概述

本策略的核心思想是在当日收盘时买入标的,并在次日开盘时卖出,以利用开盘时标的价格的涨幅获利。

策略原理

该策略主要基于两个判断:

日内交易者通常倾向于在开盘时进行买入操作,从而带动开盘时股价的涨幅。

收盘时的标的价格相对更能反映该标的的真实价值。

具体来说,该策略首先在每天收盘时(20:00)判断当日收盘价是否高于200日简单移动平均线,如果高于该平均线,则在收盘时做多;如果收盘价低于该平均线,则在收盘时做空。

在次日开盘时(9:30),如果前一日持有多头头寸,则在开盘时平仓;如果持有空头头寸,则在开盘时平仓。

通过在收盘低价买入,开盘高价卖出的操作,利用开盘股价的涨幅获得收益。

优势分析

该策略主要具有以下优势:

利用日内交易者的惯性思维,即开盘时股价上涨的特点,在开盘时卖出标的获得盈利。

使用200日移动平均线判断价格趋势,有利于把握大趋势进行操作。

操作频率低,每天只有开盘和收盘两个时间点进行判断和交易,降低交易成本。

回测数据充分,利用历史数据判断规则参数的合理性,增加信心。

程序化交易系统执行效率高,避免人为情绪影响交易决策。

风险分析

该策略也存在一定的风险:

开盘价反转的概率存在,如果开盘价向相反方向大幅反转,则会产生损失。

收盘价被人为操纵的可能性,如果收盘价被刻意推高或压低,会影响决策。

标的停牌可能导致无法在开盘平仓,产生损失。

交易成本较高的标的不适合该频率较高的策略。

参数设定不合理可能导致交易频率过高或效果不佳。

对应风险的解决方法包括:

设置止损点,控制最大损失。

采取成交量或复权等手段判断收盘价的可靠性。

优先选择流动性较好的标的。

调整移动平均线参数和开平仓时间提高策略效果。

优化方向

该策略可以通过以下方式进行优化:

在开盘价格出现反转时设置止损或止盈,避免继续亏损。

使用其他指标或模型判断股价的合理区间,避免损失。

考虑标的的流动性风险,优先选择流动性较好的标的。

测试不同的移动平均线参数,寻找最佳参数组合。

优化开平仓时间,考虑提前或延迟一定时间开平仓。

结合当前重大消息面判断收盘价的合理性。

考虑交易成本,筛选交易成本较低的标的。

整合多因子模型,充分考虑各种影响因素。

总结

本策略通过在每日收盘低价买入、次日开盘高价卖出的操作获得收益,利用了开盘涨幅较大的特点。该策略有一定的优势,但也存在一些风险需要注意。通过继续优化参数设定、止损方法、标的选择等,可以获得更好的策略效果。总体来说,本策略为日内交易者提供了一种简单可行的平仓策略思路。

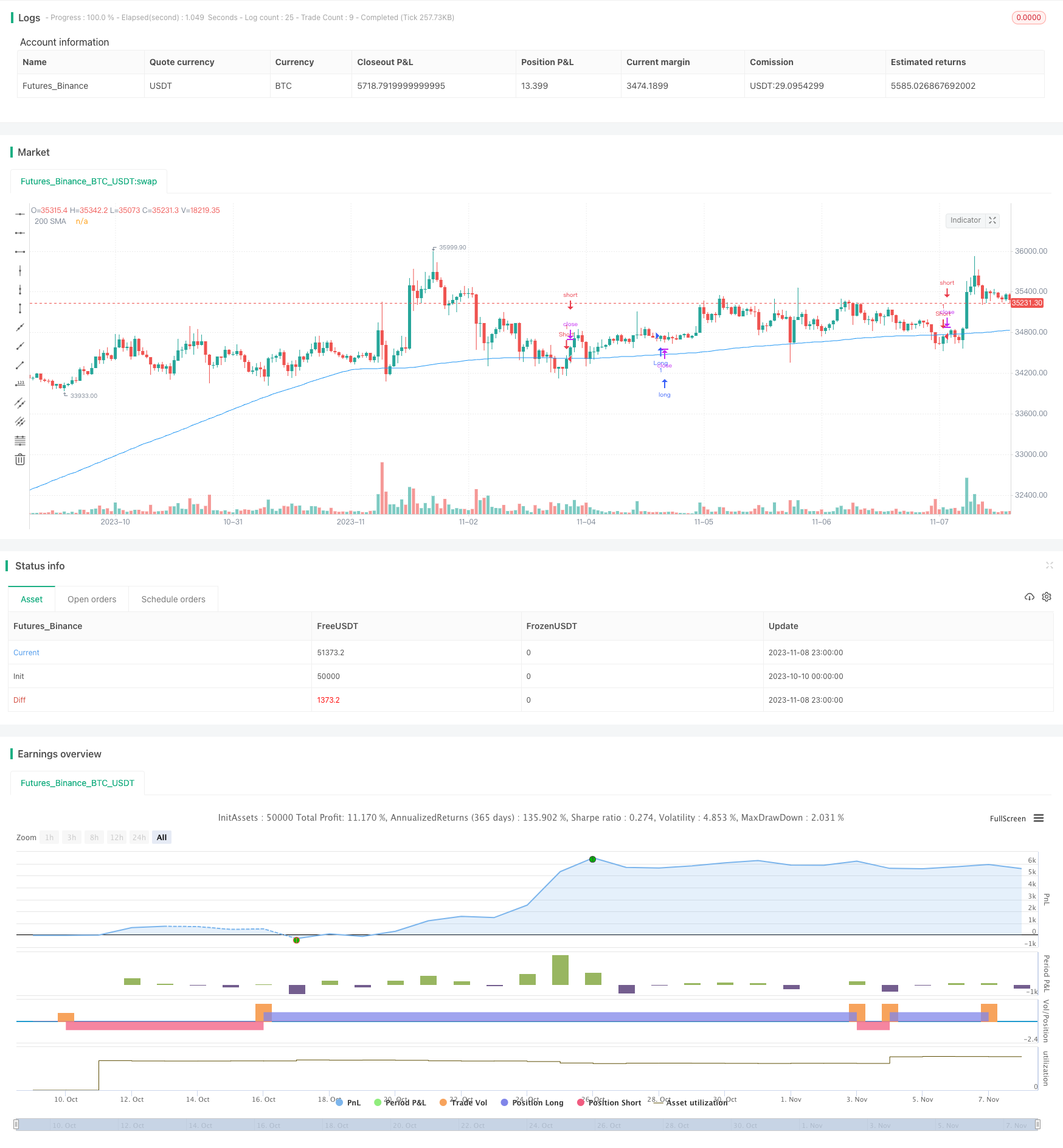

/*backtest

start: 2023-10-10 00:00:00

end: 2023-11-09 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Youngmoneyinvestments

//@version=5

strategy("End of Day Trading Strategy", overlay=true)

// Get the daily open, high, low, and close prices

daily_open = request.security(syminfo.tickerid, "D", open)

daily_close = request.security(syminfo.tickerid, "D", close)

// Calculate the 200 period SMA on daily close

sma200 = ta.sma(daily_close, 200)

// Define the entry and exit conditions

end_of_day = (hour == 20) and (minute == 0) // Assuming the end of the regular trading hours is 20:00

start_of_day = (hour == 9) and (minute == 30) // Assuming the start of the trading session is 09:30

long_condition = end_of_day and (daily_close > sma200)

short_condition = end_of_day and (daily_close < sma200)

// Execute the strategy logic

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Exit conditions

if (strategy.position_size > 0 and start_of_day) // If we are long, sell at the open of the session

strategy.close("Long")

if (strategy.position_size < 0 and start_of_day) // If we are short, buy at the open of the session

strategy.close("Short")

// Plot the SMA on the chart

plot(sma200, "200 SMA", color=color.blue)