概述

这是一个将抛物线SAR指标与三条不同周期的SMMA均线相结合的突破交易策略。它在三条均线全面上涨时做多,三条均线全面下跌时做空,同时结合SAR指标判断趋势方向,在SAR指标转向时进行反向开仓。该策略同时支持止损和止盈。

策略原理

该策略主要基于以下几点:

使用抛物线SAR指标判断当前趋势方向。SAR指标能够动态追踪价格变化,判断多头趋势和空头趋势。

设置三条不同周期的SMMA均线(快线21周期、中线50周期、慢线200周期)。当三条均线全部上涨时,视为多头趋势形成;当三条均线全部下跌时,视为空头趋势形成。

在SAR指标发生向下转向时,如果三条均线全面上涨,则做多入场。

在SAR指标发生向上转向时,如果三条均线全面下跌,则做空入场。

设置止损和止盈。止损以SAR指标作为动态止损位,止盈设置为入场价格的一定比例。

具体来说,策略首先判断当前BAR的SAR指标是否发生转向。如果SAR从向上转向向下,并且三条均线全面上涨,则做多;如果SAR从向下转向向上,并且三条均线全面下跌,则做空。

在持有头寸后,止损线设置为下一个BAR的SAR指标价位,以SAR作为动态追踪止损。止盈设置为入场价格的10%。当价格达到止盈或止损水平时,平仓退出。

优势分析

这种策略结合趋势判断指标和多时间周期均线的优点,可以在趋势发生转折时及时入场,同时通过均线过滤假突破。主要优势有:

SAR指标能够动态判断趋势转向,快速捕捉趋势转换机会。

三条均线能够有效过滤市场噪音,避免假突破。

采用SMMA均线,曲线更平滑,减少均线震荡对交易的干扰。

结合止损止盈设置,可以控制单次亏损,同时锁定部分利润。

策略参数设置灵活,可针对不同市场调整参数,优化策略效果。

风险分析

该策略也存在一些风险,主要包括:

在震荡趋势中,SAR指标可能发生多次频繁转向,导致过于频繁交易而增加交易费用。

三条均线 Settings 可能不一定完全适合所有品种,需要根据具体品种行情进行调整。

止损设置为下一个BAR的SAR价位存在时间滞后,可能扩大损失。

稳定趋势中假突破使SAR转向的问题,可以通过调整参数平滑SAR曲线来缓解。

均线Settings不当也可能错过趋势或产生错误信号,需要仔细测试优化。

对应风险,可以从以下几点进行优化:

根据不同品种波动程度调整SAR参数,降低频繁转向概率。

调整三条均线的参数,使其更贴近不同品种的特点。

优化止损策略,例如采用小止损、移动止损等方式。

在交易频繁市场使用限价单止损,避免滑点扩大损失。

做好参数调优测试,评估均线和SAR参数对策略效果的影响。

优化方向

根据以上分析,该策略可以从以下几个方面进行优化:

优化SAR参数设置,平滑SAR曲线,降低曲线转向频率,避免过度交易。

调整三条均线的长度,使其更符合具体交易品种的特性,发挥更好的趋势过滤作用。

采用动态止损策略,例如移动止损、挂单小止损等,减少止损带来的损失。

在高频交易市场使用限价单止损,降低止损滑点损失。

添加其他指标进行过滤,如RSI,KD等,提高信号质量,减少假突破概率。

优化入场条件,可考虑在SAR转向时同时检验K线形态,避免低质量信号。

添加重新入场条件,在止损后价格继续向有利方向运行时再次入场。

完善止盈策略,例如移动止盈、部分止盈、级差止盈等,提高盈利能力。

基于回测结果对参数进行优化,评估参数对整体策略效果的影响。

总结

总的来说,这是一个结合趋势跟踪指标SAR和均线的简单实用的突破策略。它利用SAR判断趋势转向的灵敏度,以及均线的滤波作用,在趋势转折点快速入场。同时设置止损止盈来控制风险和锁定利润。通过调整参数 SETTINGS 及优化入场出场条件,可以获得较好的策略效果。但交易者需要注意控制过度交易和假突破等问题,针对不同品种进行参数调优和策略测试,从而获得稳定的交易系统。

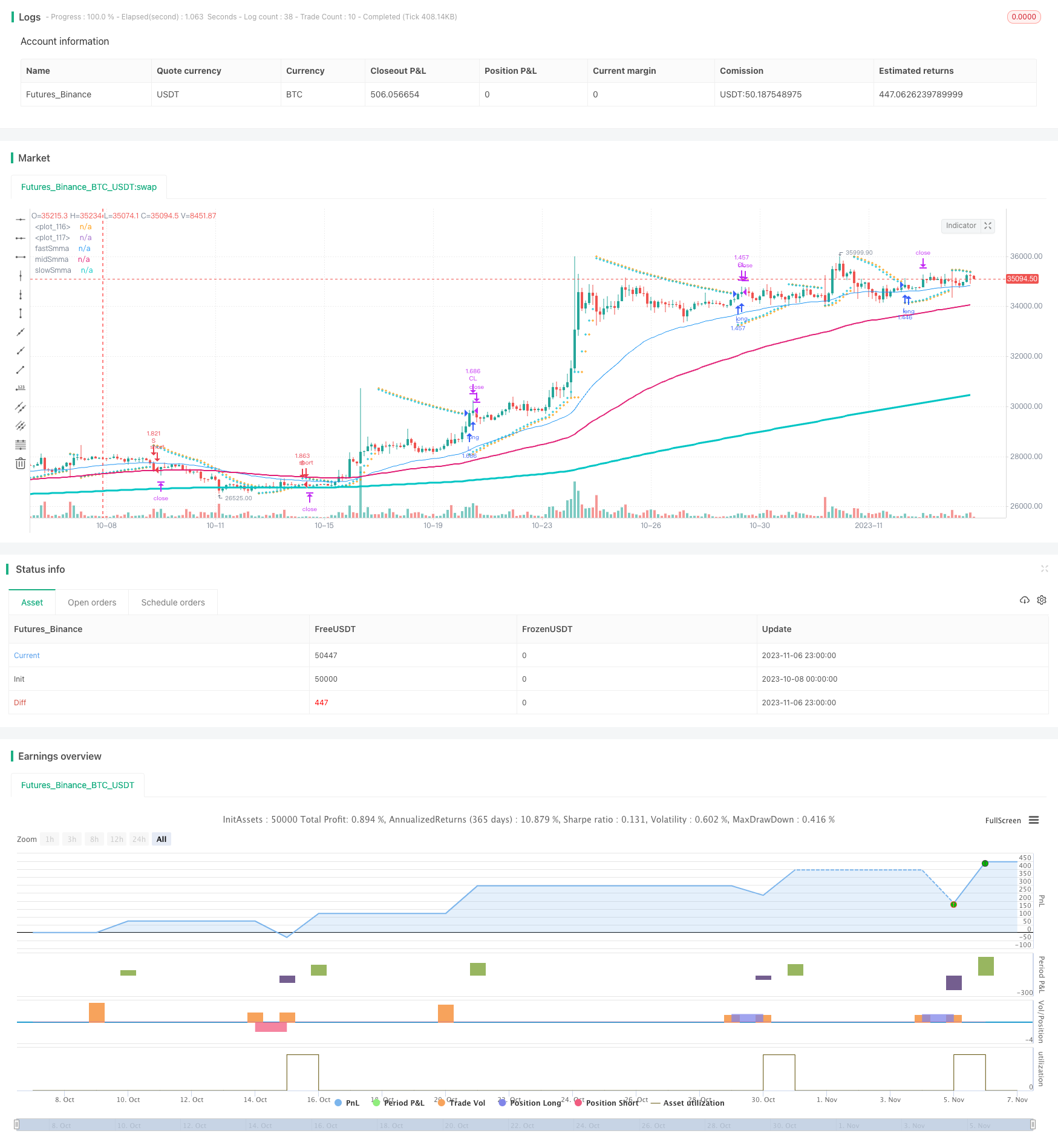

/*backtest

start: 2023-10-08 00:00:00

end: 2023-11-07 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="SAR + 3SMMA with SL & TP", overlay=true, calc_on_order_fills=false, calc_on_every_tick=false, default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency=currency.USD, commission_type= strategy.commission.percent, commission_value=0.03)

start = input.float(0.02, step=0.01, group="SAR")

increment = input.float(0.02, step=0.01, group="SAR")

maximum = input.float(0.2, step=0.01, group="SAR")

//Take Profit Inputs

take_profit = input.float(title="Take Profit (%)", minval=0.0, step=0.1, defval = 0.1, group="Stop Loss and Take Profit", inline="TP") * 0.01

//Stop Loss Inputs

stop_loss = input.float(title="StopLoss (%)", minval=0.0, step=0.1, defval=1, group="Stop Loss and Take Profit", inline="SL") * 0.01

// Smooth Moving Average

fastSmmaLen = input.int(21, minval=1, title="Fast Length", group = "Smooth Moving Average")

midSmmaLen = input.int(50, minval=1, title="Mid Length", group = "Smooth Moving Average")

slowSmmaLen = input.int(200, minval=1, title="Slow Length", group = "Smooth Moving Average")

src = input(close, title="Source", group = "Smooth Moving Average")

smma(ma, src, len) =>

smma = 0.0

smma := na(smma[1]) ? ma : (smma[1] * (len - 1) + src) / len

smma

fastSma = ta.sma(src, fastSmmaLen)

midSma = ta.sma(src, midSmmaLen)

slowSma = ta.sma(src, slowSmmaLen)

fastSmma = smma(fastSma, src, fastSmmaLen)

midSmma = smma(midSma, src, midSmmaLen)

slowSmma = smma(slowSma, src, slowSmmaLen)

isSmmaUpward = ta.rising(fastSmma, 1) and ta.rising(midSmma, 1) and ta.rising(slowSmma, 1)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

sarIsUpTrend = uptrend ? true : false

sarFlippedDown = sarIsUpTrend and not sarIsUpTrend[1] ? true : false

sarFlippedUp = not sarIsUpTrend and sarIsUpTrend[1] ? true : false

longEntryCondition = isSmmaUpward and sarFlippedDown

shortEntryCondition = not isSmmaUpward and sarFlippedUp

if(longEntryCondition)

strategy.entry("L", strategy.long, stop=nextBarSAR, comment="L")

if(shortEntryCondition)

strategy.entry("S", strategy.short, stop=nextBarSAR, comment="S")

strategy.exit("CL", when=strategy.position_size > 0, limit=strategy.position_avg_price * (1+take_profit), stop=strategy.position_avg_price*(1-stop_loss))

strategy.exit("CS", when=strategy.position_size < 0, limit=strategy.position_avg_price * (1-take_profit), stop=strategy.position_avg_price*(1+stop_loss))

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=1, color=color.aqua)

plot(series = fastSmma, title="fastSmma", linewidth=1)

plot(series = midSmma, title="midSmma", linewidth=2)

plot(series = slowSmma, title="slowSmma", linewidth=3)

plotchar(series = isSmmaUpward, title="isSmmaUpward", char='')

plotchar(series=sarIsUpTrend, title="sarIsUpTrend", char='')

plotchar(series=sarFlippedUp, title="sarFlippedUp", char='')

plotchar(series=sarFlippedDown, title="sarFlippedDown", char='')

plotchar(series=longEntryCondition, title="longEntryCondition", char='')

plotchar(series=shortEntryCondition, title="shortEntryCondition", char='')

plotchar(series=strategy.position_size > 0, title="inLong", char='')

plotchar(series=strategy.position_size < 0, title="inShort", char='')

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)