概述

该策略是一个基于相对强弱指标(RSI)的短线交易策略。它利用RSI指标识别超买超卖区间,并结合K线实体过滤虚假信号,在反转点进行买入和卖出操作。策略追求捕捉极端超买超卖状态后的反弹机会。

策略详解

原理

首先计算RSI指标,选取收盘价作为计算数据源,周期设定为7日。然后设置超买线为30和超卖区间为70。当RSI上穿30线时产生买入信号,下穿70线时产生卖出信号。

为了过滤虚假信号,要求K线实体放大为常规的1-3倍大小时才会触发交易信号。这里使用RSI 1-5根K线连续处于超买超卖区间来确认信号,实体放大倍数设定为4倍。

当RSI连续5根K线低于30时产生买入信号,若随后K线收阳线,实体放大超过4倍,则执行买入操作。当RSI连续5根K线高于70时产生卖出信号,若随后K线收阴线,实体放大超过4倍,则执行卖出操作。

为锁定利润,当持仓方向与当前K线方向一致时,在实体放大2倍的情况下平仓止损。

优势

- 捕捉超买超卖后的反弹机会

RSI指标能较好地识别超买超卖状态。当股票处于超买超卖区间时,短期内存在回落概率较大,而超卖区间往往预示着即将出现的反弹行情。该策略能在反转前夕捕捉机会。

- 实体过滤减少虚假信号

单纯RSI指标交易时可能存在较多假信号。该策略加入K线实体放大作为过滤条件,在反转拐点前夕出现放大实体K线时加入仓位,避免被震荡市场的假信号误导。

- 连续N根K线确认提高可靠性

要求RSI持续1-5根K线处于超买超卖区间进行确认,避免被个别异动K线误导,提高信号的可靠性。

- 实体放大倍数可调节

实体放大倍数可根据不同品种调整,对于大涨大跌型品种可以适当放宽条件,而对于波动平缓品种则可适当收紧,可自由调整适合自己的交易品种。

风险

- 可能存在过拟合问题

该策略参数设置具有一定程度的局限性,不同品种和不同时期需要调整参数。如果固定使用一个参数设置,则可能导致过拟合问题。

- 买卖点识别准确率不高

RSI指标本身存在一定程度滞后性,结合实体放大作为过滤条件也会提前一定幅度退出仓位。所以买卖点识别准确率一般情况下不会特别高。

- 震荡行情中可能持仓时间过长

在震荡行情中,RSI指标可能频繁触发买卖信号从而造成持仓时间过长。这时需要调整参数或暂停策略运行。

- 需适当调整持仓策略

该策略为短线交易策略,需要配合适当的持仓策略,如移除均线、止损止盈等方法,来锁定利润和控制风险。

优化思路

- 测试不同参数设置

可以测试不同的RSI参数组合,如周期、超买超卖线、以及K线实体过滤参数,优化参数以适应不同品种。

- 增加止损止盈策略

可以设置移动止损或百分比止损来锁定利润,也可以根据ATR值设置止损点,或者结合Donchain通道进行止损。

- 结合其他指标过滤

可以加入MACD,KDJ等其他指标的过滤条件,避免在无效突破时产生错误信号。也可以利用波动率指标来识别趋势中的反转信号。

- 增加趋势判断

采用均线判断趋势方向,只在趋势方向一致时考虑交易信号,在震荡行情时可以选择暂停策略。也可以结合趋势强弱指标过滤信号。

总结

该RSI反转策略整体是一个典型的短线交易策略,具有一定的优势和风险。主要优势在于能够捕捉超买超卖后的反弹,而风险主要来自信号精确度不高以及震荡行情下持仓时间过长。我们可以通过调整参数组合、增加过滤条件、优化止损策略等方式来对策略进行改进,使之能够适应更多不同的品种和行情环境,从而获得更稳定的策略收益。

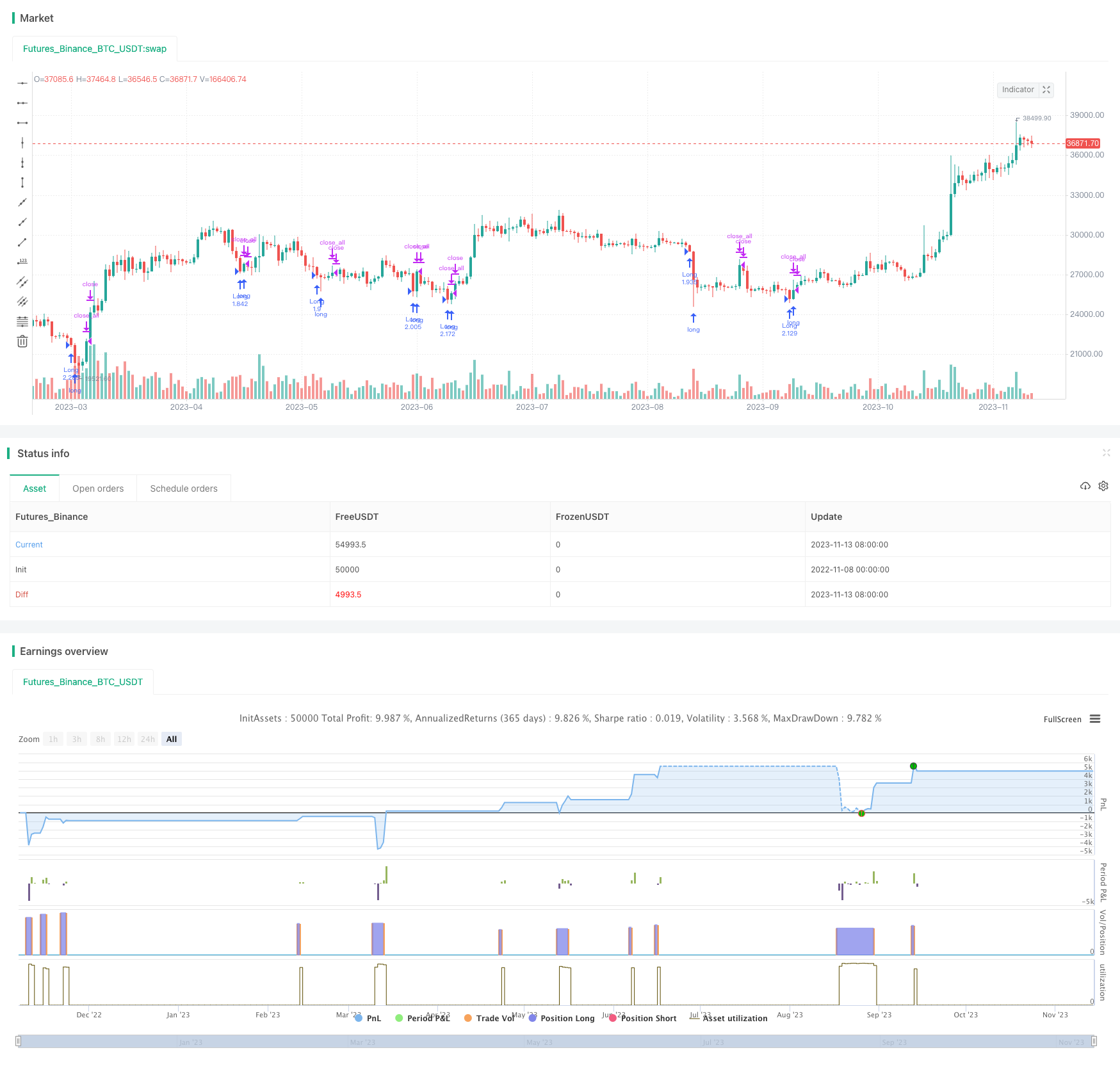

/*backtest

start: 2022-11-08 00:00:00

end: 2023-11-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Noro's FRSI Strategy v1.21", shorttitle = "FRSI str 1.21", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0, commission_type = strategy.commission.percent, commission_value = 0.0)

//Settings

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Price")

rb = input(1, defval = 1, minval = 1, maxval = 5, title = "RSI Bars")

sps = 0

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2038, defval = 2018, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Limits

bar = close > open ? 1 : close < open ? -1 : 0

uplimit = 100 - limit

dnlimit = limit

//RSI Bars

ur = fastrsi > uplimit

dr = fastrsi < dnlimit

uprsi = rb == 1 and ur ? 1 : rb == 2 and ur and ur[1] ? 1 : rb == 3 and ur and ur[1] and ur[2] ? 1 : rb == 4 and ur and ur[1] and ur[2] and ur[3] ? 1 : rb == 5 and ur and ur[1] and ur[2] and ur[3] and ur[4] ? 1 : 0

dnrsi = rb == 1 and dr ? 1 : rb == 2 and dr and dr[1] ? 1 : rb == 3 and dr and dr[1] and dr[2] ? 1 : rb == 4 and dr and dr[1] and dr[2] and dr[3] ? 1 : rb == 5 and dr and dr[1] and dr[2] and dr[3] and dr[4] ? 1 : 0

//Body

body = abs(close - open)

emabody = ema(body, 30)

//Signals

up = bar == -1 and sps == 0 and dnrsi and body > emabody / 4

dn = bar == 1 and sps == 0 and uprsi and body > emabody / 4

exit = bar == 1 and fastrsi > dnlimit and body > emabody / 2

//Trading

if up

strategy.entry("Long", strategy.long, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

sps := 1

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()

sps := 0