概述

本策略的核心思想是结合KST指标和EMA均线,实现对趋势的判断和跟随。当KST指标出现金叉并低于0时买入,当出现死叉并高于0时卖出。同时结合EMA均线作为支撑阻力,只有收盘价突破EMA均线时才发出交易信号。该策略简单实用,可以自动跟踪趋势,适合中长期持仓。

策略原理

计算KST指标:分别计算10日、15日、20日、30日的ROC指标,再分别对其加权求和,最后通过一个9日SMA平滑得到KST指标。

计算EMA均线:计算长度为50的EMA均线。

产生买入信号:当KST指标的快线上穿慢线(金叉)并低于0,同时收盘价高于EMA均线时,产生买入信号。

产生卖出信号:当KST指标的快线下穿慢线(死叉)并高于0,同时收盘价低于EMA均线时,产生卖出信号。

设置移动止损:跟踪止损设置为账户价值的1%,实现自动止损。

策略优势

KST指标可以识别趋势变化,EMA均线可以确认趋势方向,二者结合可以准确判断ENTRY时机。

采用快慢交叉结合0轴判断KST指标方向,避免无谓交易。

EMA均线作为支撑阻力,进一步过滤假信号,只在突破EMA时入场。

自动跟踪止损来控制风险,让盈利运行。

策略参数较少,容易实现和优化。

策略风险

KST指标对趋势变化判断有滞后,可能错过部分机会。可以缩短计算周期或优化加权方式。

EMA均线有滞后性,在趋势转折点可能失效。可以试验其他指标或多均线组合。

止损设置过于宽松会让亏损扩大;过于紧凑会被隔夜大幅波动止损。需要仔细测试找到平衡点。

策略信号频繁,交易成本可能较高。可以适当放宽入场条件,减少交易次数。

策略优化方向

优化KST指标的计算周期参数,找到对特定品种更敏感的参数组合。

测试不同的均线指标或组合,如MA、WMA等,看哪种与KST配合效果更好。

尝试根据波动率或ATR动态调整止损幅度。

增加过滤条件,如交易量突增等,避免被套。

考虑结合其他指标,如RSI、MACD等,使策略更全面。

测试不同品种参数效果,制定适应不同品种的优化方案。

总结

本策略整体思路清晰、可靠、容易实现,通过KST指标判断趋势转折,EMA均线进一步过滤,止损控制风险,可以自动跟踪中长线趋势。参数选取合理、优化空间大,用户可以根据需要调整参数,适用于不同品种,具有良好的普适性。本策略既适合新手学习,也可为专业交易者提供方向。通过继续优化测试,本策略有望成为稳定可靠的趋势跟随策略。

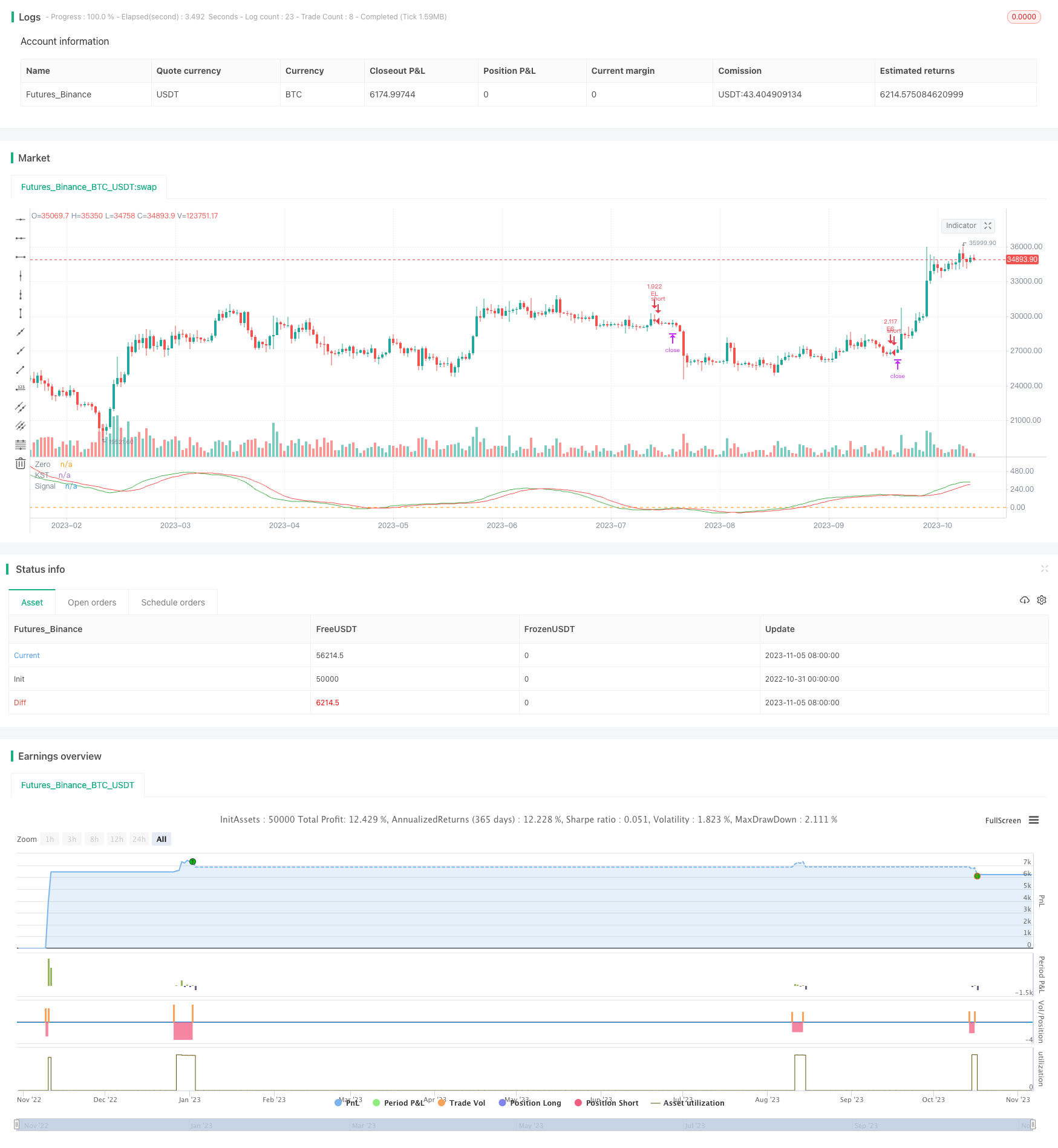

/*backtest

start: 2022-10-31 00:00:00

end: 2023-11-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Know Sure Thing and EMA Strategy by JLX", shorttitle="KST EMA JLX", format=format.price, precision=4, initial_capital = 1000, default_qty_type=strategy.percent_of_equity, default_qty_value = 100)

roclen1 = input(10, minval=1, title = "ROC Length #1")

roclen2 = input(15, minval=1, title = "ROC Length #2")

roclen3 = input(20, minval=1, title = "ROC Length #3")

roclen4 = input(30, minval=1, title = "ROC Length #4")

smalen1 = input(10, minval=1, title = "SMA Length #1")

smalen2 = input(10, minval=1, title = "SMA Length #2")

smalen3 = input(10, minval=1, title = "SMA Length #3")

smalen4 = input(15, minval=1, title = "SMA Length #4")

siglen = input(9, minval=1, title = "Signal Line Length")

smaroc(roclen, smalen) => sma(roc(close, roclen), smalen)

kst = smaroc(roclen1, smalen1) + 2 * smaroc(roclen2, smalen2) + 3 * smaroc(roclen3, smalen3) + 4 * smaroc(roclen4, smalen4)

sig = sma(kst, siglen)

plot(kst, color=color.green, title="KST")

plot(sig, color=color.red, title="Signal")

hline(0, title="Zero")

len = input(50, minval=1, title="Length EMA")

src = input(close, title="Source EMA")

offset = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

fastEMA = ema(src, len)

delta = kst - sig

buySignal = crossover(delta, 0) and kst < 0 and close > fastEMA

sellSignal = crossunder(delta, 0) and kst > 0 and close < fastEMA

longTrailPerc = input(title="Trail Long Loss (%)", type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

shortTrailPerc = input(title="Trail Short Loss (%)",type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

// STEP 2:

// Determine trail stop loss prices

longStopPrice = 0.0, shortStopPrice = 0.0

longStopPrice := if (strategy.position_size > 0)

stopValue = close * (1 - longTrailPerc)

max(stopValue, longStopPrice[1])

else

0

shortStopPrice := if (strategy.position_size < 0)

stopValue = close * (1 + shortTrailPerc)

min(stopValue, shortStopPrice[1])

else

999999

// Submit entry orders

if (buySignal)

strategy.entry(id="EL", long=true)

if (sellSignal)

strategy.entry(id="ES", long=false)

// STEP 3:

// Submit exit orders for trail stop loss price

if (strategy.position_size > 0)

strategy.exit(id="XL TRL STP", stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id="XS TRL STP", stop=shortStopPrice)

alertcondition(crossover(delta, 0) and kst < 0 and close > fastEMA,'Long alert', 'You should buy')

alertcondition(crossunder(delta, 0) and kst > 0 and close < fastEMA, 'Short alert', 'You should sell')