概述

本策略运用Williams新高新低指标识别多空反转信号,配合多重均线进行裂缝交易,再辅以RSI指标过滤假信号,实现高效的双向交易。

策略原理

Williams新高新低指标利用一定周期内最高价和最低价判断出现拐点,发出买入和卖出信号。

20日、50日和100日均线组成多重均线,当价格突破其中两条均线时,发出交易信号。

RSI指标判断超买超卖区域,用于过滤不确定信号。

策略通过判断价格突破哪两条均线,结合Williams指标信号和RSI过滤,产生稳定的买入卖出信号。

入场判断:当短周期均线由下向上突破中长周期均线,并且Williams新低和RSI低位信号同时出现时,做多;当短周期均线由上向下突破中长周期均线,并且Williams新高和RSI高位信号同时出现时,做空。

止损止盈:设定固定比例止损止盈。

策略优势

Williams指标能准确判断关键支撑阻力,识别反转信号。

多重均线突破判断,避免因单一均线震荡造成错误信号。

RSI指标辅助过滤假信号,让入场时机更加精准可靠。

固定止损止盈系统控制风险,让盈亏更加明确。

结合反转指标和趋势指标双重确认,使交易信号更加准确可靠。

策略风险

交易品种选择不当,不同品种参数需要调整。

周期选择不合理,需要针对不同周期调整参数。

固定止损止盈无法根据市场变化调整,可能过早止损或止盈不够充分。

均线震荡时容易产生错误信号。

指标发散时信号产生滞后。

策略优化方向

根据不同交易品种动态优化参数。

加入自动调整止损止盈系统,使盈亏更加合理。

增加更多指标过滤,如MACD、Stochastic等,减少错误信号。

增加机器学习算法,自动识别最佳交易时机。

结合更多趋势判断指标,识别趋势行情。

总结

本策略综合运用Williams指标、均线指标和RSI指标等多种技术分析工具,通过双重确认减少错误信号,能够有效捕捉反转机会,并配合固定止损止盈控制风险,整体来看是一个可靠实用的双向交易策略。下一步通过参数优化、止盈止损优化和模型集成等方法进一步增强策略效果。

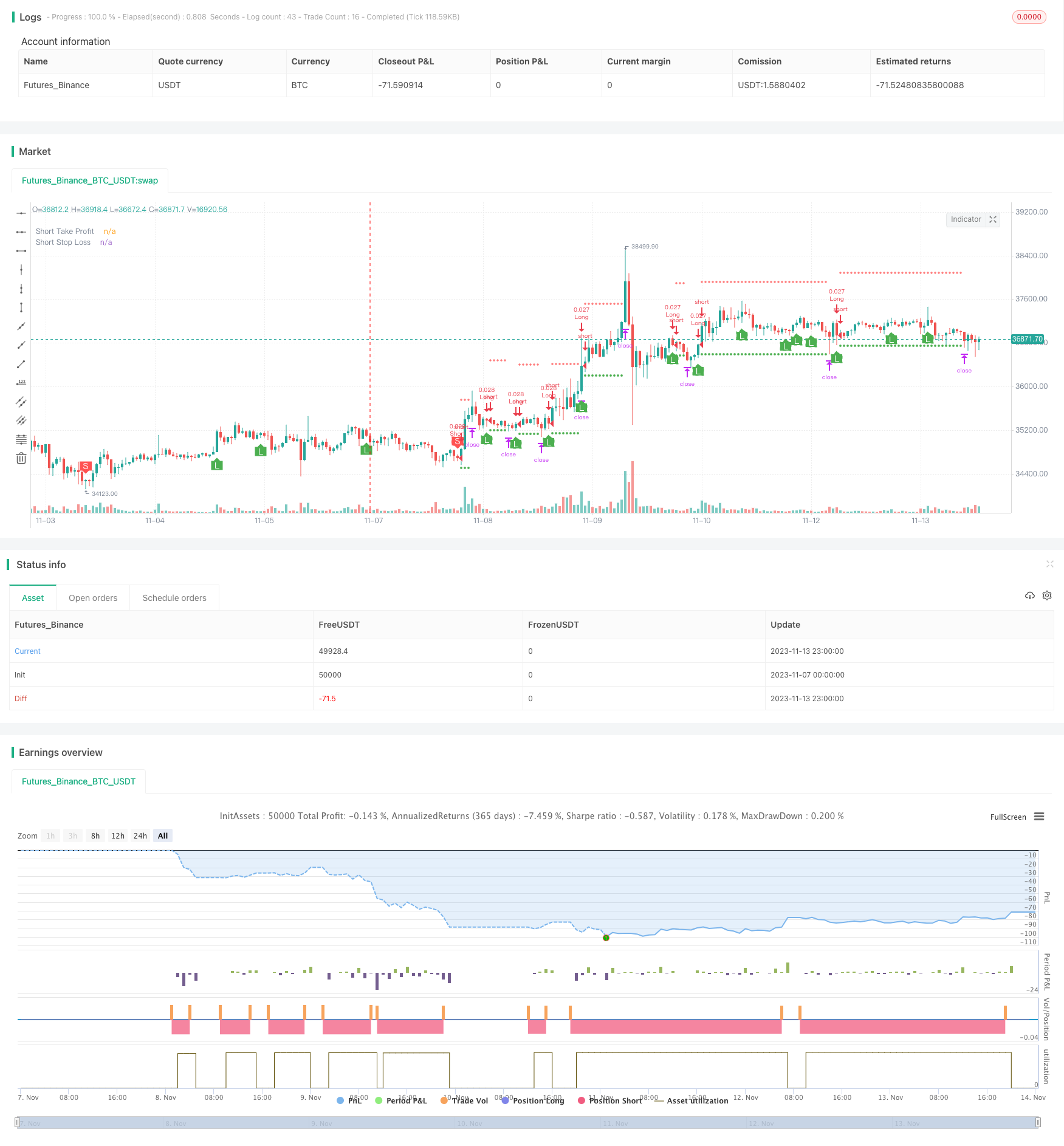

/*backtest

start: 2023-11-07 00:00:00

end: 2023-11-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © B_L_A_C_K_S_C_O_R_P_I_O_N

// v 1.1

//@version=4

strategy("Williams Fractals Strategy by ȼhąţhµяąɲǥą", overlay=true, default_qty_type=strategy.cash, default_qty_value=1000, currency='USD')

// *************Appearance*************

theme = input(type=input.string, defval="dark", options=["light","dark"], group="Appearance")

show_fractals = input(false, "Show Fractals", group="Appearance")

show_ema = input(false, "Show EMAs", group="Appearance")

// *************colors*************

color_green = color.green

color_red = color.red

color_yellow = color.yellow

color_orange = color.orange

color_blue = color.blue

color_white = color.white

// *************WF*************

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

n = input(title="Fractal Periods", defval=2, minval=2, type=input.integer, group="Williams Fractals")

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (high[n-i] < high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (high[n+i] < high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (high[n+1] <= high[n] and high[n+i + 1] < high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+i + 2] < high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+i + 3] < high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+4] <= high[n] and high[n+i + 4] < high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (low[n-i] > low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (low[n+i] > low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (low[n+1] >= low[n] and low[n+i + 1] > low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+i + 2] > low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+i + 3] > low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+4] >= low[n] and low[n+i + 4] > low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

plotshape(downFractal and show_fractals, style=shape.triangleup, location=location.belowbar, offset=-n, color=color_green)

plotshape(upFractal and show_fractals, style=shape.triangledown, location=location.abovebar, offset=-n, color=color_red)

// *************EMA*************

len_a = input(20, minval=1, title="EMA Length A", group="EMA")

src_a = input(close, title="EMA Source A", group="EMA")

offset_a = input(title="EMA Offset A", type=input.integer, defval=0, minval=-500, maxval=500, group="EMA")

out_a = ema(src_a, len_a)

plot(show_ema ? out_a : na, title="EMA A", color=color_green, offset=offset_a)

len_b = input(50, minval=1, title="EMA Length B", group="EMA")

src_b = input(close, title="EMA Source B", group="EMA")

offset_b = input(title="EMA Offset B", type=input.integer, defval=0, minval=-500, maxval=500, group="EMA")

out_b = ema(src_b, len_b)

ema_b_color = (theme == "dark") ? color_yellow : color_orange

plot(show_ema ? out_b : na, title="EMA B", color=ema_b_color, offset=offset_b)

len_c = input(100, minval=1, title="EMA Length C", group="EMA")

src_c = input(close, title="EMA Source C", group="EMA")

offset_c = input(title="EMA Offset C", type=input.integer, defval=0, minval=-500, maxval=500, group="EMA")

out_c = ema(src_c, len_c)

ema_c_color = (theme == "dark") ? color_white : color_blue

plot(show_ema ? out_c : na, title="EMA C", color=ema_c_color, offset=offset_c)

// *************RSI*************

rsi_len = input(14, minval=1, title="RSI Length", group="RSI")

rsi_src = input(close, "RSI Source", type = input.source, group="RSI")

up = rma(max(change(rsi_src), 0), rsi_len)

down = rma(-min(change(rsi_src), 0), rsi_len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// *************Calculation*************

long = (out_a > out_b) and (out_a > out_c) and downFractal and low[2] > out_c and rsi[2] < rsi

short = (out_a < out_b) and (out_a < out_c) and upFractal and high[2] < out_c and rsi[2] > rsi

plotshape(long, style=shape.labelup, color=color_green, location=location.belowbar, title="long label", text= "L", textcolor=color_white)

plotshape(short, style=shape.labeldown, color=color_red, location=location.abovebar, title="short label", text= "S", textcolor=color_white)

// *************End of Signals calculation*************

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="Orders")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="Orders")

startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100, group="Orders")

endDate = input(title="End Date", type=input.integer,

defval=1, minval=1, maxval=31, group="Orders")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="Orders")

endYear = input(title="End Year", type=input.integer,

defval=2022, minval=1800, maxval=2100, group="Orders")

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Make inputs that set the take profit % (optional)

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5, group="Orders") * 0.01

shortProfitPerc = input(title="Short Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5, group="Orders") * 0.01

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Plot take profit values for confirmation

plot(series=(strategy.position_size > 0) ? longExitPrice : na,

color=color_green, style=plot.style_circles,

linewidth=1, title="Long Take Profit")

plot(series=(strategy.position_size < 0) ? shortExitPrice : na,

color=color_green, style=plot.style_circles,

linewidth=1, title="Short Take Profit")

// Submit entry orders

if (inDateRange and long and strategy.opentrades == 0)

strategy.entry(id="Long", long=true)

if (inDateRange and short and strategy.opentrades == 0)

strategy.entry(id="Short", long=false)

// Submit exit orders based on take profit price

// if (strategy.position_size > 0)

// strategy.exit(id="LTP", limit=longExitPrice)

// if (strategy.position_size < 0)

// strategy.exit(id="STP", limit=shortExitPrice)

// Set stop loss level with input options (optional)

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=3.1, group="Orders") * 0.01

shortLossPerc = input(title="Short Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=3.1, group="Orders") * 0.01

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) ? longStopPrice : na,

color=color_red, style=plot.style_cross,

linewidth=1, title="Long Stop Loss")

plot(series=(strategy.position_size < 0) ? shortStopPrice : na,

color=color_red, style=plot.style_cross,

linewidth=1, title="Short Stop Loss")

// Submit exit orders based on calculated stop loss price

if (strategy.position_size > 0)

strategy.exit(id="ExL",limit=longExitPrice, stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id="ExS", limit=shortExitPrice, stop=shortStopPrice)

// Exit open market position when date range ends

if (not inDateRange)

strategy.close_all()