概述

本策略运用动态通道指标,根据通道的突破情况来判断行情方向,以捕捉趋势的方向。该策略主要通过计算一定时间周期内的最高价和最低价,来形成上下通道,在通道突破时产生交易信号。

策略原理

本策略使用input函数设置通道周期长度length为20天。然后计算最近20天的最高价highest(high, length)作为上轨,最近20天的最低价lowest(low, length)作为下轨。

通道内填充颜色。在上轨之上填充绿色,在下轨之下填充红色,以形成动态通道。

同时绘制200日移动平均线ema(close,200),作为判断趋势的参考。

策略以ema值为判断大趋势的基准。当close大于200日线时为看涨,当close小于200日线时为看跌。

在看涨时,如果收盘价close突破上轨,产生做多信号;在看跌时,如果收盘价close突破下轨,产生做空信号。

做多止损根据长短规则设置为下轨或中线,做空止损根据长短规则设置为上轨或中线。

策略优势

使用动态通道,能够捕捉市场变化趋势。

根据突破产生交易信号,遵循趋势交易思路。

基于移动平均线判断大趋势方向,与通道突破结合使用。

止损方式灵活,可根据市场调整。

策略风险

大趋势判断错误,可能与市场产生背离。

通道周期设置不当,将增加错误交易的概率。

止损点靠近通道,可能增加止损被触发的概率。

突破信号存在一定滞后,可能错过最佳入场点位。

对策:

基于多种指标结合判断大趋势,减少错误概率。

优化通道周期参数,使其适应不同市场节奏。

调整止损位置,确保有足够缓冲空间。

结合其他指标过滤入场信号。

策略优化方向

增加大趋势判断指标,形成指标组合,提高判断准确率。

添加交易量指标,避免虚假突破。

优化通道周期参数,使其更符合不同品种特点。

优化止损策略,实现止损动态跟踪。

增加过滤器,提高信号质量,减少不必要交易。

总结

本策略整体遵循趋势交易思路,运用动态通道判断波动范围和突破形成交易信号,可有效跟踪趋势变化,是一种可靠的趋势跟踪策略。但仍需优化大趋势判断和止损方式,并增加过滤条件,以提高策略稳定性。该策略适用于追踪中长线趋势,可结合其他策略组成多策略portfolio,对冲系统风险。

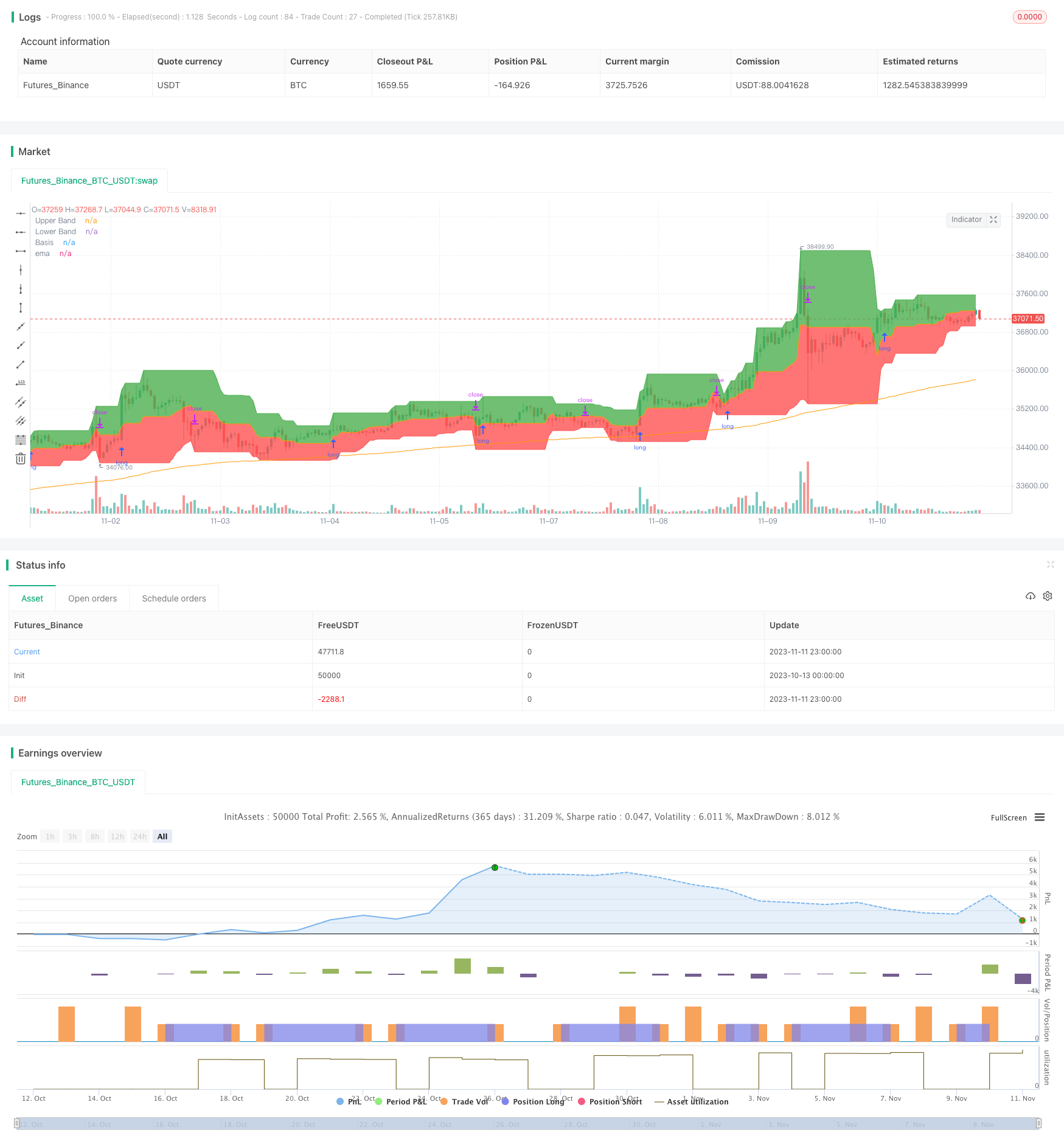

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © pratyush_trades

//@version=4

strategy("Donchian Indexes", overlay=true)

length = input(20)

longRule = input("Higher High", "Long Entry", options=["Higher High", "Basis"])

shortRule = input("Lower Low", "Short Entry", options=["Lower Low", "Basis"])

longSL=input("Lower Low", "LONG SL", options=["Lower Low", "Basis"])

shortSL=input("Higher High", "SHORT SL", options=["Higher High", "Basis"])

hh = highest(high, length)

ll = lowest(low, length)

up = plot(hh, 'Upper Band', color = color.green)

dw = plot(ll, 'Lower Band', color = color.red)

mid = (hh + ll) / 2

midPlot = plot(mid, 'Basis', color = color.orange)

fill(up, midPlot, color=color.green, transp = 95)

fill(dw, midPlot, color=color.red, transp = 95)

plot(ema(close,200), "ema", color=color.orange)

if (close>ema(close,200))

if (not na(close[length]))

strategy.entry("Long", strategy.long, stop=longRule=='Basis' ? mid : hh)

if (close<ema(close,200))

if (not na(close[length]))

strategy.entry("Short", strategy.short, stop=shortRule=='Basis' ? mid : ll)

if (strategy.position_size>0)

strategy.exit(id="Longs Exit",stop=longSL=='Basis' ? mid : ll)

if (strategy.position_size<0)

strategy.exit(id="Shorts Exit",stop=shortSL=='Basis' ? mid : hh)