概述

该策略利用不太为人所知的Coppock曲线技术指标来实现量化交易。Coppock曲线通过计算标准普尔500指数或交易等价物的变化率的加权移动平均来派生。当Coppock曲线上穿零线时产生买入信号,下穿零线时产生卖出信号。可选择使用跟踪止损来锁定利润。该策略以$SPY的Coppock曲线作为买卖其他ETF和股票的代理信号。

原理

该策略使用Coppock曲线作为产生交易信号的技术指标。Coppock曲线的计算公式为:

Coppock曲线 = 10周期加权移动平均(14周期变化率ROC + 11周期变化率ROC)

其中变化率ROC的计算公式为:(当前Close - N周期前Close) / N周期前Close

策略以$SPY的收盘价为基础,计算其Coppock曲线。当曲线上穿零线时产生买入信号,下穿零线时产生卖出信号。

优势

- 使用独特的Coppock曲线指标,相比常见的移动平均线等指标,具有更好的前瞻性

- 可配置指标参数进行优化,如加权移动平均周期、变化率计算周期等

- 采用$SPY作为信号源,市场代表性强

- 可选择trailing stop止损来锁定利润,降低回撤

风险

- Coppock曲线并不是非常普及的指标,需验证其有效性

- 交易信号可能存在拉迟,需要优化参数

- 止损设置过于宽松可能错失回撤机会

- 依赖单一指标容易产生假信号

优化方向

- 测试不同市场、不同股票以优化最佳参数组合

- 结合其他指标过滤假信号,例如成交量

- 动态优化止损百分比

- 考虑交易次数或价格突破作为入场

总结

该策略利用Coppock曲线独特的曲线形态特征来产生交易信号。相比常见指标,Coppock曲线具有更强的前瞻性。但作为独立指标其可靠性仍需验证,建议与其他因素组合使用以过滤假信号。通过参数优化、止损优化以及组合其他指标,该策略可以成为一个有效的量化交易系统。

策略源码

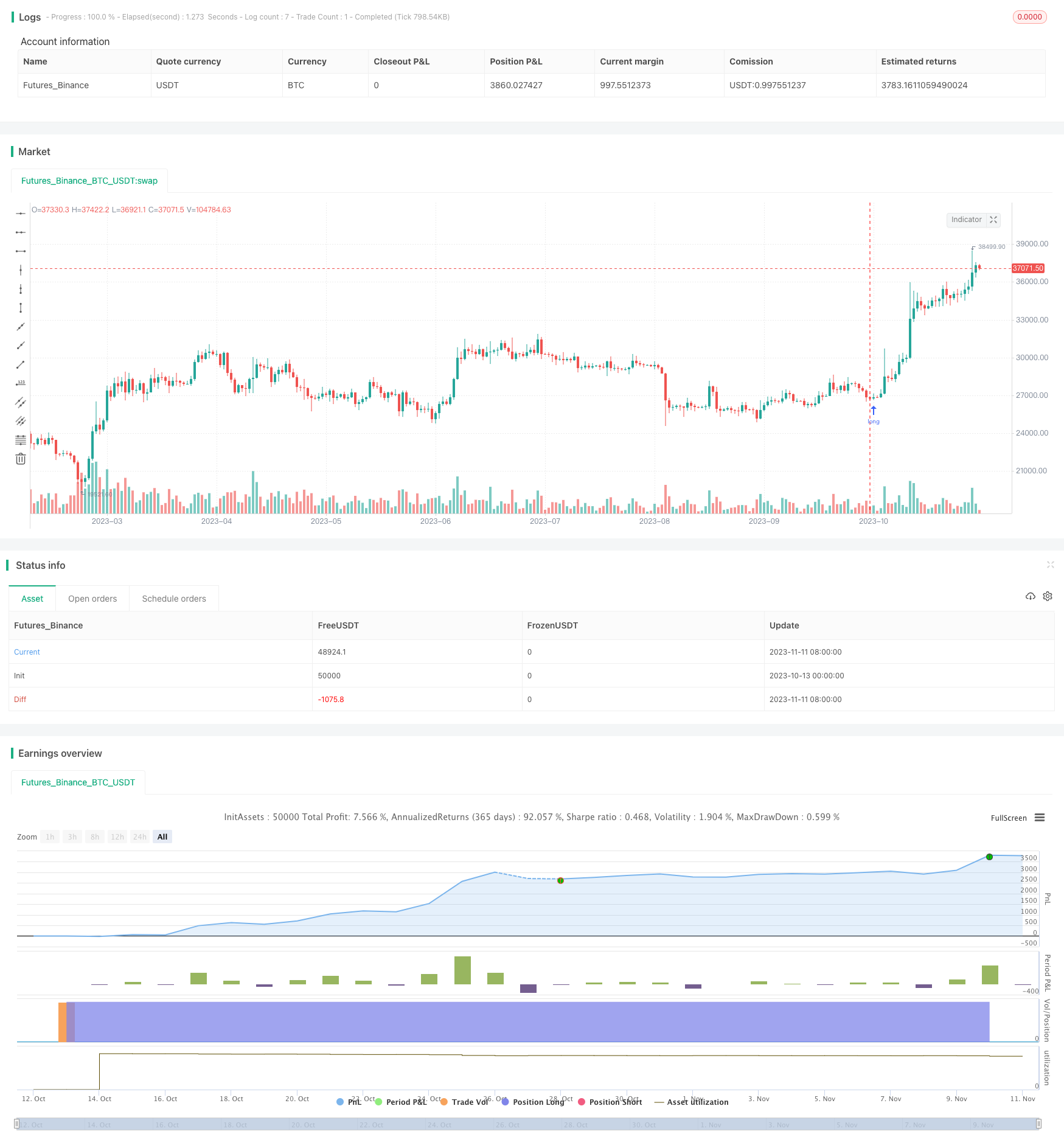

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RolandoSantos

//@version=4

strategy(title = "Coppock Curve", shorttitle = "Copp Curve Strat", default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=10000)

///trail stop

longTrailPerc = input(title="Trail Long Loss (%)", minval=0.0, step=0.1, defval=100) * 0.01

// Determine trail stop loss prices

longStopPrice = 0.0

longStopPrice := if (strategy.position_size > 0)

stopValue = close * (1 - longTrailPerc)

max(stopValue, longStopPrice[1])

else

0

//Use SPY for Copp Curve entries and exits//

security = input("SPY")

ticker = security(security, "D", close)

///Copp Curve////

wmaLength = input(title="WMA Length", type=input.integer, defval=10)

longRoCLength = input(title="Long RoC Length", type=input.integer, defval=14)

shortRoCLength = input(title="Short RoC Length", type=input.integer, defval=11)

source = ticker

curve = wma(roc(source, longRoCLength) + roc(source, shortRoCLength), wmaLength)

///Lower Band Plot///

band1 = hline(0)

band0 = hline(100)

band2 = hline(-100)

fill(band1, band0, color=color.green, transp=90)

fill(band2, band1, color=color.red, transp=90)

plot(curve, color=color.white)

///Trade Conditions///

Bull = curve > 0

Bear = curve < 0

///Entries and Exits//

if (Bull)

strategy.entry("Long", strategy.long, comment = "LE")

if (Bear)

strategy.close("Long", qty_percent=100, comment="close")

// Submit exit orders for trail stop loss price

if (strategy.position_size > 0)

strategy.exit(id="Long Trail Stop", stop=longStopPrice)