概述

本策略运用了简单移动平均线交叉和双重止盈技巧,旨在控制风险、提高获利概率。策略适合中短期交易,可以在趋势变化时捕捉机会。

策略原理

该策略基于EMA和WMA的交叉来判断行情走势。当EMA上穿WMA时,做多;当EMA下穿WMA时,做空。

每次开仓时,策略会设置两个止盈水平。第一个止盈水平固定为开仓价格+20点,第二个止盈水平固定为开仓价格+40点。同时设置一个止损水平,固定为开仓价格-20点。

当价格触碰第一个止盈水平时,平仓一半头寸。剩余头寸继续持有,追求第二个止盈水平或被止损。

这样,每个交易有三种结果:

价格触发止损,直接亏损2%。

价格先触发第一个止盈,平一半头寸,锁定1%利润,然后继续运行直至被止损,最终收支平衡,零利润。

价格触发第一个止盈后继续运行,再触发第二个止盈,最终获得1%+2%=3%的盈利。

优势分析

这种双盈止损策略最大的优势是可以控制风险,避免单次大亏损。当行情不利时,止损可以把损失控制在2%以内。当行情阳光时,两个止盈水平可以获取较大利润。

相比单一止盈止损,该策略有三种结果:亏损、盈利和不亏不赚,降低了止损的概率。即使止损,最大损失也控制在2%。相比传统止盈止损策略,这种双盈止损策略可显著降低DD和提高胜率。

另一个优势是操作简单。EMA和WMA都是广为人知的指标,容易理解。止盈止损逻辑非常清晰,可以方便监控。这让策略容易被量化交易初学者接受和实施。

风险分析

尽管该策略有一定优势,也存在一些风险需要关注。

首先,EMA和WMA作为均线指标,对震荡行情识别能力较弱。当趋势不明显时,可能产生较多错信号,导致过于频繁交易。

其次,固定的止盈止损点位可能与市场波动不匹配。当波动较大时,止盈止损可能会被突破,无法起到保护作用。

最后,该策略无法响应突发事件,存在被套利的风险。重大新闻事件发生时,行情可能出现大幅跳空,直接击穿止盈止损线,造成较大亏损。

优化方向

可以从以下几个方面进一步优化该策略:

改进进入信号。可以尝试比EMA和WMA更优秀的均线指标或趋势指标,提高信号质量。

动态调整止盈止损位。可以根据ATR、移动止损等方式实时调整止盈止损点位,使其能动态跟随市场。

增加过滤条件。可以在金叉前添加交易量或者副指标的确认,避免被套。也可以根据重大事件日历选择是否交易。

优化仓位管理。可以根据资金管理原则优化每次交易的具体仓位大小。

总结

本策略总体来说是一个简单实用的趋势跟踪策略。它使用EMA和WMA形成交易信号,并采用双重止盈技巧控制风险。相比传统策略,具有获利概率更高、风险更低的优势。当然,也需要注意指标局限性和止盈止损设置的风险。通过进一步优化,可以使该策略更稳定可靠。

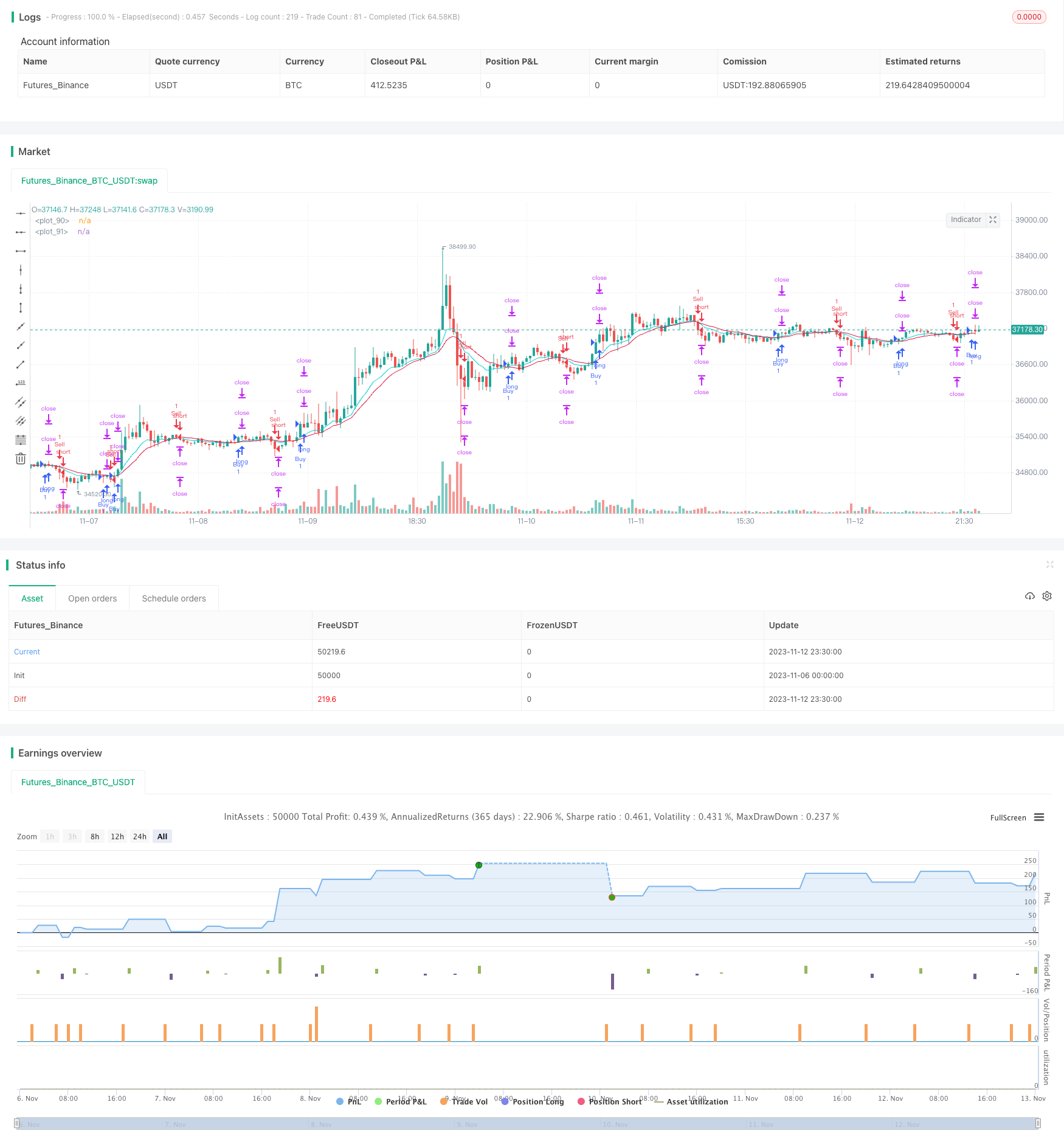

/*backtest

start: 2023-11-06 00:00:00

end: 2023-11-13 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("FS ATR & PS (MA)", overlay=true)

// Strategy

Buy = input(true)

Sell = input(true)

// Time Period

start_year = input(title='Start year' ,defval=2019)

start_month = input(title='Start month' ,defval=1)

start_day = input(title='Start day' ,defval=1)

start_hour = input(title='Start hour ' ,defval=0)

start_minute = input(title='Start minute' ,defval=0)

end_time = input(title='set end time?',defval=false)

end_year = input(title='end year' ,defval=2019)

end_month = input(title='end month' ,defval=12)

end_day = input(title='end day' ,defval=31)

end_hour = input(title='end hour' ,defval=23)

end_minute = input(title='end minute' ,defval=59)

// MA

ema_period = input(title='EMA period',defval=10)

wma_period = input(title='WMA period',defval=20)

ema = ema(close,ema_period)

wma = wma(close,wma_period)

// Entry Condition

longCondition =

crossover(ema,wma) and Buy and

nz(strategy.position_size) == 0 and

time > timestamp(start_year, start_month, start_day, start_hour, start_minute) and

(end_time?(time < timestamp(end_year, end_month, end_day, end_hour, end_minute)):true)

shortCondition =

crossunder(ema,wma) and Sell and

nz(strategy.position_size) == 0 and

time > timestamp(start_year, start_month, start_day, start_hour, start_minute) and

(end_time?(time < timestamp(end_year, end_month, end_day, end_hour, end_minute)):true)

// Exit Condition

a = input(20)*10

b = input(40)*10

c = a*syminfo.mintick

d = b*syminfo.mintick

long_stop_level = float(na)

long_profit_level1 = float(na)

long_profit_level2 = float(na)

long_even_level = float(na)

short_stop_level = float(na)

short_profit_level1 = float(na)

short_profit_level2 = float(na)

short_even_level = float(na)

long_stop_level := longCondition ? close - c : long_stop_level [1]

long_profit_level1 := longCondition ? close + c : long_profit_level1 [1]

long_profit_level2 := longCondition ? close + d : long_profit_level2 [1]

long_even_level := longCondition ? close + 0 : long_even_level [1]

short_stop_level := shortCondition ? close + c : short_stop_level [1]

short_profit_level1 := shortCondition ? close - c : short_profit_level1 [1]

short_profit_level2 := shortCondition ? close - d : short_profit_level2 [1]

short_even_level := shortCondition ? close + 0 : short_even_level [1]

// Position Sizing

Risk = input(defval=10, title="Risk per trade%", step=1, minval=0, maxval=100)/100

size = 1

// Strategy

if longCondition

strategy.entry("Buy" , strategy.long, qty=size)

strategy.exit ("Exit1", stop=long_stop_level, limit=long_profit_level1, qty=size/2)

strategy.exit ("Exit2", stop=long_stop_level, limit=long_profit_level2)

if shortCondition

strategy.entry("Sell" , strategy.short, qty=size)

strategy.exit ("Exit3", stop=short_stop_level, limit=short_profit_level1, qty=size/2)

strategy.exit ("Exit4", stop=short_stop_level, limit=short_profit_level2)

// Plot

plot(strategy.position_size <= 0 ? na : long_stop_level , color=#dc143c, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size <= 0 ? na : long_profit_level1 , color=#00ced1, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size <= 0 ? na : long_profit_level2 , color=#00ced1, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size <= 0 ? na : long_even_level , color=#ffffff, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size >= 0 ? na : short_stop_level , color=#dc143c, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size >= 0 ? na : short_profit_level1, color=#00ced1, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size >= 0 ? na : short_profit_level2, color=#00ced1, style=plot.style_linebr, linewidth=1)

plot(strategy.position_size >= 0 ? na : short_even_level , color=#ffffff, style=plot.style_linebr, linewidth=1)

plot(ema,color=#00ced1)

plot(wma,color=#dc143c)