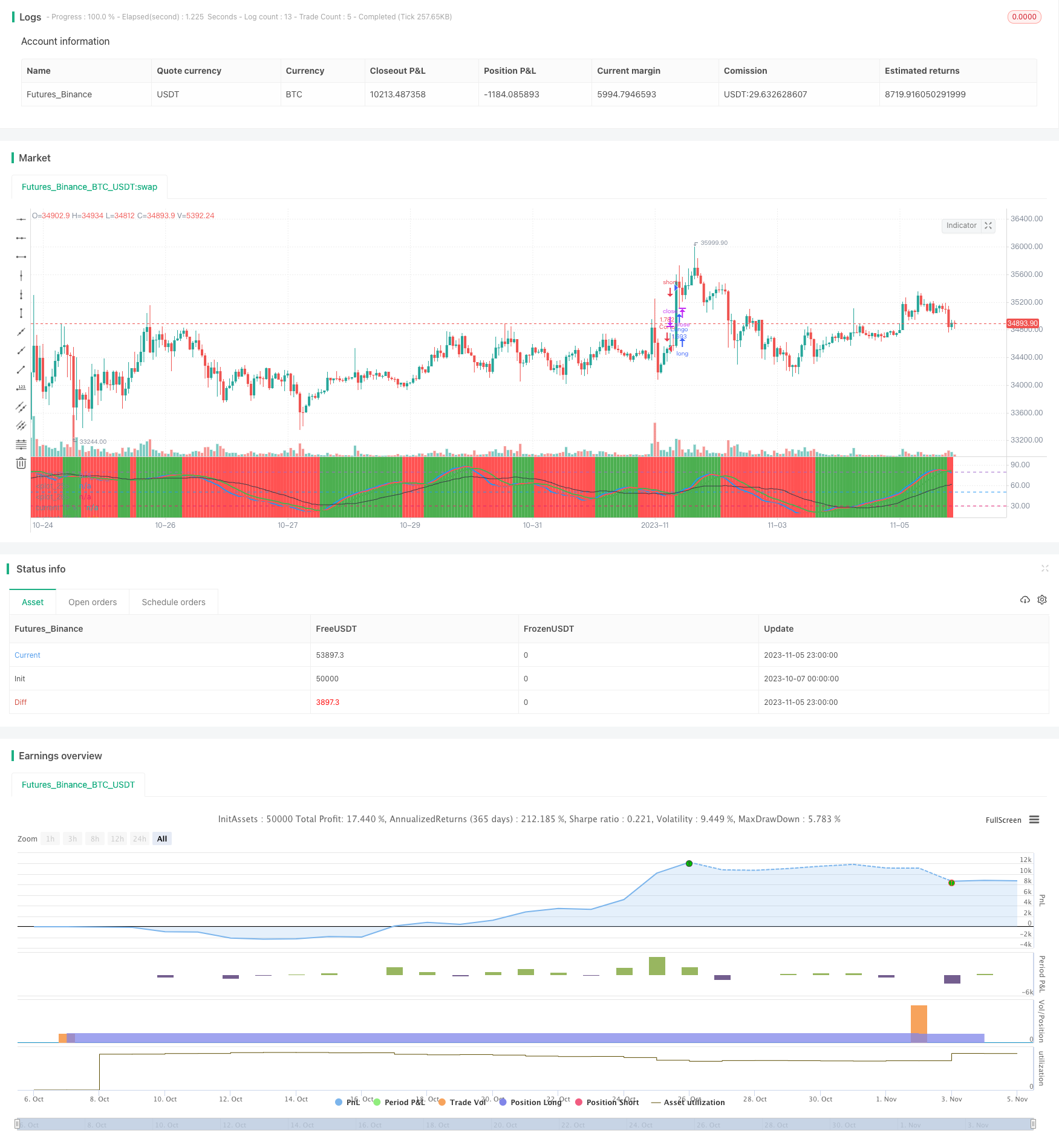

/*backtest

start: 2023-10-07 00:00:00

end: 2023-11-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("stoch startegy", overlay=false,default_qty_type=strategy.percent_of_equity,default_qty_value=100,currency=currency.USD)

len = input(54, minval=1, title="Length for Main Stochastic")

smoothK = input(12, minval=1, title="SmoothK for Main Stochastic")

smoothD = input(3, minval=1, title="SmoothD for Main Stochastic")

upLine = input(80, minval=50, maxval=90, title="Upper Line Value?")

lowLine = input(30, minval=10, maxval=50, title="Lower Line Value?")

trailStep=input(100,minval=10,title="Trialing step value")

// current stochastic calculation

k = sma(stoch(close, high, low, len), smoothK)

d = sma(k, smoothD)

//mtf stochastic calculation smoothed with period

mtfK= sma(stoch(close, high, low, len), smoothK*3)

mtfD= sma(k, smoothD*3)

plot(k,"current TF k",blue,style=line, linewidth=2)

plot(d,"current TF d",red,style=line, linewidth=2)

plot(mtfK,"MTF TF k",black,style=line)

plot(mtfD,"Multi TF d",green,style=line, linewidth=2)

hline(upLine)

hline(50)

hline(lowLine)

longCondition = crossover(mtfK, 50) and k>50 and k>d and mtfK>mtfD

if (longCondition)

strategy.entry("Lungo", strategy.long)

shortCondition = crossunder(mtfD, 50) and k<50 and k<d and mtfK<mtfD

if (shortCondition)

strategy.entry("Corto", strategy.short)

exitlong=crossunder(mtfD, upLine)

exitshort=crossover(mtfK, lowLine)

if (exitlong)

strategy.exit("Esci lungo","Lungo",trail_points=trailStep)

if (exitshort)

strategy.exit("Esci corto","Corto",trail_points=trailStep)

showZones = input(true, title="Show Bullish/Bearish Zones")

// bullish signal rule:

bullishRule = k >= mtfD

// bearish signal rule:

bearishRule = k <= mtfD

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? green : ruleState==-1 ? red : gray ) : na , title="supertrend Bullish/Bearish Zones", transp=90)