概述

移动平均线交叉策略是一个非常经典的技术分析策略。它通过计算不同周期的移动平均线,并观察它们的交叉情况来判断行情的趋势,实现低买高卖的目的。该策略适用于中长线交易,可以有效过滤市场噪音,识别趋势。

原理

该策略主要是计算10日简单移动平均线SMA和10日三角移动平均线TRIMA。当SMA上穿TRIMA时产生买入信号,表示行情由下跌转为上涨,可以买入。当SMA下穿TRIMA时产生卖出信号,表示行情由上涨转为下跌,可以卖出。

具体来说,策略首先输入收盘价,并定义计算SMA和TRIMA的周期长度。其中SMA的计算公式为:

SMA = (P1 + P2 + … + Pn) / n

其中Pn为过去n天的收盘价。

TRIMA的计算公式为:

TRIMA = (SMA1 + SMA2 + SMA3) / 3

其中SMA1、SMA2、SMA3分别是过去n天收盘价的SMA。

这样,TRIMA相当于对SMA再进行一次SMA,具有更好的平滑效果。当短周期的SMA上穿长周期的TRIMA时,表示短周期均线上的突破,可以买入。相反,当SMA下穿TRIMA时,表示短周期均线下的突破,可以卖出。

优势

该策略最大的优势就是利用了移动平均线的趋势判断能力,可以有效地识别市场趋势,滤除短期市场噪音,实现低买高卖。相比单一移动平均线,SMA和TRIMA的组合使用可以提高突破的可靠性,降低假突破的概率。此外,移动平均线本身具有较好的平滑性,也可以起到止损的效果,降低单笔止损的概率。总体来说,该策略非常适合中长线持仓交易。

风险

该策略的主要风险在于移动平均线本身滞后于价格变化,可能会错过趋势的前期,导致入场过晚。此外,当市场没有明显趋势时,该策略会产生更多假突破。最后,移动平均线策略更依赖参数优化,如果参数设置不当,也会大幅影响策略效果。

优化方向

该策略可以从以下几个方面进行优化:

优化移动平均线的周期参数,采用更科学的方法寻找最佳周期组合。

增加成交量的过滤指标,避免在成交量不佳的情况下发出错误信号。

结合趋势指标如MACD判断局部趋势,避免在盘整市中反复交易。

采用自适应移动平均线,当市场进入特定阶段时动态调整周期参数。

采用多时间框架进行验证,例如只有日线、4小时线均突破时才考虑入场。

总结

移动平均线交叉策略是一个简单实用的技术分析策略,非常适合中长线持仓交易,可以有效识别趋势方向。但该策略也存在一定滞后性,需要结合趋势判断指标进行过滤优化,降低误信号概率。如果参数优化得当,它既可以 rodeo 保护资金,又可以抓住较大的趋势机会。是非常值得研究和应用的一个策略思路。

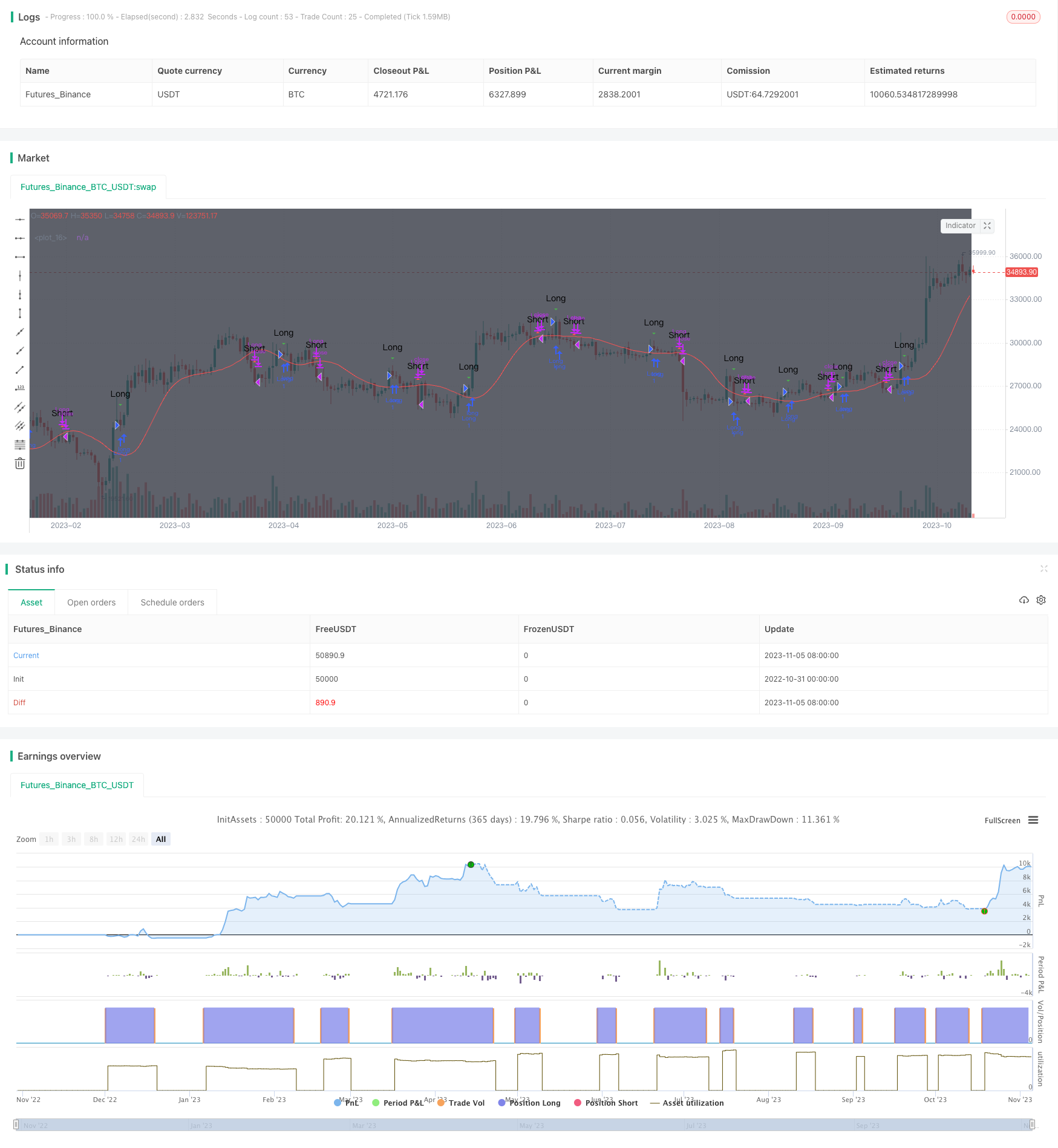

/*backtest

start: 2022-10-31 00:00:00

end: 2023-11-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//TMA strategy I came across, uses sma to display entry/exit points for both margin and non margin trading. The buy/sell signals as well as syntax are hidden behind comments if you scroll down.

//Change the commented fields for margin or spot trading!

//@version=3

strategy("MP Rollercoaster Strat", overlay=true)

bgcolor ( color=black, transp=0, title='Blackground', editable=true)

x = input(close, "Red")

n = input(10, "periods")

trima = sma(sma(x,n), n)

kisa=input(5, "Green")

sma = sma(close, kisa)

bull = (sma>trima)

fill(plot(sma, color = green), plot(trima, color=red), bull ? green : red)

//Conditions

buy_signal = crossover(sma,trima)

sell_signal = crossunder(sma,trima)

plotshape(sell_signal, style=shape.triangleup, color = red, text="Short")

plotshape(buy_signal, style=shape.triangledown, color = green, text="Long")

//plotshape(sell_signal, style=shape.triangleup, color = red, text="Sell")

//plotshape(buy_signal, style=shape.triangledown, color = green, text="Buy")

alertcondition(sell_signal, title = 'Short', message = 'e= s= c=position b=long t=market l= | delay=30 | e= s= b=short l= t=market q=0.01')

alertcondition(buy_signal, title = 'Long', message = 'e= s= c=position b=short t=market l= | delay=30 | e= s= b=long l= t=market q=0.01')

//alertcondition(sell_signal, title = 'Sell', message = 'e= s= c=order b=buy | delay=3 | e= b=sell q=99% p=0.70% u=currency')

//alertcondition(buy_signal, title = 'Buy', message = 'e= s= c=order b=sell | delay=30 | e= b=buy q=80 p=0.1% u=currency')

testStartYear = input(2018, "From Year")

testStartMonth = input(4, "From Month")

testStartDay = input(1, "From Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2019, "To Year")

testStopMonth = input(1, "To Month")

testStopDay = input(1, "To Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

if testPeriod()

if buy_signal

strategy.entry("Long", true)

if sell_signal

strategy.close("Long")