概述

该策略利用指标MACD的快线和慢线的交叉信号,结合其他多个指标进行综合判断,在瞬时时机捕捉到指数移动平均线的突破信号,做出买入或卖出决策,属于短线交易策略。

策略原理

使用MACD的快线和慢线交叉作为主要交易信号。当快线上穿慢线时看涨入场,当快线下穿慢线时看跌入场。

结合RSI指标判断是否过买过卖。RSI低于中线时看涨,RSI高于中线时看跌。

计算当前收盘价与一定周期内的SMA均线作比较,收盘价低于SMA时看涨,收盘价高于SMA时看跌。

计算一定周期内的Highest值的0.5 Fibonacci位,作为看涨的阻力位。计算一定周期内的Lowest值的0.5 Fibonacci位,作为看跌的支撑位。

当满足快线上穿和价格低于支撑位时看涨入场,当满足快线下穿和价格高于阻力位时看跌入场。

采用逐步移动止损方式。入场后开始时止损位固定为开仓价格的一定百分比,当亏损达到一定比例后改为小幅逐步追踪止损。

策略优势

策略充分利用MACD的交叉信号,这是一种经典且有效的技术指标交易信号。

结合RSI、SMA等多个指标进行确认,可以过滤假信号,提高信号的可靠性。

计算动态支持阻力位,进行突破交易,可以捕捉较大行情。

采用逐步移动止损方式,既可锁住大部分利润,也可控制风险。

策略交易逻辑清晰简单,容易理解掌握,适合新手学习。

策略风险

MACD指标存在滞后问题,可能会错过行情最佳买点卖点。

多指标组合判断增加了策略复杂度,容易出现指标冲突的情况。

动态计算支持阻力位存在错误突破的风险。

移动止损在大行情中可能过早止损,无法持续获利。

策略参数需要反复测试优化,不合适的参数会影响策略效果。

策略优化方向

可以测试不同参数组合,优化MACD周期参数。

可以引入更多指标,如布林线、KDJ等进行多维度分析。

可以结合更多因素判断支持阻力位的合理性。

可以研究更先进的移动止损机制,如时间止损、振荡止损等。

可以加入自动参数优化模块,实现参数的自动寻优。

总结

该策略综合运用MACD、RSI、SMA等多个指标,在瞬时时机捕捉到指数移动平均线的突破信号,属于典型的短线突破交易策略。策略信号生成有一定的滞后性,但可以通过参数优化提高准确率。总体来说,该策略交易逻辑简单清晰,容易掌握,表现稳健,适合大多数人学习使用,值得进一步的测试和优化。

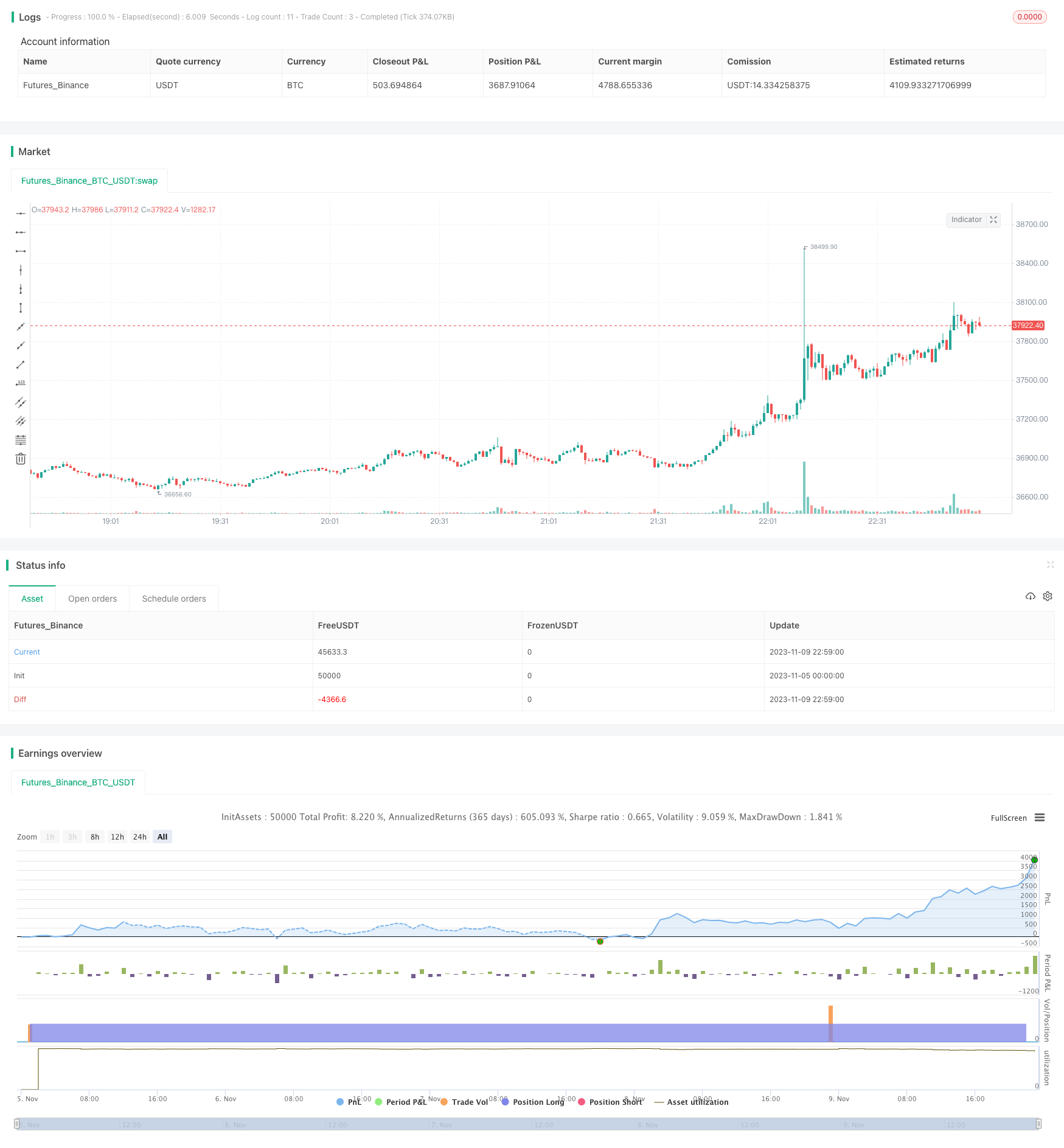

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-09 23:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © onurenginogutcu

//@version=4

strategy("R19 STRATEGY", overlay=true, calc_on_every_tick=true , margin_long=100, margin_short=100 , process_orders_on_close=true )

sym = input(title="Symbol", type=input.symbol, defval="BINANCE:BTCUSDT" , group = "SYMBOL")

timeFrame = input(title="Strategy Decision Time Frame", type = input.resolution , defval="60")

adxlen = input(14, title="ADX Smoothing" , group = "ADX")

dilen = input(14, title="ADX DI Length", group = "ADX")

adxemalenght = input(30, title="ADX EMA", group = "ADX")

adxconstant = input(19, title="ADX CONSTANT", group = "ADX")

fibvar = input (title = "Fibo Look Back Canles" , defval = 50 , minval = 0 , group = "FIBO MACD SMA")

smaLookback = input (title = "SMA Look Back Candles" , defval = 30 , minval = 0 , group = "FIBO MACD SMA")

MACDFast = input (title = "MACD Fast Lenght" , defval = 15 , minval = 0 , group = "FIBO MACD SMA")

MACDSlow = input (title = "MACD Slow Lenght" , defval = 30 , minval = 0 , group = "FIBO MACD SMA")

MACDSmooth = input (title = "MACD Signal Smoothing" , defval = 9 , minval = 0 , group = "FIBO MACD SMA")

MACDLookback = input (title = "MACD Look Back Candles" , defval = 100 , minval = 0 , group = "FIBO MACD SMA")

trailingStopLong = input (title = "Trailing Long Stop %" , defval = 2.0 , step = 0.1, group = "TP & SL") * 0.01

trailingStopShort = input (title = "Trailing Short Stop %" , defval = 2.0 , step = 0.1 , group = "TP & SL") * 0.01

LongTrailingProfitStart = input (title = "Long Profit Start %" , defval = 2.0 , step = 0.1 , group = "TP & SL") * 0.01

ShortTrailingProfitStart = input (title = "Short Profit Start %" , defval = 2.0 , step = 0.1, group = "TP & SL") * 0.01

lsl = input(title="Max Long Stop Loss (%)",

minval=0.0, step=0.1, defval=3.0, group = "TP & SL") * 0.01

ssl = input(title="Max Short Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5, group = "TP & SL") * 0.01

longtp = input(title="Long Take Profit (%)",

minval=0.0, step=0.1, defval=100, group = "TP & SL") * 0.01

shorttp = input(title="Short Take Profit (%)",

minval=0.0, step=0.1, defval=100, group = "TP & SL") * 0.01

capperc = input(title="Capital Percentage to Invest (%)",

minval=0.0, maxval=100, step=0.1, defval=95, group = "CAPITAL TO INVEST") * 0.01

symClose = security(sym, timeFrame, close)

symHigh = security(sym, timeFrame, high)

symLow = security(sym, timeFrame, low)

atr = atr (14)

/////////adx code

dirmov(len) =>

up = change(symHigh)

down = -change(symLow)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

emasig = ema (sig , adxemalenght )

////////adx code over

i = ema (symClose , MACDFast) - ema (symClose , MACDSlow)

r = ema (i , MACDSmooth)

sapust = highest (i , MACDLookback) * 0.729

sapalt = lowest (i , MACDLookback) * 0.729

simRSI = rsi (symClose , 50 )

fibtop = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

fibbottom = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

cond1 = 0

cond2 = 0

cond3 = 0

cond4 = 0

longCondition = crossover(i, r) and i < sapalt and sig > adxconstant and symClose < sma (symClose , smaLookback) and simRSI < sma (simRSI , 50) and symClose < fibbottom

shortCondition = crossunder(i, r) and i > sapust and sig > adxconstant and symClose > sma (symClose , smaLookback) and simRSI > sma (simRSI , 50) and symClose > fibtop

//////////////////////probability long/short

if (crossover(i, r) and i < sapalt)

cond1 := 35

else if (crossunder(i, r) and i > sapust)

cond1 := -35

else

cond1 := 0

if (symClose < sma (symClose , smaLookback))

cond2 := 30

else if (symClose > sma (symClose , smaLookback))

cond2 := -30

else

cond2 := 0

if (simRSI < sma (simRSI , 50))

cond3 := 25

else if (simRSI > sma (simRSI , 50))

cond3 := -25

else

cond3 := 0

if (symClose < fibbottom)

cond4 := 10

else if (symClose > fibbottom)

cond4 := -10

else

cond4 := 0

probab = cond1 + cond2 + cond3 + cond4

////////////////////////////////////////////////////////////////

///////////////////////////////////////////STRATEGY ENTRIES AND STOP LOSSES /////

var startTrail = 0

var trailingLongPrice = 0.0

var trailingShortPrice = 0.0

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close )

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close )

if (strategy.position_size == 0)

trailingShortPrice := 0.0

trailingLongPrice := 0.0

startTrail := 0

/////////////////////////////////strategy exit

if (strategy.position_size > 0 and close >= strategy.position_avg_price * (1 + LongTrailingProfitStart))

startTrail := 1

if (strategy.position_size < 0 and close <= strategy.position_avg_price * (1 - ShortTrailingProfitStart))

startTrail := -1

trailingLongPrice := if strategy.position_size > 0 and startTrail == 1

stopMeasure = close * (1 - trailingStopLong)

max (stopMeasure , trailingLongPrice [1])

else if strategy.position_size > 0 and startTrail == 0

strategy.position_avg_price * (1 - lsl)

trailingShortPrice := if strategy.position_size < 0 and startTrail == -1

stopMeasure = close * (1 + trailingStopShort)

min (stopMeasure , trailingShortPrice [1])

else if strategy.position_size < 0 and startTrail == 0

strategy.position_avg_price * (1 + ssl)

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop = trailingLongPrice , limit=strategy.position_avg_price*(1 + longtp))

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop = trailingShortPrice , limit=strategy.position_avg_price*(1 - shorttp))

////////////////////////vertical colouring signals

bgcolor(color=longCondition ? color.new (color.green , 70) : na)

bgcolor(color=shortCondition ? color.new (color.red , 70) : na)

plot (trailingLongPrice , color = color.green) ///long price trailing stop

plot (trailingShortPrice , color = color.red) /// short price trailing stop

plot (startTrail , color = color.yellow)

plot (probab , color = color.white) ////probability