概述

该策略基于LazyBear的Z距离VWAP指标,通过计算价格与VWAP的Z距离来判断是否超买超卖,以及进行入场出场。策略加入EMA均线以及Z距离回归0轴的判断,可过滤掉部分噪声信号。

策略原理

- 计算VWAP的值

- 计算价格与VWAP的Z距离

- 设置超买线(2.5)和超卖线(-0.5)

- 当快线大于慢线,Z距离低于超卖线,且Z距离上穿0轴时做多

- 当Z距离超过超买线时平仓

- 加入止损逻辑

关键函数:

- calc_zvwap:计算价格与VWAP的Z距离

- VWAP值:vwap(hlc3)

- 快线:ema(close,fastEma)

- 慢线:ema(close,slowEma)

优势分析

- 使用Z距离更直观判断超买超卖

- 结合EMA过滤假突破,避免被套

- 允许加仓,可以利用趋势获利

- 有止损逻辑,可以控制风险

风险分析

- 需确保参数设置合理,如超买超卖线位置,EMA周期等

- Z距离指标有滞后,可能错过关键买卖点

- 允许加仓会增大损失风险

- 止损位置需要合理设置

解决方法: 1. 通过回测优化参数设置 2. 结合额外指标过滤信号 3. 合理设置加仓条件 4. 动态调整止损位置

优化方向

- 优化EMA周期参数

- 测试不同的超买超卖判断标准

- 加入其他指标过滤信号噪音

- 测试不同的止损方式

- 优化入场、加仓和止损逻辑

总结

该策略利用Z距离判定价格与VWAP的关系,结合EMA过滤噪音信号,以捕捉趋势机会。策略允许加仓追踪趋势,同时设置止损控制风险。通过参数优化及加入其他指标可以提高策略稳定性。但Z距离指标存在滞后问题,在优化时需考量。总体来说,该策略以简单清晰的逻辑捕捉趋势,经过充分优化后可成为高效的趋势跟踪策略。

策略源码

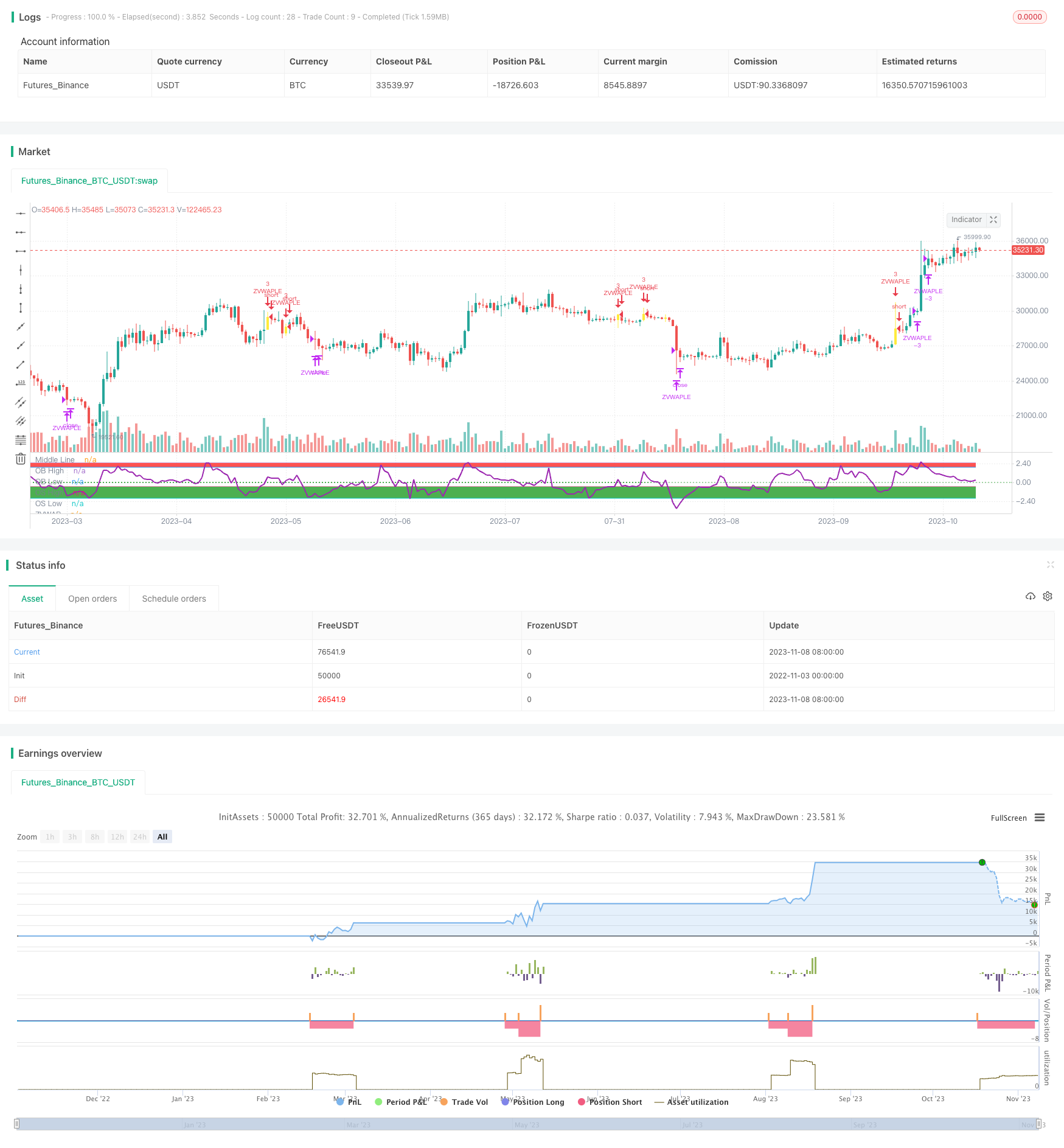

/*backtest

start: 2022-11-03 00:00:00

end: 2023-11-09 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//This is based on Z distance from VWAP by Lazybear

strategy(title="ZVWAP[LB] strategy", overlay=false,pyramiding=2, default_qty_type=strategy.fixed, default_qty_value=3, initial_capital=10000, currency=currency.USD)

length=input(13,"length")

calc_zvwap(pds, source1) =>

mean = sum(volume*source1,pds)/sum(volume,pds)

vwapsd = sqrt(sma(pow(source1-mean, 2), pds) )

(close-mean)/vwapsd

upperTop=2.5 //input(2.5)

upperBottom=2.0 //input(2.0)

lowerTop=-0.5 //input(-0.5)

lowerBottom=-2.0 //input(-2.0)

buyLine=input(-0.5, title="OverSold Line",minval=-2, maxval=3)

sellLine=input(2.0, title="OverBought Line",minval=-2, maxval=3)

fastEma=input(13, title="Fast EMA",minval=1, maxval=50)

slowEma=input(55, title="Slow EMA",minval=10, maxval=200)

stopLoss =input(5, title="Stop Loss",minval=1)

hline(0, title="Middle Line", linestyle=hline.style_dotted, color=color.green)

ul1=plot(upperTop, "OB High")

ul2=plot(upperBottom, "OB Low")

fill(ul1,ul2, color=color.red)

ll1=plot(lowerTop, "OS High")

ll2=plot(lowerBottom, "OS Low")

fill(ll1,ll2, color=color.green)

zvwapVal=calc_zvwap(length,close)

plot(zvwapVal,title="ZVWAP",color=color.purple, linewidth=2)

longEmaVal=ema(close,slowEma)

shortEmaVal=ema(close,fastEma)

vwapVal=vwap(hlc3)

zvwapDipped=false

for i = 1 to 10

zvwapDipped := zvwapDipped or zvwapVal[i]<=buyLine

longCondition= shortEmaVal > longEmaVal and zvwapDipped and crossover(zvwapVal,0)

barcolor(longCondition ? color.yellow: na)

strategy.entry(id="ZVWAPLE", long=true, when= longCondition and strategy.position_size<1)

//Add

strategy.entry(id="ZVWAPLE", comment="Add", long=true, when= strategy.position_size>1 and close<strategy.position_avg_price and crossover(zvwapVal,0))

//calculate stop Loss

stopLossVal = strategy.position_avg_price - (strategy.position_avg_price*stopLoss*0.01)

strategy.close(id="ZVWAPLE",comment="SL Exit", when=close<stopLossVal) //close all on stop loss

strategy.close(id="ZVWAPLE",comment="TPExitAll", qty=strategy.position_size , when= crossunder(zvwapVal,sellLine)) //close all zvwapVal>sellLine