概述

这是一个利用移动平均线金叉形态,配合趋势线持续上涨形成的交易策略。当快线从下方向上突破慢线时,形成金叉信号。如果金叉后的趋势能持续向上,那么就可以在这个阶段开仓做多。当价格上涨到止损线或止盈线时,就可以选择止损或止盈了。

策略原理

该策略主要基于移动平均线的金叉形态来判断入场时机。具体来说,定义了一个快速移动平均线MA1和一个慢速移动平均线MA2。当MA1从下方向上突破MA2时,就是做多的信号。

为了避免因短期金叉造成的假信号,策略加入了角度阈值判断,即只有当MA2的角度大于设定的阈值时才会触发买入信号。这可以过滤掉一些非趋势性的短期上涨。

策略同时设定了止损线和止盈线。止损线用于避免市场突然转向造成的损失,止盈线用于锁定盈利离场。具体设置为入场价格的一定百分比范围。

当价格上涨达到止盈点时,策略会选择止盈离场。同时,如果本轮上涨较强,策略会再次做空反向操作。

优势分析

这是一个比较简单直观的趋势追踪策略。它具有以下几个优势:

- 使用移动平均线组合过滤掉市场噪音,能锁定趋势方向

- 角度阈值能避免被短期震荡误导

- 双向操作,能在震荡行情中获利

- 设定止损止盈,控制风险

风险分析

该策略也存在一些风险需要注意:

- 移动平均线存在滞后,可能错过价格转折点

- 虽有止损,但在瞬息变化的市场中,止损被突破的概率还是存在

- 双边交易风险加倍,卖出点选取不当可能造成损失

- 参数设定不当,如移动平均线周期选择,可能影响策略表现

优化方向

可以从以下几个方面进一步优化该策略:

- 增加趋势判断指标,如MACD,布林带等,提高定位准确率

- 采用机器学习等方法动态优化移动平均线的周期参数

- 优化止损止盈的设置,如采用追踪止损等

- 增加交易量控制,避免亏损过大

- 结合段指等指标判断本轮趋势强度,动态调整反向开仓力度

总结

整体来说,这是一个简单实用的趋势跟踪策略。它具有一定的优势,但也需要注意风险。通过进一步的参数优化、指标优选、止损止盈设定等进行改进,可以获得更好的稳定收益。但任何策略都无法完全避免市场系统性风险,需要建立风险意识,谨慎交易。

策略源码

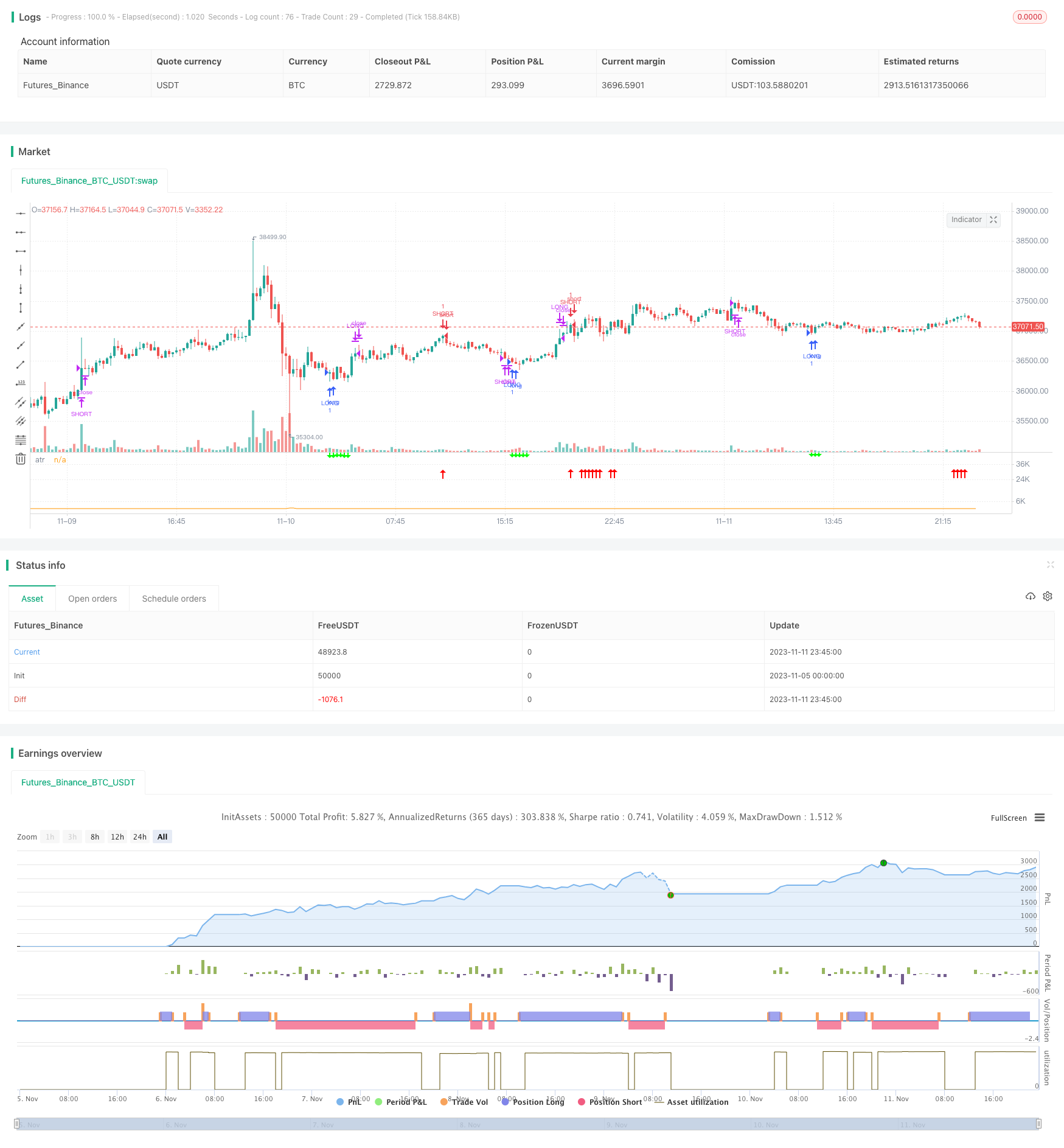

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-12 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//written by [email protected]

//@version=5

strategy(title="MJ-Dual Moving Average",initial_capital=10000,overlay=false)

// import TradingView/ZigZag/6 as ZigZagLib

// // Create Zig Zag instance from user settings.

// var zigZag = ZigZagLib.newInstance(

// ZigZagLib.Settings.new(

// input.float(5.0, "Price deviation for reversals (%)", 0.00001, 100.0, 0.5, "0.00001 - 100"),

// input.int(10, "Pivot legs", 2),

// input(#2962FF, "Line color"),

// input(true, "Extend to last bar"),

// input(true, "Display reversal price"),

// input(true, "Display cumulative volume"),

// input(true, "Display reversal price change", inline = "priceRev"),

// input.string("Absolute", "", ["Absolute", "Percent"], inline = "priceRev"),

// true)

// )

// // Update 'zigZag' object on each bar with new pivots, volume, lines, labels.

// zigZag.update()

// // plot(zigZag.pivots, "zigZag")

ma1= ta.sma(close,8)

ma2= ta.sma(close,21)

angleCriteria = input.int(title="Angle", defval=7, minval=1, maxval=13)

i_lookback = input.int(2, "Angle Period", minval = 1)

i_atrPeriod = input.int(10, "ATR Period", minval = 1)

i_angleLevel = input.int(6, "Angle Level", minval = 1)

i_maSource = input.source(close, "MA Source")

TP = input.float(1, "TP", minval = 0.1)

SL = input.float(1, "SL", minval = 0.1)

f_angle(_src, _lookback, _atrPeriod) =>

rad2degree = 180 / 3.141592653589793238462643 //pi

ang = rad2degree * math.atan((_src[0] - _src[_lookback]) / ta.atr(_atrPeriod)/_lookback)

ang

_angle = f_angle(ma2, i_lookback, i_atrPeriod)

plot(ta.atr(i_atrPeriod), "atr")

// plot(ma1,color=#FF0000)

// plot(ma2,color=#00FF00)

crosso=ta.crossover(ma1,ma2)

crossu=ta.crossunder(ma1,ma2)

_lookback = 15

f_somethingHappened(_cond, _lookback) =>

bool _crossed = false

for i = 1 to _lookback

if _cond[i]

_crossed := true

_crossed

longcrossed = f_somethingHappened(crosso,_lookback)

shortcrossed = f_somethingHappened(crossu,_lookback)

atr_factor = 1

atr = ta.atr(i_atrPeriod)

e = atr * atr_factor

afr = close

afr := nz(afr[1], afr)

atr_factoryHigh = close + e

atr_factoryLow = close - e

if atr_factoryLow > afr

afr := atr_factoryLow

if atr_factoryHigh < afr

afr := atr_factoryHigh

// plot(afr, "afr", display = display.data_window)

// plot(atr_factoryHigh, "afr", color = color.yellow, display = display.all)

// plot(atr_factoryLow, "afr", color = color.green, display = display.all)

inLong() => strategy.position_size > 0

inShort() => strategy.position_size < 0

inZero() => not inLong() and not inShort()

long = longcrossed and _angle > angleCriteria

short= shortcrossed and _angle < -(angleCriteria)

plotshape(long, "Buy", shape.arrowup, location.belowbar, color = #FF0000)

plotshape(short, "Sell", shape.arrowdown, location.abovebar, color = #00FF00)

var longTp = 0.0

var longSl = 0.0

var shortTp = 0.0

var shortSl = 0.0

[b_middle, b_high, b_low] = ta.bb(close, 20, 2)

entry_price = strategy.opentrades.entry_price(0)

if inZero()

if short

longTp := close * (1 + TP/100)

longSl := close * (1 - SL/100)

strategy.entry("LONG",strategy.long, comment = "tp:" + str.tostring(longTp) + " sl:" + str.tostring(longSl))

if long

shortTp := close * (1 - TP/100)

shortSl := close * (1 + SL/100)

strategy.entry("SHORT",strategy.short, comment = "tp:" + str.tostring(shortTp) + " sl:" + str.tostring(shortSl))

if inLong()

// if close - entry_price > close * 0.005

// longSl := entry_price + close * 0.001

if high > longTp

strategy.close("LONG")

if (close - open) > close * 0.014

shortTp := close * (1 - TP/100)

shortSl := close * (1 + SL/100)

strategy.entry("SHORT",strategy.short, comment = "tp:" + str.tostring(shortTp) + " sl:" + str.tostring(shortSl))

if close < longSl

strategy.close("LONG")

if open >= b_high and close >= b_high

strategy.close("LONG")

// if high > b_high and entry_price < high

// strategy.close("LONG")

if inShort()

// if entry_price - close > close * 0.005

// shortSl := entry_price - close * 0.001

if low < shortTp

strategy.close("SHORT")

if (open - close) > close * 0.014

longTp := close * (1 + TP/100)

longSl := close * (1 - SL/100)

strategy.entry("LONG",strategy.long, comment = "tp:" + str.tostring(longTp) + " sl:" + str.tostring(longSl))

if close > shortSl

strategy.close("SHORT")

if open < b_low and close < b_low

strategy.close("SHORT")

// if low < b_low and entry_price > low

// strategy.close("SHORT")