概述

本策略基于Hull移动平均线指标,在不同的时间轴上计算Hull MA,并比较不同时间轴上的Hull MA走势,以发现趋势的变化。当短周期Hull MA上穿长周期Hull MA时 generate买入信号; 当短周期Hull MA下穿长周期Hull MA时 generate卖出信号。

策略原理

输入参数:Hull MA周期Period, HMA2的时间轴Resolution2, HMA3的时间轴Resolution3

计算当前K线上的Hull MA值HMA

在Resolution2时间轴上计算Hull MA值HMA2

在Resolution3时间轴上计算Hull MA值HMA3

比较HMA、HMA2、HMA3的大小关系

当HMA>HMA2>HMA3时,产生买入信号

当HMA

在界面左上方显示不同时间轴上的Hull MA值和信号

使用颜色区分涨跌状态

优势分析

使用多个时间轴可以过滤假突破,避免被套。

可自定义时间轴参数,适用于不同周期。

实时显示信号,操作直观。

可视化Hull MA走势,形成当前趋势判断。

风险分析

参数设置不当可能导致过于频繁交易。

大周期Hull MA有滞后性,可能错过趋势转折点。

牛熊转换时,策略会产生虚假信号。

突破类策略,容易被假突破套牢。

交易手续费未考虑,会影响实际收益。

可通过优化参数,组合其他指标作为过滤,适当放宽止损线来减少风险。

优化方向

优化Hull MA周期参数,适应不同周期和波动率。

增加成交量指标判断,避免虚假突破。

增加震荡指标,确定趋势强度。

增加机器学习模型判断买卖时机。

结合情绪指标,发现市场热点。

调整止损策略,优化风险管理。

自定义买卖条件,组合其他指标信号。

增加基于价格通道、波段的交易策略。

总结

本策略基于Hull MA指标比较不同时间轴上的均线走势,判断当前趋势方向,在趋势发生转折时generate买入卖出信号。相比单一均线,多时间轴Hull MA可有效过滤假突破。但该策略也存在参数设置、趋势判断等问题。通过整合更多指标、优化参数设置、改进止损策略等手段,可以增强策略Profitability并控制风险。

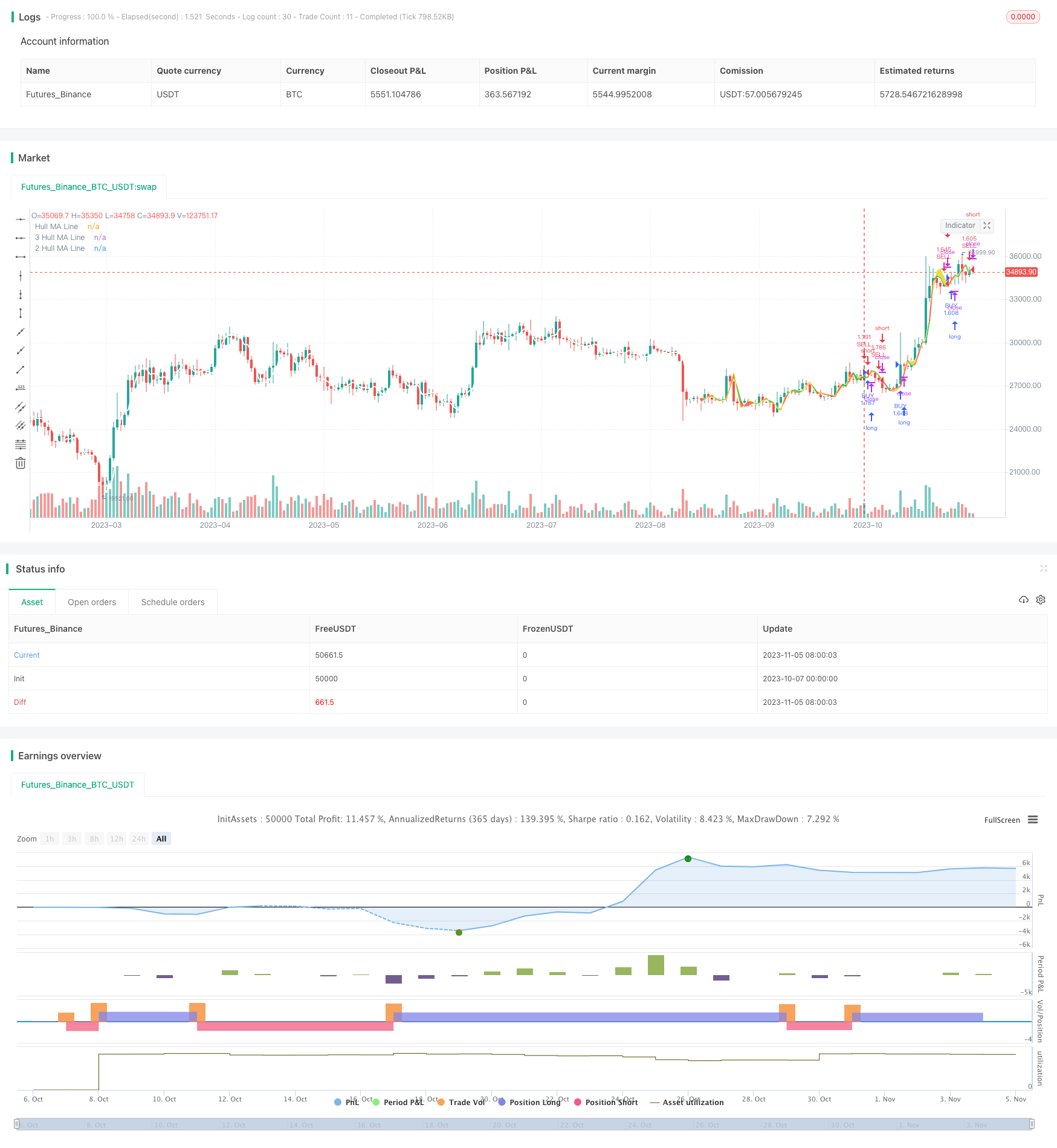

/*backtest

start: 2023-10-07 00:00:00

end: 2023-11-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

strategy("wtfBUYorSELLffs",overlay=true,currency="USD",initial_capital=100000,default_qty_type=strategy.percent_of_equity,default_qty_value=100,commission_type=strategy.commission.percent,commission_value=0.1)

Period=input(title="Hull MA Period",type=input.integer,defval=6,minval=1)

Resolution2=input(title="HMA2 Resolution", type=input.resolution,defval="60")

Resolution3=input(title="HMA3 Resolution", type=input.resolution,defval="240")

Price=input(title="Source of Price",type=input.source,defval=open)

xOffset = input(40, title="Panel offset (X-Axis)")

yOffset = input(0, title="Panel offset (y-Axis)")

lightgray = #D3D3D3FF

pnlTextColor = color.silver

pnlColor = color.black

HMA = hma(Price,Period)

HMA2 = security(syminfo.tickerid, Resolution2, HMA,barmerge.gaps_off,barmerge.lookahead_off)

HMA3 = security(syminfo.tickerid, Resolution3, HMA,barmerge.gaps_off,barmerge.lookahead_off)

HUP = HMA > HMA[1]

H1UP = security(syminfo.tickerid, Resolution2, HUP,barmerge.gaps_off,barmerge.lookahead_off)

H2UP = security(syminfo.tickerid, Resolution3, HUP,barmerge.gaps_off,barmerge.lookahead_off)

int barSize = timeframe.isdaily ? timeframe.multiplier*86400000 :

timeframe.isseconds? timeframe.multiplier*1000 :

timeframe.isminutes? timeframe.multiplier*60000 : (time[0]-time[1])

int lapos_x = timenow + barSize*xOffset

float lapos_y = highest(20) + yOffset*syminfo.mintick * syminfo.pointvalue

f_draw_infopanel(_x, _y, _line, _text)=>

_rep_text = ""

for _l = 0 to _line

_rep_text := _rep_text + "\n"

_rep_text := _rep_text + _text

// var label _la = na

// label.delete(_la)

// _la := label.new(

// x=_x, y=_y,

// text=_rep_text, xloc=xloc.bar_time, yloc=yloc.price,

// color=pnlColor, style=label.style_labelup, textcolor=pnlTextColor, size=size.normal)

// f_draw_infopanel(lapos_x, lapos_y, 8, "╚═══════════════════════╝")

f_draw_infopanel(lapos_x, lapos_y, 6, "HMA3 on TF " + Resolution3 + " = " + tostring(HMA3,"#.####") + (H2UP ? " BUY" : " SELL"))

f_draw_infopanel(lapos_x, lapos_y, 4, "HMA2 on TF " + Resolution2 + " = " + tostring(HMA2,"#.####") + (H1UP ? " BUY" : " SELL"))

f_draw_infopanel(lapos_x, lapos_y, 2, "HMA1 on TF " + timeframe.period + " = " + tostring(HMA,"#.####") + (HUP ? " BUY" : " SELL"))

f_draw_infopanel(lapos_x, lapos_y, 0, "╔═════════ HMA(" + tostring(Period,"#") +") ════════╗")

change_color=HMA>HMA3?color.green:color.red

change_color2=HMA2>HMA3?color.lime:color.yellow

plot1=plot(HMA3,color=change_color2,title="3 Hull MA Line",linewidth=2,transp=75)

plot2=plot(HMA2,color=change_color,title="2 Hull MA Line",linewidth=2,transp=75)

plot3=plot(HMA,color=color.white,title="Hull MA Line",linewidth=2,transp=75)

fill(plot1,plot3,color=change_color,transp=90)

fill(plot2,plot3,color=change_color2,transp=75)

if (H2UP and H1UP and HUP)

strategy.entry("BUY",strategy.long)

if (not H2UP and not H1UP and not HUP)

strategy.entry("SELL",strategy.short)